Micron Technology (NASDAQ:MU) shares have had a rough few months over fears that the memory upcycle may be stalling, and that AI demand could slow, which has led to a 40%+ selloff from 52-week and all-time highs. After spending much of fiscal year 2023 underwater (negative EPS in each quarter) due to low average selling prices from a memory supply glut, the last thing the company needs is a market shock to derail the ongoing recovery we have witnessed so far in FY2024. However, I think the memory upswing is very much still on track and that, on the back of this trend and the company’s continued success in high-bandwidth memory (“HBM”), this chronically undervalued stock is a Strong Buy.

It has been quite a while since I last covered MU, back in 2018 in fact. In that last article I argued, much like I will argue in this one, that a memory cycle upswing was just getting started and that the time to buy was now (well, then). That article can be read here. When it was published, the stock was trading around $40 per share, after which it went up to $60 a month later. Results can never be guaranteed, of course, but I’m seeing many of the same signs now that I did for that previous cycle, namely that Micron’s operating results have reached an inflection point, memory prices are recovering, and all of the main memory players are seeing margin improvements.

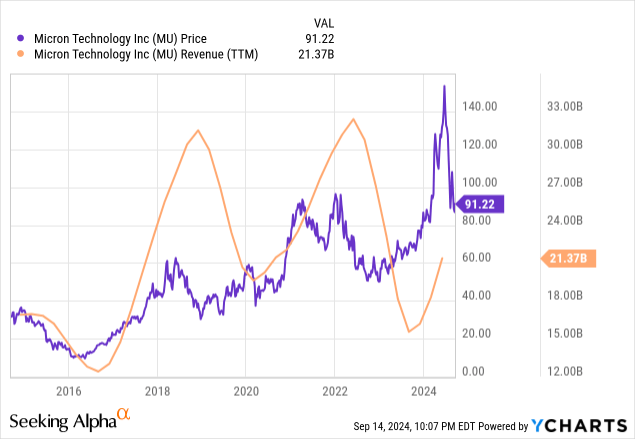

Let’s first begin by discussing the cyclicality of MU and how it has historically impacted the stock price.

As most investors are aware, Micron is a cyclical company because memory is a cyclical business with the following general stages:

1) SK Hynix, Samsung, and Micron produce chips (DRAM and NAND) to satisfy demand and make lots of money.

2) Demand eventually drops, leading to supply outpacing demand. Prices fall.

3) Memory makers continuing producing chips at lower margins to retain market share. Profits fall.

4) Demand eventually picks back up, the oversupply clears, and prices/profits begin to rise again.

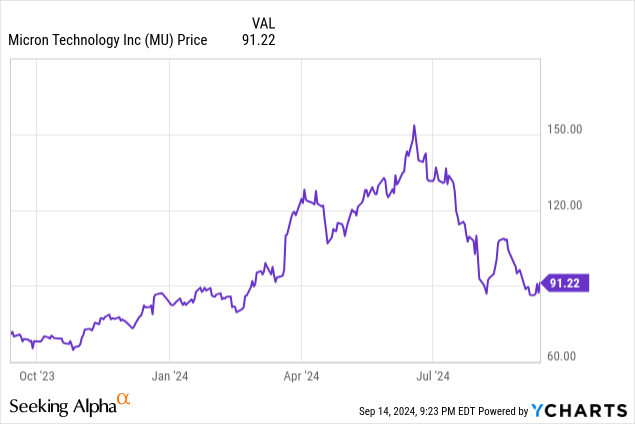

Micron stock tends to rise as memory demand strengthens and fall when it wanes:

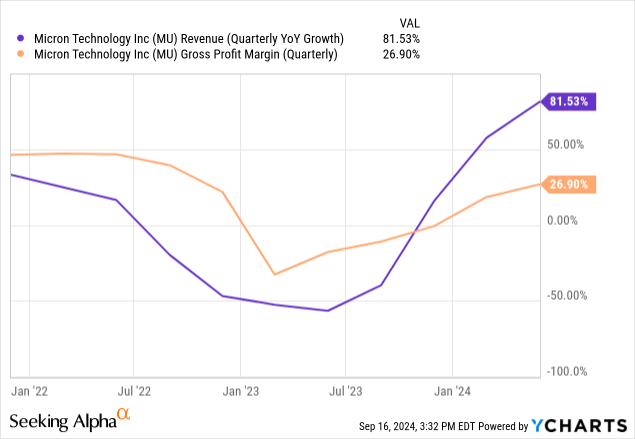

As we can see from the 10-year chart, the stock price tends to peak just before trailing twelve months revenue peaks, after which the price tails off as the down cycle begins. In the same vein, the stock tends to inflect back upwards before revenue troughs. The current cycle has been a bit rougher around the edges because of the AI frenzy, but from the most recent quarterly results (81% YoY revenue growth) and projections for Q4 2024 (90% YoY growth), we can clearly see that sales have begun their rebound from cycle lows.

The historical correlation of cyclical operating results and stock price would indicate that MU will rise in the coming quarters as financial performance improves and revenue growth rapidly increases off the previous cycle’s lows. However, not all cycles are created equal and historical analysis can only tell us so much.

Part of MU’s recent woes have been concerns over whether the current upward trajectory of this cycle is slowing already. Just last week, Micron was downgraded by multiple analysts, with one citing an expected temporary slowdown in non-HBM (PC/smartphone) demand and the other citing an expected oversupply of HBM chips in 2025.

While an oversupply of HBM seems unlikely due to the ongoing strong GPU demand for AI applications, including the launch of Nvidia’s (NVDA) Blackwell and AMD’s (AMD) MI325X this quarter, concerns over a short-term slowdown in consumer memory sales appear more well-founded. In Q3, Micron reported an increase of about 20% QoQ in NAND ASPs, but with a slight decline in bit shipments. TrendForce is projecting NAND ASPs to increase again next quarter, but for bit shipments to decline by about 5%. Typically, memory upcycles consist of a combination of increased ASPs in addition to increased bit shipments, so this is a slight concern, especially with 30% of Micron’s revenue derived from NAND sales.

However, this is a small blip in what is likely to be a multi-year upswing as a near-term slowdown in consumer memory products is offset by expected increases in server and enterprise SSD demand.

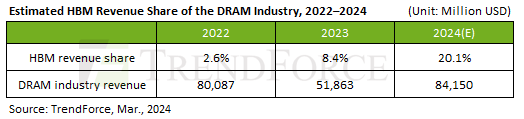

As mentioned earlier, a significant driver of the memory upswing will be DRAM demand, specifically HBM. While the market is still in its relative nascency, a bit growth is expected to increase significantly due to continued demand for AI applications. Here’s a snapshot from back in March of HBM’s progression:

TrendForce

By the end of 2024, HBM will likely make up a fifth of total DRAM revenue share, or close to $17 billion on an annual basis, and its impact on Micron’s operating results is still relatively minimal compared to what we’ll see in 2025. I think this excerpt from the company’s Q3 earnings presentation provides interesting and bullish context:

Our HBM shipment ramp began in FQ3, and we generated over $100M in HBM3E revenue in the quarter, at margins accretive to DRAM and overall company margins. We expect to generate several hundred million dollars of revenue from HBM in FY24, and multiple $Bs in revenue from HBM in FY25. We expect to achieve HBM market share commensurate with our overall DRAM market share sometime in CY25. Our HBM is sold out for CY24 and CY25, with pricing already contracted for the overwhelming majority of our 2025 supply.

Micron is expecting the ramp of HBM to provide rapid growth and expects to capture HBM market share in a similar proportion to its current general DRAM market share, which depending on the estimate is probably around 20-25%. With most of the company’s HBM capacity already sold out for 2024 and 2025, it seems unlikely that the supply glut for these highly coveted chips, predicted by one of the aforementioned analysts that downgraded the stock, will come to pass.

Further, not only are many more chips being sold with HBM memory, but each successive generation of GPU accelerator, for example, crams more memory on each chip. Nvidia’s H100 and H200 GPUs have 80GB of HBM3 and 141GB of HBM3E, respectively, while the upcoming B100 and B200 will have 192GB of HBM3E, with a likely memory upgrade to ~270GB in 2025. Not to be outdone, AMD’s MI300X has 192GB of HBM3 and its upcoming Q4 release, the MI325X, will have a whopping 288GB of HBM3E. Whatever the outcome of the AI wars, Micron wins.

A final added benefit of HBM is that the high sell price allows for higher margins as well. As Micron ramps up sales and HBM becomes a greater share of the product mix, margins will increase across the board.

Micron made the daring decision to mostly skip volume production of vanilla HBM3 and to instead focus on ramping HBM3E in order to front-run SK Hynix and Samsung, which resulted in success as the company was able to secure partnership with Nvidia for their upcoming processors. As the HBM market continues to grow, Micron has positioned itself as a major player.

As these headwinds and tailwinds converge, Micron is set to report fourth quarter earnings next week. SK Hynix and Samsung won’t be reporting for another month, so this report will give us more concrete insight into how the memory market has been fairing the last couple of months. Here are my primary expectations:

- Micron will likely report weakness in NAND shipments but higher NAND revenue due to increased ASPs but muted consumer demand

- HBM will begin to make a significant impact on DRAM revenue and market share will increase

And here are, in my opinion, the most important things to watch for:

- Is Micron expecting consumer NAND and DRAM demand to remain weak in 1H 2025 or to improve?

- Is HBM demand still high, indicating the continued strength of the AI market?

It seems from the multitude analyst downgrades that they are expecting the answer to both those questions to be bearish. Considering this is just the beginning of a memory upcycle that will likely last multiple years, I expect any demand weakness to be transitory and for DRAM demand, and HBM specifically, to buoy results in the meantime. But interested investors should focus on the above questions while reading the upcoming earnings report for indications of demand strength or weakness going forward.

Additionally, the cyclicality and unpredictability at play here should not be discounted by investors. MU has already swung wildly this year, and these swings might not be over just yet. There is always the risk that consumer memory demand could remain weak for the foreseeable future, leaving enterprise sales to do most of the heavy lifting. In such a scenario, any enterprise slowdown would constitute a fairly substantial demand shock to Micron and other memory makers, driving the share price down.

In a similar vein, Micron is also susceptible to a recession scenario in which demand falls suddenly, and the memory cycle upswing is cut short. This would be especially painful since the most recent downswing essentially just ended and the company’s financial position hasn’t yet recovered. I don’t expect to see continued weakness in consumer memory demand or a recession, but these are risks investors should be aware of nonetheless.

Investor Takeaway

Historical analysis of previous memory cycles indicates that MU is likely to rise in the coming quarters as the company rebounds from a deep trough in the wake of the previous cycle’s downswing. After a dismal 2023, operating results are finally recovering, making now a solid time to buy. On the back of ramping HBM sales to premier customers like Nvidia, Micron is well-positioned to ride this memory upcycle, and the AI wave, higher. For these reasons, I consider MU a Strong Buy for those with short-term investing horizons.

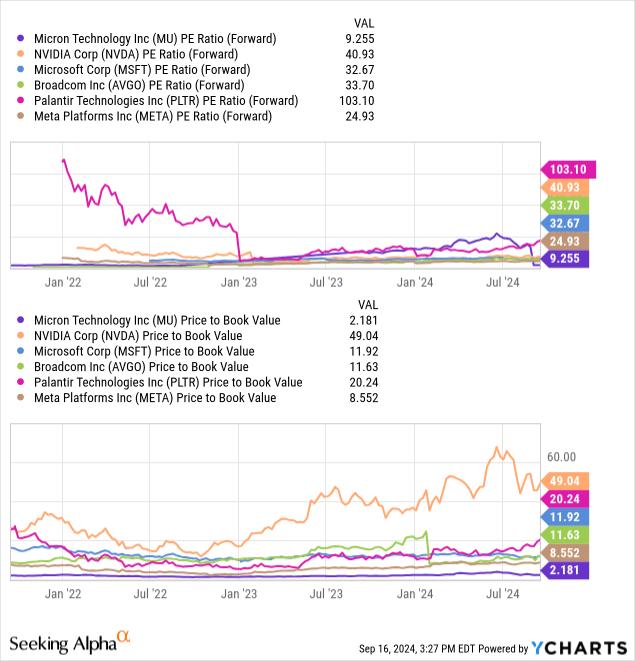

The stock has a forward P/E ratio of around 9, which is much more attractive than the S&P 500’s average of 22, likely due to investor concerns over cyclicality. An analysis of P/B and P/E ratios shows that relative to other AI stocks and tech stocks, Micron is currently valued at a discount:

Despite the improving memory market and Micron’s success in breaking into HBM and gaining market share, the stock is being priced like there’s an imminent risk to investors. From my analysis in this article, I don’t believe that to be the case.

This valuation coupled with growing revenue, margin expansion, and brightening market conditions makes Micron an attractive value play in my opinion.

On the back of exploding HBM revenue, Micron will likely see record revenue in FY2025, providing a market wary of cyclicality with data demonstrating that these fears are overblown. For those with long-term investing horizons, I would also consider the stock a Strong Buy with the caveat that the cyclicality of the stock can cause significant volatility, so those with a low-risk tolerance might want to look elsewhere.

Thanks for reading!

Read the full article here