Investment Thesis

PPG Industries, Inc. (NYSE:PPG) shares have gained about 11% over the last year. Although this stock has an attractive dividend policy and its growth metrics are very appealing, my midterm outlook of this stock is skeptical following its strategic review of North American architectural coatings. From a technical standpoint, there is a potential downward movement before an upward rebound based on the current price pattern, and from a valuation standpoint, this stock is almost trading at its fair value warranting a hold rating.

Company Overview

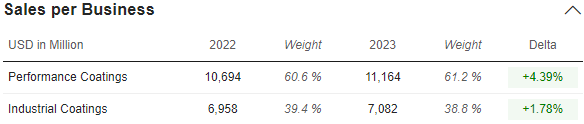

PPG is one of the world’s leading producers and distributors of coating, paints, lining, and other specialty materials used in automotive and construction industries. The company operates through two major segments. The first one is the performance coatings which offer various coatings and finishes used in several industries and applications. It entails refinishing, aerospace, and architectural coatings. The other segment is the industrial coatings which include protective and decorative finishes used in industrial equipment and some consumer products. In addition, it also offers finished aluminum coils and coatings used for automotive equipment. Below is the revenue contribution for each segment for the 2022 and 2023 FYs.

Market Screener

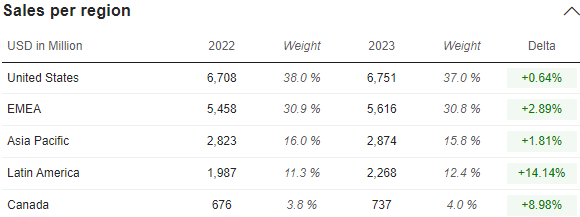

While it is apparent that this company has a wide range of products targeting different markets, it is also worth noting it operates in several geographical areas which speaks volumes about the company’s diversity both geographically and product-wise. For this reason, I believe this company has distributed its risk adequately to weather the adverse effects of concentrating on one product line or one geographical market. Below is the company’s performance in different states.

Market Screener

MRQ Performance

On January 19th, 2024, this company reported its Q4 2023 performance whose highlights and my takeaways are presented in this section. To begin with, the company reported quarterly revenue of $4.35 billion, representing almost a 4% YoY growth rate and beating estimates by $83.96 million. Further, its adjusted EPS was $1.53 up from $1.22 the same quarter the previous year and beating estimates by $0.03. Most interestingly, the average segment margin grew by 260 bps YoY marking the fifth consecutive quarter of YoY margin expansion. It is worth noting that, in this quarter, the company reported a record adjusted EPS and operating cash flow. Even though these figures appear very alluring, it is concerning to note that the company’s net income decreased by about 62% from Q4 2022 to $90 million in Q4 2023. I attribute this drastic drop to several reasons such as costs associated with strategic actions, for example the divestiture of its European and Australian traffic solution business, as well as the market fluctuations that may have affected its profitability.

In general, the company had a good quarterly performance which could have been excellent if it were not for the low net income. The CEO attributes the company’s good performance to several reasons such as its diversified portfolio, demand stabilization in its key markets such as Europe, and also growth in some key markets, especially the aerospace and automotive industries.

Looking ahead, the management has an optimistic outlook with an estimated adjusted EPS ranging between $1.80-$1.87 in Q1 2024 and $8.34-8.59 for the full year. Following this performance, below are my takeaways.

First off, this performance demonstrates the company’s resilience. This is because, despite global economic pressure characterized by historically high inflation rates, the company managed to register record sales and remain profitable, showcasing its ability to adapt and thrive. Secondly, the company’s record operating cash flow and adjusted EPS depicts its strategic management because it illustrates that the management can effectively manage costs. Lastly, these results demonstrates the company’s positive outlook suggesting the management’s confidence in its business growth and performance, something which I believe inspires confidence in investors. However, despite this performance and the management’s optimistic outlook, my midterm outlook for this company is blurred following its strategic review as will be discussed later in this article.

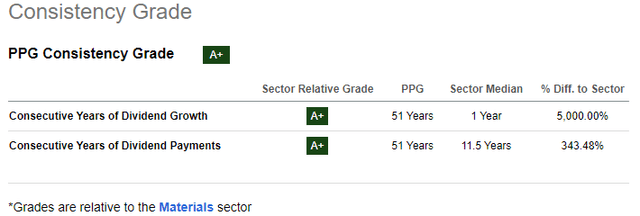

Dividend: Engrossing

PPG’s commitment to providing shareholder values is evident in its consistent and reputable dividend history. First off, the company has paid dividends for 51 consecutive years compared to the sector’s average of 11.5 years. Further, it has grown its dividend for 51 consecutive years compared to the sector’s average of 1 year. In my view, this history is not only remarkable but outrageous.

For this reason, I believe this is a good dividend pick for investors seeking reliability, consistency, and growth in their dividend portfolio. However, despite this growth, potential investors need to note one flaw in this company’s dividend and that is its low yield. PPG has a trailing yield of 1.79% which is 14.73% lower than the sector median. However, I am optimistic that following its impressive record of growth, this yield will improve in the future and possibly exceed the sector median. My optimism can be backed by the company’s forward dividend yield of 1.81% which is higher than its trailing yield compared to the sector’s forward dividend yield of 1.92% which is lower than its trailing yield.

Seeking Alpha

While this past performance is very attractive, I believe what matters most to us is the future possibilities. With this in mind, the future of this company’s dividend policy is as attractive as its history. To support this, the company has a forward dividend per share growth rate of 5.15% which is 47.24% higher than the sector median growth rate of 3.50%. In addition, its dividend is very secure and sustainable with ample room to grow. With a trailing cash dividend payout ratio of 32.12% and a trailing GAAP dividend payout ratio of 48.13%, it is apparent that this company’s dividend payment is adequately covered by its cash flow and earnings and thus very sustainable. Further, the modest payout ratios reflect the potential for future growth owing to the sustainability of this policy. With the company’s earnings projected to grow by about 10.2% in the next three years, I am optimistic about this haughty dividend stock.

Growth

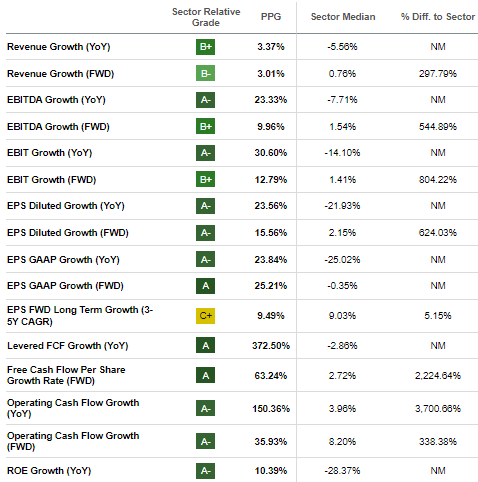

Empirically, EPS exhibits a positive correlation with share prices and this explains why this is always a factor to consider before I make any investment decision. From my experience, companies that can sustain EPS growth in the long run tend to have their shares grow as well. So, let’s evaluate PPG’s EPS trends and put them in perspective. The company has a trailing EPS growth rate of 23.78% and a 3-year CAGR of 6.24%. My focus here is majorly the 3-year time horizon because my investment decisions are majorly long-term goals oriented. Although this growth rate is relatively low to merry about it, it signifies that forward strides are being made, which can be a reason to be optimistic.

To have a clear picture, it’s good to look at EPS growth alongside revenue and profitability, especially EBIT. Interestingly, its revenues and EBIT have all grown remarkably YoY especially when compared to the sector medians. It is even more attractive to see their forward growth rates being better than the sector medians, a sign that this company is growing. Below are the growth grades of the company which are very pleasing.

Seeking Alpha

Based on this background, PPG appears to be growing better than its sector peers, which positions it as a good growth option in this sector.

Despite my optimism based on this company’s dividend and growth metrics, I am cautious to invest here at the moment because I foresee a bleak midterm outlook following the company’s review of the North American Architectural coatings which I will discuss in the section that follows.

The N. American Architectural Coatings Review: A Reason To Be Cautious Or Patient

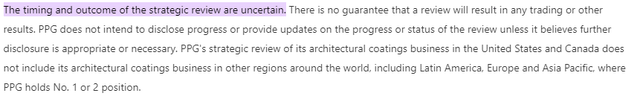

In February this year, PPG announced its hiring of Goldman Sachs to help them in reviewing strategic alternatives for its architectural coatings business in the US and Canada. The review entails well-known brands such as Glidden, Olympic, and Dulux among others. While the company is considering selling it, this is subject to ongoing review where different options will be evaluated.

It is important to note that the business segment has been playing a significant part in this company’s financials, contributing about 10% of the total net sales in 2023. The review is aimed at assessing whether the business would grow faster with a partner or different owner or is best suited to operate as a standalone entity or joint venture.

Given this strategic move, I have a holistic view of it. In one dimension, the outcome could lead to a realignment of resources and investments, therefore unlocking value for investors. It could also improve the company’s cost structure as well as give their revenue streams strength depending on the alternative chosen. In other words, this move has the potential to improve the company’s efficient allocation of resources and therefore unlock value creation of investors. While this is a long-term optimistic possibility, the other dimension I am viewing it is a bit skeptical and ranges from the short to midterm horizons.

Even though this deal is very strategic and justifiable considering the company is considering the best opportunity cost, it comes with some immediate and potentially long-term negative impacts which I believe could hurt the company at least to the midterm horizon. To begin with, the process is bound with uncertainties in outcomes and timelines.

ECHEMI

Given these uncertainties, there could arise customer concerns and operational disruptions. Customers might be concerned about the continuity and quality of products during and after the process, something which could translate to a lost market share. Secondly, this process could result in disruption of the day-to-day routine as the management focuses on the ongoing process which could result in low productivity during the process.

Thirdly, the review might affect employees’ performance as they worry about their job security and career prospects within the company. Further, there is a possibility that investors and customers might react negatively due to perceptions that it is a sign of trouble within the company, something that will hurt the stock price and market reputation.

Lastly, is the financial implication. In the event, the decision adopted is to sell the unit, which would imply that the company has lost about 10% of its net revenue something which will hurt its bottom lines and the overall financial performance. Replacing that lost revenue stream could be challenging and therefore the company’s financial outlook could be blurred.

Based on this information, I believe this deal comes with some immediate risks which I expect to drive share prices downwards perhaps in the midterms. For this reason, I think it is wise to invest here with caution and most preferably, be patient as we monitor the progress and outcome of the process.

Valuation And Technical Take

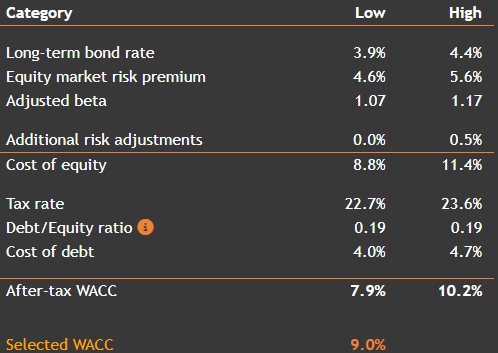

In valuing this stock, I will use a DCF model. In my estimations, I assumed a growth rate of 7% which is conservative given the company’s 5-year free cash flow CAGR of 12% and reflective of my skeptical outlook given the ongoing strategic review. Further, I assumed a discount growth rate of 9% as estimated by value investing a figure I agree with given the realistic inputs in the computation as shown below.

Value Investing

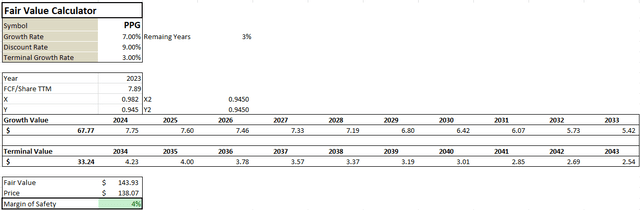

Given the above assumptions and assuming the trailing FCF/share of $7.89, I arrived at a fair price of about $143.93 which translates to a 4% margin of safety. Below is my model output.

Author

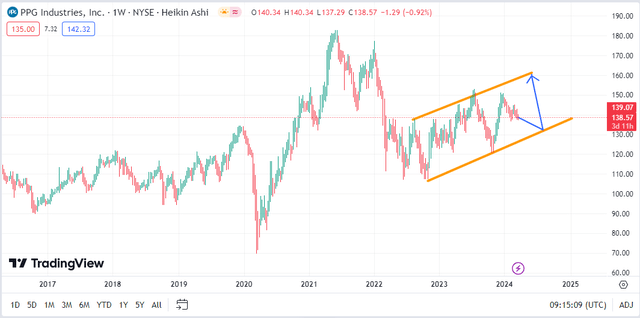

Based on my estimation, this stock is almost trading at its fair value where I believe a hold decision is justified. Further, from a technical point of view, the stock is currently moving in a rising rectangle pattern forming higher highs and higher lows. Currently, the price is approaching its support zone at about $132 where I expect it to bounce back and move towards a new higher high at about $160. This implies that potential investors need to be patient and wait for a better entry point at about $132.

Trading View

However, you should proceed with caution because the impacts of the ongoing review might disorient the current price pattern, meaning a possibility of breakout beyond the lower and upper trend lines is possible and the most imminent is a downward breakout.

Conclusion

In conclusion, PPG is an attractive company with a very appealing dividend policy and growth profile compared to sector medians. However, its ongoing strategic review poses some immediate risks that could hurt this stock. Additionally, the stock is currently trading near its fair value warranting a hold decision, but potential investors should watch the price movement to buy at the support zone, but this should be viewed alongside market sentiments given the potential negative impacts of the North American architectural coatings review. Considering this information, we need patience here.

Read the full article here