Things are starting to look interesting for SentinelOne (NYSE:S) investors.

I’ll first share my general thoughts about SentinelOne, and thereafter, provide more analysis and details about recent developments.

I’ll end off with how I think SentinelOne will be able to achieve breakeven in FY2025, using CrowdStrike (CRWD) as a benchmark.

Thoughts

Background

SentinelOne was once classified in the same ranks as Microsoft (MSFT) and CrowdStrike. These companies are regarded as the next generation cybersecurity players bringing timely innovation and superior protection to a world where cybersecurity threats have become more complex and increasingly widespread.

However, with rising rates and an uncertain environment, SentinelOne was more negatively affected than the other two players as it saw a more difficult operating environment, resulting in budget constraints and elongated sales cycles, as well as customers looking to consolidate their cybersecurity vendors.

SentinelOne also had to pivot from growth mode to focus on profitability as the market was increasingly negative on unprofitable technology companies.

As a result, SentinelOne corrected from its once lofty valuation of more than $20 billion to $5 billion today.

Here’s what I think:

While valuation has not been attractive for the longest time, I argued in my earlier article that after the steep drop in the stock post earnings, it is finally time for me to look into entering the company.

Since then, I think that there are signs of improvement, and that this contrarian thesis is playing out.

Firstly, I think that SentinelOne is actually making impressive progress on the profitability and cashflow front. I’ll illustrate in greater detail in this article, and I still think that the market is not appreciating the fact that management is so focused on profitability and executing so well on it.

Secondly, as a result of the first point, I do think that it is on track to achieve positive free cash flows by the second quarter of next year, and also achieve breakeven non-GAAP operating margins for fiscal year 2025.

The most important thing of all here, in my view, is that if it is able to achieve this next year, and at the same time show that growth does not slow down materially from where it is today, the market will regain its confidence in SentinelOne and we will not see it in at these depressed multiples today.

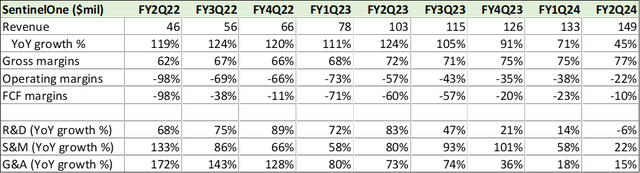

As can be seen below, revenue growth was more than 90% from FY2Q22 to FY4Q23. However, this was clearly sustained by the high sales and marketing expenses growth, because when the company cut back on this from FY1Q24 onwards, growth slowed.

SentinelOne key metrics (Author generated)

While the focus on profitability has definitely shown results, I think that to regain market confidence, the company needs to show that its long-term growth trajectory remains and that its competitive position remains strong.

In this regard, I think that management did make me more confident about its sales execution and win rates against competitors, while also showing that it continues to gain share and improve on its competitive moat.

Driving (large) customer growth

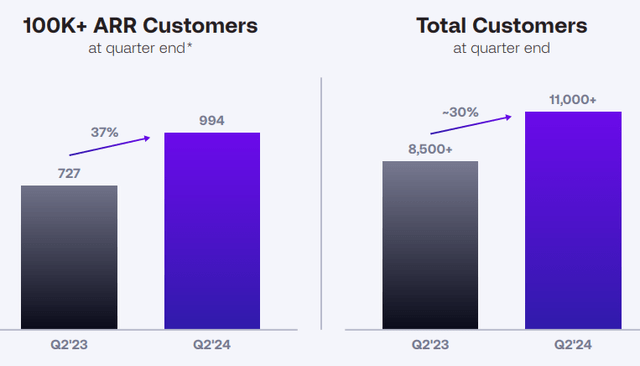

SentinelOne demonstrated that it not only is capable of growing its customer count but was also executing well in terms of the growth in the number of large customers.

This does signal to the market that SentinelOne is seeing a strong momentum with large customers, which is crucial in today’s market.

In FY2Q24, SentinelOne added 700 new customers, growing by 30% from the prior year.

More importantly, large enterprises, or customers with more than $100k in ARR grew 37% from the prior year to 994 in FY2Q24. Also, customers with more than $1 million ARR grew even faster than the $100k ARR group.

This led to an increasing business mix from customers with more than $100k in ARR.

The large wins secured in the quarter came from US federal agencies, global healthcare companies and technology companies, and also spanned across both endpoint and cloud footprints as large businesses are choosing SentinelOne as a result of its strong performance, the breadth of its platform and a superior return on their security investments.

This momentum in large customers was driven by strong sales execution and win rates against both legacy and large next generation security vendors.

Large customer growth (SentinelOne)

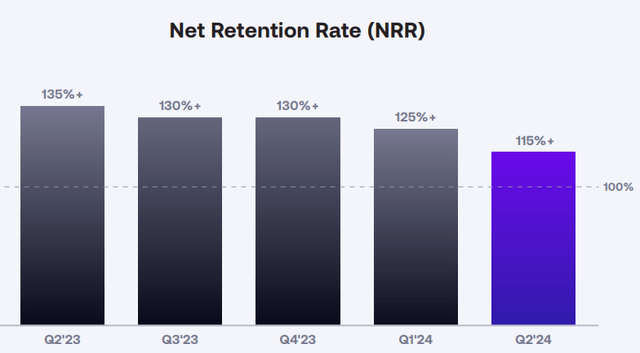

Long-term growth in new product categories and module adoption to drive net retention rates.

Net retention rate of the platform came in at more than 115% in the quarter driven by its platform approach. I think we are seeing some near-term weakness with SentinelOne’s NRR here, given it now includes legacy products from its acquisition of Attivo last year, and macro-driven budget constraints are also having a temporary impact to near-term expansion rates. For reference, CrowdStrike’s NRR was around 120% in FY1Q24 and FY2Q24, so SentinelOne is somewhat in-line with CrowdStrike here.

Net retention rates (SentinelOne)

In the long-term, one of the drivers for platform expansion will come from emerging product categories, growing module adoption and high customer retention rates.

In the quarter, more than a third of SentinelOne’s quarterly bookings came from its endpoint solutions.

In particular, the fastest growing solution for SentinelOne was Singularity cloud, which is then accompanied by other fast growing new categories like Singularity Data Lake, Vigilance MDR and Ranger.

As a result, with continued growth in product categories, I see module adoption as a significant growth driver going forward.

In fact, SentinelOne mentioned in the earnings call about how they are starting to see large security deals.

Evidence of consolidation happening in SentinelOne platform

SentinelOne was able to give examples of enterprises that are consolidating on its unified platform, which was nice to see after last quarter.

The first one is a large enterprise that substituted seven different security vendors with SentinelOne’s platform. SentinelOne went one step further to state that there are two of the largest endpoint vendors in there, which are obviously Microsoft and CrowdStrike.

The reason for consolidation with SentinelOne is that it not only led removed the challenge of needing to manage multiple solutions and consoles, but it also led to an autonomous protection in just one console, improved security and better customer experience.

The second win in the quarter was another multi-million-dollar deal with a global healthcare enterprise that looked to consolidate the current multiple security products they have onto the SentinelOne unified platform. The main value proposition of SentinelOne for this customer here was that SentinelOne’s platform unifies security data and actions to bring about improved outcomes.

Hitting back at CrowdStrike

With CrowdStrike and SentinelOne competing in the same market, there is no doubt that competition between the two companies is tough. But the rivalry between the two is the most open and blatant one that I have seen in a while.

Given CrowdStrike’s prior comments, I think that SentinelOne’s CEO Tomer Weingarten response is one that I must highlight here.

The first point to note is that he sees SentinelOne’s competitive position is improving and that on the technology side of things, SentinelOne is seeing considerable differentiation.

The second point is that SentinelOne pointed out that it is the “only platform out there” that delivers its promise on having a unified platform. In fact, SentinelOne’s CEO Tomer Weingarten had this to say about CrowdStrike’s recent comments:

I think if you want to talk about competitors, let’s also talk about the blatant misrepresentations they had on their earnings call made so clearly.

I think it’s unbelievable that you see them calling out or implying that, you know we are a coin for a company when it’s plain to see that we’re the broadest platform out there.

When they call themselves a unified platform, but actually have two distinctively different platforms, two consoles, two languages, two product lines, that’s an overt missed representation and that confuses customers, I think it’s just shocking to see that.

When they say that the only generative AI company to demo generative AI at conference shows, that’s also a blatant lie. I mean, obviously, we’ve been the first to demo that. There are other vendors that have demoed that. Everybody is giving live demos. We actually gave hands-on live demos.

So, if we talk about the competition, I think it’s important to separate fact from all these rumors and speculations and misrepresentations and our competitive positioning, our technology is true.

I think that’s what customers are getting into their hands, that the reason we win, that’s the reason that we continue to grow market share.

Tackling sale rumor

During the earnings call, CEO Tomer Weingarten said that talks of the sale were rumors and speculation and emphasized that the team’s focus is on “building an independent company for the long-term”.

He also mentioned that SentinelOne has “the best technology and a clear strategic road map to disrupt a $100 billion market with the potential to multiply its current market share in the coming years”.

Lastly, on maximizing its business potential, customer value and delivering innovation, he mentioned that he thinks that SentinelOne can “do that the best as possible as a public independent transparent company”.

Again, in an interview with CNBC, CEO Tomer Weingarten made clear his intentions, as shown below:

Obviously, there is an unbelievable amount of rumors and speculation in the market.

I think what you can easily see from our numbers is that we’re a high-growth company, a high-performance company. We’re solely focused on our individual path. We have demonstrated unbelievable margin improvement alongside incredible growth, so all in all right now, for us it’s just doing the best that we can to drive our innovation, protect our customers.

The best way to do that is to remain a publicly traded independent company.

Free cash flow and operating margins improving

With SentinelOne, I think one of the most impressive feats that is likely being ignored by the market is its ability to drive margin expansion and deliver improving profitability and free cash flows.

Firstly, I think not many may be aware of this, but SentinelOne is “confident” that they will achieve free cash flow in the second half of its next fiscal year. This means that in just the next one year, we will see a positive free cash flow company. This comes as SentinelOne delivered 55 percentage points of free cash flow margin expansion in FY2Q24. This was achieved through its proactive efforts to streamline its cost structure, which is also resulting in an impressive margin expansion story for SentinelOne.

This leads me to my second point on margins. Gross margins reached a new record, improving 5 percentage points from the prior year as SentinelOne was benefiting from the growing unit economics and data efficiencies from its growing scale. This means that since its IPO, SentinelOne has managed to deliver more than 20 percentage points in non-GAAP gross margin growth and the company is now operating within its own long-term gross margin target range.

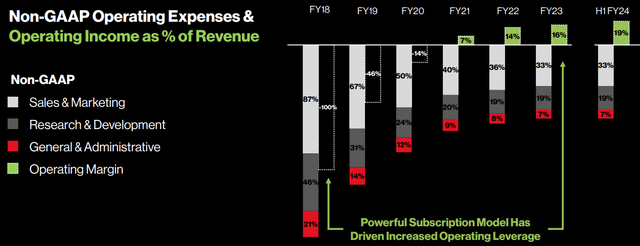

Thirdly, on operating margins, SentinelOne’s GAAP and non-GAAP operating margins improving by 39 and 34 percentage points from the prior year respectively. In fact, it is worth nothing that this is the 8th consecutive quarter that SentinelOne is improving non-GAAP margins by more than 25 percentage points from the prior year.

My thoughts are that the market may be overlooking the free cash flow improvements as well as gross and operating margin improvements that SentinelOne is delivering. At the end of the day, it shows that at its current scale and as it grows, there are significant margin expansion opportunities ahead for the company, while it also demonstrates that its business model is scalable as it continues to be driven by SentinelOne’s price discipline and strong unit economics.

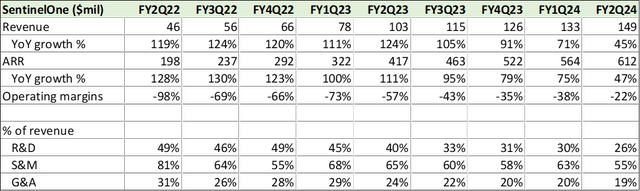

ARR and revenue growth

The key here after all the margin expansion and free cash flow improvement is the growth profile.

Where will SentinelOne’s ARR and revenue growth be after sales and marketing has been cut back? This will be the most important question to answer.

To help us with that, let us look at the FY2Q24 numbers.

SentinelOne’s ARR grew to $612 million, up 47% compared to the prior year. While this was faster than the 37% ARR growth of CrowdStrike, the deceleration from the 95% or more growth in ARR seen in FY3Q23 and before raises questions about where the sustainable growth rate will be. It’s a similar case for revenue growth given revenue growth in FY2Q24 was 45%, down from the more than 100% revenue growth seen in FY3Q23 and before.

Opex as a % of revenue and top-line growth (Author generated)

I think that taking CrowdStrike’s expenses as a percentage of revenue will give us some clue about where SentinelOne needs to head in order to achieve breakeven operating margins. In FY2021, CrowdStrike achieved 7% non-GAAP operating margins with sales and marketing, R&D and general and administrative expenses at 40%, 20% and 9% of revenues respectively. Technically, CrowdStrike would have reached breakeven even if it raised sales and marketing as a percentage of revenues to 47%. Take note that CrowdStrike’s gross margins were at 74% in FY2021, compared to SentinelOne’s 77% gross margins today.

Opex as a % of revenue (CrowdStrike)

For SentinelOne to reach breakeven margins, SentinelOne will be able to achieve this with 50% sales and marketing expenses as a percentage of revenue, and if R&D and general and administrative expenses are kept at similar levels to today (17% and 12% respectively as a percentage of revenue in FY2025), with revenue growth at around 40% for FY2025 and gross margin expansion by 1 percentage point, the company will be able to achieve breakeven operating margins.

The remaining question here is, with sales and marketing expenses making up 50% of revenues, how will this affect revenue growth? In FY2Q24, the number was at 55% of revenues and in the quarter before that, it was at 63% of revenues.

I do think that there are levers here for revenue growth, namely newer emerging product categories that are gaining traction, as highlighted above, improved sales execution and a continued emphasis on innovation and improving its competitive moat.

Liquidity and cash position

Just one final note that SentinelOne remains very well capitalized today, and with its push to be free cash flow positive next fiscal year, this means that the company is in a position of balance sheet strength.

For reference, SentinelOne highlights that it has cash, cash equivalents and investments of $1.1 billion.

Investments here refer to what it labels as long-term investments. These are investments with maturity of more than 1 year and majority of which are US Treasuries, corporate bonds and US agency securities. The total amount of long-term investments in its balance sheet amount to $410 million.

As a result, the shorter dated investments and cash make up $690 million today. This is still ample liquidity given that SentinelOne is expected to have free cash flow of negative $80 million in FY2024 and then in FY2025, the company will generate positive free cash flows.

Valuation

SentinelOne has performed relatively well since when we bought it when the stock sold off in its last earnings.

I think the market is starting to appreciate that it is not as bad as it seems, but at the same time remains apprehensive at the moment.

I am reiterating my 1-year price target for SentinelOne.

My 1-year price target for SentinelOne is $20.50.

I think that the EV/Sales multiple remains the most reasonable method to derive the near-term price targets given that SentinelOne is currently still working towards profitability.

I applied a 7.5x EV/Sales multiple for the 1-year price target respectively, as elaborated before.

Conclusion

I have gone to great lengths to elaborate on why I think SentinelOne is showing progress towards positive profitability and cash flows, and how the company will be able to achieve their targets in the near-term.

Management’s comments about their competitive position and their stance on remaining a publicly traded independent company helps to remove any uncertainties about recent competitor commentaries and the sale rumors.

At the end of the day, SentinelOne needs to remain as a public company for the upside from my contrarian thesis to materialize.

SentinelOne remains a beaten down company with low market confidence despite its strong execution it has shown, and I think that this is an attractive opportunity that can benefit shareholders with a longer-term investment horizon.

Read the full article here