New York Community Bancorp (NYSE:NYCB) is a $4 billion bank that has been through substantial struggles due to fears about its liquidity. The company has worked hard to fix its portfolio, narrowly avoiding bankruptcy, but obviously investors were burned in the process. As we’ll see throughout this article, the company has the ability to drive substantial shareholder returns.

New York Community Bancorp Transition

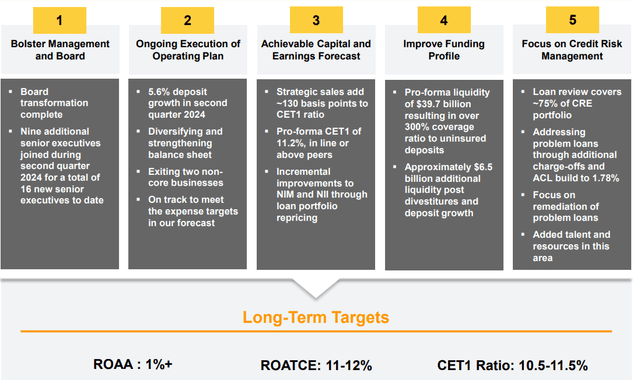

The company is working to transition its bank, with its board transformation complete and numerous new senior executives.

New York Community Bancorp Investor Presentation

The company managed 5.6% deposit growth indicating panic among its customers has decreased, and it has a CET1 ratio of 11%. The company has continued to use strategic sales and divestitures to improve its overall portfolio of assets, and the company has massive liquidity versus uninsured deposits (deposits likely to fall under a run).

The company is working hard on its loan review and its ACL (allowance for credit losses), which we’ll discuss in more detail later, is almost 1.8%. This transition is essential for the company.

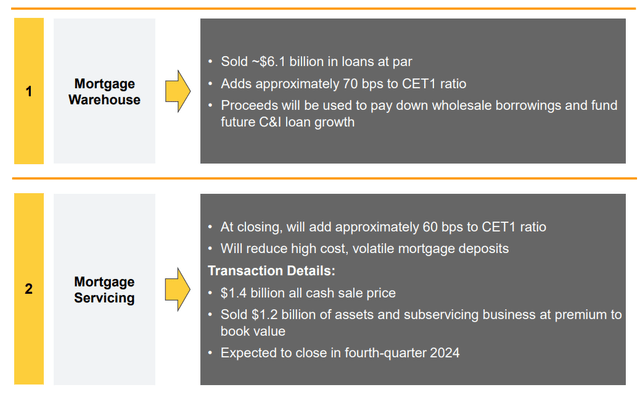

New York Community Bancorp Divestiture

The company has managed to sell $6.1 billion of mortgage loans at par, adding 70 bps to its CET1 ratio and helping cleanup the portfolio.

New York Community Bancorp Investor Presentation

The company plans to pay down wholesale borrowings and work to fund future loan growth. The company’s mortgage servicing business also adds 60 bps to its CET1 ratio, again helping its overall business. The sale has a $1.4 billion all cash sale price at the end of the year, with the strength of the business shown through $1.2 billion of assets sold at a premium to book value.

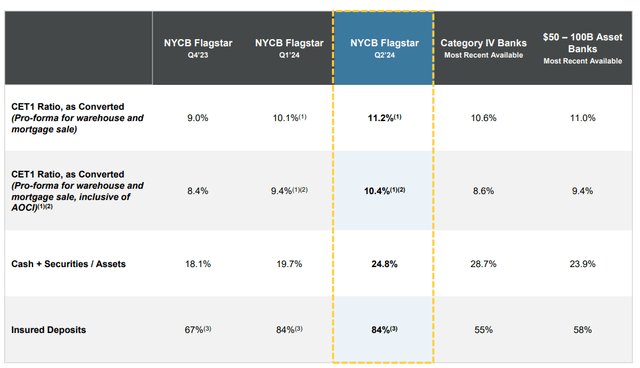

New York Community Bancorp Capital

The company has substantially improved over the past several quarters and is now stronger than its peers.

New York Community Bancorp Investor Presentation

The company’s CET1 ratio has increased by more than 2% over the last 2 quarters and has gone from being slightly below its peers to well above. The company’s cash and securities / assets is well above $50-100 billion asset banks in its competition. Most importantly for the company its insured deposit % has increased dramatically.

That’s a massive risk to the company and the chance of a run on the bank.

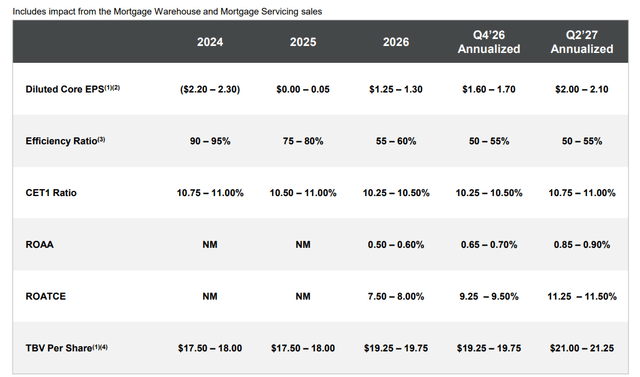

New York Community Bancorp Forecast

The company is forecasting massive improvement in its bank through the upcoming years.

New York Community Bancorp Investor Presentation

Specifically, the company expects its diluted EPS to grow to $2.05, a level that would put its current share price at a P/E of ~5. The company plans to keep its CET1 ratio roughly constant as the company’s efficiency ratio also improves. The net result of the company’s efforts here is its TBV per share increasing to more than $20/share, putting the company’s current P/B at

Given the company’s share price, that’s strong multi-bagger potential if the company can accomplish what it has set out to do.

New York Community Bancorp Investor Presentation

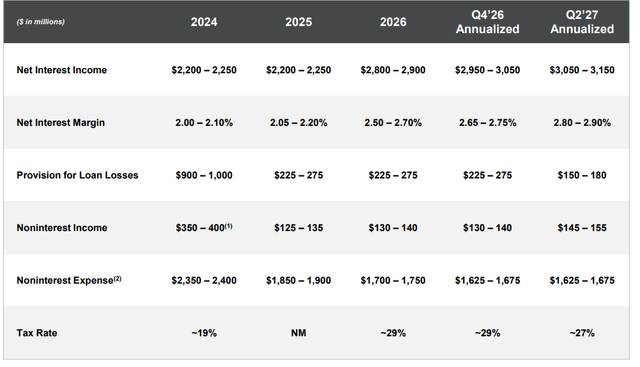

There are a few key things the company needs to manage to do. It needs to cut expenses while increasing net interest income by roughly 40%. That’s potentially difficult to do in a market where rates are longer increasing, and other banks have high-yield offerings for depositors. The company also needs to cut its provision for loan losses.

The company is spending heavily there now, but it’s hoping a cleaned up balance sheet will help it out substantially, enabling its net interest margin to increase to 2.85%. That’s key to the company’s forecasts for earnings and its ability to drive future shareholder returns. It’s a lofty ambition with minimal detail on exactly how it’ll be accomplished, which is a risk.

New York Community Bancorp Loss Allowance

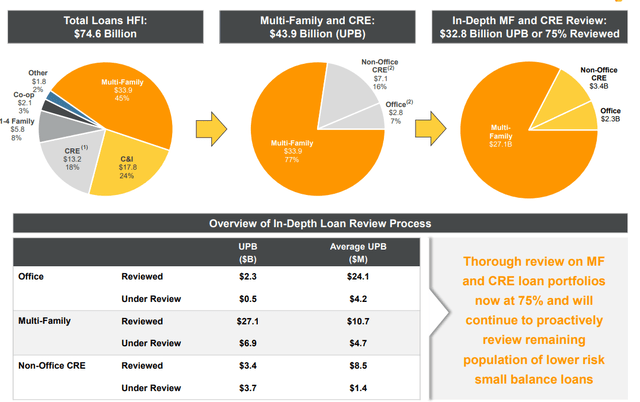

The company is working hard to review its held for investment loans ($74.6 billion) versus $79 billion in total deposits.

New York Community Bancorp Investor Presentation

The company has reviewed the vast majority of its loans here, with roughly 75% of its loans reviewed and the company focusing on continuing to de-risk that. Multifamily loans remain the largest segment of the company’s business, and it’s key for the company to clear up its segment here. It’s worth noting, though, real estate remains strong.

This segment for the company is much less risky than the company’s commercial real estate business which has been affected by changing trends post COVID-19.

New York Community Bancorp Investor Presentation

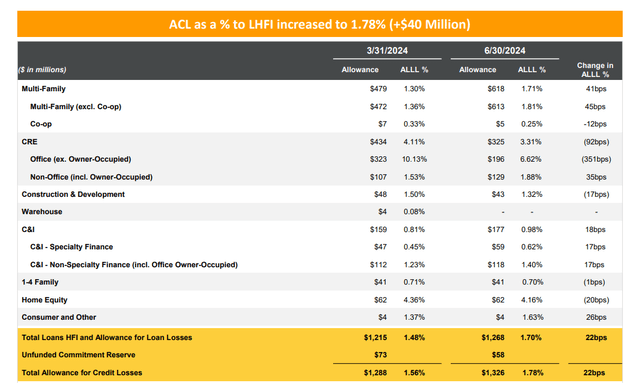

The company’s multifamily business has a 1.7% ALLL at $618 million, a strong QoQ increase. This business being 75% reviewed is now much closer to being in a good position. The largest segment for the company’s ALLL is commercial real-estate, specifically office businesses excluding owner-occupied, which has a 6.62% allowance.

Most of the decrease in allowance has come from the company also charging off 9.9% of loans. Fortunately, the company’s total office portfolio is $2.8 billion, which makes the high rate of losses for the company less risky and shows a more diversified business. The company has seen many struggling loans move to current, and its working hard here.

The $1.32 billion allowance for credit losses will help cover the vast majority of the risk the company faces after a strong increase in 2024, and the company expects that to remain flat. The company has $1.94 billion in non accrual loans currently, which is hefty, but something the company can afford to handle, not counting partial recoveries on a lot of these loans before par.

Overall, the strong improvement here will enable the company to continue driving shareholder returns over the next few years as an improved portfolio frees cash for other goals.

Thesis Risk

The largest risk to our thesis is the company’s massive transition that it’s working to undergo. That’s a massive effort with lots of moving parts, and the company needs to do it without losing the trust in the company that it’s worked so hard to build. Whether it can do that remains to be seen over the next several years.

Conclusion

New York Community Bancorp has gone through a difficult time. However, the company is still a strong bank with a strong portfolio of assets. It’s worked hard to manage its deposits and clean up its underperforming loans while generating strong interest income. A potential decline in rates by the Fed could also help its net interest income.

The company has some lofty targets and ambitions and despite the risk, it’s shown the willingness to work hard and accomplish its targets. We see the company as having multi-bagger potential given its strong portfolio of assets, however, whether that pans out remains to be seen. Let us know your thoughts in the comments below.

Read the full article here