Shares of Molson Coors Beverage Company (NYSE:TAP) have seen a setback as of late after enthusiasm around the stock topped in the summer, due to self-inflicted troubles at its major peer Anheuser-Busch InBev SA/NV (BUD).

Given that development, I cheered for Molson after Budweiser had its own hangover, after a major mistake by this peer provided a much-needed boost to Molson Coors which had seen only a modest recovery since the pandemic.

That boom was clearly visible in the second quarter results, but fearing that effect is not set to last for a long time, I understand why shares have reverted. I like this move, looking to re-enter a position in the fifties.

A Recap

Molson Coors is still is facing the hangover from a 2007 tie-up between Canadian Molson and U.S.-based Coors and the M&A which followed. Investors were initially upbeat on the tie-up, with growth potential seen at home and Eastern Europe. However, the combination ended up being too small in the consolidation wave which followed.

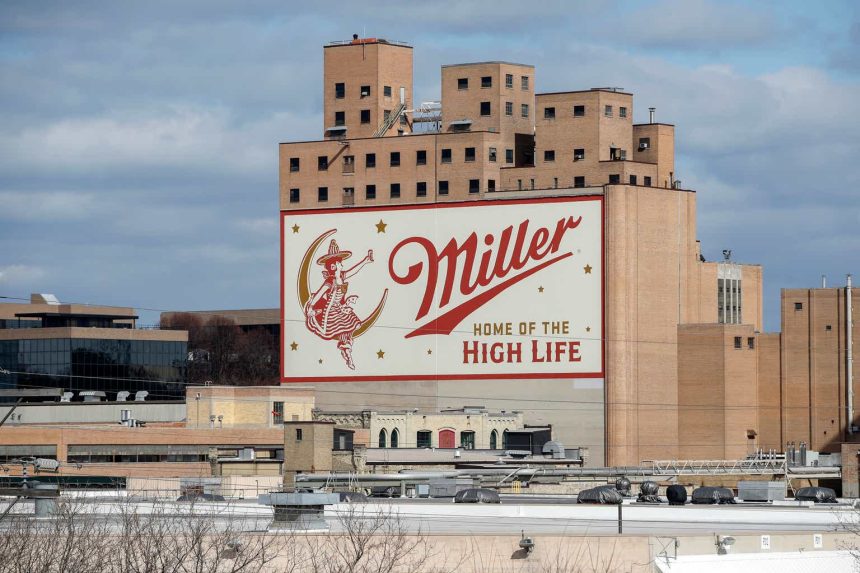

Its major rival, Anheuser-Busch InBev, tied up with SABMiller in 2014, with the M&A frenzy triggering Molson Coors to buy out the remaining stake in the joint venture Miller Coors back in 2015. The enthusiasm meant that shares peaked around the $100 mark, leaving high expectations for years to come.

That deal left the business saddled with over $11 billion in net debt, a substantial number in relation to a $2.5 billion EBITDA number. Pro forma sales were seen around $11 billion, with earnings reported around $4.50 per share. Sales actually fell to $10.6 billion through 2019, although net debt had come down to $8.5 billion.

A $50 stock pre-pandemic saw earnings multiple compress from 20 times earnings to about 12 times earnings, all amidst lackluster operating performance, with the company missing out on the trend for alternative and alcohol-free beers. Shares fell to the $30 mark during the pandemic, as many of the peers of Molson Coors were consumed outdoors.

After sales fell to just $9.7 billion during the pandemic year 2020, sales recovered in a modest fashion to $10.3 billion in 2021 and to $10.7 billion in 2022. Adjusted EBITDA slipped by 2% to $2.0 billion in 2022, although net debt had come down to $6.0 billion, marking continued improvements on that front. Net earnings fell a percent to $892 million, with earnings per share down five cents to $4.10 per share.

The company posted a 6% increase in first quarter sales in 2023, as the company confirmed the full-year guidance which called for mid-single digit growth. With InBev executing a controversial marketing campaign around Bud Light, boycotts hurt weekly sales of that important brand by about a third, with those trends lasting for weeks, providing a boon to its peers. This meant that Molson Coors likely saw a big boom in second quarter sales earnings, although I did not expect a major longevity effect.

After having taken a position in the forties during the pandemic, I was happy to use the momentum to cash out on the shares at $70 per share, as a 10 time multiple has expanded to 15 times earnings, making me inclined to cash out as the performance outside the controversy was not impressive enough to hold onto the shares at those levels.

Coming Down

Since July, shares have fallen from the $70 mark to $60, with shares now trading just below that levels. In July, the company paid out its quarterly dividend of $0.41 per share.

On the first of August, much anticipated second quarter results were released with sales up 12% to $3.27 billion, with underlying earnings up 49% to $387 million and earnings per share up by similar percentages to $1.78 per share. The company cut back net debt to $5.65 billion and with the quarterly numbers pushing up trailing EBITDA to $2.26 billion, leverage ratios have fallen to 2.5 times.

While the company did not specifically point toward the gains related to the mishap of Bud Light, the company now sees full year sales up by the high single digits, with revenues up 9% and change in the first half of this year.

Later in August, Molson Coors announced the purchase of Blue Run Spirits, moving away from the core beer segments, although no financial details on the deal or revenue contribution were announced. In September, the company expanded its partnership with ZOA Energy. While no details on the expanded relationship were announced, ZOA posted $100 million in sales in 2022, sales which furthermore rose by more than 100% compared to the year before.

Early October, Molson Coors announced new long term targets at its strategy day. The company outlined various strategic initiatives, but overall this should translate into modest long terms sales growth and mid-single digit earnings (per share) growth, while the company targets a leverage ratio of 2.5 times, in line with current leverage ratios.

The company has announced a $2 billion buyback program, with a 5-year duration, as the annual $400 million in buybacks is relatively modest, equal to 3% of the outstanding share base.

And Now?

While this year´s earnings will likely come in between $4.50 and $5.00 per share, driven by the wounds at Bud Light, one ought to factor in the one-time benefit to this year´s earnings. I believe that shares could fall in 2024, as I believe that a $4.50 per share number is more realistic.

With shares down from $70 to $59 and change, that move cut the valuation multiple by 2–3 times by the summer, as the second quarter was decent. That said, some recent acquisitions (at unknown prices) mean that some interest in those strategic initiatives is seen.

Amidst all this, I am gradually warming up to Molson Coors Beverage Company stock here again, with shares down 15% from the summer peak. However, opportunities elsewhere in the market make me a patient buyer until levels in the mid-fifties are seen on the board.

Read the full article here