Meta Platforms (NASDAQ:META) slumped following a Q1’24 earnings report where the company projected a new round of spending on AI. The stock rebounded off the 2022 lows below $100 due in part to controlling spending and ushering in a year of efficiency. My investment thesis is Bullish on the stock following this dip, as the social media company invests in the future and has a big potential TikTok ban catalyst.

Source: Finviz

AI Spending Cycle

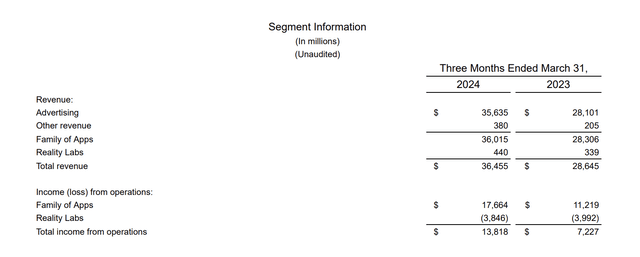

Meta slumped following earnings due to the social media company proposing another investment cycle for generative AI. The company easily beat Q1 analyst estimates due to surging video ad demand, but the market was also disappointed with Q2 guidance.

Due to timing issues, Meta reported spectacular Q1 growth of 27%. The company was unlikely to repeat this growth rate at their scale, and forecasts were for growth to slip below 20% going forward anyway.

Meta guided to Q2’24 revenues of only $36.5 to $39.0 billion, below estimates of $38.3 billion. The midpoint targets are a rounding error for a company approaching $150 billion in annual sales.

The bigger market fear is Meta entering another investment phase, this time for AI. After all, the company forecasts spending more on Reality Labs after losing $3.8 billion alone in Q1. These investments don’t even have a line of sight into paying off shareholders, with meager quarterly sales of only $440 million.

Source: Meta Platforms Q4’23 earnings release

The stock plunged, but management didn’t actually guide up to spending anything materially higher in the current year. Total expenses are forecast at $96 to $99 billion, only up $2 billion at the low end. Some of these higher expenses are even tied to legal expenses, costs most companies would exclude from guidance.

The major spending increase is the capital expenditures. These costs are jumping ~$4 billion above the original target in 2024. A lot of these data center costs will flow through to depreciation charges over time.

The unknown fear is a big jump in costs in 2025. Meta only grew operating expenses 6% YoY during the quarter. Investors shouldn’t be shocked with higher expenses going forward, as up to 20% growth supports higher spending levels.

Though, the main issue with Meta is the obsession with reporting total costs, despite knowing the market wants a distinction between the 2 buckets. By nature, total costs will grow along with higher revenues just from COGS alone, and revenues will ramp from $36 billion in Q1 to an estimated $45 billion in Q4.

The AI spending cycle shouldn’t be feared, as Meta will ultimately monetize the Meta AI assistants being built. The one area to watch is that LLMs are constantly becoming dramatically more expensive, with the big tech companies spending dramatically more to build each new generative AI tool.

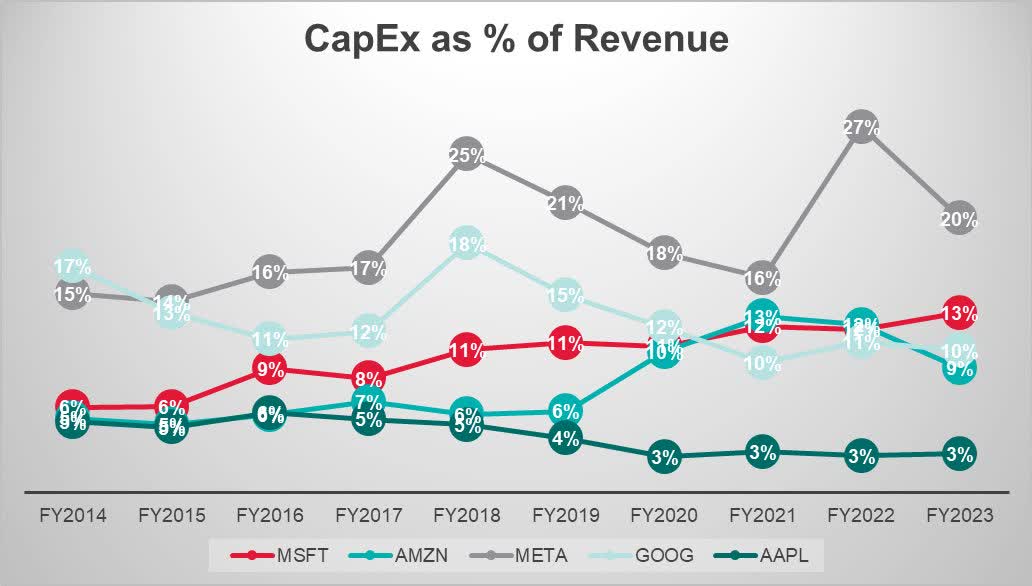

Meta has now forecast capex spending this year of at least $35 billion, after only spending $6.7 billion in Q1. The company will average $10 billion per quarter the rest of 2024, while Google (GOOG) (GOOG) and Microsoft (MSFT) have ramped up spending with amounts doubling the Q1’23 levels. All of these AI giants were only spending ~$5 billion per quarter back during 2021, even with booming online demand following Covid boosts.

While these companies have generally boosted capex spending, a lot of the spending is in line with growing revenues. Meta had actually cut spending as a percentage of revenue in 2023, but the recent spending trends suggest 2024 levels will change the investing landscape again with midpoint capex of $37.5 billion amounting to 24% of revenues.

Source: @AlphaSeeker84 on Twitter/X

Despite the lower revenue levels than the other big AI companies, Meta is able to invest aggressively in investments for the future due to higher gross margins.

Normalized EPS Model

Meta reported EPS surged during Q1, with operating margins nearly doubling the Q1’23 levels at 38%. Despite spending aggressively on the Metaverse, Meta still produced an EPS of $4.71. In addition, one could probably strip out several billion of one-time costs, like legal fees, to obtain a higher quarterly EPS metric.

The natural big concern is that Meta now spends the next couple of years investing as aggressively in generative AI as to cause analysts to significantly cut EPS targets for future years. Analysts appear to have already started cutting EPS targets beyond 2024.

CEO Mark Zuckerberg is a huge believer in personalized AI, where AI assistants are able to accomplish tasks for users and turn into Agents. The company mentioned the following AI opportunities:

- AI Assistants

- Creator AIs

- Business AIs

- Internal coding and development AIs

The big question is the level of investing, whether Meta will go full-speed ahead into AI spending like Metaverse, where losses are running at an ~$15 billion annual rate. The key here is that our investment thesis became bullish back in 2022 when the stock was beaten down and Meta appeared to have a plan to cut the massive Reality Labs losses.

The company would see a $5+ EPS boost from driving away the losses in that category. Now, Meta appears headed on a path towards further growing the Meta Labs losses while adding to the losses via investing in the AI assistants and agents.

The consensus estimates have the social media giant generating a nearly $23 EPS in 2025. With the stock down at $443, Meta actually trades below 20x EPS targets. An investor still has an optionally to view the stock in the terms of adding back the big Reality Labs losses to generate a $27-28 EPS.

The stock is incredibly cheap here, though Meta faces some volatility due to the market not appreciating blips in earnings growth due to investments. The stock only trades at 16x a more normalized EPS of $28 with the Reality Labs losses eliminated.

Deepwater Asset Management analyst Gene Munster forecasts the TikTok ban could lead to Meta winning 50% of the U.S. revenues, amounting to an overall 5% revenue boost equivalent to only $7 to $8 billion. Estimates have TikTok U.S. revenue up at $16 billion for 2023, so the impact might not be larger based on growth in 2024.

Meta ended the quarter with a massive net cash balance of ~$40 billion, with positive free cash flow of $12.5 billion in Q1 alone. The company even spent $14.6 billion on share repurchases while paying $1.3 billion in dividends for a total capital return of nearly $16 billion in the last quarter.

Takeaway

The key investor takeaway is that the dip in Meta Platforms following the Q1’24 results make the stock very appealing again. Even just assuming all of the extra spending never ends, the stock is cheap for the growth rates. Once assuming the Metaverse is eventually monetized or divested, the normalized EPS of $28 makes the stock very cheap.

Investors should use spending fears during 2024 to snap up Meta shares. The company is aggressively investing in both AI and the Metaverse and the company should eventually see a payoff leading to the next decade of growth.

Read the full article here