I recently wrote a cautious follow-up article on the Global X U.S. Preferred ETF (PFFD), arguing that caution is warranted for funds heavily invested in preferred shares of financial companies, as the root cause of the March regional bank crisis have not been resolved. With long-term interest rates dramatically higher now than in March, systemic risks have actually increased, despite the seemingly calm macro environment.

I believe the risks I identified in my PFFD article applies equally well, if not more so, to the Invesco Financial Preferred ETF (NYSEARCA:PGF). First, the PGF is susceptible to duration risk as its portfolio is focused on fixed-rate preferred securities. Moreover, PGF is solely focused on financial preferred securities, which have heightened systemic risks compared to other sectors. I recommend investors seek their preferred share exposures elsewhere.

Fund Overview

The Invesco Financial Preferred ETF is a passive ETF that tracks the ICE Exchange-Listed Fixed Rate Financial Preferred Securities Index (“Index”). The PGF ETF will invest at least 90% of its assets in fixed-rate, U.S. dollar denominated preferred securities issued by financial companies, such as banking, brokerage, finance, investment and insurance companies.

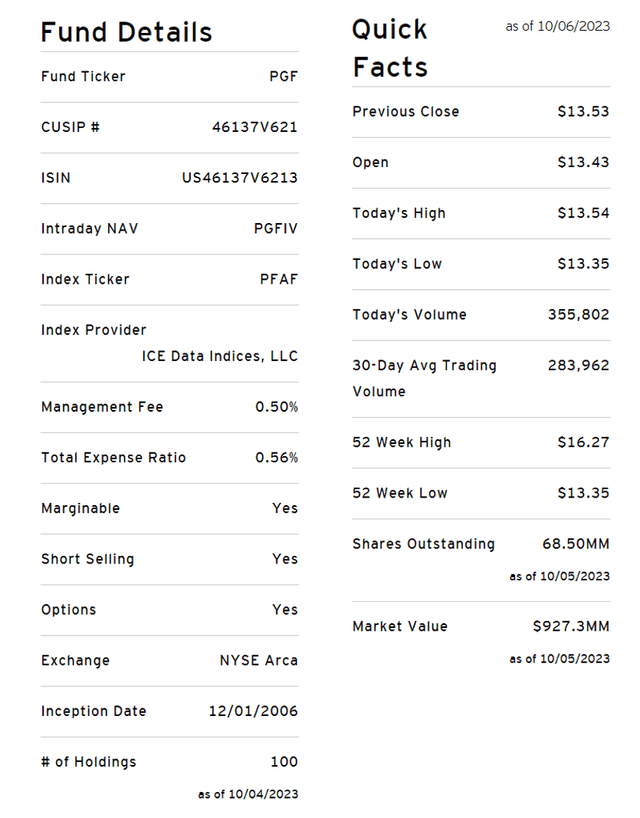

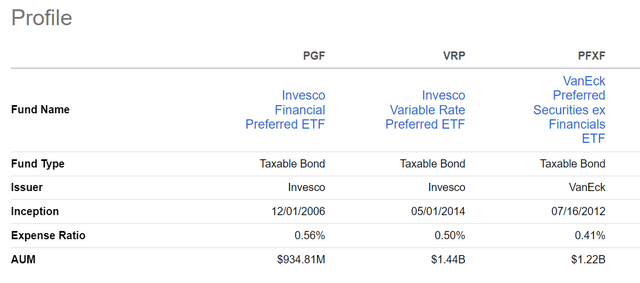

The PGF ETF is popular with investors over $900 million in assets and charges a 0.56% expense ratio (Figure 1).

Figure 1 – PGF overview (invesco.com)

Portfolio Holdings

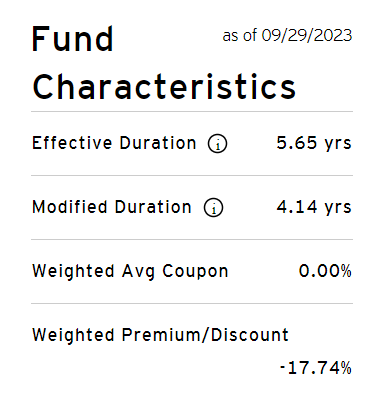

The PGF fund holds 100 securities with a portfolio effective duration of 5.7 years (Figure 2). As interest rates have risen, the average security is now trading at a discount to par.

Figure 2 – PGF has a 5.7 year duration (invesco.com)

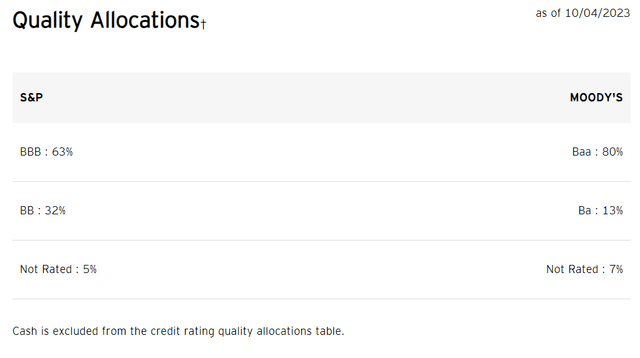

Figure 3 shows the PGF ETF’s credit quality allocation. Using S&P ratings, 63% of PGF’s preferred security holdings are rated BBB, and 32% are rated BB.

Figure 3 – PGF credit quality allocation (invesco.com)

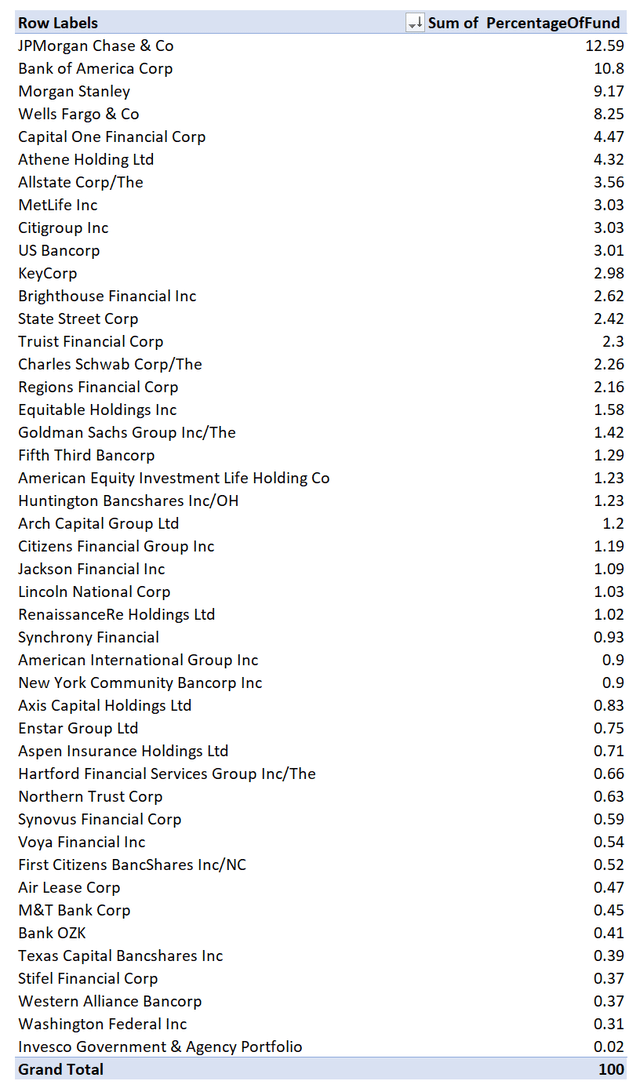

Although the PGF ETF has 100 positions, it is exposed to only 45 issuers, with several issuers like JPMorgan, Bank of America, and Morgan Stanley dominating the portfolio at 12.6%, 10.8%, and 9.2% respectively (Figure 4).

Figure 4 – PGF portfolio dominated by a few issuers (Author created with data from invesco.com)

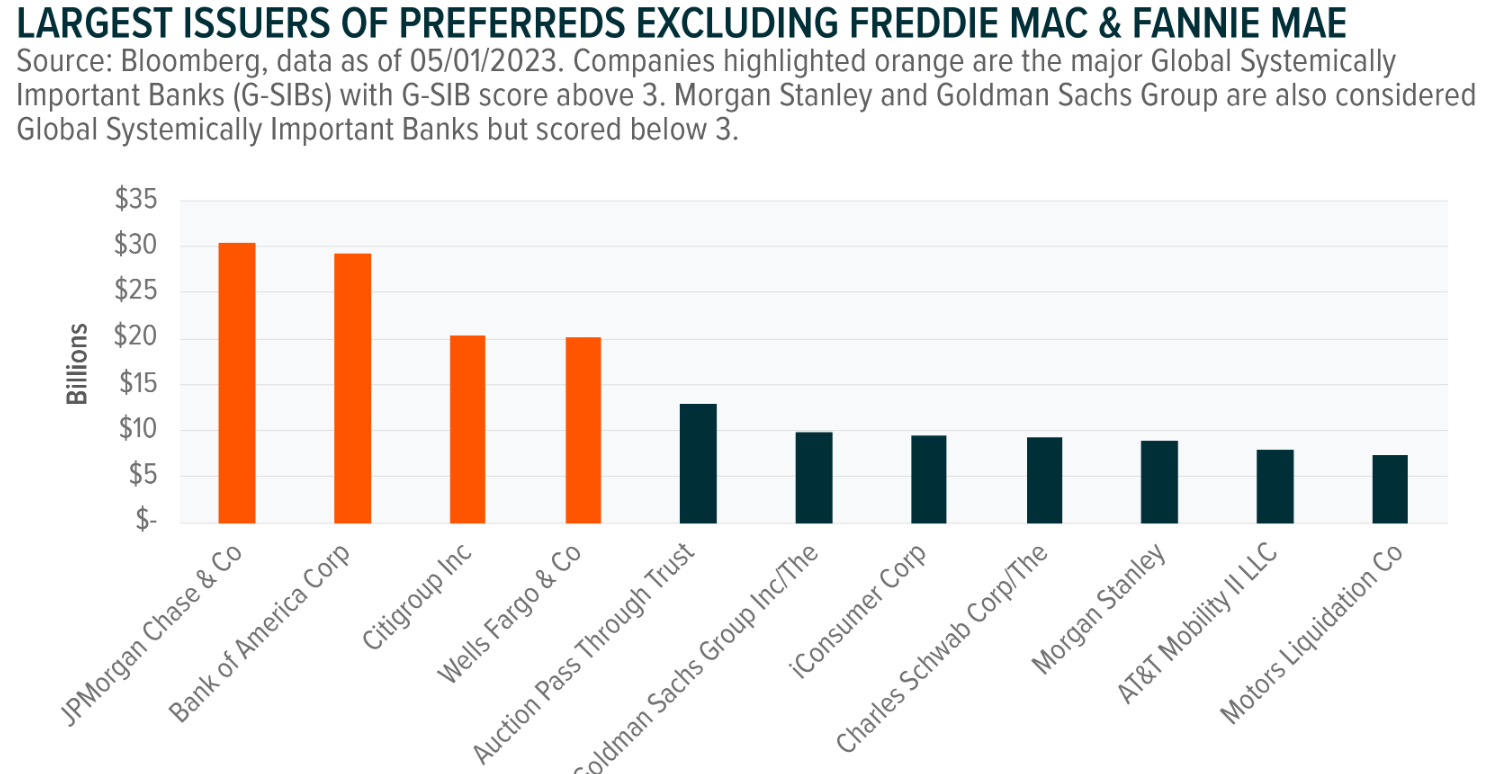

Interestingly, PGF’s largest issuer exposures are different from the largest issuers of preferred shares on the market, as Citigroup and Goldman Sachs’ weights are materially smaller in PGF and Morgan Stanley is materially larger (Figure 5).

Figure 5 – Largest preferred share issuers (vaneck.com)

Distribution Yield Is Attractive

One of the main attraction of the preferred share asset class are their high dividend yields. Preferred shares are similar to bonds in that they pay periodic, contractual dividends to shareholders, similar to how bonds pay coupon payments.

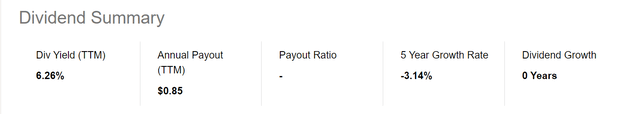

The PGF ETF pays an attractive trailing 6.3% distribution yield (Figure 6). PGF’s distribution is paid monthly.

Figure 6 – PGF pays an attractive 6.3% distribution yield (Seeking Alpha)

But Total Returns Have Been Poor

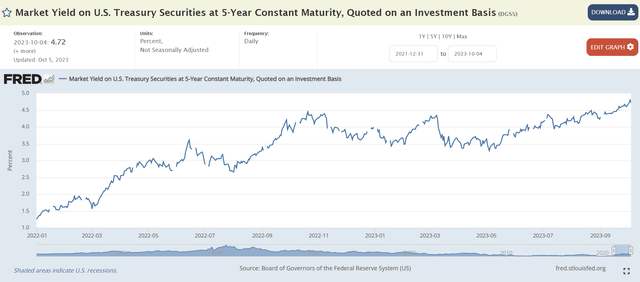

However, the fixed-rate preferred shares within PGF’s portfolio has come under pressure in the past 2 years as the Federal Reserve had been aggressively raising interest rates to combat inflation. The Fed have raised short-term interest rates by 525 bps and long-term interest rates have risen in sympathy, with the 5-year treasury yield rising by almost 350 bps since the beginning of 2022 (Figure 6).

Figure 7 – 5 year yields have risen by almost 350 bps (St Louis Fed)

Rising long-term interest rates have caused fixed-rate preferred shares to lose value, with the average security within PGF’s portfolio now trading at a 17.8% discount to par, as mentioned above.

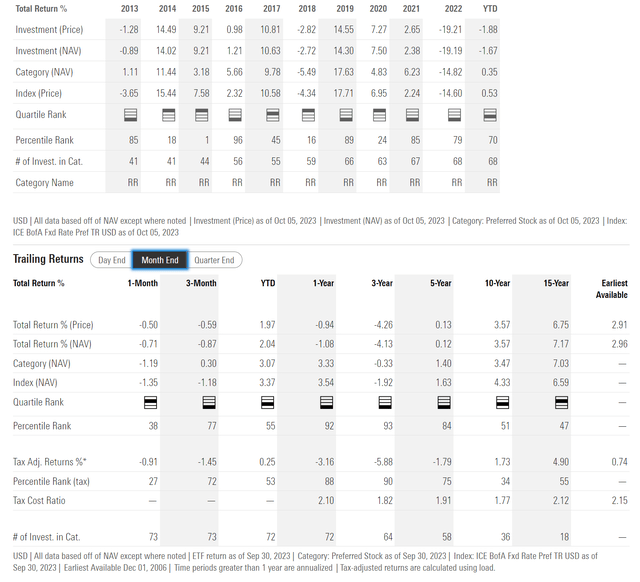

The poor performance of fixed-rate preferred shares in 2022 have decimated PGF’s short-term performance, with the fund recording 3 and 5-year average annual returns of -4.1% and 0.1% respectively to September 30, 2023 (Figure 8). Longer-term returns are better, with 10 and 15-year average annual returns of 3.6% and 7.2% respectively. Since inception, returns have been modest at only 3.0% p.a.

Figure 8 – PGF historical returns (morningstar.com)

How High Can Yields Go?

I have two main concerns with PGF’s strategy of owning a portfolio of fixed-rate preferred shares of financial companies. First, there is the question of how high long-term interest rates can rise.

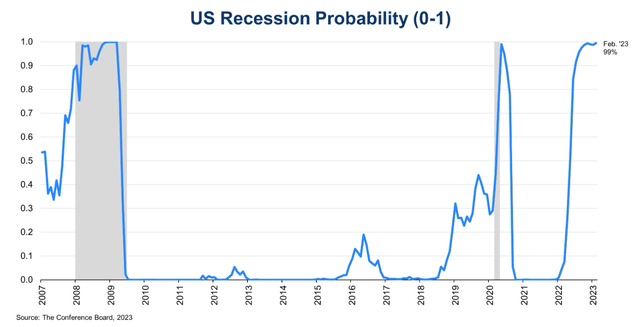

For most of this year, analyst opinions on the future path of the Fed’s interest rate policies have ebbed and flowed, seemingly on a week-to-week basis. When we experienced the regional bank crisis in March, the consensus view was that the U.S. economy would shortly enter a recession and the Fed would have to cut interest rates to stimulate the economy (Figure 9).

Figure 9 – Analysts have been forecasting a recession since the Spring (Conference Board)

However, during the summer, economic data like GDP reports continued to beat expectations, and gradually, investor focus has shifted to a ‘soft landing’ scenario.

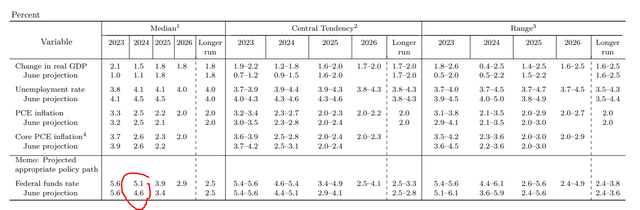

In recent weeks, bond traders have had to further raise their expectations for long-term interest rates, as the Fed boosted their forecasts for 2024 Fed Funds rate from 4.6% to 5.1%, suggesting they are serious about maintaining tight monetary conditions ‘higher for longer’ (Figure 10).

Figure 10 – Fed has raised 2024 Fed Funds forecast to 5.1%, suggesting ‘higher for longer’ policies (Federal Reserve)

While many pundits on TV and social media have been calling the top in yields and have been recommending investors buy duration, they have repeated been proven wrong as interest rates continue to surge higher.

As the non-farm payrolls report on October 6th showed, as long as the economy continues to perform (NFP was 336k vs. 170k expected), the Fed will continue to have cover to maintain ‘higher for longer’ interest rates, and long-duration assets like PGF may continue to suffer.

Financials Have Heightened Systemic Risk

Furthermore, as we saw in the March regional bank crisis, preferred shares of financial companies have systemic risk that are not present in other sectors.

In March, U.S. regional banks suffered a massive run on confidence as investors questioned their balance sheets and depositors fled from weaker banks. While the problems have receded to the background, they have not been resolved.

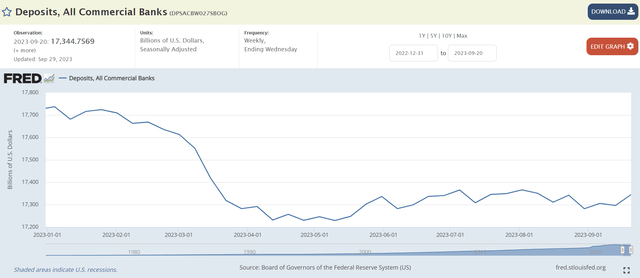

First, if U.S. commercial bank deposits have not fully recovered the outflows from March (Figure 11).

Figure 11 – Commercial bank deposits have not recovered outflows (St Louis Fed)

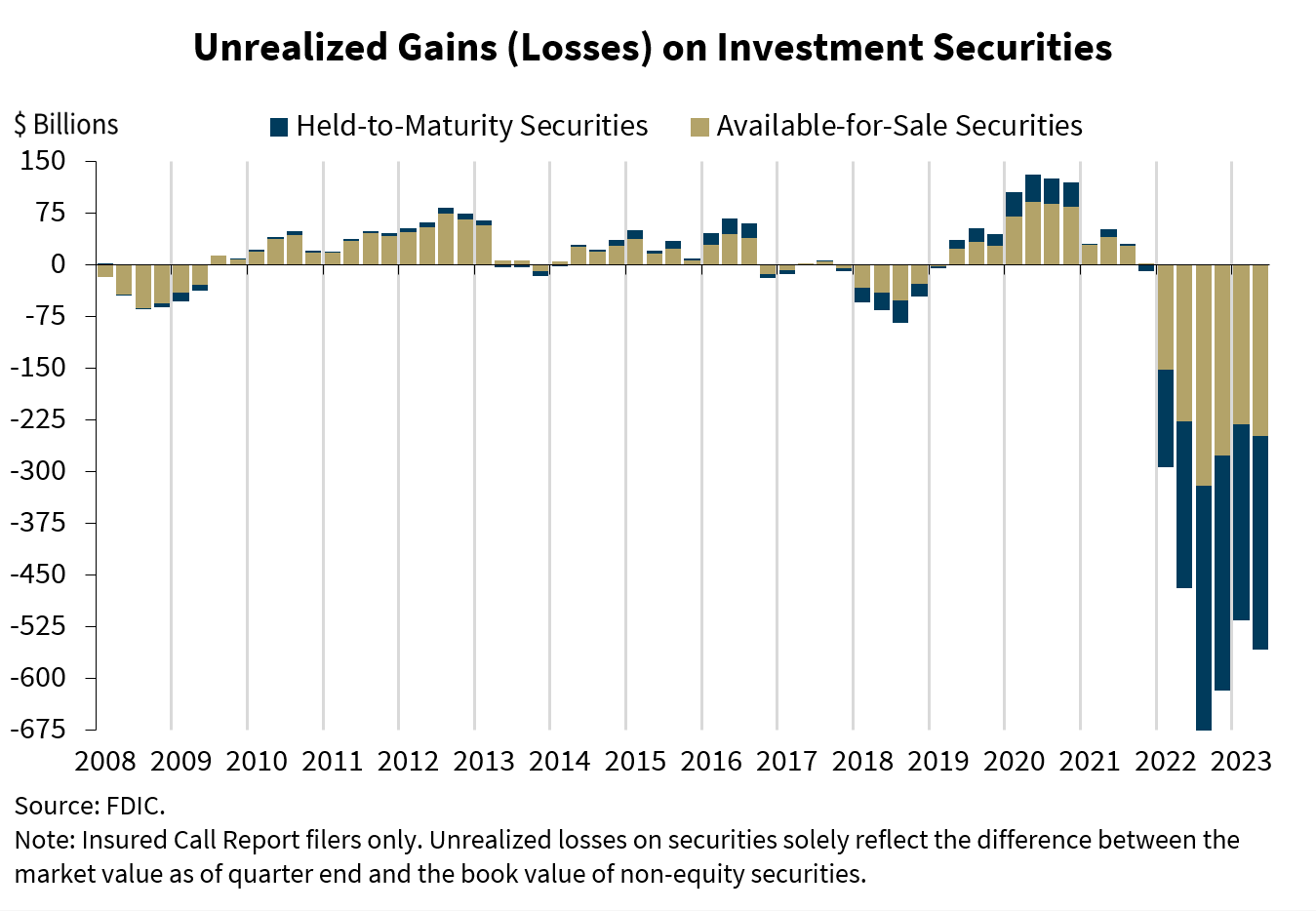

On the asset side of bank balance sheets, investors were worried about unrealized losses on investment securities caused by rising interest rates. As of the end of Q2/2023, commercial banks had $558 billion in unrealized losses on their balance sheets, an increase of 8.3% QoQ according to data from the FDIC (Figure 12).

Figure 12 – Unrealized security losses remain a big issue (FDIC)

Since long-term interest rates are significantly higher now than in March and Q3/2022, the unrealized losses problem could actually be much larger if bank balance sheets are marked-to-market.

Unlike other sectors where fundamentals deteriorate gradually, the financial sector tends to suffer from periodic ‘systemic’ crises like the March regional bank crisis. When crisis do hit, financial preferred shares can lose most of their value virtually overnight.

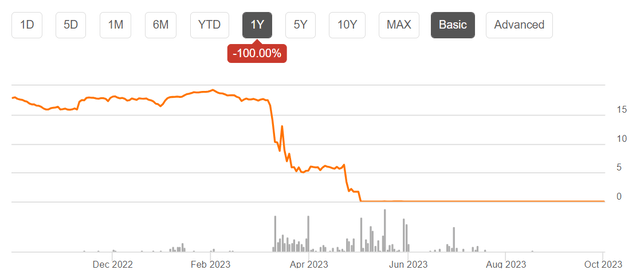

For example, preferred shares of First Republic Bank, one of the victims of this year’s regional bank crisis, had traded between $16-19 for much of last year. Then almost overnight, they collapsed to $5 and then $0, as the bank was taken over by the FDIC and sold to JPMorgan (Figure 13).

Figure 13 – FRC preferred shares were wiped out virtually overnight (Seeking Alpha)

While major money center banks like JPMorgan and Bank of America are unlikely to fail like First Republic, the risk of financial contagion from systemic risks is always present. In 2008 during the Great Financial Crisis (“GFC”), many financial giants like Lehman Brothers and AIG failed overnight and many preferred shareholders were wiped out.

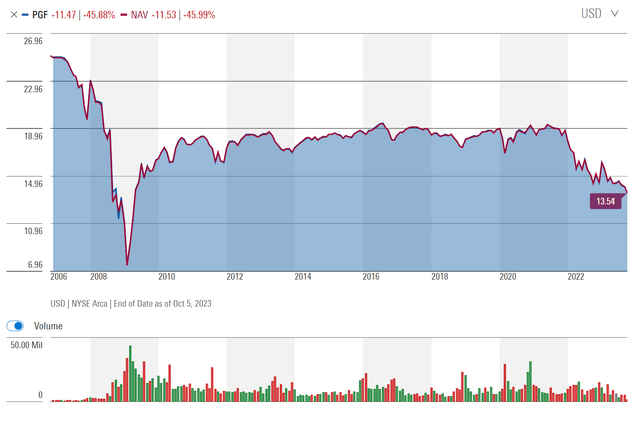

The PGF ETF itself has battle scars from the GFC era, as its NAV dipped to a low of $7.50 in February 2009 from over $20 in December 2007 (Figure 14).

Figure 14 – Financial preferred shares have heightened systemic risks (morningstar.com)

Alternatives To PGF

Instead of the PGF ETF, investors who are interested in preferred shares should consider the Invesco Variable Rate Preferred ETF (VRP) or the VanEck Preferred Securities ex Financials ETF (PFXF). The VRP ETF holds variable rate peferred shares that do not have PGF’s duration risk. However, VRP does have 74% financials exposure. The PFXF ETF is mostly fixed-rate preferreds as well, but does not have financial sector exposure (Figure 15).

Figure 15 – PGF vs. peer funds (Seeking Alpha)

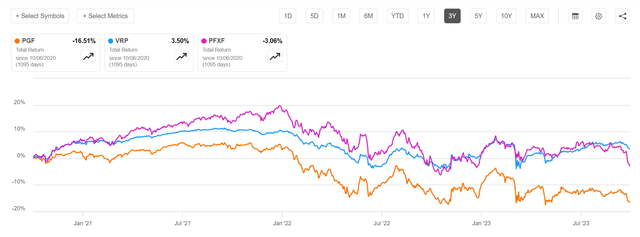

Figure 16 shows the 3-year total return performance of the PGF ETF compared to VRP and PFXF. As expected, VRP has significantly outperformed PGF due to its floating rate nature. PFXF has also outperformed PGF due to its lack of financials exposure.

Figure 16 – VRP and PFXF has outperformed PGF (Seeking Alpha)

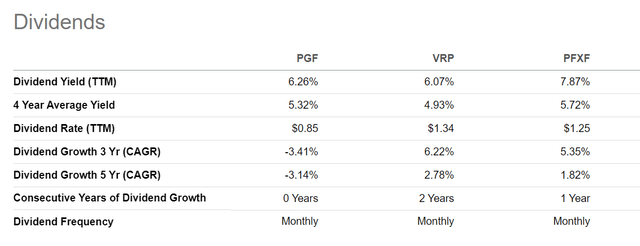

Moreover, PFXF pays a more attractive distribution yield compared to the PGF (Figure 17).

Figure 17 – PGF vs. VRP and PFXF distribution yield (Seeking Alpha)

The only upside to PGF is if interest rates were to suddenly return to the post-COVID lows, then PGF may deliver large capital gains as its fixed-rate preferred shares are trading at a significant discount to par. However, investors should note that in order for interest rates to decline significantly, the economy must weaken materially or a new bout of systemic risk would need to occur, neither of which would be beneficial for the financial sector.

I wrote about the VRP ETF here, and the PFXF ETF here.

Conclusion

The Invesco Financial Preferred ETF is a passive ETF of fixed-rate preferred shares issued by financial companies like banks and insurance companies. I believe the PGF ETF faces 2 main headwinds. First, rising long-term interest rates are causing MTM losses to long-duration assets like fixed-rate preferred shares. More importantly, financial companies have heightened systemic risk that was partly exposed in the recent regional bank crisis.

Instead of the PGF, I recommend investors consider alternative funds for preferred share exposures like the VRP and PFXF that have reduced duration risk or financials exposure.

Read the full article here