Roughly a half year ago I published an article on Cohen & Steers REIT & Preferred Income Fund (NYSE:RNP) – RNP: 8.5% Dividend Backed With Robust Fundamentals – arguing that the high-yielding dividend is protected by strong fundamentals.

The supporting elements of the underlying strength were and still are the following:

- Exposure to preferred securities. RNP has close to 50% of its total holdings allocated into preferred instruments that are issued by high quality REITs, banks and investment grade utility firms. An exposure to preferred capital structure per definition implies greater predictability and safety for dividend seeking investors as in the case of cash flow struggles, the equity layer acts as a first buffer before any cuts on the preferred payments are considered.

- Exposure to large cap and well-capitalized REITs. RNP’s portfolio is further enhanced by the defensive security selection policy, which has a meaningful skew towards investment grade and large-scale equity REITs (the other half of the portfolio). For example, the Top 10 holdings account for ~31% of the total portfolio and at the same time all carry an investment grade credit rating. Plus, on a sector-level there is less than 3% exposure towards currently struggling office space.

- Well-structured leverage profile. As of now, ~34% of the RNP’s assets are supported by an external leverage. This leverage is structured very favourably, where the fixed rate component of debt, which constitutes 81% of the total debt, is stipulated at 1.8% with a remaining maturity of 2.8 years. What this does is it keeps the magnified returns protected from the interest rate volatility and allows to capture an attractive spread between cost of financing and the yield that RNP can access via its investments.

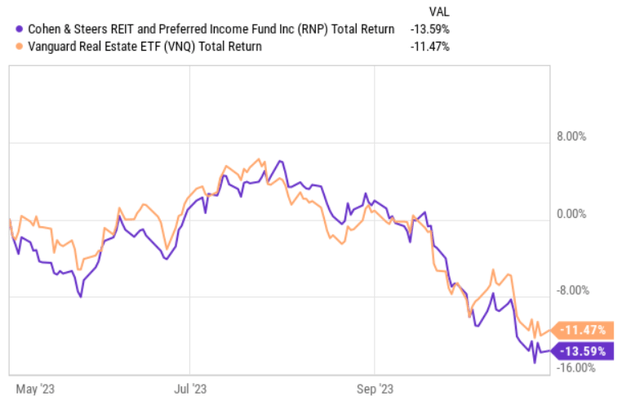

Despite these characteristics, RNP’s share price has declined significantly since the publication of my article.

Ycharts

Over the past couple of months RNP has moved in tandem with the broader REIT market, registering a negative performance of ~14% (on a total return basis).

From the chart above we can see that really starting only from September RNP has assumed a negative performance trajectory. This coincides perfectly with the sudden recalibration of market’s expectations on the future SOFR levels.

In other words, the double digit drop in RNP’s market cap is mostly explained by the interest rate dynamics; not the situation in the underlying fundamentals.

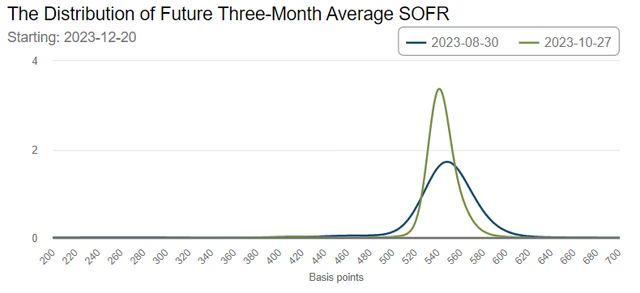

Atlanta Fed

Here the chart captures this story nicely. If we compare the prevailing expectations by the market on SOFR with those of August 2023 (before the RNP started to drop), we can notice a more aggressive view on the Fed Funds rate.

Now, what we know so far is that RNP carries a resilient and relatively low-risk portfolio, which inherently keeps the dividend streams safe, but the share price has gone down considerably due to systematic and not idiosyncratic reasons.

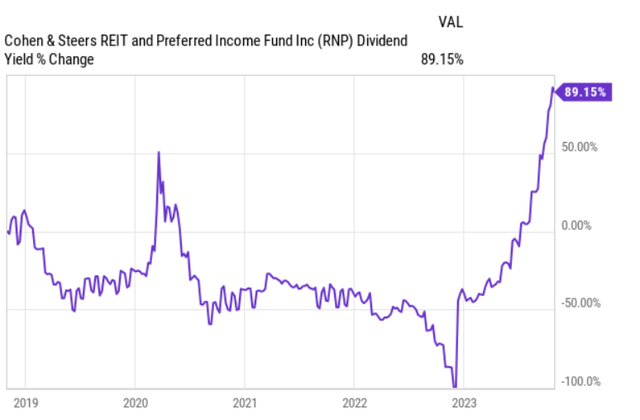

Ycharts

Due to the massive declines, RNP’s dividend has experienced rather positive rate of change dynamics. Currently, RNP yields 10%, which considering the investment grade and preferred share exposure seems quite attractive.

Thesis update

Conceptually, all of the key variable factors remain intact. RNP’s portfolio quality and defensive caricaturists have not changed and still offer an increased protection for yield-seeking to count on the future dividend streams.

What has changed is that RNP has become cheaper and more attractive to investors. On top of the lucrative yield, RNP now embodies an interesting opportunity that could reward investors not only via current income front but also from the capital appreciation component.

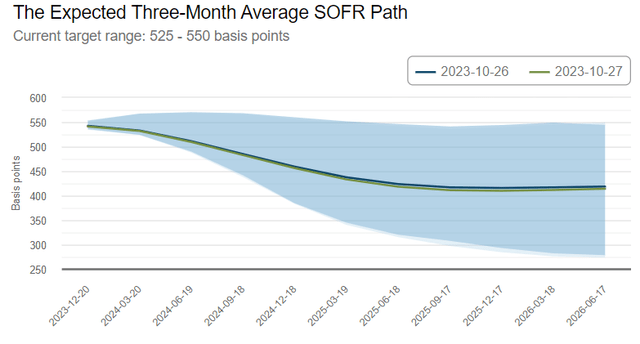

Atlanta Fed

By looking at the expected future SOFR curve, it is evident that gradually there will be some form of SOFR normalization during 2024 and 2025. If not a major correction then at least a stabilization, which should per definition decrease the risk premium that is stemming from the interest rate volatility or unpredictability.

If we compare now to the situation back in September this year, we can really see a more realistic curve, where the market does not anymore assume a sharp drop in the SOFR already in 2024 and then essentially 2% rate in 2025.

This means that the market has finally repriced assets based on more conservative assumptions.

For the RNP this means the following:

- The cost of financing will (highly likely) be lower when RNP’s fixed rate debt maturities kick in by the end of 2026 / early 2027.

- The variable debt part should not impose additional headwinds to the cash generation profile.

- Gradually, the pressure on valuations for duration risk heavy securities should weaken due to a combination of lower SOFR and reduced SOFR volatility.

As stated earlier, the market has punished a lot RNP because of the structural exposure to the interest rate risk. Nevertheless, the overall debt financing portfolio of RNP aligns nicely with the market’s consensus expectations on the future SOFR, where the highest interest rate risk for RNP occurs in 2027, which coincides with normalized conditions. Until 2027, RNP has isolated itself from the interest rate risk that is associated with external leverage.

Granted, after the debt is fully refinanced in 2027, it is very likely that there will be a notable drag on the RNP cash flows due to higher interest rates. Currently, the fixed rate debt component is priced at 1.8%, which is way below the market level (and most likely the level we will be experiencing in 2027).

With that being said, RNP has a nice wiggle room to mitigate the risk of tapping into the current dividend distribution levels in order to cover the increase in financing costs.

Until 2027, RNP has the luxury to reduce the leverage by not embarking on new dividend hikes and instead directing part of the incremental cash generation towards managing the debt balance.

Going forward, there is a significant potential for the RNP portfolio constituents to deliver dividend growth as the other (non-preferred capital) part of the portfolio is invested into large cap and financially resilient REITs.

Large cap REITs, which are not operating in the office segment are still doing fine and are able to provide investors with enhanced dividend distributions.

Let’s take a look at RNP’s Top 5 positions:

- American Tower (NYSE:AMT): FFO payout ratio of 64% and 5-year historical dividend growth at 16%.

- Prologis Inc. (NYSE:PLD): FFO payout ratio of 62% and 5-year historical dividend growth at 13%.

- Welltower Inc. (NYSE:WELL): FFO payout ratio of 69% and 5-year historical dividend growth at negative 6%.

- Invitation Homes (NYSE:INVH): FFO payout ratio of 58% and 5-year historical dividend growth at 19%.

- Digital Realty Trust (NYSE:DLR): FFO payout ratio of 74% and 5-year historical dividend growth at 4%.

All in all, solid FFO payout ratios and great dividend growth track record send an encouraging signal to RNP’s unitholders that the Fund will manage to enjoy some upward potential in the internal cash generation.

Bottom line

In my humble opinion, the offered dividend yield of 10% carries rather favourable risk and reward ratio.

Due to the recent price declines, RNP’s yield has reached even more attractive levels without any immediate concerns on the Fund’s ability to continue servicing the historical payments.

There could be potential concerns in 2027 once RNP will have to rollover its external financing, but until then RNP has time on its side, where it can work on reducing the leverage through further increased in the underlying dividend paid by the large cap and investment grade REIT holdings. In addition, by 2027 there is a notable probability that the financing costs will be lower due to a combination of normalized SOFR and reduced risk premium linked to SOFR volatility.

It is not often when a Fund that does not have any exposure to struggling sectors (e.g., office space) and instead has investments into investment grade and large cap names with roughly half of the allocations higher up in the capital structure (i.e., preferred shares) offers a double digit dividend.

For me this is a buy.

Read the full article here