When everyone in the world was focused on who was winning the gold medals at the Paris Olympics, I was paying attention to the second-place finishers, with their truly precious silver medals. Yes, because while gold is gold, don’t make the mistake of undervaluing silver, especially now. There are many ways to invest in silver, and as you may already know, using an ETF like Global X Silver Miners (NYSEARCA:SIL) we don’t invest in silver in the same way as buying a kilo of silver, like what you might see in the cover image of this article. Instead, this ETF provides the opportunity to participate in the ecosystem behind silver. At the same time, there is a passive solution in the market that offers a good way to benefit from the appreciation of silver prices. That’s ETF is called iShares Silver Trust ETF (NYSEARCA:SLV). You might now ask, “why do you think a great time for silver is coming, and which is better to participate in the bull run?” In my opinion, SIL ETF.

Why I think it’s a great moment to invest in silver?

Did you already watch Powell’s speech at the Jackson Hole symposium? I think the entire financial world was tuned in at that moment, as this speech was probably one of the most anticipated of the year. Aside from that, the macro scenario is pretty clear (perhaps too clear).

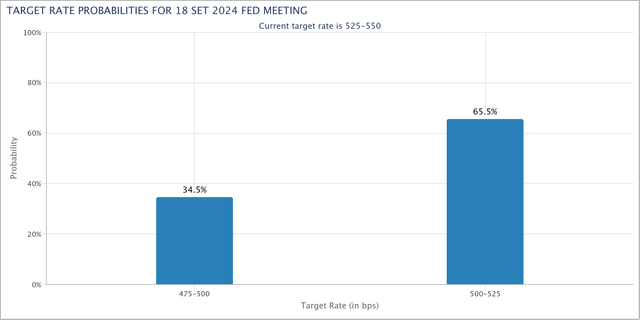

Target rate probabilities (FedWatch Tool)

The situation is such that the CME FedWatch Tool now considers only two scenarios: a 50 basis point cut with a 34.4% probability and a 25 basis point cut with a 34.5% probability. The job market is hot, yes, but according to Powell, the recent increase in the unemployment rate is due to a rise in the labor force participation, which is precisely the Fed’s goal.

What has happened in the past in similar economic contexts?

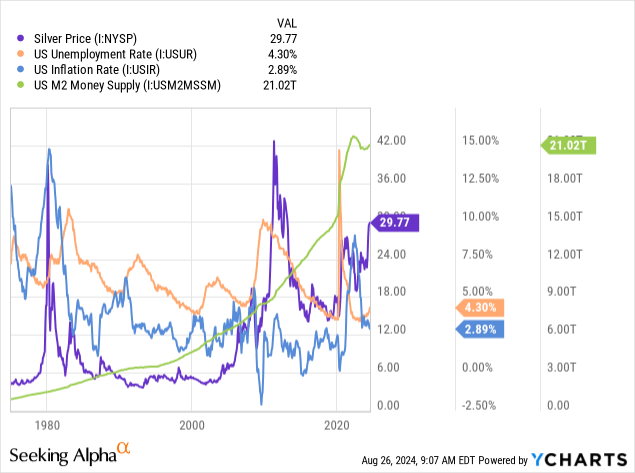

Look at this chart; maybe there are a few too many lines, but I’m confident that you’ll appreciate this representation.

What drives the price of silver? If you google it, the answer you’ll get is “inflation.” Yes, everyone knows that gold and silver are considered “safe-haven assets,” so their prices should theoretically change in response to market “fear.” Whenever inflation rises or, in a different scenario, the unemployment rate increases, gold and silver should also increase. Well, not entirely. I believe that silver and gold are not always “safe-haven assets,” but (certainly) they are excellent “stores of value,” and trust me, that’s not quite the same thing. For further insights, take a look at this very interesting article. What I mean is that the size of this market segment grows when the M2 money supply increases. Naturally, this can be correlated with inflation, but not necessarily. Don’t you think? When the U.S. inflation rate was near 0%, the M2 year-over-year change was positive. And for this reason, silver and gold prices went up. To sum up, for this reason, in my opinion, the interest rate cuts in this decade could give silver the necessary “push” to surpass its previous highs.

SLV ETF or SIL ETF?

When you buy a financial tool like the SIL ETF, you’re not buying silver itself; you’re buying into the ecosystem behind silver. By investing in SIL, you’re purchasing a stake in 40 companies, with the top 10 holdings making up approximately 74.58% of the fund. Read that again: you’re essentially investing in 10 stocks, and to do so, you’re paying an expense ratio of 0.65%, which is higher than many peers.

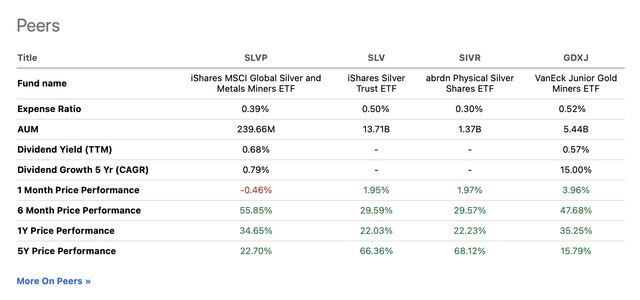

SIL Peers (Seeking Alpha)

Instead, inviting directly in Silver thanks to SLV gives the possibility to expose our portfolio to the price of silver bullion with a lower expense ratio of 0.50%.

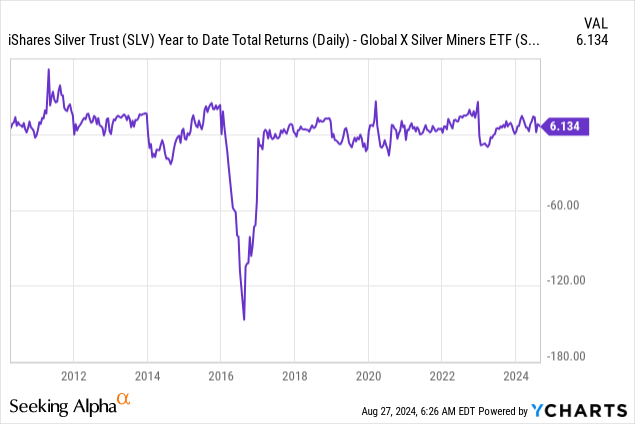

The spread between these two financial tools reflects the differences of expense ratio, but first of all, the fact that that two ETFs in reality are investing in two different things even if the long-term trend is pretty similar.

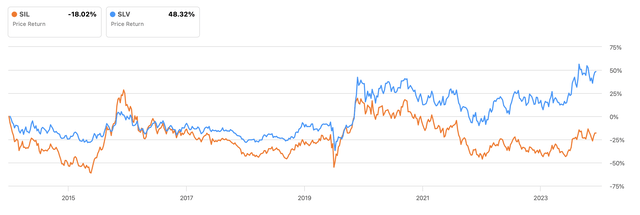

SLV, SIL (Seeking Alpha)

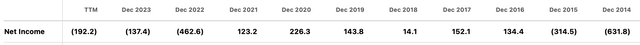

As you can see, there are certain technical points where investing in SIL is more advantageous than investing in SLV. However, in the long term, SLV has provided higher returns. This has happened in the past, when the spread between the stock prices of companies working with silver and the price of silver itself increased because the market suddenly had to reprice the profitability of silver-related stocks. Take, for example, Pan American Silver Corp. (PAAS), the top holding in the SIL ETF, where, naturally, net income grows as the price of silver increases.

PAAS:CA – net income (Seeking Alpha)

So, for this reason, whenever we see a discrepancy between the price of silver and the price of the SIL ETF, there could be hidden alpha, and the market might be waiting for the earnings call to adjust its valuation. Given the current spread between SLV and SIL, this could be a good time to consider taking a position in SIL.

What Could go wrong?

In my opinion, the macro scenario is pretty clear, with little probability of significant changes. A potential issue could arise from the fundamentals of the companies that make up the SIL ETF. There are many metrics to consider, and I understand that an increase in the price of silver alone isn’t enough to drive a significant rise in the SIL ETF. However, even in this case, I believe the economic context could support my analysis: in a recession scenario, precious metals could act as “safe-haven assets” while the Federal Reserve tries to calm the market with substantial interest rate cuts. Both SIL and SLV could maintain an alpha relative to the broader market (e.g., the S&P 500). In a soft landing scenario, the companies within SIL could benefit from increased profitability, driven by a prolonged period of high silver prices.

Conclusion

Yes, I know… The SLV ETF is the better solution for exposing our portfolio to the silver market. That’s because if you want to invest in the silver ecosystem or silver itself, SLV and SIL maintain a strong correlation, but SLV has a lower expense ratio and better performance than SIL. I would confirm a HOLD rating.

Read the full article here