Stable prospects for Nomad Foods (NYSE:NOMD) on the back of an increase in A&P investments, steady growth in Europe’s frozen food market along with opportunistic expansion to new markets through a combination of inorganic and organic strategies. Their valuation appears fair.

Company Overview

Nomad Foods is Europe’s leading frozen foods company based on net sales value. The company’s portfolio of frozen food products includes fish, vegetables, poultry, meals, pizza, and ice cream sold through retailers under long-standing household names such as the “Bird’s Eye” brand in the UK and Ireland, “Findus” in Italy, France, Spain, Sweden, Switzerland and Norway, “iglo” in Germany and other continental markets, “La Cocinera” in Spain, “Ledo” in south-eastern Europe and “Frikom” in Serbia and North Macedonia. The majority of the company’s products are in the savory frozen food market where Nomad Foods’ market share is around 18% according to Nielsen and Nomad Foods holds the number one position in sixteen European geographies.

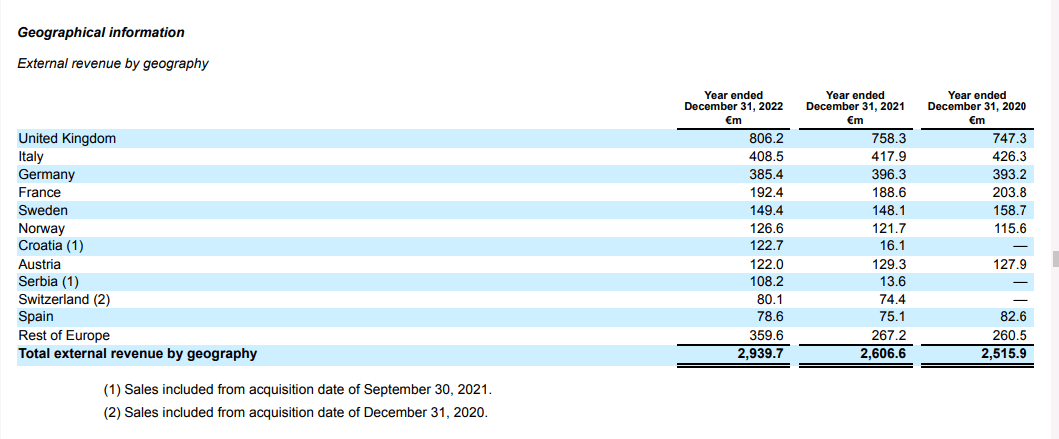

Nomad Foods’ top 6 markets (UK, Italy, Germany, France, Sweden, and Austria) which collectively represent about 80% of Europe’s savory frozen food market, account for 70% of the company’s total revenues.

Nomad Foods, 10-K, FY2022

1H 2023 performance

1H 2023 revenues rose 6.3% on a reported basis (up 8.3% organically) to EUR 1.5 billion driven by pricing which helped offset volume declines (management said the company lost about 1% value share in Q2 2023 to private label brands). Gross margins expanded 50 basis points to 28.6% helped by pricing actions and cost control programs. Operating profit declined 13% YoY however it was up 8% after adjusting for one-off non-operating expenses.

Near term, management is optimistic about seeing tangible sales volume growth and market share increases in the 2H 2023 and 2024 on the back of increased A&P investments in Q3 2023. Management expects A&P expenses to reach roughly 4% of FY2023 sales, significantly higher compared to FY2022 when it was around 3% of sales. Moderating inflation is expected to minimize margin pressure. FY2023 revenues are expected to grow in the mid-single digits on an organic basis.

Improving supply chain conditions should reduce inventory stockpiling, and thereby ease working capital pressures and normalize free cash flows going forward; FY2022 free cash flows of EUR 224 million is the lowest since FY 2018. 1H 2023 free cash flows of EUR 108.8 million is more than double the EUR 41.4 million reported in the same period last year.

Looking further ahead, prospects are stable. The company’s long-term performance has generally been consistent with revenues, profits, and cash flows largely on an upward trajectory over the past few years. There are reasons to see continued growth going forward. Europe’s frozen food industry outlook is generally stable with the region’s frozen food market projected to grow in the mid-single digits over the coming years. Additionally, the company continues to expand market penetration within Europe, leveraging on its retail and distribution networks throughout the region. Goodfella’s frozen pizza is currently being expanded beyond their traditional markets of the UK and Ireland and into other European markets, specifically France and Spain. The expansion into France is opportune considering Nestle’s (OTCPK:NSRGY) troubles in the country (following an E.coli outbreak at one of its frozen pizza factories, Nestle announced they would be closing the factory, opening a gap in the market for players like Nomad Foods).

Nomad Foods’ growth strategy has also included making bolt-on acquisitions of smaller companies and expanding them on the back of Nomad Foods’ retail and distribution networks, as well as acquisitions for the purposes of geographic expansion. Their acquisition of Fortenova Group gives them access to frozen foods brands Ledo and Frikom which are the leading brands by market share in many eastern and central European markets and provide a platform to further expand into these markets.

Nomad Foods’ debt to equity, while better than rivals like Nestle and Unilever, is not particularly low, but consistent cash flow generation and decent interest cover (5.2x) gives them some flexibility (albeit limited) to continue making smaller bolt-on acquisitions in the longer term.

Risks

Stiff competition

As the biggest frozen food company in Europe Nomad Foods enjoys scale advantages however frozen food (particularly subcategories like frozen vegetables such as peas and potatoes) is essentially a commodity product in a saturated market with ample competition from private label supermarket brands that have a price advantage which may be particularly relevant for consumers in the UK and the euro area going forward considering weak medium-term economic growth projections (roughly around 1.5% for both UK and euro area) due to reasons including energy price shocks, tighter financing conditions, and modest fiscal policy. Competitive pressures from cost-competitive private label brands may dent Nomad Foods’ financial performance.

Potential sanctions on Russian seafood

Russia accounts for nearly 40% of global whitefish catch and up to 75% of the most popular wild-caught fish varieties and EU imports of Russian fish have so far remained strong despite the Russia-Ukraine conflict (European Union imports of Russian fish were up 20% in 2022).

Nomad Foods is the largest buyer of Marine Stewardship Council certified wild-caught whitefish sourcing globally and while the company has been making efforts to diversify fish sources, Russia remains a major source with the company noting in their latest annual report that their fish primarily originates from wild-caught fish in the North Pacific predominantly from the U.S. and Russia. It may take a while for Nomad Foods to reduce their reliance on Russian fish and until then, any sanctions imposed on Russian fish imports may be detrimental to Nomad Foods’ financial performance.

Conclusion

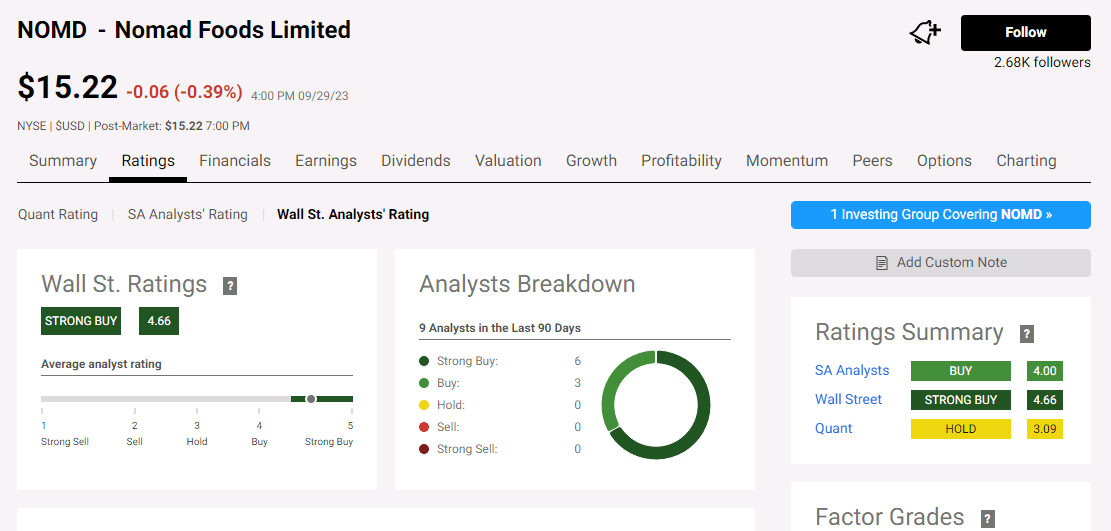

Nomad Foods has a buy analyst consensus rating.

Seeking Alpha

Taking the following assumptions suggests Nomad Foods is worth around $2.8 billion, roughly on par with its current market cap of $2.6 billion.

|

Revenue growth YoY |

5% over the coming two years |

|

Terminal growth rate % |

2% |

|

Net margin % |

8% (FY2022 = 8.5%) reduced slightly to account for possible A&P increases to counter competition |

|

Depreciation |

2.8% of revenues |

|

CAPEX |

2.9% of revenues |

|

Working capital |

0.3% of revenues |

|

Discount rate ` |

10% |

Read the full article here