Investment Thesis

Shift4 Payments (NYSE:FOUR) is an underrated payment processing entity that empowers intricate commercial ecosystems to conveniently accept and oversee their transactions through a unified platform. In contrast with its rivals, the company is undervalued, making it a compelling choice for investment due to its potential for growth. I am giving this stock a strong buy rating.

Company overview

Shift4 Payments, an autonomous and foremost entity, stands as a major player in comprehensive integrated payment processing and cutting-edge technology solutions in the United States. The company made its market debut through an initial public offering (IPO) in 2020. Shift4’s primary specialization revolves around delivering adept payment services catering to a diverse clientele encompassing the restaurant, hospitality, sports stadium, and casino sectors. The dissemination of these services is orchestrated through a well-structured framework comprising adept internal sales and support teams, supplemented by an extensive network of software partners. The customer spectrum spans from everyday food outlets like Wendy’s and TGI Fridays to esteemed hospitality providers such as Hilton and Four Seasons. An astonishing number of over 100,000 restaurants currently rely on Shift4’s advanced payment technology.

Stock Price Performance

In June 2020, the company initiated its IPO by offering 15 million shares of its Class A common stock at a rate of $23.00 per share (with an additional option for underwriters to buy 2.25 million shares within 30 days).

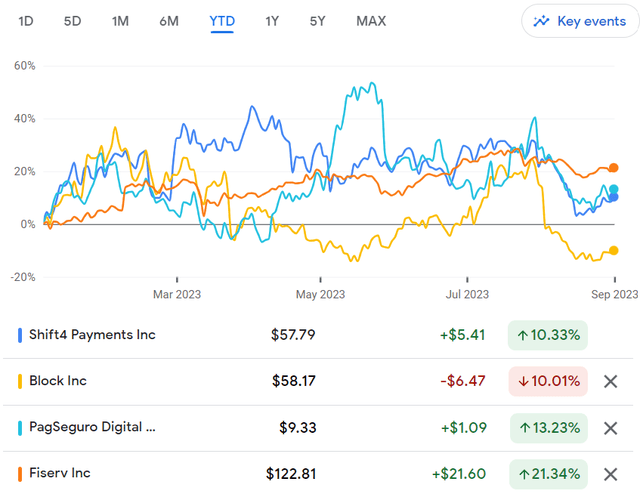

Subsequently, there has been an impressive price return of 142%, resulting in a market capitalization of around $4.5 billion. However, as of the current year, 2023, the company’s shares have experienced a small incline of 10.33% in comparison to the Russell 1000’s year-to-date return of 15.71% when factoring in dividend reinvestment (with a price change of 14.51%). Notably, the company’s beta in relation to the S&P 500 currently stands at 1.41, while against the Russell 1000, it registers at 1.44. This signifies a heightened responsiveness to shifts in market activity.

The performance chart from Google shows the YTD returns of Shift4 relative to its peers.

Google

Growth via Acquisitions

The management is strategically utilizing the proceeds garnered from its IPO, debt financing, and its own primary and secondary share offerings, amounting to almost $1 billion, to fuel its expansion through acquisitions. So far, Shift4 has successfully acquired nine different organizations, with a notable example being the Swiss-based company Online Payments Group, acquired for $125.9 million in September. This move has significantly fortified Shift4’s plans for international growth. Moreover, through the acquisitions of Online Payments Group and Finaro, the company has strategically positioned itself to cover a substantial portion of the European market. Worth noting is that Finaro holds banking licenses not only in Europe but also in Japan and Hong Kong.

By integrating the Online Payments Group into its fold, Shift4 has gained access to new technological capabilities, including recurring billing and advanced fraud protection mechanisms. These technological enhancements are poised to accelerate Shift4’s ability to both attract and seamlessly incorporate new customers into its ecosystem. In addition to its presence within the hotel and restaurant sectors, Shift4 has broadened its reach to encompass diverse fields such as sports stadiums, airlines, charitable organizations, and entities within the food and beverage domain.

The table below shows the acquisitions the company has made.

|

Acquiree Name |

Announced Date |

Value (M) |

Sector |

|

Focus POS Systems |

04 May 2023 |

$ 45.00 |

Software |

|

Online Payments Group |

01 September 2022 |

$ 125.90 |

Tech |

|

The Giving Block |

01 May 2022 |

$ 54.00 |

Cryptocurrency |

|

Finaro |

01 May 2022 |

$ 575.00 |

Ecommerce |

|

VenueNext |

04 May 2021 |

$ 72.00 |

Sporting and Events |

|

3dcart |

06 November 2020 |

$ 59.10 |

Ecommerce |

|

Lighthouse Network |

18 June 2018 |

Undisclosed |

Software |

|

Future POS |

06 October 2017 |

Undisclosed |

Software |

|

POSitouch |

06 October 2017 |

Undisclosed |

Software |

|

Restaurant Manager |

01 August 2017 |

Undisclosed |

Hospitality |

Institutional Shareholders

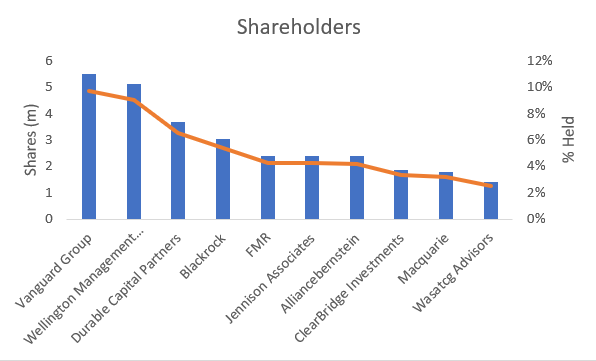

Over 80% of Shift’s voting authority and a stake of 35.09% in the company are under the control of Chief Executive Jared Isaacman. Apart from Jared’s significant holdings, the predominant portion of the total shares is owned by institutional investors, who have seen a 0.58% increase in ownership over the last three months.

The chart provided showcases the prominent institutional shareholders among a total of 606, collectively owning around 78 million shares. The bar chart shows the shares held in million while the axis on the right shows this as a percent of the total shares outstanding. Notably, Vanguard emerges as the largest shareholder with an ownership close to 10% of the total shares.

Yahoo Finance

Market Sentiment

As an additional point to consider, the put/call ratio stands at 1.62, signaling a bearish sentiment within the market. This sentiment is driven by the backdrop of increasing interest rates and recent remarks from Jay Powell, which suggest a prolonged duration of higher rates, possibly even undergoing further increments if deemed necessary.

Competitors

By the end of 2022, Shift4 introduced its SkyTab restaurant payment system, which competes against rivals like Adyen, Toast, and Block. During the second quarter alone of this year, approximately 6,500 SkyTab systems were deployed and the SkyTab is less than a third of the cost of the many competitors. Primary competitors cost stands at $65,289 in total vs $18,475 for SkyTab.

Among these contenders, Block underwent an impressive surge during the pandemic, boasting returns surpassing 200%. However, its performance post-pandemic has been notably less impressive. The stock plunged from approximately $275 per share to slightly under $70 per share by mid-2023. During the past several quarters, Block has reported rather unfavorable net income figures, with losses spanning from $80 million to $540 million. This is primarily attributed to elevated operating expenses and unexpectedly high product development costs.

Shift4 also adopts a pricing structure that involves a $29.99 monthly charge for restaurants, along with the provision of free-of-charge point-of-sale devices. Additionally, Shift4’s revenue streams are diversified, encompassing processing fees levied as a percentage of the payment volume. This strategic approach grants Shift4 a significant competitive edge by catering optimally to upscale table-service restaurants, distinguishing itself from establishments like lower-tier coffee shops and self-service outlets found in the quick-service fast-food sector.

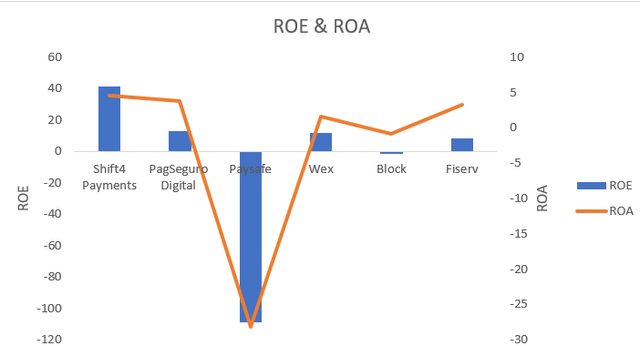

Analyzing the graph provided, it becomes evident that among its competitors, Shift4 boasts the most elevated Return on Equity (ROE) and Return on Assets (ROA). These metrics offer insights into the financial performance and efficiency of each company. A higher ROE and ROA generally indicate better profitability and efficient asset utilization, while negative values suggest potential financial challenges.

Bloomberg

Earnings and comparisons

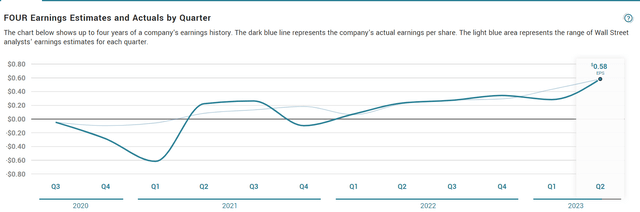

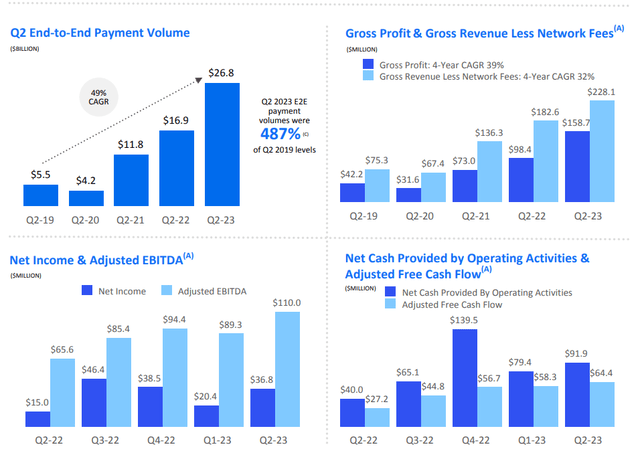

Shift4 Payments released its latest earnings figures on August 3rd, 2023, reporting an EPS of $0.58 for the quarter, surpassing the estimated $0.34. During the quarter, the company recorded a gross revenue of $228.10 million, a notable increase compared to the $182.6 million in the previous quarter. Projections anticipate a revenue of $252 million in Q3. The table below illustrates this with the chart showing the rise in EPS since 2020.

|

Quarter |

Est EPS |

Reported EPS |

% chg |

Est Revenue (M) |

Reported Revenue (M) |

|

Q2 2023 |

$0.34 |

$0.58 |

71% |

$229.41 |

$228.10 |

|

Q1 2023 |

$0.26 |

$0.28 |

8% |

$191.93 |

$182.6 |

Market Beat

Looking at the company’s financial health, the free cash flow for the year ending in 2022 amounted to $213 million, and it is anticipated to grow to $257 million in 2023 and further to $350 million in 2024. Additionally, it is anticipated that net debt will experience a 18% increase in 2023, followed by a subsequent decrease of 25% in 2024.

Over the past year, Shift4 Payments has generated earnings per share (EPS) of $1.69. At its current stock price, this translates to a price-to-earnings (PE) ratio of 42.65. Forecasts suggest a 32% earnings growth for Shift4 Payments in the upcoming year, with EPS expected to rise from $1.96 to $2.60 per share. For the year 2024, a 28.3% year-over-year growth is expected, with projected EPS of $3.33 per share. The earnings release for Q3 is expected to occur on November 6th.

Annual Report

Competitor Performance

In the same industry, there’s another competitor known as PagSeguro Digital (PAGS), and its Q2 results were unveiled on August 24th. The market had anticipated this company to reveal quarterly earnings of $0.25 per share in its upcoming report, reflecting a decline of -46.8% compared to the previous year. However, the actual reported quarterly earnings turned out to be $1.28 per share, surpassing expectations significantly.

For PagSeguro Digital, the projected revenue for this quarter stood at $689.4 million, indicating a 13.2% decrease from the corresponding period in the prior year. Nonetheless, the actual reported revenue amounted to $785 million, compared to $803 million in the equivalent period of the previous year, signaling a -2.2% year-over-year growth rate.

Analyst Recommendations and Valuations

Based on data gathered from Bloomberg, a striking 90% of analysts endorse a “buy” recommendation, with merely 5% each suggesting a “hold” or “sell.” Additionally, the 12-month target price stands at $82.05, indicating a substantial return potential of 44%.

Despite having a higher PE ratio compared to the industry average of 12.8 and the peer average of 13.8 in the US Diversified Financial sector, I maintain the view that the company is undervalued. By employing the Discounted Cash Flow (DCF) method and making assumptions based on an equity risk premium of 5% and a risk-free rate of 4.18% (the latter being the yield of the 10-year US government bond at time of writing), I have calculated the fair value of FOUR to be $89.5. Given the current market price of $57.79, this suggests a discount of 35%. Below is a table of my assumptions for the DCF model and I have kept the forecast period to 5 years due to the limited amount of historical data.

| Price | $ 57.79 |

| Equity Risk Premium | 5% |

| Risk Free Rate | 4.18% |

| Discount Rate | 9.18% |

| Forecast Period | 5y |

| Growth Rate | 0.80% |

| Enterprise Value | $ 5,800 |

| Common Equity | $ 4,550 |

| Shares Outstanding | 58 |

| Predicted Price | $ 78.45 |

| Discount | 35.75% |

Conclusion

In conclusion, Shift4 Payments presents a compelling investment opportunity in the payment processing industry. This underappreciated company offers a unified platform for managing transactions and it has proven itself in a variety of sectors, from restaurants to hospitality and beyond. Despite impressive stock price growth since its IPO in 2020, recent market dynamics and strategic acquisitions have positioned the company for continued expansion and success.

The current market sentiment may appear bearish due to factors like rising interest rates, but Shift4 Payments’ strong fundamentals, demonstrated by robust earnings and healthy financials, tell a different story. Furthermore, Shift4 Payments competes effectively with its peers, offering competitive pricing and innovative solutions like the SkyTab system. The company’s earnings consistently surpass expectations, and its forward-looking projections suggest strong growth in the years ahead.

Analysts and investors seem to recognize the potential here, with a vast majority recommending a “buy.” Even with a higher PE ratio than industry averages, Shift4 Payments appears undervalued, as evidenced by a DCF-based fair value estimate that implies a 35% discount from the current market price. For investors seeking a promising opportunity in the payment processing industry, Shift4 Payments deserves strong consideration as a stock with the potential for significant growth.

Read the full article here