Stanley Black & Decker, Inc. (NYSE:SWK) is undergoing a slow turnaround as it destocks inventory, implements cost reductions, and rationalizes investment spend. The main red flag from its Q3 2023 report was that its organic sales declined 4% year-over-year, mainly due to lost unit volumes of 3% in its Tools & Outdoor segment and 4% in its Industrial segment. So there was an improvement relative to the YTD volume decline of 7% in Tools & Outdoor, but a slight deterioration relative to the 2% volume decline for Industrial. What’s driving this trend? Relatively lower post-pandemic demand in its key end markets and intense competition. Volume declines occurred across all regions, especially in its largest market of North America. In its Q3 2023 earnings call, SWK management guided that revenue will be more stable next year, but admittedly volumes remain uncertain:

“And so I think the topline next year, we are expecting a similar establish type macro environment with some dynamic elements around it, but it’s really going to depend on our volume next year, is really going to depend on has the consumer stabilized and the rebalance between goods and services and has the outdoor business stabilized post-COVID.”

SWK is caught between cheap DIY products sold at your typical home improvement retailers and very high quality brands like BOSCH, Milwaukee, and Makita, depending on the customer, i.e. DIY, repair shops, and heavy construction. Importantly, organic volumes need to be addressed if SWK is going to outperform over the long run.

Some Green Shoots

Of course, SWK has very high quality brands of its own, so management is focused on leveraging these assets by reallocating dollars into them, including DEWALT, CRAFTSMAN and Stanley, among others. Management is allocating incremental spend for innovation, which should produce higher margins and benefit long-term performance. To bolster sell through, SWK management also described in the Q3 2023 earnings call that their outlook: “assumes approximately $125 million of annualized innovation and market activation investment, with a goal to ultimately deploy $300 million to $500 million over the next three years.” I don’t know how this spends sizes up to its competitors, but the fact that management is looking to reallocate reinvestment spend and ramp it into year 2 and 3 is promising.

Regarding top line performance, aerospace and automotive were strong at 29% and 9%, respectively. Its subsidiary, Consolidated Aerospace Manufacturing, LLC (“CAM”), sells products into the aerospace and defense industry, which is a cyclical, but a more high growth industry than its primary end markets. SWK acquired CAM for $1.2 billion after tax benefits, which generated about $375 million in net sales during 2020. With the aerospace and defense industry observing explosive post-pandemic growth over the last few years, this acquisition is steadily becoming a larger piece of consolidated results. Next, its automotive unit produced 9% growth, despite the negative effects of the GM strike that lasted thorough part of Q3. After being resolved by Oct. 30, auto should see demand normalize.

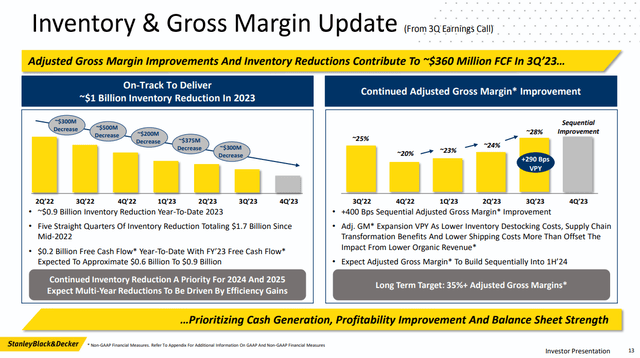

Regarding inventory and gross margins, SWK outlined in its Investor Presentation that the turnaround is underway based on steady inventory reductions and gross margin improvements taking effect.

SWK Investor Presentation, Slide 13 (Stanley Black & Decker’s Investor Relations)

Turning to pricing on the Q3 2023 earnings call, management described that the market overall is fairly balanced: “we see fairly good stability in the pricing and not a lot of competitive deep discounting and our — just to reiterate, our focus is to be healthily involved in the promotional aspect of the business, because we think it’s important to have those key brands and products out in front of our end-users and our customers, and we intend to continue at kind of those traditional levels.” This factor is helpful to put into context because it enables management to implement price increases on higher sell-through products and provide promotions where SWK is seeking market share.

Regarding M&A activity, SWK announced that they plan to sell its STANLEY Infrastructure business for $760 million. That translates to about 1.65x revenue and an EV/EBITDA range between 9x and 10.5x using estimated mid-to-high teens adjusted EBITDA margins. At first, this doesn’t appear to be a particularly good or bad asset sale relative to the broader business, and the market had little reaction. But the important thing to consider is that management plans to use the proceeds for debt reduction. For example, using midpoint revenue of $460 million and an EBITDA margin of 17% would generate about $78 million in annualized EBITDA. Not even factoring reinvestment requirements, it would have taken this subsidiary nearly 10 years to retire this debt. So from that perspective, this is a pretty good deal for shareholders. Additionally, about $37 million in net interest expense will be eliminated overnight, so net earnings “lost” is actually closer to $41 million, if that, all for a $760 million net reduction to enterprise value.

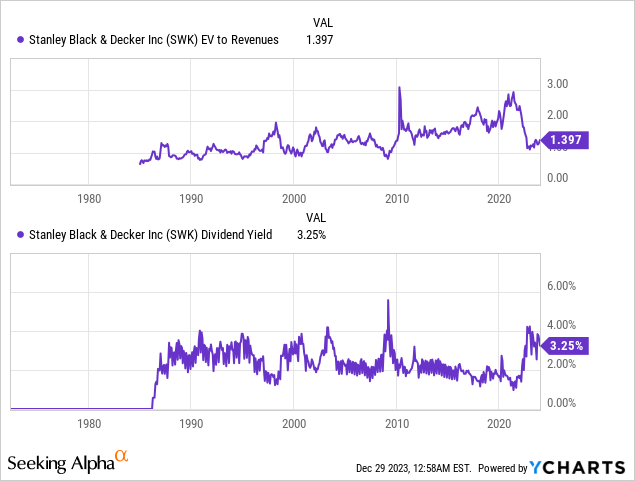

From a valuation perspective, SWK is trending near the middle of its long-term average on an enterprise value to revenue ratio at 1.4x. Somewhat more enticing is that its dividend yield is near the higher end of its long-term average at 3.25%. For a typical business, that’s not very appealing, but SWK counts itself as a dividend king, meaning that it has increased its dividends for 50+ consecutive years. Dividend increases will be subdued in the near-term, but should improve longer term as the turnaround materializes.

Bottom Line

SWK isn’t out of the woods yet, especially given ongoing organic volume declines. However, if its customer end markets stabilize, arguably the main factor pressuring earnings, then sentiment would quickly improve. Management is also taking decisive action to shed underperforming assets, target higher margins, and invest in growth. Barring a major hit to the economy, I’m bullish on SWK. Thanks for reading and please comment below.

Read the full article here