Rivian Automotive (NASDAQ:RIVN) saw its share price decline by one-fifth on Thursday after the electric vehicle company announced that it would raise more debt in order to finance the production ramp of the R1T and R1S. In a press release and filing with the SEC, the EV company said that it seeks to issue $1.5B in convertible senior notes which represents dilution risks to shareholders. Rivian also, at the beginning of the week, released production and delivery figures for the third-quarter that showed that the company is making massive progress with regard to its production setup. As a result of the production update, I believe Rivian will fly past its 52 thousand EV unit production target for FY 2023!

Previous rating

I rated Rivian hold due to the company’s narrowing losses and raised guidance in terms of production for FY 2023. Since Rivian saw considerable momentum in production and deliveries in Q3’23, the company could beat expectations with regard to full-year production. Further, the market appears to overreact to the debt offering which creates a buying opportunity.

Production report and increased odds of beating FY 2023 production target

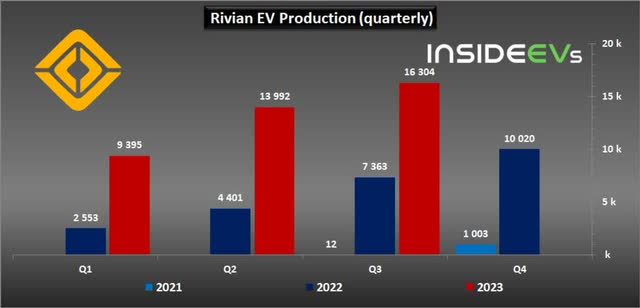

According to the company’s third-quarter production update which was released at the beginning of the week, Rivian produced 16,304 electric vehicles at its manufacturing plant in Illinois in Q3’23, showing 17% quarter over quarter growth. The company also delivered 15,564 vehicles which was an improvement of 23% compared to the previous quarter.

In the first nine months of the year, Rivian produced 39,691 electric vehicles, showing 177% year over year growth. The electric vehicle company has guided for 52 thousand electric vehicles to be produced in Illinois this year, meaning the company would have to produce another 12,309 electric vehicles in the fourth-quarter which should be easily achievable. Based on Rivian’s third-quarter accomplishments, the EV firm would only have to achieve 75% of its Q3’23 production volume to meet guidance… a target that I believe will be easily surpassed.

Source: InsideEV

The Q3’23 production update demonstrates that Rivian has made significant progress in terms of growing its production and I now believe that the EV company will be able to fly past its recently raised production goal of 52 thousand EV units.

Assuming a stable production volume quarter over quarter in Q4’23 (no growth), Rivian would be on track to produce approximately 56 thousand electric vehicles in FY 2023. If Rivian were to grow fourth-quarter production at the average sequential production rate achieved between Q1’23 and Q3’23, 31.7%, then Rivian would report 21,478 EVs produced in Q4’23.

$1.5B convertible debt offering

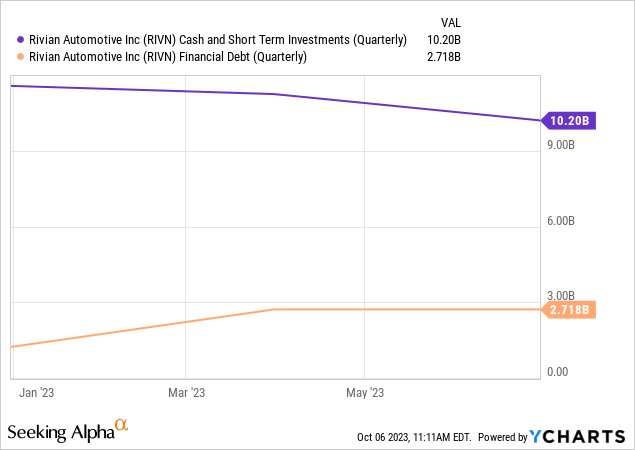

Rivian has said in a regulatory filing that it seeks to raise $1.5B in convertible senior notes due 2030 (+ an option for another $225M) in a private offering which, of course, poses a dilution risk to investors. However, considering how much progress Rivian has made in terms of growing its production and how solid the balance sheet already is, I believe investors are overreacting to the debt raise.

Rivian is burning through a lot of cash and a debt raise at some point was expected. Rivian burned through approximately $2.3B in cash in the first six months of the year, or about $1.15B per quarter. The debt raise is not an existential issue for the EV company, however, as it carried $10.2B in cash on its balance (including short term investments)… enough, by current cash burn rates, to last at least until the end of FY 2024. Rivian also carries very little debt on its balance sheet and can easily handle additional debt.

Rivian’s valuation

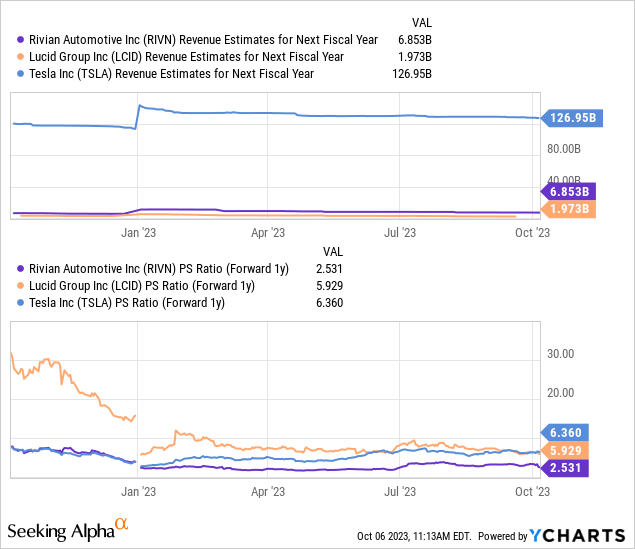

Rivian is commanding a decent valuation multiplier factor although the EV company is not yet profitable. However, Rivian is still significantly cheaper than Lucid Group (LCID) and Rivian has pulled way ahead of the company in terms of production/delivery volume as well.

Tesla (TSLA) is still by far the most highly-valued electric vehicle company — with a P/S ratio of 6.4X — as it is the leader in the industry, has a global production and distribution network in place and is already profitable.

Rivian is expected to achieve revenues of $6.85B in FY 2024 which implies a year over year top line growth rate of 59%. With a price-to-revenue ratio of 2.5X, Rivian is no longer as outrageously valued as it was in FY 2022 and the 20% drop on Thursday implies a much more favorable risk profile.

Risks with Rivian

I believe Rivian’s risk profile has quite considerably decreased following Thursday’s 20% decline, in my opinion. This is because the EV company reported material progress in terms of growing its production at the beginning of the week and investors are panicking over the debt offering which makes no sense to me. Rivian has a very solid balance sheet, a mountain of cash and very little debt. With delivery growth also soaring, Rivian doesn’t seem to have a demand problem either.

Final thoughts

I have stayed on the sidelines with regard to Rivian for as long as the EV company has been listed on the stock market, but I am risking a small position now because I believe investors are overreacting to the $1.5B debt offering that was announced yesterday. Rivian is also doing much better in terms of growing production now and if the EV firm maintained Q3 production levels in the fourth-quarter… Rivian would fly past its 52 thousand EV production target. The debt offering is a short term negative for the shares, but the valuation is now much more attractive, and risks, in my opinion, have decreased following the production update!

Read the full article here