It’s seriously time to start hedging with some bets against the S&P 500. The market has had a face-melting run-up and the options market is signaling complacency. In this article, we’ll cover the warning signs I’m seeing and some of the ways to hedge.

Warning Signs

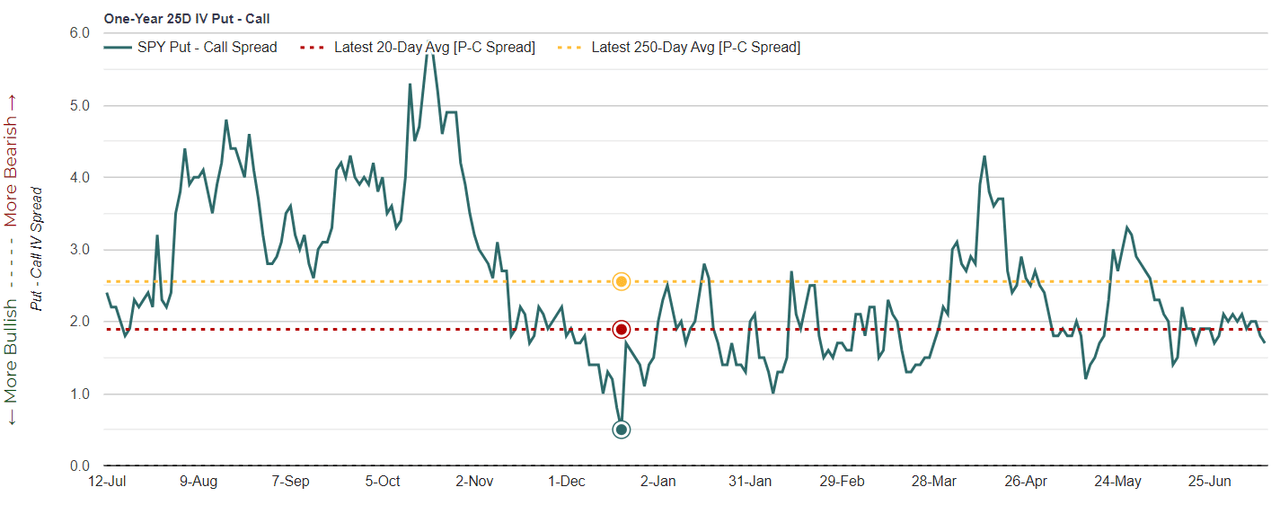

To begin, the implied volatility skew between puts and calls on SPY is becoming increasingly flat as the VIX is staying at lows. Generally, the spikes in the IV skew signal local bottoms, and sustained decreases in the skew along with a dampened VIX signal complacent markets.

SPY IV Skew (Market Chameleon)

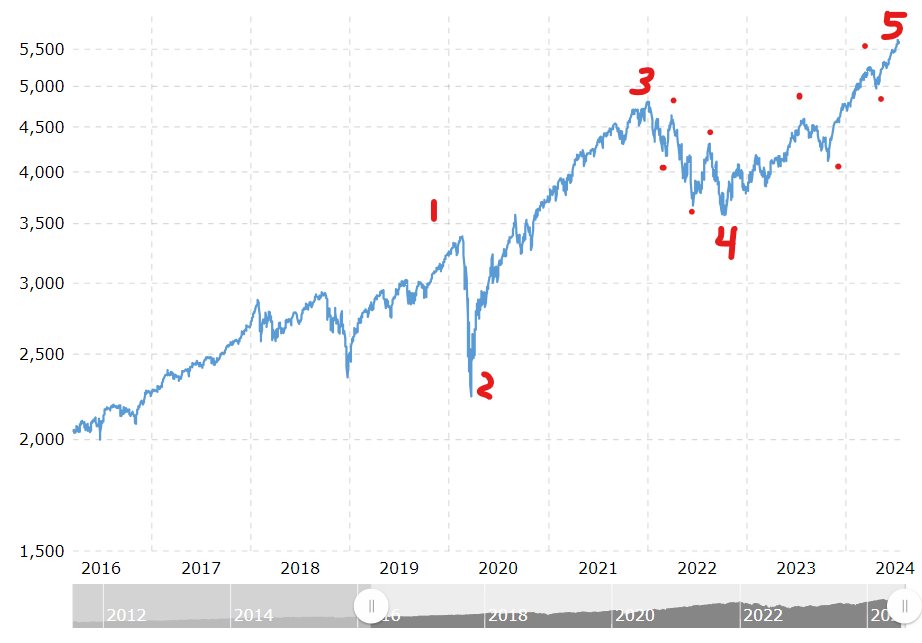

SP500 (Seeking Alpha)

We may soon see a selloff, much like in early April. Back then the drawdown stopped at 5% but this time the market might be in for a larger correction than that. July 28, 2023 to October 27, 2023 was the drawdown that happened before April. That was a 10% correction. Ever since the market bottomed in October of 2022, which was the end of a 23% correction, we’ve been seeing mostly up with very few instances of seriously poor sentiment or volatility.

From a technical standpoint, it seems we are in the final phases of a very large 5 wave sequence. This could potentially be the start of a deep correction should the fifth wave start to give out into a new reversal. If this estimate is correct, then the next phase should be entering into a 3 wave sequence marked by lower lows. Sentiment has been enormously positive on US equities for well over a decade and may be due for a reversal; however, temporary that may be.

SPX since 2016 (macrotrends.net)

I also don’t think we should ignore the yield curve’s inversion. This is now the longest 2-10 inversion in history, making a market correction quite overdue. A lot of people are saying that the yield curve is broken, but I’ve honestly yet to hear any reasonable theories as to why it might be broken.

Finally, I see the continued devaluation of the Japanese yen paired with the uptick in Japan’s inflation as posing a possible persistent macro headwind which no one seems to be talking about. It is currently the cheapest it has been in years to visit Japan as a tourist (assuming you are using the euro or the dollar) due to how much the yen has collapsed against the dollar.

With Japan experiencing some higher-than-normal inflation for the first time in decades, we might see the Bank of Japan be forced to intervene in ways that will affect the value of the dollar, which in turn could lead to massive volatility in the US equity markets. What this might look like is selling US debt to buy the yen, something many believe happened extremely recently. Another possibility could be raising Japanese interest rates to a high enough point that it shuts down the lucrative dollar-yen carry trade. This would be followed by large capital outflows from US assets.

The macro specifics for this last factor could be an article on its own. I’m simply laying out some of the budding risks I see which motivate the need to strongly think about hedging.

Hedging

It would be wise to continue hedging over the next year because the probability for a correction is elevated, given the factors I just listed. Meanwhile, the options we can use to hedge are, as shown in the IV skew and the VIX, relatively cheap. The risk-reward for hedging is quite favorable at this moment.

The exact method for hedging depends on how you think this upcoming drawdown could play out. If you believe it will be a very fast crash like the one in early 2020, then the best hedge would be far OTM VIX calls or far OTM SPX puts. For VIX, aim for strike prices beyond 50, although right now even the 40 calls could be quite lucrative. For SPX, aim for roughly 30-50% below the spot price. Ideally, you want to cash out the positions as the underlying closes in on the strike price of the contract. Such positions have extreme convexity. As long as there remains about a month or so left on the contracts when the crash materializes, you are looking at a potential 30-100x on the funds used to set up the hedge. This means that just a 1% portfolio allocation to these positions will save the rest of the portfolio from a 30% drawdown in SPX.

If you believe the drawdown could be long and drawn out, like in the first three quarters of 2022, then collars are probably the best way forward. This looks like shorting a call and buying a put. The risk with collars is that you are capping further upside.

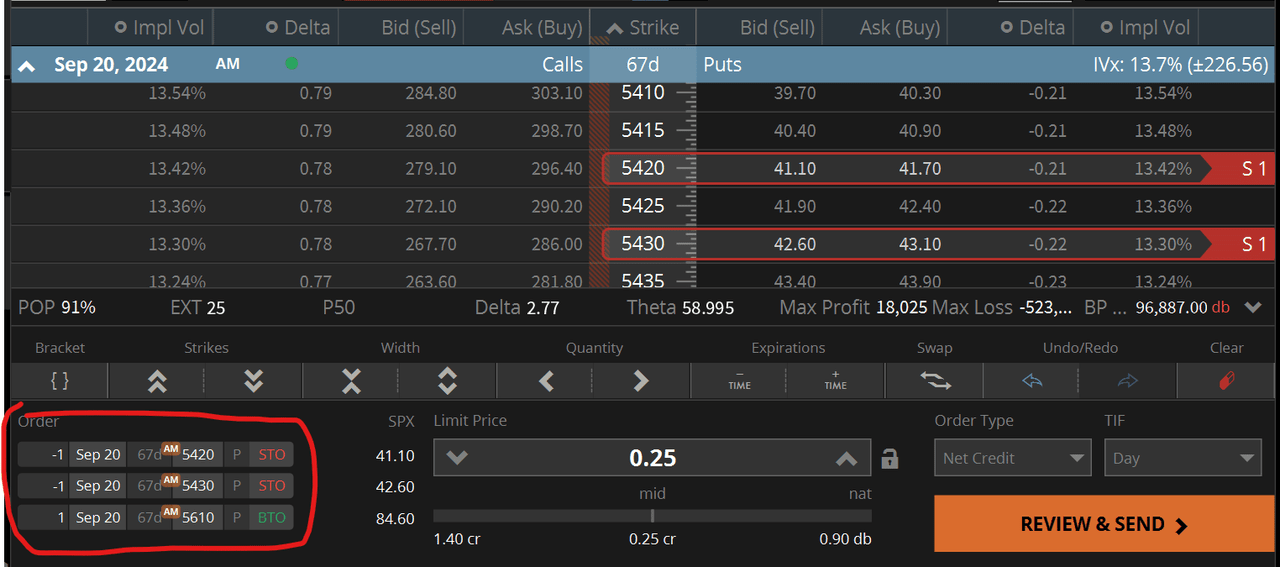

Another possibility for “slow crashes” is to buy ATM or NTM puts and sell more further OTM puts in a ratio spread. For example, right now, one could buy one SPX 5610 put expiring on September 20 while selling two contracts at lower strikes— in this case 5430 and 5420.

SPX put ratio spread (tastytrade)

This position could be entered at minimal upfront cost, while providing more and more protection up until the spot price falls below the lowest strike price. The break-even point for this trade would be when SPX falls so far below the lower strike price that it totally cancels out the protection from the strike of the long put to the strike of the short put. If SPX goes further below, then the hedge will start turning into a loss.

This put ratio spread works great in a slow and steady march downwards. You see, when markets start a slower descent, you can often close the ratio spread at a profit because the long put would be deep ITM while the short puts are barely ATM but almost expired. The whole position can basically be closed for a big profit. The best thing is that you can then roll it into a new tranche of puts at a new expiration while benefiting from the fact that the skew has most likely increased, which means you receive relatively more premium for shorting OTM puts at that point. Lastly, the put spread does not cap your upside, so even if the market continues to go up you wouldn’t lose anything (and the hedge took minimal upfront cost too).

There’s little harm in combining both “fast crash” and “slow crash” hedges. You just have to ensure you don’t get confused about which strategy each put belongs to. For more of my thoughts on hedging, check out this article I wrote a few years ago: “Practical Hedging in US Equity Markets.”

Final Thoughts

The markets are entering increasingly dangerous territory. Investors should consider hedging. Don’t be one of those people who argue against hedging just because they think that it is market timing and that no one can time the market. None of this is about timing the market. It is about observing and reacting to the probabilities in front of you based on qualitative facts which have portended volatility in the past.

In a previous article about hedging, I was met with the following comment:

When you sell your hedges you pay a short term capital gains tax. When you sell longs you might be paying LT gains. Which one is better depends on the embedded gains, the size of the drop and your tax bracket.

To which I responded with:

No, it is still better to hedge because of the possibility that you will be wrong. Let’s say that you sell your longs and you are wrong because the index moved up. You miss the upward move, but you will have to pay LT gains taxes. If you hedged, you still miss the upward move, but you now get a tax deduction from your losses on the hedge.

Once you consider the bigger picture, you realize that the decision becomes simple:

Expected Value of Tax Liability for Hedging

= P(wrong) * (negative number, ST loss) + P(right) * (positive number, ST gains)

= ~0, assuming you are wrong 50% of the time and down moves and up moves are similar

Expected Value of Tax Liability for Selling Longs

= P(wrong) * (positive number, LT gains) + P(right) * (positive number, LT gains)

= (positive number, LT gains) -> will always be bigger than 0, again assuming down moves and up moves are similar

Thus, it is trivial to see that hedging will be the better choice most of the time. One has to be right much, much more often than one is wrong for selling longs to work out better.

Another point is that the above math applies only to linear hedges. Convex hedges (catastrophe insurance/ tail hedging) are a different flavor altogether. The gains from these hedges make them amply worthwhile LT tax or not, especially because they reduce a portfolio’s path dependence and protect long term CAGR from unforeseen exogenous events.

None of this has to do with market timing. It is about staying vigilant and smart to protect your hard-earned money.

Read the full article here