In October 2023, I issued a buy rating for Norwegian Air shuttle ASA and the stock has climbed around 70 percent ever since compared to broader market returns of 20%. However, since my last report published in February this year, the stock price has modestly declined on a positive market. In this report, I will be analyzing the first quarter results and I will be assessing whether Norwegian Air Shuttle is still worth its buy rating.

Norwegian Air Shuttle Sees Losses Narrow In Q1 2024

Norwegian Air Shuttle

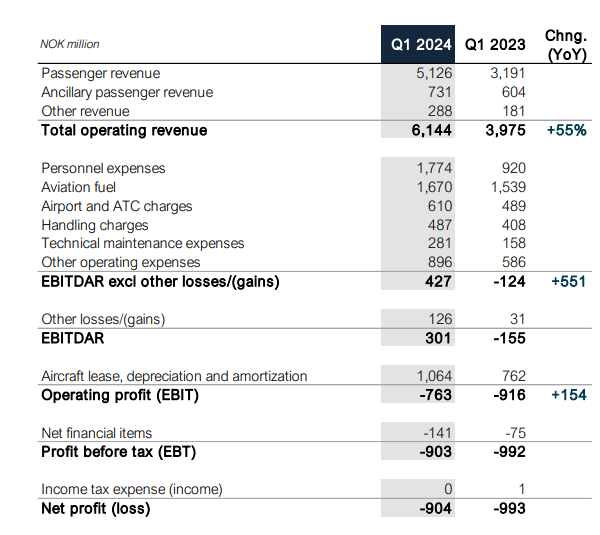

First quarter revenues increased 55% to 6,144 million NOK. This was driven by a 10% expansion in capacity of which 75% was driven by newly acquired Widerøe. Overall, Widerøe added 38% to the revenues as it is revenues per available seat mile are significantly higher than that of Norwegian. Norwegian, however, also saw its units revenues increase from 0.63 NOK to 0.73 NOK. It should be noted that this is partially driven by Easter occurring in March this year rather than April and higher ancillary revenues.

Total operating costs rose 41% driven by 312 million NOK higher operating expenses excluding fuel and other items, 98 million in forex headwinds and 156 million in higher depreciation and amortization and roughly the same amount in higher lease costs while fuel costs increased 64 million NOK. It should be noted that half of the increase in operating expenses excluding fuel and other items was actually driven by crew training. As a bigger business and in preparation for the summer season it makes sense for those costs to be elevated now.

EBITDAR before other losses or gains showed a 551 million NOK swing giving Norwegian a 7% EBITDAR margin for the quarter. On EBIT level, the company was still significantly loss making for the quarter with a 12% loss margin but it still better than the 23% loss margin in the comparable period last year.

Unit costs excluding fuel increased from 0.55 to 0.61 and that is not quite what anyone would be looking for when adding capacity. However, it should be noted that Norwegian overall is a bigger business but through the winter it operates at minimum levels. That means that compared to last year a bigger part of the business was idle and that has a negative effect on unit costs.

I believe that overall the addition of Widerøe provides nice unit revenue additions for Norwegian and will feed passengers from the Norwegian domestic network into the hubs of Norwegian to fly to destinations in Europe. With Easter falling in March rather than April, the April bookings are a bit softer but it is important to note that booked revenues from May to August are exceeding pre-pandemic levels which provides solid support for the 15% capacity expansion the airline wants to executed during that period.

Norwegian Air Shuttle Debt Continues To Rise

Norwegian Air Shuttle

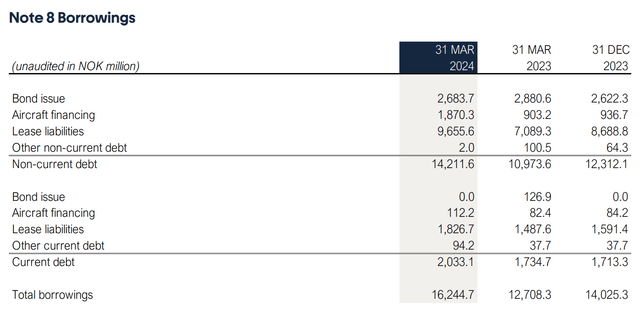

Those that have been following my coverage on Norwegian or the company itself know that before it restructured, Norwegian grew debt and its business without creating value. For that reason, we are keeping an eye on borrowings. We do see that borrowings continue to increase. However, there are two things that should be pointed out and that is that the growth Norwegian Air Shuttle is executing now is much more efficient while a significant portion of its borrowings are lease liabilities which grow as the business also grows. Its actual debt without lease liabilities is 4,742 million NOK compared to 3,765 million NOK a year ago. Half of the increase is driven by lease liabilities with the other half driven by aircraft financing. Cash and cash equivalents rose by 1.8 billion NOK, so year-on-year we see an improvement in the net debt without lease liabilities and that is actually very strong given that the company acquired Widerøe in an all cash deal.

Norwegian Air Shuttle Increases Guidance For 2023 Earnings

Norwegian Air Shuttle

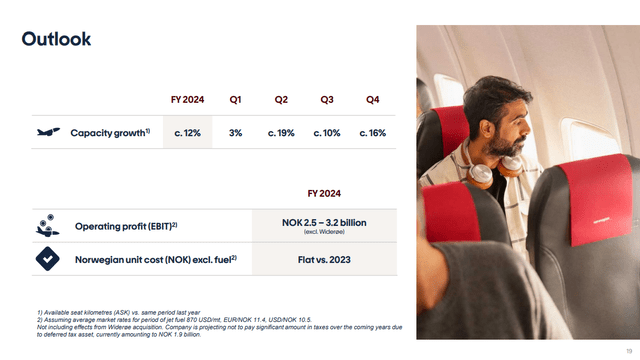

In the first quarter, we still saw a small year-on-year capacity growth and that does make sense as Q1 is a very weak quarter for Norwegian to the extent that they operate minimum schedules to reduce costs. In the quarters ahead, however, we see double digit growth which should bring the full year capacity growth to 12%. Operating EBIT excluding Widerøe is expected to be NOK 2.5-3.2 billion compared to 2.2 billion NOK a year ago.

So, overall it is looking very much like Norwegian being in an efficient growth mode rather than unbridled growth that lacks any value creation.

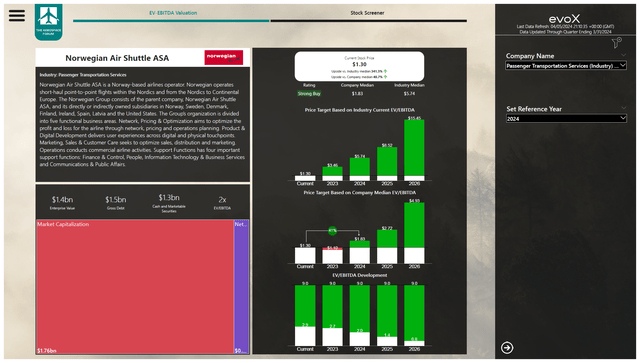

Norwegian Stock Remains Undervalued

The Aerospace Forum

Valuing Norwegian Air Shuttle stock can be very tricky. The reason is that its median EV/EBITDA over the past 10 years is significantly higher than the one we see today. That is not necessarily an issue, but it is a fact that the company is shaped completely differently today than it was years ago. I am currently using the current EV/EBITDA to value the company which I believe provides a safe basis for valuation. Using that multiple and when implementing the balance sheet data and forward projections for Norwegian Air Shuttle I come to a price target of $1.83 for 2024 representing 41% upside.

Conclusion: Norwegian Air Shuttle Remains A Buy

The first quarter results are not quite representative for many airlines to project forward into the remainder of the year and that holds true even more for Norwegian. However, we did see positives as the company was able to cut its losses through the winter while it is essentially a bigger business than it was a year ago. I believe that is very promising for the remainder of the year. Somewhat surprising to me is that Norwegian is even considering to pay a dividend over 2024 payable in 2026 when its latest bond is matured. That shows a lot of confidence in the future.

Obviously, for Norwegian we have to see how robust the market remains and how many deliveries it will get from Boeing to grow its fleet but overall I am liking the prudent management strategy and reiterate my strong buy rating and lift my price target by $0.12 cents to $1.83.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here