The Dow Jones Industrial Average rose on Friday as traders weighed the latest U.S. jobs report to conclude a winning week.

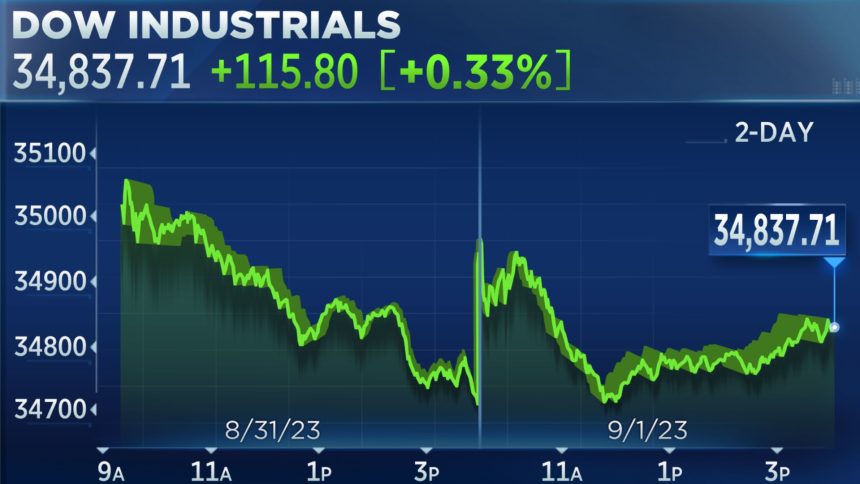

The 30-stock Dow ticked up 115.80 points, or 0.33%, to close at 34,837.71 The S&P 500 added roughly 0.18% to finish the session at 4,515.77, and the Nasdaq Composite inched down 0.02% to end the day at 14,031.81.

The major averages were up sharply earlier in the day. The Dow briefly traded more than 250 points higher, while the S&P 500 and Nasdaq climbed about 0.8% each before easing.

The Dow and the Nasdaq added 1.4% and about 3.3% for the week, respectively, notching their best performances since July. The S&P 500 gained 2.5% to register its best week since June.

Unemployment rate jumps

The latest U.S. nonfarm payrolls report showed the unemployment rate ticked higher to 3.8% in August, reaching its highest level in more than a year. Economists had expected it to remain at 3.5%.

In another sign of a slowing economy and easing pricing pressures, average hourly earnings increased 4.3% on a year-over-year basis, less than the 4.4% increase expected by economists polled by Dow Jones.

August payrolls grew at a faster-than-expected pace, with 187,000 being added. However, job numbers first reported for June and July were revised down by a combined 110,000.

“It would be a mistake to look at today’s employment report, along with recent data, and say the Fed is done,” said Steve Wyett, chief investment strategist at BOK Financial. “Even though trends in inflation are moving the right direction and a broader view of the employment market would indicate wage pressures should abate, overall economic growth is above trend and inflation remains well above the Fed’s recently confirmed 2% target.”

Following the release, the CME Group’s FedWatch tool showed traders have priced in a 93% chance of the central bank holding rates at current levels at its policy meeting later this month.

Investors also pored over fresh earnings reports. Database software maker MongoDB and Dell Technologies advanced 3% and 21%, respectively, on the back of stronger-than-expected earnings reports. Shares of athletic apparel retailer Lululemon Athletica added 6% after crushing Wall Street’s estimates.

Correction: A previous version misstated Steve Wyett’s title. He is chief investment strategist at BOK Financial.

Read the full article here