Back in June, I wrote that SoundHound AI’s (NASDAQ:SOUN) stock was trading more on AI hype than fundamentals, making it a risky investment for those who are not momentum investors. Since then, the stock has been cut in half. Let’s catch up on the name.

Company Profile

As a refresher, SOUN offers a voice AI platform that improves human-computer interactions by allowing for more conversational, natural interactions and allowing people to ask more complicated questions. Its speech-to-meaning technology can convert speech into meaning in real-time through the use of automatic speech recognition and natural language understanding.

SOUN generates revenue in a few ways, although most of it currently comes from royalties from its Houndify platform. When its platform is incorporated into a device, it will collect royalties based on usage, volume or duration. It also has subscriptions for services that don’t have a physical product, such as food ordering. It also has a music recognition app, which it is hoping to monetize through advertising and lead generation.

Weak Bookings And Added Debt

In my last article on SOUN, I noted that the stock had been a steady riser after pretty lackluster Q1 results. However, the stock lost its momentum in July and hasn’t been able to recover.

For Q2, SOUN saw its revenue jump 42% to $8.8 million. That’s obviously off a very low base and just $690,000 above analyst expectations. The company credited the growth with an increase in auto units as well as a slight increase in unit prices.

Its cumulative bookings backlog, meanwhile, grew 20% year over year. While that is nice growth, it has continued to meaningfully decelerate. Over the past year, bookings growth has gone from 207% in Q2 ($283 million), to 239% in Q3 ($302 million), to 59% in Q4 ($332 million), to 46% in Q1 ($336 million) and now only 20% growth in Q2 ($339 million). That’s a rapid deceleration of growth the past three quarters. In fact, its cumulative backlog was up only $3 million sequentially in Q2 and up only $7 million combined the past two quarters.

Notably, while the backlog is quite large compared to revenue, SOUN’s average contract is 6.5 years and the future revenue is projected to be back-end weighted.

This is the second quarter in a row now where SOUN has seen 1% or less sequential bookings growth. That’s not ideal for a more mature company, let alone a company that should be in the early stages of growth.

For the quarter, the company reported a loss of -$29.1 million, or -10 cents per share. That came in 2 cents ahead of the analyst consensus. Adjusted EBITDA was a loss of -$9.9 million, improving from a loss of -$20.0 million a year ago.

Operating cash flow for the quarter was -$19.2 million.

Gross margins for the quarter made a notable improvement, coming in at 79%, up from 60% a year ago. This has driven by scale and the company migrating its data center to the cloud.

The company ended the quarter with $115.8 million in cash and equivalents, as well as $13.8 million in restricted cash, and $66.4 million in debt.

Looking ahead, the company reiterated guidance for 2023 revenue to come in between $43-50 million. It anticipates being EBITDA positive in Q4.

On the call, SOUN management talked up the company’s opportunity in the restaurant space, which is one area it is looking to make big inroads into, and make it a second strong vertical for the company after Autos.

On its Q2 earnings call, CEO Keyvan Mohajer said:

“During the last week of July, about 93% of orders placed with our Smart Ordering solution were handled by AI and only 7% were from transfers. We expect the rate of these transfers to decrease over time as callers become more comfortable and confident speaking to an AI. … We’ve heard from restaurants loud and clear. They are hungry for this type of automation as it directly creates financial returns by addressing labor shortages, overall cost pressures and help them generate revenue. We are deeply engaged with thousands of brands and have already closed with hundreds of them, thanks to our direct sales and strong channel partner ecosystem, including Toast, Square, Oracle and Olo. Last week, we announced that we are significantly expanding our relationship with White Castle, where they’re committed to provide AI-powered ordering to 100 drive-thru lanes by the end of 2024. And because our products are designed to be scalable, we can address a wide vagary of restaurants across a diverse area of cuisines and different sizes. For example, we are also delighted to be providing voice AR technology to Beef ‘O’ Brady’s, which is a part of FSC Franchise Co., is a restaurant company with multiple brands that span 25 states and more than 180 locations. And you’re adding more customers every day. For instance, Kneaders bakeries, Hot Table, Naz’s Halal, Slim & Husky’s, Crust Pizza, Kumori Sushi, Noi Thai, Bozelli’s Italian and Dialog Cafe, among hundreds of others, note especially the diversity of cuisine types and brand sizes, which give us access to a larger market share than vendors that due to technology and scale limitations need to focus on just enterprise customers or specific cuisines.”

While SOUN has made nice inroads into the automobile vertical and restaurants look like a nice opportunity, the company’s booking growth the past two quarters has been pretty abysmal for a growth company of its size. At the same time, the company is burning cash and just raised variable debt that at the end of June had a 13.6% interest rate. Debt at that interest rate with no free cash is burdensome.

Valuation

SOUN is projected to grow revenue nearly 48% to $45.8 million. On that basis, SOUN stock trades at a price-to-sales multiple of over 10x.

Further out, however, analysts are expecting big growth from SOUN. For 2024, the revenue consensus is for sales growth of 62% to $74.1 million. Then in 2025, one analyst is projecting revenue to grow 36% to $100.4 million. Notably, this estimated growth has come down a lot since I last looked at the stock.

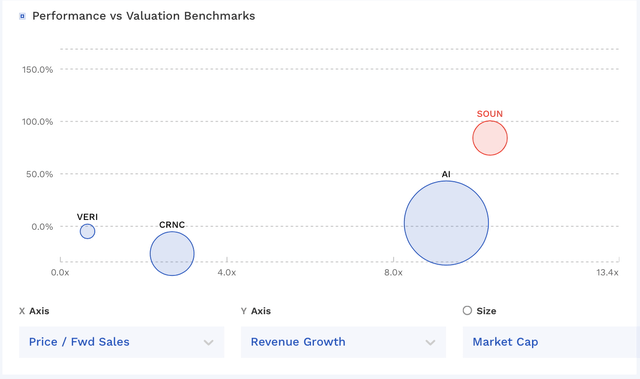

SOUN trades at one of the higher valuations among early-stage AI companies.

SOUN Valuation Vs Peers (FinBox)

Conclusion

While SOUN has some potential opportunities, it clearly has a number of things going against it at the moment. Chief among them is that new contracts have largely dried up, with only 1% sequential billings growth each of the past two quarters. That is just poor given where the company should be in its growth curve.

At the same time, the company is burning through a lot of cash ($34 million in the first 6 months of the year against a $472 million market cap). While that happens with young growth companies, SOUN isn’t growing that fast and the company just took on some very high interest rate debt. That’s just a bad combination and is only going to make its cash burn worse, especially as interest rates have shown no signs of easing.

As such, I think investors need to stay away from SOUN. The company will likely need to raise equity, or it could be looked at bankruptcy concerns in a year or two.

Read the full article here