Investment Thesis

As ProFrac Holding (NASDAQ:ACDC) hits relative all-time lows, I was surprised to see that cash flows remain resilient and are actually growing according to the latest quarterly earnings. At the end of the day, cash flows ultimately determine a company’s intrinsic valuation in my opinion. Despite challenging market conditions, the company records free cash flow sequential growth of 187% in the second quarter of 2024. Thus, I expect capex to continue to decrease in response to a soft market and free cash flow should accelerate, leading me to rate shares as a buy.

Company Overview

ProFrac Holding is a “vertically integrated and innovation-driven energy services holding company providing hydraulic fracturing, proppant production, other completion services and other complementary products and services to leading upstream oil and natural gas companies” according to the annual report. They are primarily known for helping oil and gas companies do fracking, helping E&P companies grow and expand their production capabilities.

They operate in three segments: Stimulation Services, Proppant Production, and Manufacturing. Stimulation services refers to “a fleet of mobile hydraulic fracturing units and other auxiliary equipment that generates revenue by providing stimulation services to our customers”. Their fleet is electric powered, which seems to be the trend nowadays as customers want more environmentally friendly fracking solutions. Proppant Production refers to providing “proppant to oilfield service providers and E&P companies”, which is typically sand designed to keep the fracture open for fracking. Finally, Manufacturing refers to “products such as high horsepower pumps, valves, piping, swivels, large-bore manifold systems, and fluid ends”.

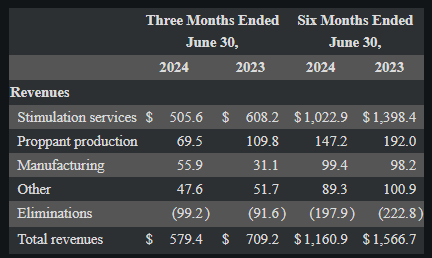

ProFrac offers both fracking and the complementary tools to help their customers succeed in their exploration and production efforts. However, the majority of revenues come from Stimulation Services, at around 87% of total sales for the three months ended June 30, 2024.

Seeking Alpha 10-Q

As a fracking services company, their revenues are directly impacted by demand for oil and gas from E&P companies, their customers. Typically, when oil prices are high, demand for fracking goes up and so does revenues for ProFrac. Increased drilling activity bodes well as it allows ProFrac to charge higher average prices and activate more of their fleet. Thus, I see ProFrac as a very cyclical company with fundamentals that go up and down with the broader oil and gas commodity market.

Overall, I see ProFrac as an expert in providing fracking services, with an emphasis on being environmentally conscious with their electric fleet and dual fuel technology to keep emissions down. And recently, they have made several acquisitions to expand their holdings’ portfolio to include a synergistic set of companies that assist each other to create a “unique, full-service offering” for E&P companies. I like the track record, cash flows, and improving profitability and view shares as a buy at the bottom of today’s stock price chart.

Savvy Acquisitions Strengthens Vertical Integration

Over the past few months, ProFrac Holding has made a few acquisitions, according to the recent 10-Q,

In April 2024, we acquired all of the remaining equity interests of BPC. BPC is the parent company of FHE, which manufactures equipment used in the hydraulic fracturing industry. The total purchase consideration was $39.8 million, consisting of cash consideration of $14.9 million and our pre-existing investment of $24.9 million.

In June 2024, we acquired 100% of the issued and outstanding capital stock of AST, a pressure pumping services provider serving the Permian Basin, for total purchase consideration of $174.0 million in cash.

In June 2024, we acquired 100% of the issued and outstanding common stock of NRG for total purchase consideration of $6.0 million in cash.

I believe management has a good understanding of capital allocation and has a track record of making good purchases at the right price to strengthen their vertical integration, giving them a fuller service offering and cost efficiencies compared to competitors. Whether it’s equipment or pumping services, it appears that ProFrac is trying to control all the parts of the fracking process themselves, which in my view strengthens their services and gives them some pricing power.

Furthermore, these acquisitions in my view improve the economies of scale for ProFrac, allowing them to be a more preferred choice from large E&P operators looking for someone who can handle a lot of business. As management indicates in their earnings call, “Larger operators driving consolidation prefer to collaborate with service companies that deliver efficiency at scale”.

Therefore, I think ProFrac’s advantage may allow them to bounce back hard in the cyclical market of fracking. Through successful integration of their acquired assets, they are one of the lowest-cost operators in their industry and also have the expertise and offering to become a one-stop shop for their customers. Thus, I like the acquisition track record and view it as a competitive edge that ProFrac can leverage to outperform.

Free Cash Flow Remains Resilient

Despite a weak natural gas market with persistently low prices affecting fracking demand, I believe ProFrac can continue to generate free cash flow even during a cyclical trough. Management comments in their earnings call,

Of note, we generated $74 million in free cash flow in the second quarter. These results illustrate that at scale, ProFrac is built to navigate market headwinds while generating free cash flow.

Although adjusted EBITDA declined, ProFrac generated free cash flow of $74 million, demonstrating our ability to successfully navigate ebbs and flows and activity.

I believe their cost structure and their capital expenditures management is very prudent during a challenging environment, and proves that a vertically integrated business model has unique advantages in a cyclical industry. However, I do expect natural gas to be a major anchor to fundamental performance as oversupply reduces demand for fracking natural gas, leading to some goodwill impairments in the last quarter according to the 10-Q,

In 2024 a decline in natural gas prices reduced our customers’ activity levels in the Haynesville basin, which is heavily concentrated with natural gas wells. This activity downturn has significantly reduced the operating results of our Haynesville Proppant reporting unit.

Based upon the results of our interim quantitative impairment test, we concluded that the carrying value of the Haynesville Proppant reporting unit exceeded its estimated fair value, which resulted in a goodwill impairment charge of $67.7 million for the three and six months ended June 30, 2024.

Nonetheless, I think this is the last bit of bad news that will stem from low natural gas prices. It is a tough market to be in, but the cat is out of the bag and goodwill impairments do not affect free cash flow, as it is a non-cash expense. Therefore, I think that the key performance indicator that matters for investors is free cash flow, and the surprising resilience of it makes me believe ProFrac can survive cyclical downturns.

I expect that low natural gas prices may put some of ProFrac’s competitors out of business, as they cannot compete against ProFrac’s low-cost operating structure. Eventually, as the market improves, ProFrac may emerge stronger and have even higher free cash flows than we are seeing today. My point is, if they can survive tough times today, they are likely to thrive in better times tomorrow. Thus, free cash flow’s resilience amid declining revenues is the signal that investors should watch, giving them confidence in ProFrac’s business.

Valuation – $9 Fair Value

For my valuation, I will assume a floor in revenues and adjusted EBITDA that I think ProFrac can earn at a minimum going forward. Given a cyclical market, it is challenging to predict precisely what cash flows will look like, so it makes sense to me to set floors to simplify the valuation process.

I think sales can remain at least $2 billion going forward, assuming each quarter can earn at least $500 million in sales. Given weak natural gas prices, I believe revenues have hit a cyclical trough and do not expect any further declines. Then, I think FCF margins can come in at least 7%, which is around the sector median. 7% of $2 billion is $140 million in annual free cash flow, which is actually conservative given that free cash flow was $74 million just for the last quarter.

Divide $140 million in annual free cash flow by shares outstanding of 160 million gets me $0.88 in FCF/share. Assuming investors want a free cash flow yield of 10%, we multiply $0.88 x 10 = $~9, rounded up. Therefore, I think the stock is undervalued today as it underestimates ProFrac’s vertically integrated business model.

The stock sells at a cheap P/S ratio of 0.46, way below the sector median of 1.37x. With arguably better management and lower cost structure, these discounts to the sector median seem unwarranted, and I expect a reversion to the mean to occur which should lift the stock to my fair value of $9.

While leverage may be a concern to some, I think that management can pay it down successfully given their focus on free cash flow and solid sources of liquidity. Management alleviates my concern over debt in their transcript, “The majority of our debt does not mature until January 2029. We intend to utilize free cash flow in future periods to deleverage”. So, I think the market is undervaluing ProFrac’s free cash flows and that management has ample opportunities to pay down debt for creditors.

Risks

The fracking business is very cyclical, and we may see oil prices drop significantly. Given the boom and bust nature of these commodities, investors may have to wait a while to see any gains in their shares, so a further prolonged cyclical downturn may cause revenues to decline more than I expect, below $2 billion annually.

We may see more goodwill impairments if the acquisitions do not perform well during a cyclical bust. This may negatively affect earnings which can lead to further stock price declines. Also, politicians such as Harris have suggested they may ban fracking, which would obviously put ProFrac at major risk. As such, political risk does affect this stock and investors should take note.

Competition is fierce as drilling and fracking can be mostly seen as a commodity type service, where the lowest prices typically wins. Although ProFrac has visions of differentiating through their vertically integrated business that offers a full one-stop shop type offering, competitors may copy this and make ProFrac’s uniqueness the norm.

Buy ProFrac

I think the stock sells too low, and the fundamentals are quite strong given the acquisition track record, vertical integration, and strong resilient free cash flow generation. Now is a good time to buy in my view as the cyclical downturn in natural gas offers a potential bottom. The bottom line to me is that at the end of the day, if the free cash flow is there the stock is a buy.

Read the full article here