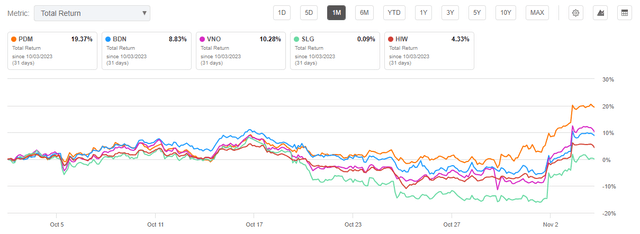

Shares in Sunbelt-focused office operator, Piedmont Office Realty Trust (NYSE:PDM), have gained nearly 20% in the last month, outperforming other peers, as well as the broader market.

Seeking Alpha – 1-Month Performance Of PDM Compared To Peers

Still, shares are sitting on heavy one-year losses, and they continue to trade near the lower end of their 52-week range. At a forward multiple of funds from operations (“FFO”) of just 3.5x, I continue to view the stock’s valuation as well out of range with the quality of their Class-A office portfolio.

I’ve consistently maintained a bullish stance on the company, with a “strong buy” view on my most recent updates. It has yet to materialize, however, as shares are down over 17% since my last update, where I elaborated on my views regarding the dividend cut and the company’s refinancing activity.

Even with the reduction in the payout, the dividend still yields over 8% at current trading levels, an attractive premium over comparatively risk-free alternatives in U.S. Treasurys. The attractive dividend yield, the perpetually low valuation, and positive leasing updates reinforce my conviction in the stock. In my view, PDM remains a “strong buy.”

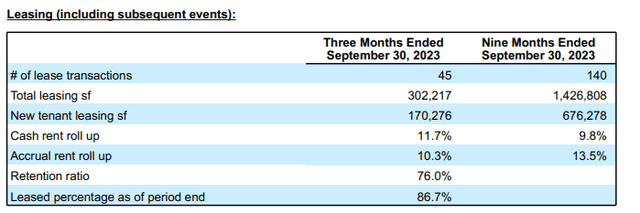

PDM Key Portfolio Metrics

PDM reported a portfolio leased rate of 86.7% as of September 30, down slightly from the same period last year but up 50 basis points (“bps”) from June 30.

The spread between PDM’s leased and economic rates remained wide at the end of the period, at 590 bps. This includes over 1 MSF of executed leases for vacant space yet to commence or under rental abatement. This represents about +$36M in additional cash revenues. This stacks favorably against PDM’s scheduled lease expirations for the final quarter of the year, estimated at 2% of annualized lease revenues.

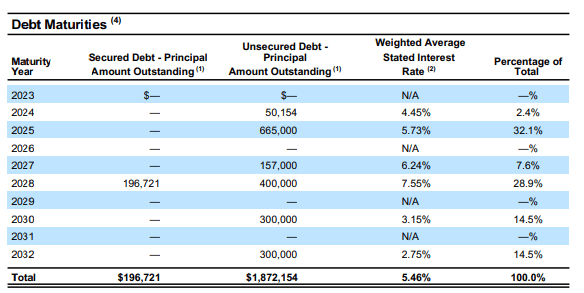

At period end, PDM’s net debt multiple stood at 6.4x, effectively unchanged from prior quarters. The weighted average interest rate on the total stack increased to 5.46% from 4.49% last quarter, primarily due to recent refinancing activity, which I described in further detail in my last coverage on the stock.

PDM Q3 Supplemental – Debt Maturity Schedule

The uptick in the weighted rate is expected to increase their interest burden in the periods ahead. As one offset, PDM does benefit from a more favorable maturity ladder, as the largest near-term debt due isn’t until 2025. Additionally, PDM also had about +$450M in availability on their credit facility at the end of the last quarter, providing the company with a healthy liquidity position.

Recap Of PDM Q3 Results

In Q3, PDM logged 302K SF of leasing activity, 170K SF of which was attributable to new tenant leasing. This represented PDM’s 11th consecutive quarter of positive leasing activity in relation to pre-COVID levels.

PDM also boasted of another quarter of positive spreads on cash rents. In fact, spreads were in the double-digits, at 11.7%. In addition, retention improved to 76% from 69.3% last quarter. This came as PDM reported positive absorption during the quarter.

PDM Q3 Supplemental – Summary Of Quarterly Leasing Activity

Another positive mark during the quarter was PDM’s cash basis growth in same-store net operating income (“NOI”). PDM recorded 5.3% growth during the quarter, following either flat or negative marks in the periods prior. The combination of new commencements and expiring abatements in excess of expired leases was primarily to credit for the increase.

Looking ahead, the management team left their forward guidance range for core FFO unchanged. But they did note that they expect to land at the low end of the range, which would be about $1.74/share. The more cautious outlook stemmed primarily from the higher-for-longer outlook on interest rates.

Releasing Of U.S. Bancorp

The most significant update on the Q3 earnings release pertained to the news surrounding U.S. Bancorp (USB). At present, the company is their single largest tenant, accounting for just under 5% of annualized lease rents. In prior quarters, there was continuing uncertainty surrounding the renewal of their headquarters in Minneapolis. And the uncertainty and associated non-renewal risk was one oft-cited bear-case against PDM.

In Q3, PDM dispelled those fears by reporting that subsequent to quarter end, the entire 447K SF space was renewed through 2034. This represents a major win for PDM on top of leasing results that could already be viewed as positive.

While the deal was reported to be flat in terms of releasing spreads, the positive spin was it included no free rent, as well as market level tenant improvements. That is, PDM didn’t have to provide major concessions to bring back a long-time tenant at the top of their overall tenant roster.

PDM Dividend Payout

Beginning with the third quarter payout, PDM reduced their annual dividend from $0.84/share to $0.50/share. This no doubt disappointed investors. However, it shouldn’t have come as a surprise. In earlier coverage on PDM, I forecasted that the annual dividend would be reduced to $0.45/share. By my estimates, the dividend cut was less than expected, a net positive overall.

And at the current payout level, the dividend provides an attractive spread over risk-free alternatives, which currently are providing about 5%.

On an annualized basis, PDM is generating about $1.29/share in AFFO based on Q3 AFFO of approximately +$40M and their current share count of about 123.8M. This would peg the payout ratio at less than 40%, well below the sector average of 75%.

I, therefore, view the payout in its current form as safe. Of course, changes in projected taxable income, which is less transparent to investors, can alter the calculus. But PDM CFO, Bobby Bowers, did note that the current dividend approximates their forecasted taxable income over the next one to two years. At least during this period, the dividend should remain safe from any further reductions.

Is PDM Stock A Buy, Sell, Or Hold?

I maintain a strong bullish view on PDM. The worst for the company clearly hasn’t materialized. And it is unlikely to do so in the months ahead.

Earlier in the year, PDM faced elevated refinancing risk due to an upcoming maturity in 2024. The company successfully pushed out the maturity to later years and improved their overall debt ladder in turn.

The threat of a dividend cut also always loomed large for PDM, given the challenged state of the office market. But even after the cut, the payout still provides an attractive yield to income-focused investors. Additionally, it’s backed by a low payout ratio. Granted, the prior payout also came accompanied by strong coverage. But the tax outlook was more uncertain previously than at present.

And finally, PDM updated investors in Q3 with a positive note surrounding the renewal of their largest tenant, US Bancorp. The non-renewal risk with the tenant was a prime bear-case point for PDM in prior periods. But with the tenant locked in for the next ten years, investors should breathe a sigh of relief. Even better is that the deal was completed with no free rent and with tenant improvements in-line with market averages; in other words, PDM didn’t have to stretch too far to retain their top tenant.

Higher interest rates will likely weigh on results. And this is reflected in the forward outlook for FFO, which the management team sees at the lower end of their stated range. But even if PDM were to generate $1.74/share in FFO, which would be the low point in the targeted range, shares would still trade at a multiple of just 3.50x at its current stock price. In my view, this is wildly out of line with the inherent risks in the stock, much of which has already been addressed. Even at a 5x multiple, shares would have upside potential of over 40%.

For investors seeking selective positioning in the beaten down office sector, I continue to believe PDM presents the most upside potential, especially considering the worst appears behind the company.

Read the full article here