Dear readers/followers,

I cautioned care when it came to PPL Corporation (NYSE:PPL) last time around. While this utility is indeed a very safe operation, albeit with a low overall yield compared to what is available in the sector, the valuation relative to the possible upside in the context of this macro made no sense to me this time around.

Well, that turned out to be the right choice for this venture. My “HOLD” rating has seen a 10.98% negative total RoR, compared to the S&P500’s almost double-digit upside since that time back in December of last year. It goes to show you that if you can get a good valuation in a stock, focus on those undervalued stocks – and that’s what I am continuing to do here.

I usually have a very strong 10-13% position of my portfolio in utilities – it’s currently below 10%, but still with very strong companies like Enel (OTCPK:ENLAY) and others – so I remain both heavily invested in, and heavily interested in this sector which overall hasn’t performed as stellar as some might have hoped.

Let’s look at both what PPL has done, and what it might do going forward.

This is an update from this article, during which I held a relatively conservative thesis due to the valuation which I saw as too high for what was on offer.

PPL – Upside from a solid utility

I love utilities due to their regulated and safe operations. In the case of PPL, we’re talking about a Pennsylvania, Kentucky, and Rhode Island-exposed utility with a rate base of almost $24B. We’re talking over $15B worth of market cap with an annual revenue of almost $8B, servicing an area that’s larger than many nations, with over 20k square miles. 3.5M customers and their accounts make this company their first choice.

And, honestly, it probably has one of the best balance sheets in the US utility sector, due to its zero issuance of equity.

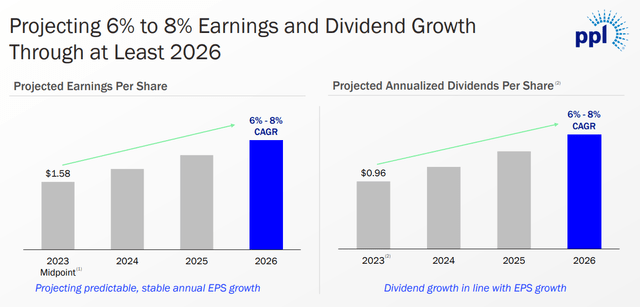

The reason why you should invest in PPL, at least if you listen to the company’s reasoning, is rather simple. Do you want 6-8% annual EPS and dividend growth until 2026E and (potentially) beyond, based on one of the strongest balance sheets out there for the sector, and are you “happy” with a yield of around 3.8%?

If so, buckle up, because this company may be right for you.

2Q23 is the latest set of results we have, and this marks my first update in over 9 months. The company reaffirmed its 2023E target, forecasting a range of around $1.5 to $1.65 for the year, with a midpoint just south of $1.6. Solid GAAP and non-GAAP earnings of almost $0.3 on a quarterly basis came in. The company’s utility operations delivered good performance, and this was despite storm activity in key areas in PA/KY.

The Rhode Island integration continues – and despite storms, remains on track. The company expects to be able to introduce advanced metering, or AMF, this year if the RIPUC decision comes during this fall.

Like with all utilities in this sector, the company has a regulator that oversees its operation and essentially decides what it can and cannot do in exchange for income safety. So when a company wants to do something in terms of metering, like AMF, the regulator needs to “say their piece” before it can be done.

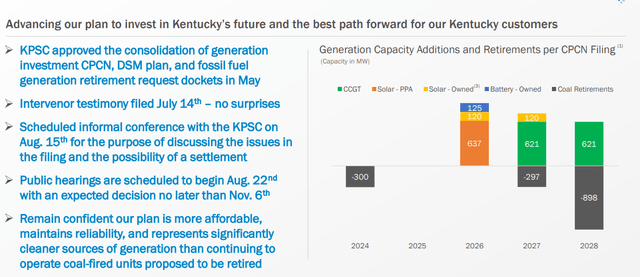

For a company like PPL, it means that it’s actually under the jurisdiction of several regulators – illustrated by the recent CPCN filing.

PPL IR (PPL IR)

As you can see, this is for the Kentucky portion of the company’s operations, which are expected significant changes until the late 2020s, as the company continues to retire legacy assets.

PPL’s largest risk is perhaps that it’s actually exposed to weather risks. Most US states and utilities home to those states have some weather risks. I’ve actually made a few afternoons out of looking at what states are most and least disaster/weather-prone respectively. It’s far from a close-to-exact science, but if you’re going to invest in Florida or California, you usually want to know what you’re getting into.

The most disaster-prone states, which by the way are also confirmed by others looking into this, would be states such as Oklahoma, Texas, Mississippi, California, and the obvious Florida. We’re talking Hurricanes, floods, tornadoes, blizzards, and even earthquakes.

PPL doesn’t operate in the least disaster/weather-prone areas, which are usually said to be areas like Vermont, New Hampshire, Alaska, and Delaware (Source), but it’s at least not among the worst.

These sorts of comparisons should not make you decide one way or another – but they can still be useful. PPL is a very solid company regardless of the weather risks to its operation geography, and its arguments remain strong.

PPL IR (PPL IR)

The biggest issue I see even after a 10%+ drop is that you can literally get a better yield from a standard bank savings account or an MMF. Even with the estimated CAGR in its EPS and dividends, it doesn’t seem certain to me that the yield would outperform what you could get here – a bit of a problem.

PPL IR (PPL IR)

With recent further hawkish sentiment, I would not be surprised to see utilities further repriced as the yields increase even more, and funding costs are boosted yet again. I am not questioning the company’s fundamentals or plans – even its capital plan is, as I see it, solid, with an ever-increasing focus on deploying capital in Rhode Island as well over 2023-2026. The company’s rate base CAGR of 5% is also…realistic, though here I would be a bit more cautious. PPL has only managed 4.1% historically, and while increased CapEx and inflation as well as costs generally should mean that regulators accept a higher growth, I’ve seen surprises here as regulators might be more likely to let utility returns suffer rather than add to an already-strained household expense item for their citizens.

The fact is that most utilities are choosing (or perhaps not choosing, given the current ESG climate), to go into very heavy CapEx areas during one of the most unfavorable environments to do so in terms of cost development. While PPL’s fundamentals, including a very solid A-rating for the company’s long-term outlook from S&P Global and a Baa1 stable from Moody’s, remain very solid, this does not mean that we might not see a decline in the company’s valuation, because frankly, the company has not been a good investment for several years. Since COVID-19, if you invested, you would have seen annualized returns of 12%. That might sound good, but in the context of what other businesses have done since COVID-19, it’s actually poor. And if you look at the 5-6 year RoR, that number is actually very poor, with a negative 14% total RoR since mid-2017 if you had invested in the company at that time.

Let’s look at what sort of valuation I would want to see prior to investing in this company, to ensure a 15%+ annualized rate of return.

PPL Corporation – 15% annualized is difficult to see here.

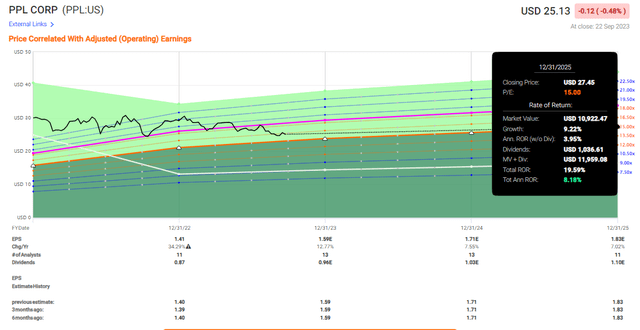

I went into this article expecting that I could look at maybe changing my rating for the company. However, the increased interest rates currently relevant, and the overall valuation of the company- because it’s still above 16x normalized, make this an impossibility to me.

At a 15x P/E forward basis with the current estimates to 2025E, we get an annualized RoR of just north of 8%.

PPL Upside (FAST Graphs)

That’s roughly half of what I typically look for – and it’s a no-go for me here.

My previous PT was just south of $25/share. But that was at an interest rate of less than 3% – and as of now, I’m lowering my price target for the company to at least $22/share.

Why so low?

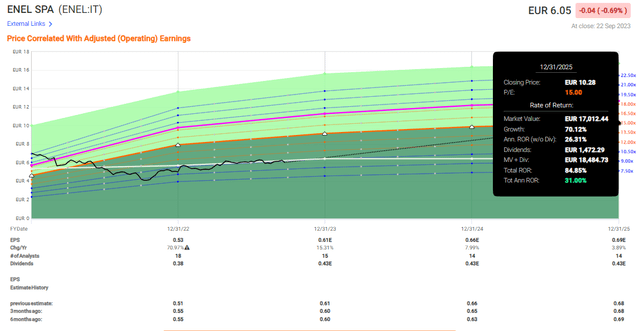

Because of what else is available on the market, for one. Do not make the mistake of thinking the utility market is one where you can’t find good yields. I mentioned Enel earlier. Here is the upside you can get from a 15x P/E normalized for Enel, as a comparison.

Enel Upside (FAST Graphs)

And did I mention that Enel is more than 3x the size of PPL, with a yield that’s more than double that of its American counterpart, as well as a substantially better set and portfolio of renewable assets?

You’re starting to see the problem of why PPL, especially on an international comparison, is not worth over 15x P/E.

And if it’s not worth over 15x, we need to discount the company.

S&P Global analysts, however, are in disagreement with me here. 13 analysts follow PPL, and 7 of them are at very clear “BUY”, with a range from $26/share to $32/share ending up at a PT of $29.9/share. That’s an upside of nearly 19% here.

I cannot say much here, beyond that I don’t agree with how they’re discounting (or rather, not discounting) PPL as an investment given what else is available. The company is most certainly one of the more qualitative businesses in this industry, but that does not mean I accept below 10% annualized growth rate inclusive of dividends here. There are too many good options out there.

When it comes to PPL, it all comes down to how exactly you choose to value the company in relation to what else is available and how it should be discounted at a 5.5% interest rate, yielding only 3.8%.

I work from the strong stance that I want better returns than the risk-free rate when I do invest, and while the company could go up based on EPS growth, I see a higher likelihood based on the current macro, that we’re in for a longer period of underperformance.

This is the reason I’m cutting my PT for the company. In the long term, it might indeed be worth $30/share once we cycle out of the current interest rate environment.

But for now? Anything above $23-$24, and I say you’re not doing yourself any sort of favors investing here.

Thesis

My current thesis for PPL is as follows:

- This is a solid, class-leading utility with good fundamentals, a well-covered yield following a dividend cut, and an excellent operating environment with great investment plans. On every level, this ticks the boxes of what a utility “should” be and how it should operate.

- However, the company’s premiumization is completely unwarranted here – and the returns on a conservative basis if investing here are abysmal.

- It’s a “HOLD” – and my PT is $22 before I’ll invest a cent in the company.

- This represents a cut of my PT, but the same rating I held in my last article. I believe you should be careful investing in anything that isn’t undervalued here, especially when the risk-free rate has a better yield than your potential investment.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic, good enough upside based on earnings growth or multiple expansion/reversion.

The company does not fulfill my valuation criteria, which makes it a “HOLD”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here