I have assumed a conservative stance on PennantPark Investment Corporation (NYSE:PNNT) since early January this year, when I published my first article on this BDC. The key reasons for my skepticism against PNNT were the following:

- Excessive exposure to non-first lien investments, which renders the BDC riskier than the average peer in this space.

- Thin margin of safety when it comes to the coverage of a base dividend.

- High concentration in equity-type instruments, which makes the dividend coverage less predictable as the distributions from the equity investments are inherently more volatile than from, say, first lien investments.

Several months after the publication of that first article on PNNT, I revisited the thesis by synthesizing the Q1, 2024 earnings report. From the data it was clear that there was no reason to change the thesis. During the first quarter, PNNT recorded a notable spread compression, considerable increase in external leverage, and on top of that showed no signs of strengthening dividend coverage (despite the increase in leverage).

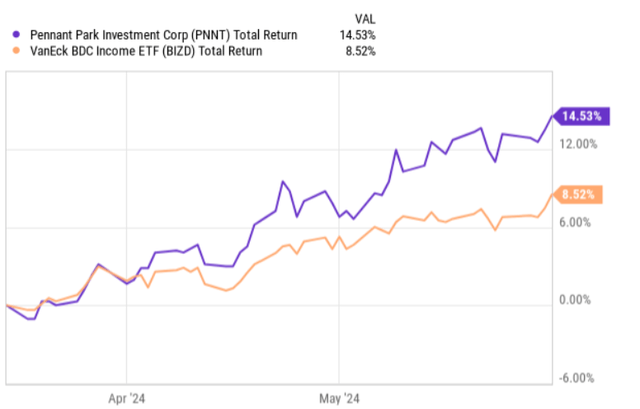

Yet if we now look at the performance, it is obvious that my thesis, especially after digesting the Q1 report, was wrong. PNNT has managed to outperform the BDC market by a huge margin.

YCharts

Let’s now review the most recent earnings report and determine whether there is a justified basis for becoming more optimistic about PNNT’s return and dividend prospects.

Thesis review

The Q2 2024 earnings report embodies mixed messages. On the one hand, there is some deterioration in the underlying fundamentals. On the other hand, the competitive position of PNNT has improved. The improvement in PNNT’s position, combined with an increased dividend of ~10% has triggered such a reaction by the market, sending the stock price materially above the BDC index level.

During Q2, PNNT generated a core net investment income of $0.22 per share, which is $0.04 below Q2 2023 and $0.02 below the result that was achieved the previous quarter. In other words, the momentum in the underlying cash generation is bad. Plus, the recent dividend increase now implies that the quarterly base dividend payment has reached $0.24 per share, which is above this quarter’s core net investment income result.

So far, it does not look sustainable at all.

The caveat here for why management decided to step up its dividend distributions even though core net investment income has been declining, is the reliance on equity type income. Namely, PNNT holds roughly 17% of its portfolio in equity and preferred instruments, and an additional 6% in a separate JV, which is also mostly driven by the equity dynamics. This means that on top of generating cash from the interest bearing investments, PNNT on a quite systematic basis, recognizes gains from successful equity exits or revaluations. These components allow PNNT to close the gap between the dividend and core net investment income. For example, the increase in net assets (before dividend distributions) was $0.25 per share this quarter, which means that the dividend is covered.

The other aspect, which relates to improved PNNT’s competitive position, comes from the fact that most of the investments that PNNT makes are located in the core middle market segment, where the competition is not as tough as in the upper middle market space. Since the competition in the core middle market is not as strong as elsewhere in the BDC segment (as companies with $10 million to $15 million of EBITDA are below the threshold of syndicated and high-yield markets), PNNT is able to avoid major pressure on the spreads and keep the underwriting standards strict.

During the most recent earnings call, Art Penn – Chairman and CEO – gave a nice color on this theme:

On average, we have seen a 50 basis point tightening of first lien spreads over the last six months. However, we continue to believe that the current vintage of core middle market directly originated loans is excellent. In the core middle market leverage is lower, spreads and upfront OID are higher and covenants are tighter than in the upper middle market. Despite covenant erosion in the upper middle market and the core middle market, we are still getting meaningful covenant protections.

While 50 basis points of tightening imposes challenges on the core net investment income front (as we can see in Q2 figures), it is still much lower than what other BDCs have been experiencing.

When it comes to keeping the covenants strict, the quarterly net investment funding statistics confirm that PNNT has been able to maintain a conservative policy. The weighted average debt-to-EBITDA of new fundings was at 4.3x, which is 0.01x below the total portfolio weighted average of 4.4x. Similarly, the interest coverage statistics have come in at stable levels.

In this context, Art Penn also made an interesting comment, indicating there is a statistical benefit of keeping the allocations in the core middle market segment:

Many of our peers are focused on the upper middle market, state that those bigger companies are less risky. That is a perception that may make some intuitive sense but the reality is different. According to S&P, loans to companies with less than $50 million of EBITDA, have a lower default rate or higher recovery rate than loans to companies with higher EBITDA.

Finally, before we transition to a summary section, I would like to highlight the answer by Art Pen to an analyst’s question around the overall sustainability of the dividend given the suboptimal dynamics at the core net investment income end:

First, it’s important for everyone to know we have a lot of spillover probably about $1 a share of spillover that we’re going to need to be to pay out a significant portion of that anyway. Now then you turn to what’s our recurring ongoing NII. And we believe that based on the performance of the portfolio based on continued growth of the joint venture that, that $0.24 is achievable on a recurring basis anyway.

The bottom line

All in all, Q2 2024 earnings came with some rather complex data points, where we could notice a divergence between the underlying performance and management’s optimism on PNNT’s ability to distribute even higher dividends.

The optimism is to a large extent justified given PNNT’s focus on the core middle market, which is exhibiting milder competition, allowing the BDC to avoid spread compression or the decrease in portfolio quality just to get the new volumes in. Plus, there is a significant value potential embedded in PNNT’s equity and preferred stock positions that, once realized, could support the dividend.

Having said that, I still do not feel comfortable going long PNNT due to the following reasons:

- The external leverage of 1.4x is still very high and significantly above the sector average.

- PNNT’s ability to accommodate the dividends is dependent on how successful the equity sale component takes place, which is inherently an unpredictable and market condition dependent process.

- The fact that the core net investment income result keep dropping, while the leverage is this high, increases the risk of PNNT becoming even more reliant on the unpredictable equity sale (and JV monetization) process.

As a result of these dynamics, I am still inclined to avoid PennantPark Investment Corporation.

Read the full article here