ETF Overview

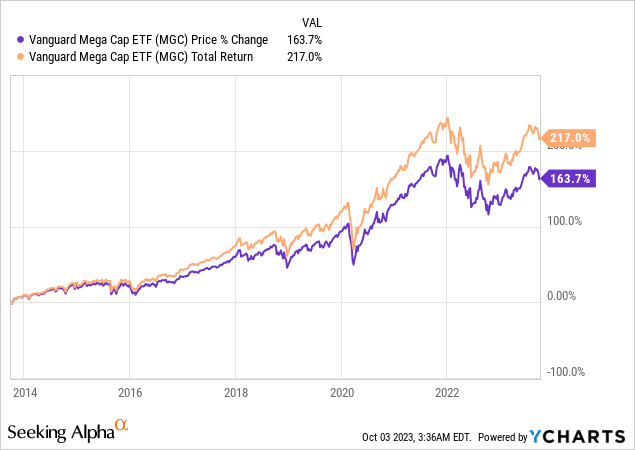

Vanguard Mega Cap Index Fund ETF Shares (NYSEARCA:MGC) has a portfolio of 230 largest stocks in the U.S. in terms of market capitalization. This represents about 70% of the total U.S. market capitalization. MGC appears to offer better downside protection than its small-cap and mid-cap peer funds and usually rebounds faster after market downturns. However, its valuation is quite expensive relative to the historical average. In addition, macroeconomic environment may continue to worsen as the Federal Reserve will likely keep the rates higher for longer to combat inflation. Given that the market usually won’t see a bottom before a recession, but during the recession, there may still be significant downside risk ahead. Hence, we think investors should patiently wait on the sidelines.

YCharts

Fund Analysis

MGC had a spectacular run in the past year

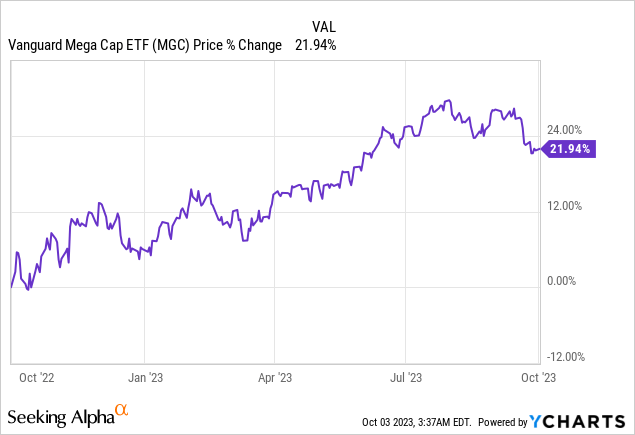

This past year has been great for many investors as the broader market rebounded strongly from the significant decline in the first 10 months of 2022. The S&P 500 index rebounded 21.5% from a year ago. MGC also did quite well in the past year and slightly outperformed the S&P 500 index. As can be seen from the chart below, MGC delivered a return of 21.9%.

YCharts

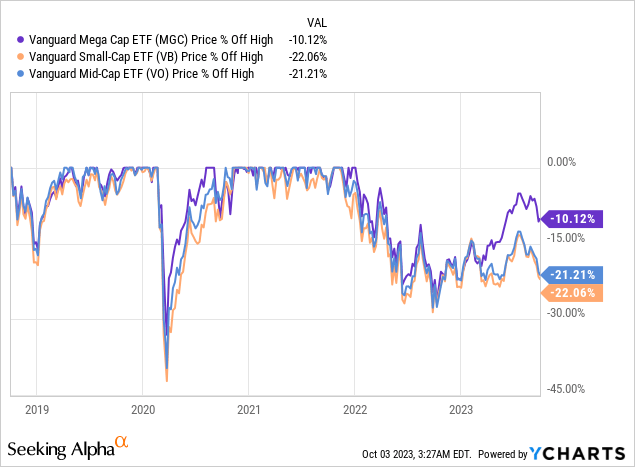

Mega cap stocks are more resilient during market turmoil and usually rebound first

What we really like about mega-cap stocks is that they tend to outperform their smaller-cap peers in times of turmoil. Using the analogy of a boat in a storm, a larger boat is more likely to survive a big storm than a smaller boat. The same is also true with mega-cap stocks. These companies tend to have much stronger balance sheets and more established business models to weather any storms in economic downturns. In contrast, small-cap or mid-cap stocks may struggle more as they are not as established as their mega-cap peers.

Let us look at how MGC and its small-cap and mid-cap peer funds have performed in the past 5 years. As can be seen from the chart below, MGC has declined by about 33% at the initial outbreak of the pandemic in 2020. In contrast, its small-cap and mid-cap peers Vanguard Small-Cap Index Fund ETF Shares (VB) and Vanguard Mid-Cap Index Fund ETF Shares (VO) have both declined by over 40%. The same trend was also true during the stock market decline last year. As can be seen, MGC performed slightly better than VB and VO last year.

YCharts

Besides better downside protection than its small-cap and mid-cap peer funds, MGC usually also rebounded faster after the market turmoil. As can be seen from the chart above, MGC climbed up first after the sharp decline in 2020 and has outperformed its smaller peers in the stock market rally this year.

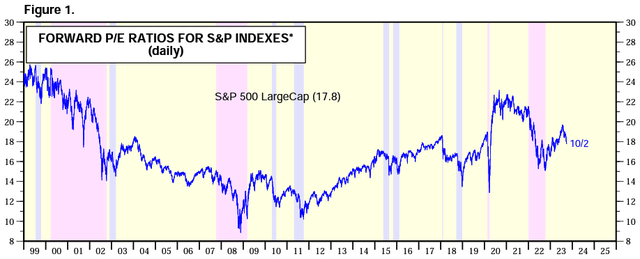

MGC is still expensive

MGC and the S&P 500 index represent about 70% and 80% of the market capitalization of the U.S. equity markets respectively. Therefore, there is a significant overlap between MGC and the S&P 500 index. Hence, we can quickly gauge MGC’s valuation by checking the S&P 500 index’s valuation. Below is a chart that shows the S&P 500 Index’s historical forward P/E ratio in the past 2 decades. As can be seen from the chart below, its current forward P/E ratio of 17.8x is towards the high end of its historical average. Although this valuation came down quite a lot from the high reached during the pandemic, this value is still towards the high end of the historical average range between 2003 and 2023. Hence, MGC appears to be overvalued.

Yardeni Research

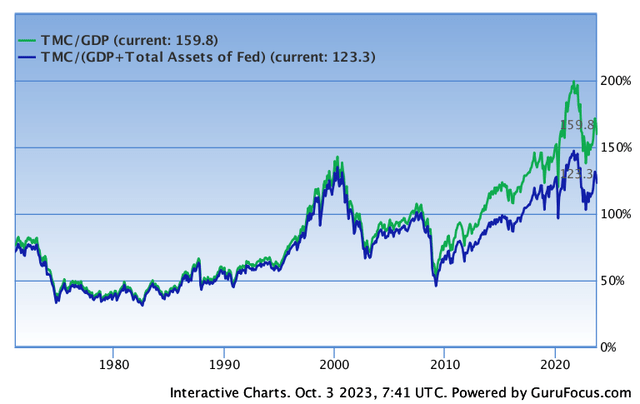

One may argue that this valuation is reasonable since there is still so much liquidity available in the market due to the Federal Reserve’s massive quantitative easing policy in the past 2 decades. However, we can also check another indicator called the revised “Buffett Indicator” to see whether the market’s valuation is expensive or not. In a Forbes interview in December 2001, Warren Buffett recommended using the ratio of total market capitalization to GDP to evaluate whether the broader stock market is overvalued or not. According to Warren Buffett, if the total market capitalization to GDP ratio is in the range between 75% and 90%, the market’s valuation is considered reasonable. If this ratio is above 90%, the stock market is expensive. If this ratio is above 120%, the broader stock market will be very expensive.

Since we need to also consider the Federal Reserve’s enormous balance sheet, the denominator of the equation needs to be revised to include the total assets of the Federal Reserve. Taking this into consideration, the revised ratio is equal to the total market capitalization divided by GDP plus Fed Assets ratio. Given that MGC represents 70% of the total market capitalization of the U.S. stock market, this approach appears to be reasonable.

As can be seen from the chart below, this revised ratio is currently about 123.3%. While this ratio has declined significantly from nearly 150% during the peak of the pandemic, it is still quite elevated compared to the historical average. Therefore, we think the broader market is quite expensive.

GuruFocus

What will happen to the economy next?

As we have seen from MGC’s price chart, MGC’s fund price may still go down significantly in times of economic uncertainty. Therefore, the question we need to ask is whether there will be an economic recession coming or not. Our base case is that there will be a recession coming in the first half of 2024. This is because the Federal Reserve’s policy to keep the rates higher for longer to combat inflation may eventually cause a hard landing of the economy. The reason this has not yet happened is because it usually takes about 6~12 months for the impact of the rate hikes to fully propagate through the economy. Given that stock markets usually don’t bottom out before the recession, but during the recession, we think there is still enormous downside risk.

Investor Takeaway

MGC is a better choice for investors seeking better protection in an economic downturn than small-cap and mid-cap funds. However, there is still significant downside risk due to its lofty valuation, and the likelihood of an economic recession coming in the first half of 2024. Therefore, we think investors may want to patiently wait on the sidelines.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Read the full article here