Back in July, I previewed ServiceNow’s (NYSE:NOW) earnings, saying that the company would likely need to post some extraordinary results given its high valuation. The stock in down about -10% since that write-up. Let’s catch-up on the name.

Company Profile

As a reminder, NOW is a software-as-a-service (SaaS) company that manages workflows across systems by connecting siloed systems and bringing them to a single platform. The company’s product began as an IT Service Management (ITSM) solution to help IT departments better manage their networks, optimize costs, and quickly identify and fix any security vulnerabilities. Since then, it has expanded its use cases to other departments as well.

Its offerings now include solutions for customer service, human resources, and the areas of automation, procurement, and low code. The platform also has solutions for legal services and health & safety. Its offerings are sold as a subscription mainly through a direct salesforce.

Strong Q2 Results Don’t Move the Needle

In my earnings preview, I noted that history and analyst channel checks pointed to NOW likely topping analyst expectations, and on that front the company did deliver. However, also as expected, that by itself was not enough to lift the stock, with it falling -3.9% the next session after its report.

For the quarter, the company grew revenue 23% (and 23% ex-FX as well) to $2.15 billion. That edged past the consensus of $2.13 billion. Subscription revenue jumped 25% to $2.075 billion. Professional service revenue fell -20% to $75 million.

Adjusted EPS of $2.37, meanwhile, easily topped analyst estimates of $2.02.

The company had 70 transactions over $1 million in new net ACV in the quarter, representing 30% growth.

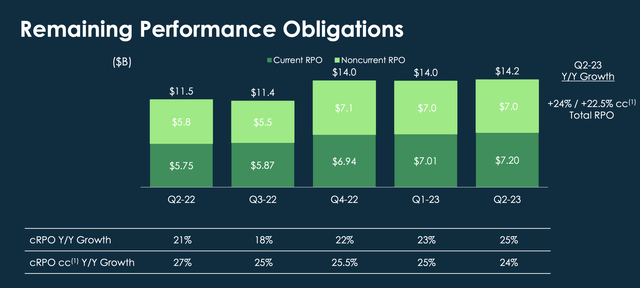

One area I said investors should pay attention to for the quarter was its RPO (deferred revenue + backlog) growth. On that front, NOW saw RPO grow 24% to $14.2 billion, and current RPO (cRPO) jump 25% to $7.2 billion, or 24% on a constant currency basis.

Company Presentation

While these numbers were solid, you really needed to see an acceleration in growth from these numbers to get the stock moving. While cRPO did accelerate on an absolute basis, growth slowed slightly on a constant currency basis. This is very good growth, but NOW’s stock valuation is pretty pricey, so it really needed to a big number to get investors excited.

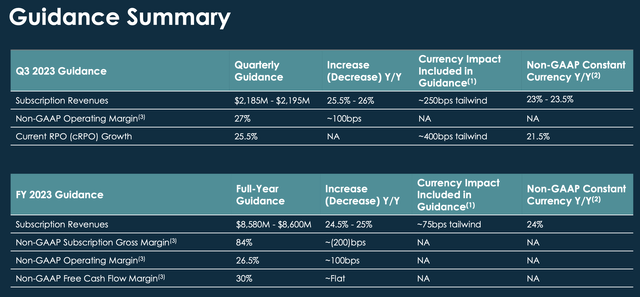

Looking ahead, the company projected Q3 revenue to grow 25.5%-26.0% to $2.185-2.195 billion. On a constant currency basis, it was looking at growth of 23.0%-23.5%

It also projected cRPO to be grow 25%, or 21.5% on a constant currency basis. That would continue a trend of modest cRPO growth deceleration on a constant currency basis.

Company Presentation

Overall, NOW once again put together very strong quarterly results. As I noted in my original write-up, NOW is a great company, and I think it has been continuing to prove that each and every earnings report. While some SaaS companies have complain about a tough macro environment and corporate budget issues, it has just continued to deliver solid growth, which speaks to the power of its solutions.

AI Hype

Following earnings, management has hit the investment conference circuit, with a big focus on generative AI. Management noted that over the past six years, it’s done a lot of acquisitions in the space to help add technology in the areas of machine learning, automation, and other areas. The company also noted that every time it meets with customers, generative AI is always a topic of discussion.

At a Deutsche Bank Conference at the end of August, SVP & GM of Technology Workflows Pable Stern said:

“All these conversations we have with customers always starts with the voice of the customer, telling us about where they are, what are their top priorities and what they need to solve for. And then we will have a conversation based on what they want to talk about. And generative AI is in every one of those discussions. And so the demand is there, the interest, the potential. And we not only see it from the executives. So when I talk to like a CIO or a CTO, we hear it. But then also from a practitioner perspective, and we have over 100 customers who’ve already signed up with us on design partner programs for our generative AI solutions, customer-facing use cases, employee-facing use cases, that type of demand is really unseen in terms of like how quickly we’ve seen, for what is a new product, demand coming in from the market. Now you asked about some of the risks. Well, one of the things that we really pride ourselves on is, if you think about a lot of the acquisitions we’ve done in the past, so companies in the AI space, like Element AI. We’ve not only focused on getting IP on the technology and being able to move machine learning forward, we’re also really focused on trustworthiness. And what can happen with that AI? And how do you — how can you trust what Gen AI is doing to not only deliver insights, but make sure that your data is your data and things are protected? And so I think like one of the things that does come up in a lot of the conversations with our customers is they trust ServiceNow.”

Meanwhile, at a Goldman Sachs conference earlier this month, CEO William McDermott noted that the Pro Version of its solution that was introduced a few years ago comes with a 25% uplift in pricing. Given all the attention around AI, this should be a nice boost in the future for NOW. There is likely still some hesitancy about AI, and companies want to be careful with it, but as it becomes more prevalent, NOW should see some nice upsell opportunities.

Valuation

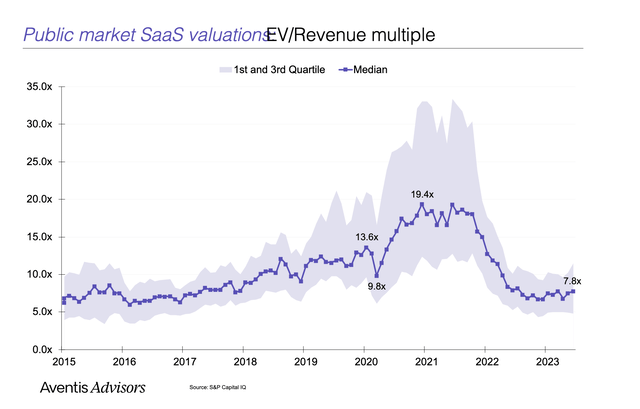

SaaS companies are generally valued based on a sales multiple given their high gross margins and the companies wanting to pump money back into sales and marketing to grow.

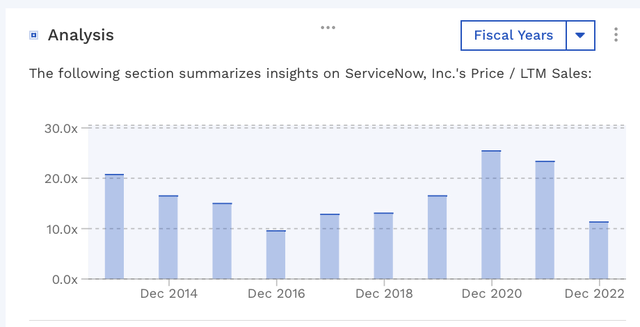

In this regard, NOW is valued at a P/S ratio of about 12.6x based on the 2023 consensus for revenue of $8.91 billion. Based on the 2024 revenue consensus of $10.86 billion, it trades at a P/S multiple of 10.3x and an EV/S multiple of 9.9x.

In the past, the company has often traded at over 13x LTM sales sometimes over 20x. However, growth is slowing from over 30% to the low 20% range. It is projected to be 23% this year and 21.8% next year.

NOW P/S Historical Valuation (FinBox)

For a SaaS company with gross margins north of 75%, no debt, and growing revenue in the low to mid 20% range spending a reasonable amount of sales & marketing, I generally view a valuation of 10x P/S as towards the high-end of being a reasonable valuation. This is right around where NOW currently sits based on 2024 estimates. The industry has around an 8x multiple with similar 20% growth. I don’t think the huge multiples that were seen between 2020-2022 made sense.

Aventis Advisors and Capital IQ

Conclusion

NOW continues to prove it’s a great company, with continued solid results. Meanwhile, the company is way ahead of the AI curve, having built out and acquired its technology over the last several years. It has also formed a partnership with chip leader NVIDIA (NVDA) to help develop enterprise-grade generative AI solutions. Given the pricing uplift it sees with its already established Pro product with AI capabilities, the future should remain bright for NOW, especially when it comes to helping leading the pack with AI.

That said, NOW’s stock is still not cheap. Given its growth, I think it’s multiple looks pretty appropriate. If you own the stock I would continue to do so, but I’m not a new money buyer at current levels. As such, I rate the stock a “Hold.”

Read the full article here