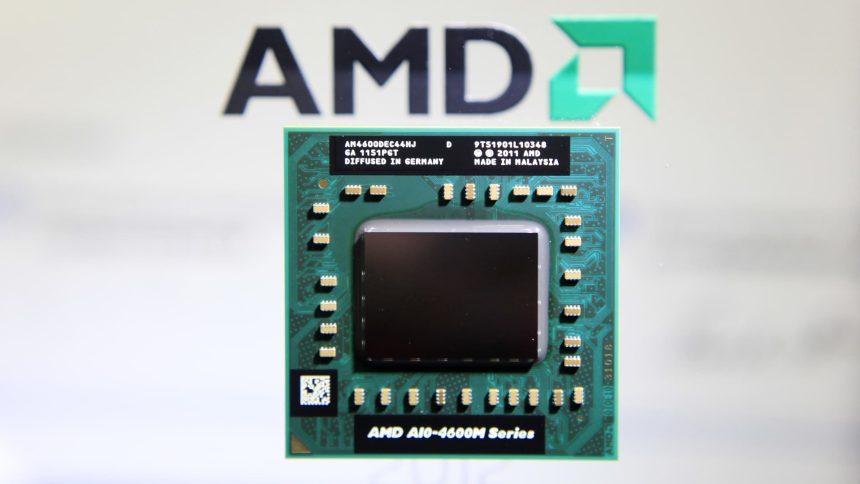

Check out the companies making headlines in midday trading. Advanced Micro Devices — The chipmaker’s stock gained more than 2%. Advanced Micro Devices announced plans to buy server builder ZT Systems in a cash-and-stock deal totaling $4.9 billion. HP — Shares slid more than 3% after Morgan Stanley downgraded the personal computing company to equal weight from overweight, citing limited upside potential. Sweetgreen — The salad chain dropped 6% after Piper Sandler downgraded Sweetgreen to neutral from overweight, saying the risk/reward for the stock is now more balanced. Analyst Brian Mullan issued the rating change on the back of a softening outlook on the fast casual sector, but he noted that his long-term view on Sweetgreen remains bright. Estee Lauder — The beauty stock added about 1%. Estee Lauder offered disappointing guidance for the 2025 fiscal year. The company also announced that its CEO Fabrizio Freda will retire at the end of fiscal 2025. Fubo TV — The sport-focused streaming stock rallied 33%. A U.S. judge on Friday temporarily blocked sports streaming service Venu from launching. Fubo TV had alleged in the suit that the joint sports streaming service from Disney, Warner Bros. Discovery and Fox was anticompetitive. Taylor Morrison Home — The stock added 3% following an upgrade at BTIG to buy from neutral. The firm said it has increased confidence in the homebuilder’s long-term goals. General Motors — The industrial giant’s stock inched higher by less than 1%. GM said it’s laying off more than 1,000 salaried employees globally in its software and services division following a review to streamline the unit’s operations. The layoffs include roughly 600 jobs at General Motors’ tech campus near Detroit. Dutch Bros — Shares of the coffee chain dipped 3% after Piper Sandler downgraded the stock to neutral from overweight. Dutch Bros could be hurt by softening traffic to fast casual restaurants, according to the investment firm. Zim Integrated Shipping Services — The marine shipping stock popped 23% after raising its full-year outlook for adjusted earnings before interest, taxes, depreciation and amortization. The company said to expect between $2.6 billion and $3 billion for adjusted EBITDA in the full year, higher than its previously forecasted range of $1.15 billon to $1.55 billion. Zim also said it earned $1.93 billion in revenue during its second quarter. Shake Shack — Shares slipped 3% after Piper Sandler downgraded the burger chain to neutral from overweight. The firm cited a worsening industry backdrop. McDonald’s — The burger giant jumped 3% after Evercore ISI hiked its price target to $320 from $300. “We are increasingly bullish on McDonald’s US business for 2024 with some relative market share trend improvement occurring recently which we believe will continue through 2H24,” analysts wrote in a Monday report. The firm kept its rating of outperform on McDonald’s. — CNBC’s Alex Harring, Michelle Fox, Yun Li, Sarah Min, Hakyung Kim and Jesse Pound contributed reporting

Read the full article here