Bonds are clearly a far more attractive asset class today than they were in 2022. With the Fed seemingly finished with raising rates (or so we hope), and volatility falling for bonds more broadly, now may be a good time to consider allocating. But why do it from a passive perspective? That’s the angle that the PIMCO Multisector Bond Active Exchange-Traded Fund ETF (NYSEARCA:PYLD) takes.

Launched in mid-2023, the fund offers diverse exposure to yield-oriented fixed income sectors. As an actively-managed exchange-traded fund, or ETF, it aims to deliver diversified yields and long-term capital appreciation. With the experience of PIMCO as a tailwind, the bet here is that active management on the bond side can outperform.

In order to do this, PYLD is benchmark-agnostic, and multisector. The fund is managed by a team of seasoned experts from PIMCO, all of whom have a wealth of experience in credit subsectors. The fund leverages PIMCO’s expertise across a broad opportunity set, making it an attractive choice for investors looking for yield generation and downside mitigation.

The fund’s strategy revolves around maintaining broad exposure to various yield-oriented fixed income sectors. It lays emphasis on investments that are more strategic or long-term in nature, with less focus on short-term tactical trading strategies.

Fund Holdings

The PIMCO Multisector Bond Active Exchange-Traded Fund includes a variety of fixed income instruments of varying maturities. The fund’s holdings span across different sectors, including corporates, mortgages, sovereigns, and ABS among others.

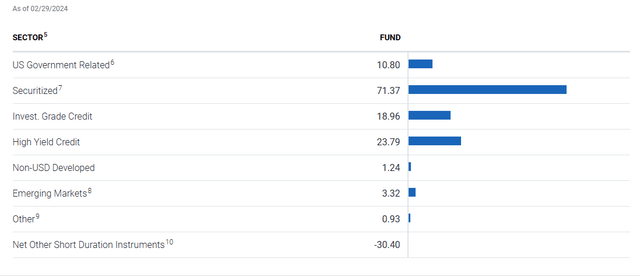

pimco.com

The fund’s holdings were largely concentrated in the ‘Securitized’ asset class, which includes Agency MBS, non-Agency MBS, CMBS, ABS, CDO, CLO, and pooled funds. This was followed by Investment Grade Credit and High Yield Credit. The fund also held a small proportion of non-USD Developed and Emerging Markets securities.

When we look at rate sensitivity, the effective duration currently is 4.74. Clearly the active management team is not comfortable with taking on duration risk just yet. It will be interesting to see how that perhaps changes as this I would suspect is where the real value might come in from management. For now though one can argue it’s not needed, as the 30-Day SEC Yield is 5.69%. Nothing wrong with that at all for low duration.

Peer Comparison

Comparing PYLD with its peers in the bond ETF space, it becomes evident that it has carved a unique niche for itself. While most bond ETFs focus on either investment-grade or high-yield bonds, PYLD offers exposure to both and is active. This diversified exposure sets it apart from its peers and enables it to potentially generate higher yields and capital appreciation.

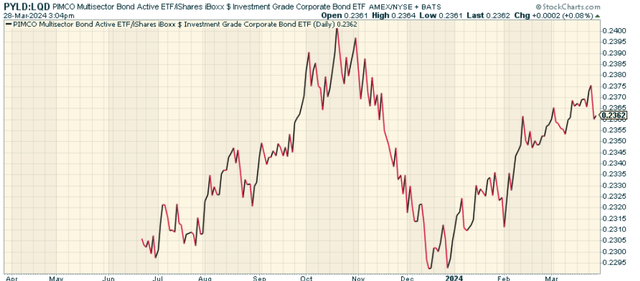

Relative to the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) (which is passive) it’s had volatile relative performance. Right now in an uptrend and higher than where we started, which suggests the active management does seem to be helping at the margin.

stockcharts.com

Pros and Cons of Investing in PYLD

Like any investment, investing in the PIMCO Multisector Bond Active Exchange-Traded Fund comes with its own set of pros and cons.

Pros:

-

Diversified Exposure: PYLD offers diversified exposure to various yield-oriented fixed income sectors, which helps in risk mitigation and yield generation.

-

Active Management: The fund is actively managed by a team of seasoned experts from PIMCO, which enhances its potential for outperformance.

-

Attractive Yield: With a focus on yield-oriented sectors, PYLD has the potential to deliver attractive yields, especially in a higher interest rate environment.

Cons:

-

Interest Rate Risk: Given its exposure to various bond sectors, PYLD carries a significant amount of interest rate risk. A rise in interest rates can negatively impact the value of the bonds in the fund’s portfolio.

-

Credit Risk: The fund’s exposure to high-yield bonds and securitized assets implies a certain degree of credit risk. Any defaults or downgrades in these assets can affect the fund’s performance.

Conclusion

While PIMCO Multisector Bond Active Exchange-Traded Fund ETF is a new fund, I think it’s worth considering for those seeking diversified exposure to yield-oriented fixed income sectors. Its active management, diverse holdings, and attractive yield make it a worthy consideration. However, the fund’s susceptibility to interest rate and credit risk should not be overlooked. I’d like to see a bit more performance, and perhaps duration timing, before being fully convinced. Still – PYLD is worth paying attention to.

Read the full article here