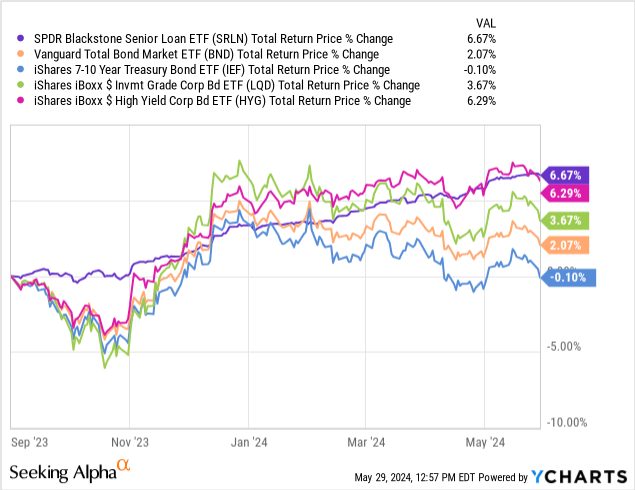

I last covered the SPDR Blackstone Senior Loan ETF (SRLN), an actively-managed senior loan ETF, in late 2023. In that article, I argued that SRLN’s strong, growing yield and low rate risk made the fund a buy. SRLN has posted reasonably good returns since, outperformed most bonds and bond sub-asset classes, and seen double-digit dividend growth. Performance has been quite good, and broadly in-line with expectations.

SRLN continues to offer investors a strong dividend yield with low rate risk, and so the fund remains a buy. It remains a somewhat risky choice though, with high credit risk.

SRLN – Basics

- Investment Manager: State Street

- Dividend Yield: 8.85%

- Expense Ratio: 0.70%

- Total Returns CAGR 10Y: 3.43%

SRLN – Overview and Analysis

Strategy and Portfolio

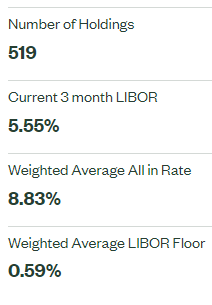

SRLN is an actively-managed ETF focusing on senior loans, which are senior secured variable rate loans from non-investment grade corporations. SRLN provides investors with diversified exposure to these securities, with investments in more than 500 loans from several sectors.

SRLN

SRLN

Notwithstanding the above, SRLN is much less diversified than several of the largest bond ETFs in the market, including the Vanguard Total Bond Market Index Fund ETF (NASDAQ:BND) and the iShares Core U.S. Aggregate Bond ETF (NYSEARCA:AGG), as these have exposure to several bond sub-asset classes.

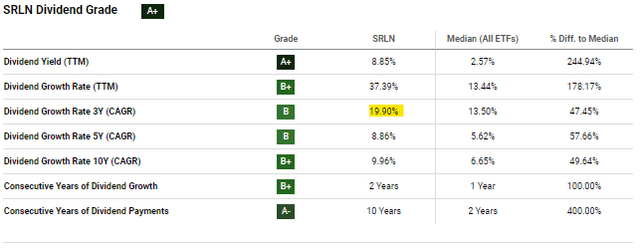

Strong 8.9% Dividend Yield

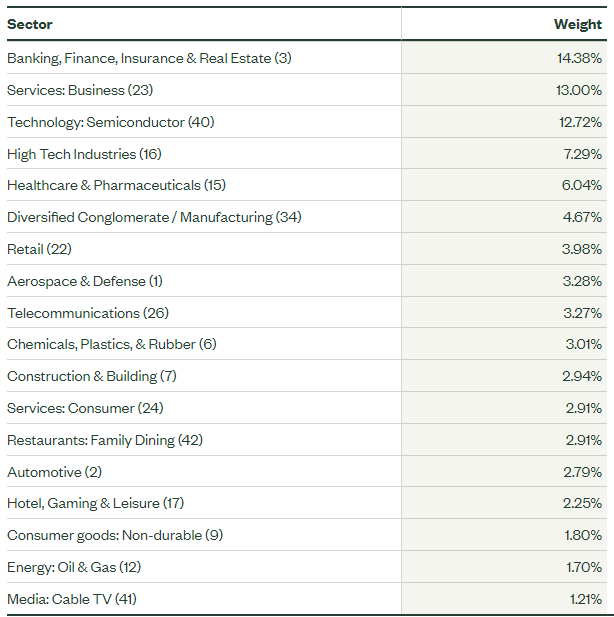

Federal Reserve hikes have led to higher interest rates across the board. Senior loans have been one of the biggest beneficiaries of these, as these are variable rate loans. Senior loans rates have risen by around 4.2% these past few years, much higher than average.

JPMorgan Guide to the Markets

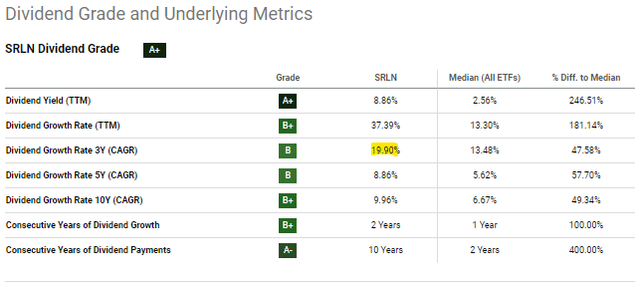

SRLN’s dividends have also seen massive growth these past few years, in-line with the above.

SRLN

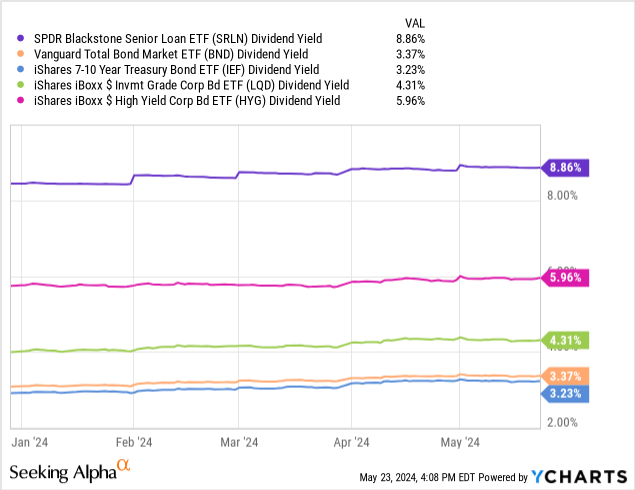

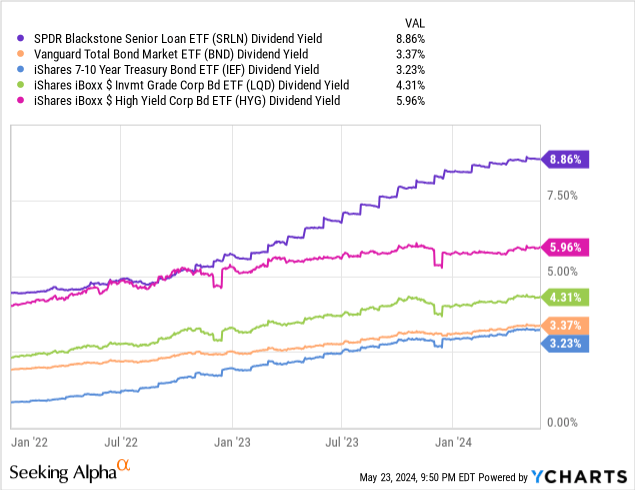

Right now, the fund sports a 8.9% dividend yield, quite strong on an absolute basis, and higher than that of most bonds and bond sub-asset classes.

Data by YCharts

SRLN’s strong 8.9% dividend yield is a significant benefit for shareholders, and the fund’s key advantage relative to peers.

As is the case for most bond or loan funds, dividends should decline as the Federal Reserve cuts rates later in the year. Dividend cuts should be swift, and of similar magnitudes to rate cuts: if the Fed cuts 1.0%, dividends should decline by 1.0%. Investors should be able to lock-in rates by focusing on long-term bond funds, but they will not do so by investing in SRLN.

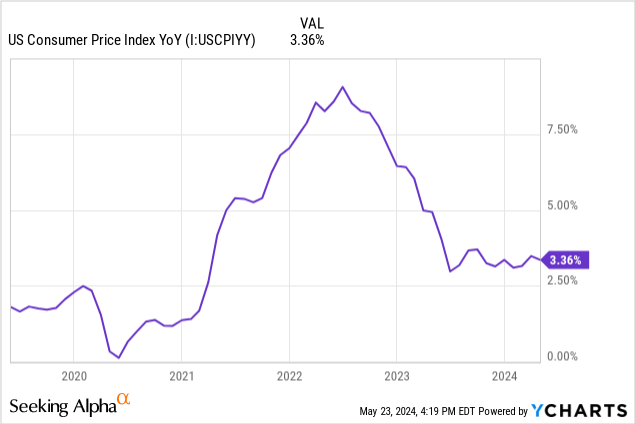

In my opinion, lower rates will almost certainly occur sometime in the future, but I’m not expecting significant, swift rate cuts myself. Inflation remains stubbornly above-target and has been flat for around a year. Under these conditions, near-term rate cuts seem unlikely. Powell seems to agree, arguing more or less the same after the April CPI report.

Data by YCharts

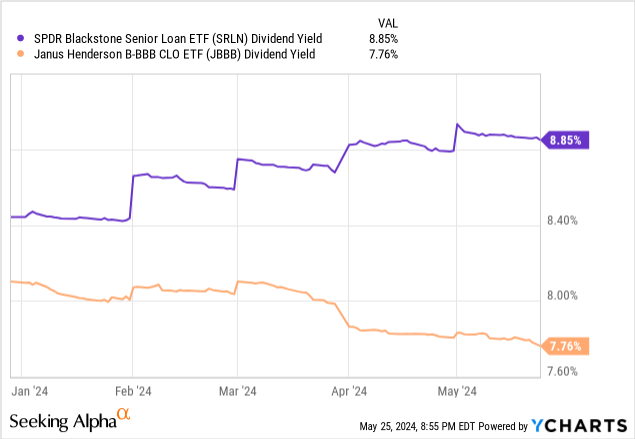

As SRLN trades with a healthy spread relative to peers, rate cuts would have to be quite significant for the fund to start yielding less than its peers. Under current conditions, this does not seem all that likely for the next two years or so, at the very least. Much will depend on future Fed policy, however.

Credit Risk

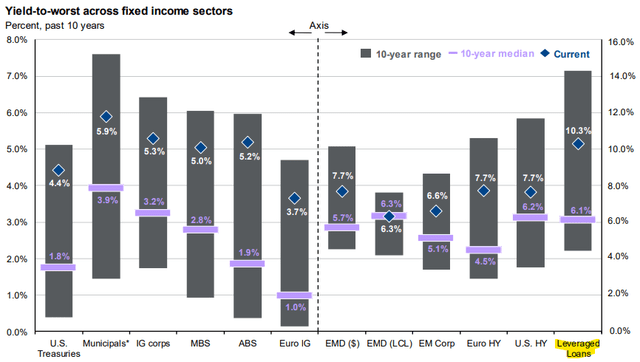

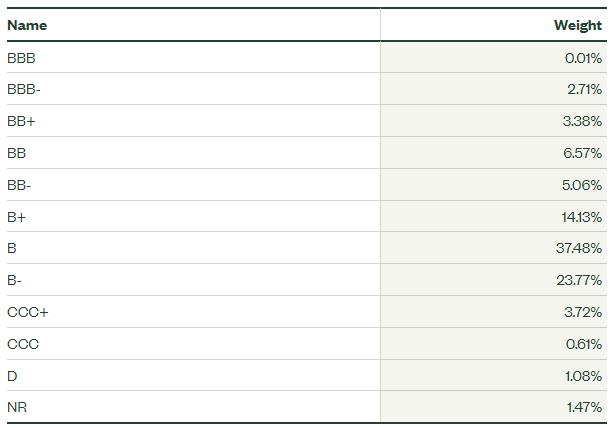

Senior loans almost always come from non-investment grade corporations. These are comparatively weak companies, with weak credit ratings. SRLN itself focuses on loans rated B, a relatively weak rating, even for a senior loan (or high-yield) ETF. From prior coverage, most of SRLN’s peers focus on bonds / loans rated BB.

SRLN

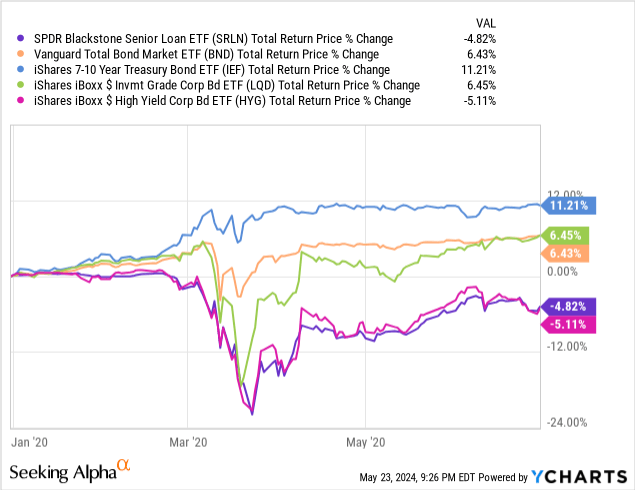

SRLN’s issuers are generally able to fulfill their financial obligations without any issues right now, but most would start to have trouble if economic conditions were to deteriorate, and so default rates would spike. As such, expect significant, above-average losses for SRLN during downturns and recessions, as was the case during early 2020. Losses were not materially different from those of high-yield corporate bonds, somewhat outperforming expectations.

Data by YCharts

SRLN’s above-average credit risk is an important negative for the fund and might be a deal-breaker for more risk-averse investors.

Interest Rate Risk

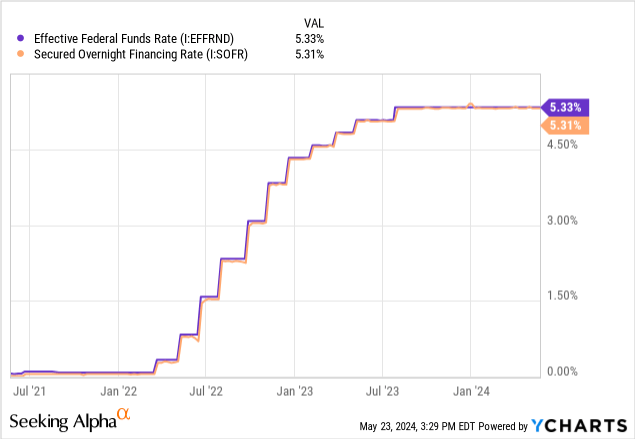

Senior loans are almost always variable rate loans, indexed to specific rates, and so see higher coupon rates when these rates rise. Rates are generally reset quarterly. Most are indexed to SOFR, which is, for our purposes, functionally identical to the Federal Reserve funds rate.

Data by YCharts

So, senior loan coupon rates fluctuate alongside Fed rates every quarter. Do remember that most bonds have fixed rates from issuance until maturity, unlike senior loans.

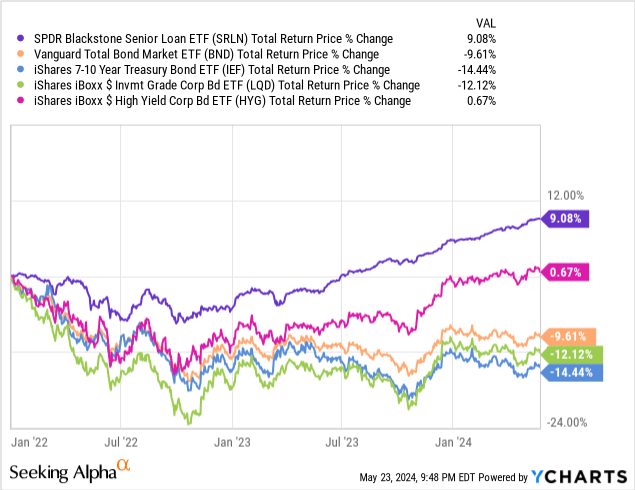

SRLN focuses on senior loans, so has negligible interest rate risk and duration, same as these securities. Expect below-average losses and outperformance when rates rise, as has been the case since early 2022.

Data by YCharts

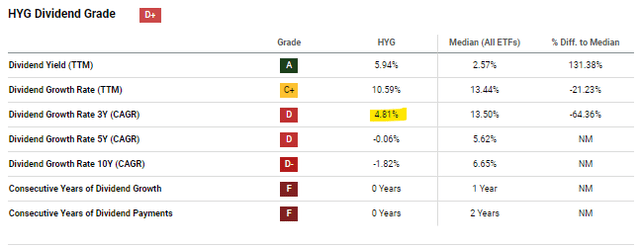

At the same time, the fund’s dividends should increase much more swiftly than those of its peers when rates rise. As an example, SRLN has seen four times the dividend growth than the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), the largest high-yield corporate bond ETF, these past three years.

Growth for SRLN:

Seeking Alpha

Growth for HYG:

Seeking Alpha

This is also quite apparent when comparing SRLN’s yield to those of its peers since early 2022. SRLN’s yield has increased by much more than average, especially easy to notice when comparing the fund to HYG.

Data by YCharts

On a more negative note, and as previously mentioned, SRLN’s dividends should decline when the Fed starts to cut rates. Dividend cuts should be swift, and of similar magnitude to rate cuts. As SRLN trades with a healthy spread to its peers, see above, rates would have to decline by a lot for the fund’s dividends to become uncompetitive. In my opinion, this is unlikely to occur in the short-term.

Performance Track-Record

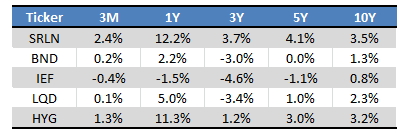

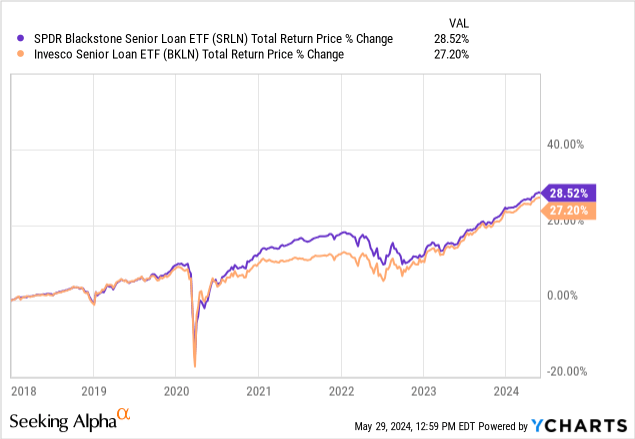

SRLN’s performance track-record is reasonably good, with the fund consistently outperforming its peers.

Seeking Alpha – Table by Author

Some other comments on the above.

SRLN’s long-term returns are quite low, as rates were much lower in the past. Defaults and recent price losses were also partly responsible.

SRLN’s medium-term returns are quite a bit weaker than expected. 3Y returns should be higher, as rates have been reasonably high these past three years. Not entirely sure why this occurred, but I believe some combination of timing and changes in credit spreads played a role. When I compare SRLN with the Invesco Senior Loan ETF (NYSEARCA:BKLN), I see comparatively strong returns during 2021, weaker ones during 2022, similar long-term returns. The pattern is consistent with / explains SRLN’s comparatively weak 3y returns.

SRLN’s short-term returns are quite strong, due to a combination of higher rates and tighter credit spreads. Insofar as rates remain high, returns should remain reasonably good moving forward. Double-digit annual returns are unlikely, at least in the long-term, as credit spreads can’t continuously tighten, and the fund does not sport a double-digit yield.

Overall, SRLN’s performance track-record is reasonably good, although a bit weaker than I expected for a variable rate fund.

SRLN versus JBBB – Quick Comparison

Long-time readers know I’ve been bullish on CLO debt ETFs for years, due to their high yields and low overall risk. These are broadly similar to SRLN, so thought to do a quick comparison. I’ll be focusing on SRLN and the Janus Henderson B-BBB CLO ETF (BATS:JBBB), which focuses on BBB-rated CLOs in the following.

Both SRLN and JBBB focus on variable rate investments. Interest rate risk and duration is negligible for both.

Both are somewhat expensive funds, SRLN a bit more. SRLN sports a 0.70% expense ratio, compared to JBBB’s 0.49%.

SRLN’s credit risk is significantly higher, as the fund focuses on non-investment grade loans, compared to JBBB’s investment-grade holdings. CLOs default rates are incredibly low too, reducing the fund’s credit risk.

Both funds sport strong, above-average dividend yields. SRLN’s yield is more than 1.0% higher, however. More on this later.

Data by YCharts

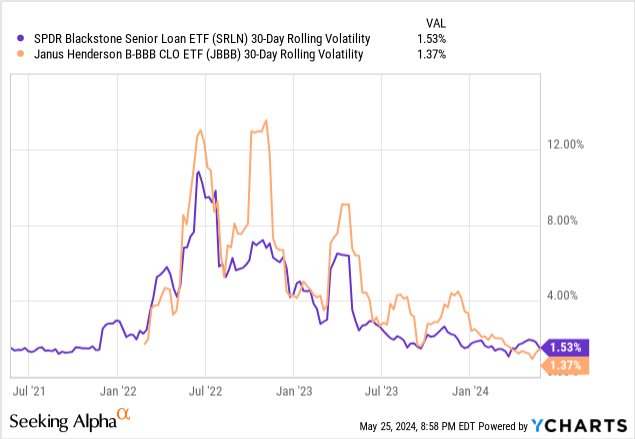

Overall, SRLN is a broadly risk, volatile choice, due to focusing on non-investment grade loans. JBBB should be a much safer, stable choice, considering the characteristics of its underlying CLOs. In practice, volatility is comparable to that of SRLN. In my opinion, this is because CLOs are somewhat illiquid investments, and are perceived to be quite risky.

Data by YCharts

Notwithstanding the above, the actual credit risk of most investment-grade CLOs is quite low, which should reflect positively on JBBB’s long-term share prices and returns.

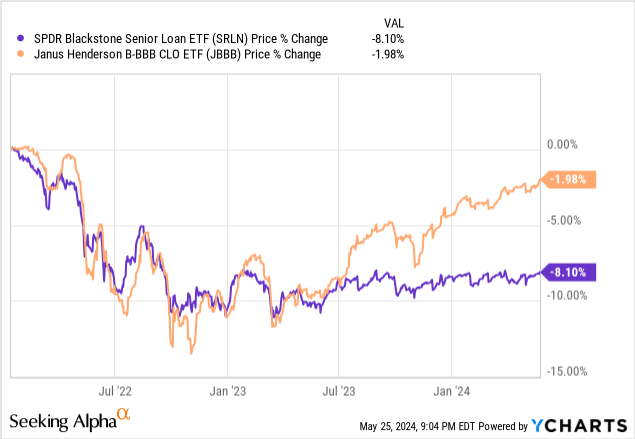

As an example, both SRLN and JBBB saw some capital losses / lower share prices in 2022, due to (somewhat) higher default rates and bearish market sentiment. JBBB’s share price has steadily recovered since mid-2023, SRLN’s has not. Looking at the fundamentals, JBBB’s share price should simply have not declined, but a short-lived downswing is not too far off from expectations.

Data by YCharts

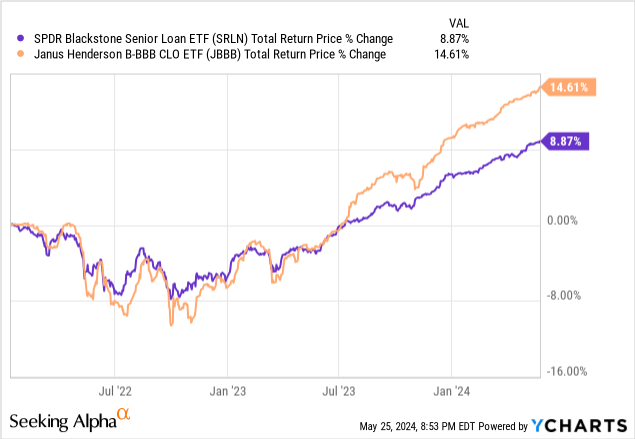

In my opinion, and considering current market and industry conditions, JBBB should achieve higher long-term returns than SRLN. This has been the case since inception, as expected.

Data by YCharts

Overall, JBBB seems quite a bit better than SRLN. I maintain a buy rating on SRLN as it like a strong investment opportunity as a whole, but JBBB seems stronger.

Conclusion

SRLN’s high 8.9% dividend yield, low rate risk, and strong recent performance, make the fund a buy.

Read the full article here