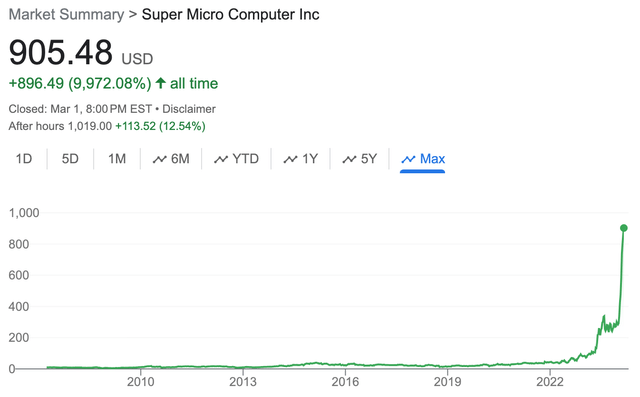

Shorting high-flying stocks, like Nvidia (NVDA) or Advanced Micro Devices (AMD), can be nerve-racking, as Super Micro Computer (SMCI) bears found out, painfully, since the start of this year:

Google Finance

The Direxion Daily Semiconductor Bull 3X Shares ETF (NYSEARCA:SOXL) allows a more diversified and leveraged approach to betting against a group of high-flying artificial intelligence-related companies. According to Direxion:

The Direxion Daily Semiconductor Bull 3X ETF seeks daily investment results before fees and expenses of 300% of the price performance of the ICE Semiconductor Index. There is no guarantee the fund will meet its stated investment objective.

I would say, “The emphasis is mine,” but Direxion indeed emphasizes that sentence in the fund’s Fact Sheet, and for good reason: In the last 10 years, the “Bull 3X” ETF has returned only 40 percent, nowhere near the triple return of the index return of 24 percent in the same period, according to the below performance table posted on Direxion’s website:

Direxion.com

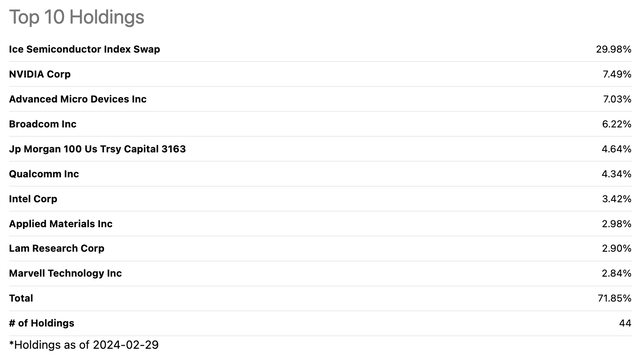

The index that the 3X Bull ETF targets is the NYSE Semiconductor Index (ICESEMIT), a rules-based, modified float-adjusted market capitalization-weighted index that tracks the performance of the 30 largest U.S.-listed semiconductor companies. The following table lists the top 10 constituents of the exchange-traded fund as of February 29, 2024:

SeekingAlpha

Potential Reasons For Underperformance

There are various reasons why a leveraged ETF can materially undershoot its investment objective, and in this case, I believe the following three are the primary reasons:

- The ETF charges a high expense ratio of 1.0 percent, which is nearly twice as high as the median expense ratio of all ETFs, according to the estimate provided by Seeking Alpha;

- The ETF exhibits an extreme portfolio turnover of 97 percent, more than triple the median portfolio turnover of all ETFs; and

- Any secondary, underlying fees associated with the ICE Semiconductor Index Swap, which is the ETF’s top holding listed in the above table.

In general, Leveraged ETFs decay due to the compounding effect of daily returns, the volatility of the market, and the cost of leverage. This structural decay is why I recommend shorting the 3X Bull ETF rather than buying its sister, the Direxion Daily Semiconductor Bear 3X ETF (SOXS).

Conclusion

With their 69x and 385x price-to-earnings ratios as of the last close, the Nvidia and the AMD stocks could be considered to be overvalued. Still, given the positive momentum and sentiment in the artificial intelligence-related stocks, shorting the NVIDIA or the AMD stock could be nerve-racking; therefore, I recommend that bears instead consider shorting the diversified basket offered by SOXL, which poses much less risk of getting caught in a potential short squeeze.

Read the full article here