Shares of MGIC Investment Corporation (NYSE:MTG) have been a strong performer over the past year, rising by over 36%, as the company has benefited from elevated home prices and strong employment. These factors have led to virtually nonexistent losses on its private mortgage insurance (PMI) policies. I last covered MGIC in February, downgrading shares to a “hold” with a fair value just below $22.50, as I felt their rally had turned the stock into a market performer. Since then, shares have returned about 12%, in-line with the S&P 500’s rise, consistent with a hold recommendation. With updated financials and some sluggishness in the housing market, now is an opportune time to revisit MTG.

Seeking Alpha

In the company’s first quarter, MTG earned $0.65 in adjusted earnings, up from $0.54 last year. There have been two significant drivers of its income growth. First, MGIC has been a beneficiary of higher interest rates on its $6.1 billion portfolio of investments and cash. Investment income rose by $10 million from last year to $60 million.

Now, in my view, we are likely to see the Fed begin lowering rates later this year; while the exact path is uncertain, I view a first cut as likeliest in September. This will reduce interest income on cash and equivalents. However, MGIC does have $351 million of unrealized losses on securities purchased when rates are lower. Eventually as these securities mature, they can be reinvested at higher yields. My expectation is that these factors will broadly cancel out, leaving interest income at this elevated level but also meaning further increases are unlikely.

Additionally, MGIC has used its strong financial health to aggressively buy back stock leading to a 7.1% decline in the share count over the past year. It did $93 million of Q1 buybacks and another $55 million in April. A $750 million buyback through 2026 has been authorized, and repurchases alongside its 2.1% dividend yield are a key source of value creation for the company.

A reason MGIC has been able to return capital aggressively to shareholders is the very strong operating environment. MGIC offers PMI, which is used when a homebuyer puts less than 20% down, which is what Fannie Mae/Freddie Mac will insure. So, when a homeowner puts down 5%, MGIC will insure the 5-20% piece of the home value and then a government agency does the balance.

As such, MGIC faces losses only when a homeowner defaults and the house is worth less than the loan value. The strong jobs market has helped keep defaults low, and given how buoyant home prices have been, most homes can be sold above their mortgage value, resulting in no loss.

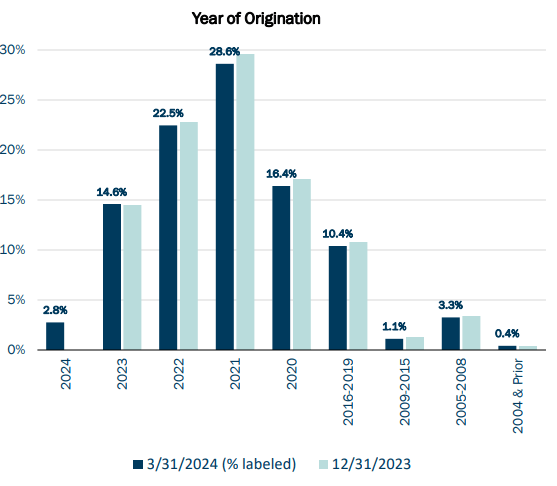

Because mortgages are typically 30 years, policies can remain outstanding for several years. As you can see below, the majority of its insurance exposure is for loans taken out in 2021 and earlier. This has been a significant positive for MGIC’s profitability because home prices have risen so much that prices would now need to fall 30+% for mortgages written in early 2021 and earlier to be underwater.

MGIC

Indeed, MGIC has been nearly a no loss business in recent years. It faced just $5 million of losses in Q1 after $9 million of net recoveries in Q4. It carries $504 million of loan loss reserves, flat sequentially, but down $54 million from a year ago. This favorable environment has allowed it to draw down reserves. Now, the fact MGIC did face a net loss in Q1 is an item to monitor. As the chart above shows, as it writes more policies, its back book gradually becomes a smaller share of its total business, meaning the “low risk” and highly profitable policies are a smaller share of its business. I also focus on “persistency,” which measures policies remaining. MTG had an 85.7% persistency, a tick down from 86.1% in Q4, which hastens this transition.

I would also be clear that just because a policy is higher risk does not mean it is high risk. In Q1, it wrote $9.1 billion of policies with a 757 average FICO and 93.1% loan to value (LTV). Activity was up about 11% from last year. This is a solid FICO score, and prices would need to fall 7% on average for loans to be underwater. There is still cushion, just not as much as on a home bought in 2020. As such, I expect to see losses remain low, just not entirely nonexistent going forward.

Importantly, MGIC has been tightening standards. Its 757 Q1 FICO score is higher than the 746 average FICO across its total book. Encouragingly, its delinquent inventory is down about 2.5% from last year. This is contrary to trends into autos and credit cards, in part because elevated home prices mean consumers can sell their home above their mortgage value.

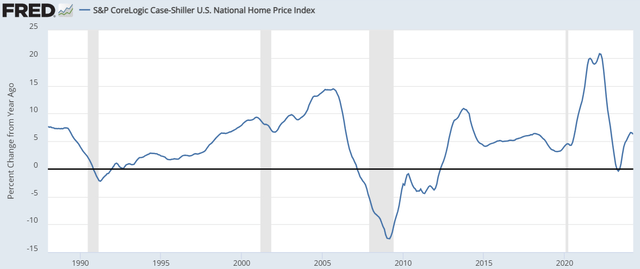

Notably, home prices have rebounded in recent months, as you can see below. According to RedFin, home prices are up about 4.8% over the past year through May, slightly lower than Case-Shiller’s estimate but still favorable. Ultimately, MGIC does not need prices to keep rising, given it has some cushion and some principal is repaid with each monthly mortgage rate. It really needs prices to simply not fall.

St. Louis Federal Reserve

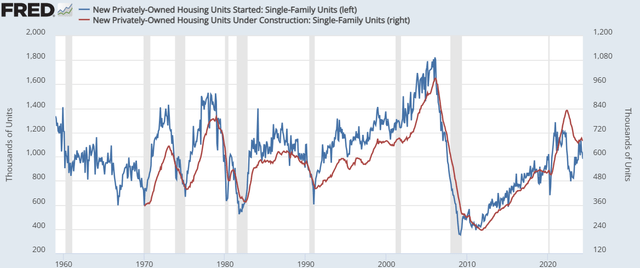

I do not expect prices to continue to rise as fast, but I view the backdrop constructively. As you can see below, the number of homes under construction has slowed. Limited new supply is likely to limit pressure on prices. More broadly, the level of home construction is still fairly muted relative to history, and given how little construction occurred in the 2010s, I continue to view the US housing market as structurally undersupplied, which should support prices.

St. Louis Federal Reserve

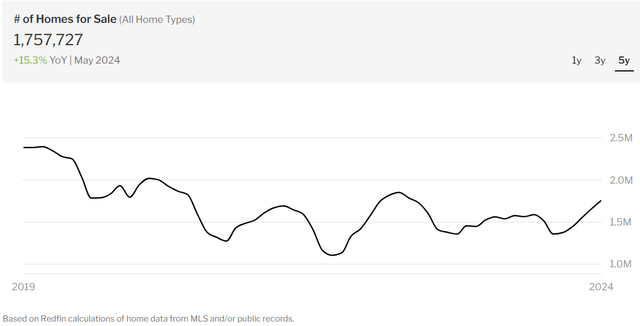

One risk to this is that more homes are being listed for sale, which could pressure existing home prices. Many homeowners with low mortgage rates have likely been hesitant to move and lose their low-rate mortgage, which has constrained existing home supply. However, eventually some life events force moves (a job relocation or another child, for instance), and as such, some moves can only be deferred so long. We may be nearing that point, which is one reason I expect home price appreciation to slow.

RedFin

Still, inventories are relatively modest vs pre-COVID levels. Additionally, some would-be buyers may be waiting for lower mortgage rates to buy. If we do begin to see Fed cuts as I expect, this could create some new demand, helping to mitigate increased supply. This leaves me believing risks to home prices are fairly balanced, and a significant decline, barring a large recession, is unlikely.

MGIC has operated in a perfect environment for the past two years or so, enjoying higher interest income and essentially no losses. I do not argue it is moving to a bad environment, just a downgrade from perfect to “good.” In that environment, it can continue to buy back stock. It has $793 million in liquidity at the holding company, and a $350 million intercompany dividend is being paid in Q2. MGIC also has $6 billion of statutory capital, including $708 million of surplus.

This capital position should enable the operating entity to pay dividends to the Holdco, which is the entity that makes share repurchases and common stock dividends. Additionally, due to policies rolling off, there are $248 million of scheduled reserve releases this year, and then over $500 million per year from 2025-2033. This will allow MGIC to issue new policies without needing to retain earnings, instead recycling this capital, and return virtually all cash flow to shareholders.

MGIC has an $18.97 book value and $20.18 excluding accumulated other comprehensive income, so shares are about 1.05x book value, which in my view reflects the fact its loan loss reserves are likely elevated vs likely losses, given the rise in home prices since 2020. That said, its loan exposure does get slightly riskier with each new loan, as older policies become a smaller part of its business

As such, I expect the company is running at peak earning, and we are likely to see slow but steady increases in policy losses. We are likely to see about $2.50-$2.60 in earnings this year, and then assuming deceleration in home price appreciation and several Fed rate cuts, $2.30-$2.50 in 2025.

At ~9x 2025 earnings, MGIC is not an expensive stock, but if we do see a recession or sharper decline in rates, earnings would also fall further. A recession is not my base case, so I am retaining a “hold” rating. However, while MTG has been able to keep up with the market; if we see the S&P continue to rally at this pace, it may not have the same upside.

Still, I do not see outright downside, especially as it should be able to buy back about 5% of shares over the next year. I would expect shares to remain around current levels and likely face resistance at 1.1x book value or $22.50. There is not an urgency to sell, but with capped upside, I would consider reallocating elsewhere.

Read the full article here