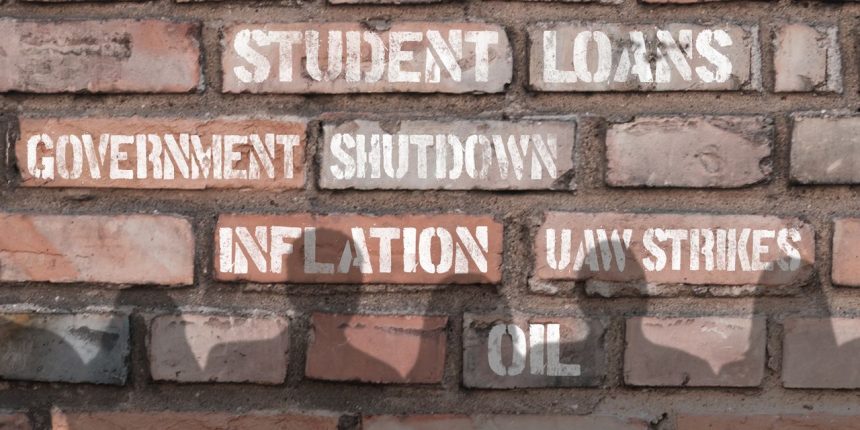

Investors face a growing list of risks heading into the fourth quarter that just keeps getting bigger — from rising interest rates to a possible revival of inflation and gridlock in Washington that may become headwinds for economic growth.

The Federal Reserve remains in rate-hiking mode and is unlikely to cut borrowing costs next year by as much as previously thought. The prospect of $100-a-barrel oil at a time of expanded strikes by the United Auto Workers union is reigniting inflation concerns. Meanwhile, mitigating factors that could slow economic growth — such as the possibility of a government shutdown and the resumption of student-loan payments — might not be enough to shake the Fed’s inflation-fighting resolve.

Read: Risk of government shutdown soars as House Republicans leave town in disarray amid hard-right revolt and Student-loan payments are about to resume. Defaults are expected to follow.

See also: Fed’s Collins doesn’t rule out more interest-rate hikes

It all adds up to an ever-growing wall of worry for many investors and traders, who had expected inflation to fade and the Fed to be done with raising interest rates. With the central bank’s main interest-rate target already at a 22-year high and likely to go higher by December, Treasury yields have reached levels not seen in at least a dozen years, putting a cap on how much further equity markets can climb and creating the need for investors to search for protection.

A day after the Fed’s policy update on Wednesday, which underscored a message of higher-for-longer rates, strategists Jay Barry, Jason Hunter and others at JPMorgan Chase & Co.

JPM,

the biggest U.S. bank, said their bearish equity view was “gaining material traction” and that September through mid-October “also happens to be the most bearish time of the year for risky markets from a cyclical perspective.”

Comparing the current period to 1987, the year of the “Black Monday” crash, they said they expect the U.S. stock market’s slide to accelerate into the fourth quarter, but stopped short of calling for a “crash.”

The rise in market-implied rates that followed the Fed’s announcement has created an environment of “more losers than winners” — in the words of portfolio manager Christian Hoffmann at Thornburg Investment Management — with equity prices and bond prices both falling on Thursday.

On Friday, all three major U.S. stock indexes

DJIA

SPX

COMP

ended lower for the fourth straight day, producing weekly losses which shrank each of their year-to-date gains. Meanwhile, Treasury yields finished not far from their highest levels since 2006-2011 as fed funds futures traders priced in a 40.7% likelihood of further Fed tightening by year-end.

Read: ‘The world has changed’ as investors absorb highest Treasury yields in a dozen years or more

Some analysts remained optimistic though. “Higher rates for longer is not necessarily this terrible thing if the Fed hangs out there because growth is good,” said Jeffrey Cleveland, chief economist at Payden & Rygel in Los Angeles, which manages more than $144.4 billion in assets. “Growth is coming in stronger than everyone expected, and that’s what is forcing the revisions in interest rates. That’s not necessarily bad for the riskier parts of our portfolios,” like high-yield corporate bonds.

“The economy seems to have pretty good momentum and should be able to withstand some of those worrisome issues,” Cleveland said via phone. “The momentum is sufficiently strong enough that most investors should be able to jump over the wall of worry, without running into the wall,” he said, adding that the U.S. economy should dodge a recession over the next 12 months.

However, not even Fed Chairman Jerome Powell is entirely sure the U.S. can achieve a soft landing and avoid a recession, even if that’s the outcome policy makers are hoping for, judging by their projections for growth, unemployment, and inflation through 2026. The central bank’s favorite inflation gauge, the personal consumption expenditures price index, is set to be released on Friday and is the data highlight of the week ahead. July’s PCE report showed the annual rates of headline and core inflation stubbornly stuck above 2%.

At the moment, the world’s largest economy appears to be undergoing a “controlled landing,” in which the labor market is healthy but cooling, wage growth is moderating, and consumers and businesses are conservatively spending, according to chief economist Gregory Daco of EY-Parthenon, the global strategy consulting arm of Ernst & Young in New York. His firm expects real GDP growth of 2.2% in 2023 and a more muted 1.3% in 2024.

“We are not going back to a free-money era anytime soon, and the best way to approach the new paradigm of higher-for-longer interest rates is to acknowledge and adjust to it,” Daco said via phone. “Every portfolio is going to be different and have its own approach to risk objectives and returns, so it’s not about one asset class versus another. It’s about understanding what your risk tolerance is and how to maximize your returns when the cost of capital and the cost of equities is going to be higher.”

Michael Landsberg, chief investment officer of Landsberg Bennett Private Wealth Management in Punta Gorda, Fla., which manages $1 billion in assets, said that there are “big question marks about earnings season, which begins in mid-October” and “we need earnings to grow meaningfully in order to have any kind of noticeable move higher in markets.”

“With inflation, interest rates and earnings growth fears in the U.S., it’s important for investors to have exposure to non-U.S. equities, particularly countries like Japan and India, whose central banks are not aggressively raising rates like they are in the U.S.,” Landsberg wrote in an email to MarketWatch. “We have been bullish on the U.S. dollar and favor foreign ETFs in Japan that are short the yen.” His firm also likes using ETFs in India “for both large- and small-cap exposure.”

No major U.S. data is scheduled to be released on Monday. Tuesday brings reports on September consumer confidence, new home sales for August, and S&P Case-Shiller’s 20-city home price index for July.

Data on durable-goods orders for August is due on Wednesday, followed the next day by weekly jobless benefit claims and a revision to second-quarter GDP.

In addition to August’s PCE data, Friday brings reports on personal income and spending, plus retail and wholesale inventories, for the same month.

Read the full article here