Summary

- Ørsted recently released a troubling press release about problems with their US wind energy portfolio, after which its stock collapsed by almost 25%

- The company has many things going for it: an expanding market, a good development pipeline and a strong history of growth

- In this article, I will explain why I believe this press release is a reason for investors to take caution, and not add to your position at these lower stock prices

Danish wind power giant Ørsted (OTCPK:DNNGY) recently held a conference call during which they announced some major setbacks on its US wind portfolio. As a result, its share price plunged 25% intraday, ending the day about 20% down, its steepest single-day drop ever.

I wrote about Ørsted in December 2021, arguing that the stock looked attractive at that moment, coming down from overvalued levels at the beginning of 2021. At that time, I gave Ørsted a buy rating, because of the many tailwinds which the company enjoyed, such as scale advantages, raised sustainability targets and the possibility that wind energy would become more competitive if fossil fuel prices would rise. Since my previous article, Ørsted’s stock has dropped even more.

Ørsted currently looks cheap

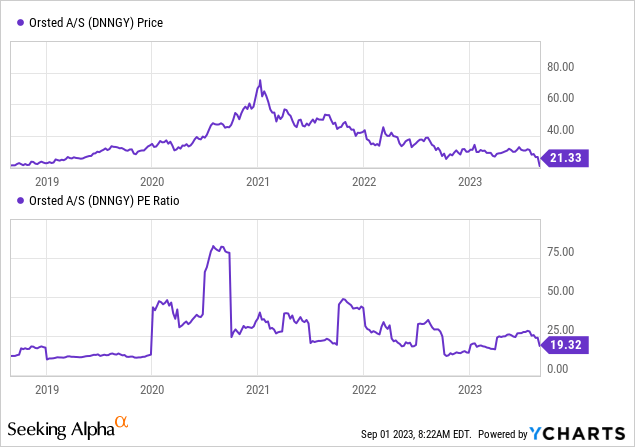

Looking at some financial metrics, Ørsted’s stock is hovering around the lowest point it has been in years:

Figure 1: share price and P/E ratio of Ørsted during the last 5 years (source: YCharts)

Ørsted’s share price came down all the way from more than $70 a share in 2021 to a bit more than $21 nowadays. Also, looking at their price-to-earnings ratio, the stock seems to be relatively cheap compared with their own ratio during the last 5 years. Please note that, since Ørsted’s earnings can be notoriously lumpy, their PE ratio has fluctuated very much in the past, as I also explained in my previous article.

Still, as explained well in this article by WideAlpha, the company has a good project development pipeline, a strong track record for growth and is likely to further profit from the shift to renewable energy in the future.

Impairments

But let us take a look at the recent bad news, and try to analyze if this bad news warrants a 20% share price plunge.

Here are some snippets from the Ørsted press release about their US portfolio, released on the 29th of August (selected to show only the most relevant parts and highlighted by the author for emphasis):

The Ocean Wind 1, Sunrise Wind, and Revolution Wind projects are adversely impacted by a handful of supplier delays. … These impacts will lead to impairments of up to DKK 5 billion, assuming no further adverse developments in the supply chains on these projects.

We continue to engage in discussions with federal stakeholders to qualify for additional tax credits beyond 30%. If these efforts prove unsuccessful, it could lead to impairments of up to DKK 6 billion.

Furthermore, the US long-dated interest rates have increased, which affect our US offshore projects and certain onshore projects. If the interest rates remain at the current level by the end of third quarter, it will cause impairments of approximately DKK 5 billion.

In plain English, the three main issues with Ørsted’s US portfolio are:

- Supply chain problems, amounting to at least DKK 5 billion (and maybe more)

- Possibly no additional tax credits, costing DKK 6 billion

- Additional interest costs by rising US interest rates, amounting to DKK 5 billion (if the interest rates stay at the current level)

As an analyst, I believe it would be safe to say that the estimate of the impairments from the supply chain issues is likely to become higher eventually, especially since Ørsted communicated that it amounts to 5 billion assuming no further adverse developments. Also, I think it is unlikely US long-dated interest rates would drop quickly during the third quarter of this year, making the interest-related impairments of 5 billion very likely to materialize.

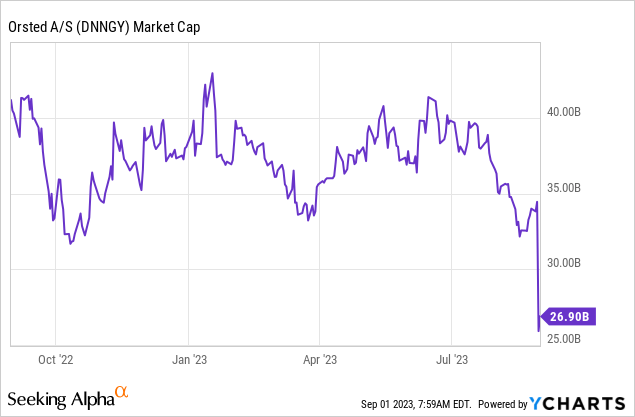

All in all, it would be safe to say the company will suffer about DKK 16 billion of impairments from their US portfolio, at the very least. This amounts to about $2.3 billion dollars. Let us take a look at the total market capitalization of Ørsted:

Figure 2: market capitalization of Ørsted during the last year (source: YCharts)

On the day of the press release, the stock took a dive from about $34B to around $27B today. This means that about $7 billion of market capitalization was lost because of a likely impairment of $2.3 billion. Rationally thinking, this makes little sense. Does this mean that this is a great buying opportunity for people wanting to invest in Ørsted? Before I try to answer this question, let us go back a few weeks to the interim financial report of the first half year of 2023.

Trust

On the 10th of August, Ørsted released its H1 2023 results, featuring a net profit of DKK 2.7B and a steady return on capital employed (ROCE) of 13%. The H1 report briefly mentioned that for the Sunrise Wind Project, Ørsted filed a request in the state of New York to get retrospection inflation indexing, but other than that there was no indirect mention of possible arising impairments in this financial report.

As an investor, I believe the company did not do itself a favor by not mentioning possible impairments in their H1 financial report. Sending out a press release about large impairments almost three weeks after their interim financial report caused a huge shock on the market for Ørsted investors.

I believe the large drop in share price is warranted, even if the possible impairments are likely to be a couple of factors lower than the drop in market capitalization.

Fair value

At this moment it is very difficult to pin a fair value on Ørsted’s stock. If I would really have to make an estimate, I would use the earnings per share over the last couple of years, and apply a price-to-earnings ratio which I believe is fair: 20. (please note that I will do these calculations in DKK since it’s a lot easier and I do not have to convert currencies)

| Earnings per share of Ørsted in DKK (source: Ørsted financial reports) | 2023 (only the first half) | 2022 | 2021 | 2020 | 2019 | 2018 |

| 5.3 | 34.6 | 24.3 | 38.8 | 12.8 | 45.3 |

In the table I pasted the earnings per share over the last 5.5 years. Please note the heavy fluctuations, which is the reason why I feel it is rational to take an average of the last couple of years. If we take the values of 2023 (and multiply it by 2 to get a very rudimentary estimate of 2023’s EPS), 2022 and 2021 and simply take the average of this, we get (10.6+34.6+24.3)/3= 23.2 DKK earnings per share. Multiplied by 20, we get a fair price of 464 DKK, which corresponds with a price of $20,55 for the DNNGY OTC shares. This is about 4% lower than the current share price, which confirms my hold rating.

In my calculation of the fair value of Ørsted, I assumed that the company would earn the same amount in the second half of 2023 as in the first half of 2023. The first half of 2023 was a relatively modest one, with only 5.3 DKK earned per share, so I think this is a conservative estimate. But with the looming impairments and the loss of trust, I believe this estimate is fair. If Ørsted’s 2023 EPS figure proves to be much higher or lower, it could turn my hold rating into a buy or a sell.

Conclusion

Most of the drop of the share price of Ørsted is likely due to the loss of trust. I must say that as an investor in the company, I am not pleased by the way these setbacks were suddenly communicated without any mentioning of them in their H1 2023 results. I am not selling my shares, but I will continue to monitor the situation. Even though Ørsted’s share price looks low compared with previous years, I will not add to my position at this moment.

I come from the Netherlands, and an old Dutch saying goes: “trust arrives on foot and leaves on horseback”. Ørsted needs to regain trust of its investors, and this might take a while.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here