Thesis

Synopsys, Inc. (NASDAQ:SNPS) holds the top position in Electronic Design Automation and is the second-largest player in semiconductor Intellectual Property, which are foundational industries supporting the long-term growth of the semiconductor sector. I see Synopsys playing a pivotal role in facilitating a new wave of semiconductor startups, particularly those focused on artificial intelligence, in the coming years. There is significant potential for Synopsys to expand its operating margin as it continues to experience increased demand for its software and tools used in semiconductor design. This demand is being driven by long-term trends favoring a greater number of chip designs with higher complexity. However, the stock is currently trading at a premium multiple, which keeps me cautious on taking an entry into the stock at this time, and hence, I assign a hold rating for now to SNPS.

Q2 Review and Outlook

Synopsys reported F2Q23 results that beat both top- and bottom-line expectations. As expected, the company slightly raised its full-year outlook, calling for FY23 growth to approach 15%. After a relatively downbeat F1H23, SNPS is delivering the promise of a strong F2H ramp, with EDA driving the majority of the incremental revenue in F3Q and IP likely leading the sequential growth in F4Q. Indeed, AI has been a strong driver for the overall business, and the team estimates that its AI-related revenues represent 10-12% of company revenues, which I believe is driving an above-average corporate growth rate. Moreover, the team is leveraging AI capabilities to help drive higher performance/efficiency within its portfolio of products (e.g. Synopsys.ai). Adoption of these AI tools are strong, and the team noted Synopsys.ai has driven 270 commercial customer tapes out (up from 100 tapeouts in February). These newer products are driving higher value capture per license renewal for SNPS and in some cases 20% higher than prior contract values. I believe the company’s IP agreement with Intel will support a higher IP revenue run-rate for SNPS in F4Q and beyond. Moreover, I think the strong EDA and IP run-rates exiting FY23 will precede the company’s issuance of strong FY24 guidance in December.

Leader in EDA

Synopsys holds a leading position in the Electronic Design Automation industry, commanding a 32% market share. Together with Cadence, it forms a dominant duopoly, accounting for 62% of the market, as reported by IDC. Both companies offer a comprehensive suite of solutions for designing, simulating, and verifying semiconductor chips during the research and development phase. Synopsys primarily focuses on selling software for chip design and simulation, along with semiconductor intellectual property, emulation and prototyping hardware, and related services. With the increasing complexity and density of chips, there is a growing preference for integrated toolsets like those offered by Synopsys, as opposed to individual solutions. EDA tools also help customers save time and money by simulating chip development before expensive manufacturing processes. Additionally, Synopsys has expanded into the DevSecOps domain through its Software Integrity segment.

Company Presentation

End-Markets for Semiconductors Are Broadening

Synopsys’ sales could see a boost from the rapidly expanding segments within the semiconductor market. These segments are experiencing significant growth due to major technological trends such as artificial intelligence, 5G, Internet of Things, and the development of electric and autonomous vehicles. Unlike the past, where semiconductor sales were primarily driven by new computers, servers, or smartphones, the next decade’s growth drivers are expected to be more diverse. This diversification could lead to pockets of faster growth compared to the overall semiconductor market, which is projected to grow at an annualized rate of 5% from 2022 to 2027.

The demand for new chip designs is on the rise, especially in areas like advanced driver-assistance systems for automobiles, where optimized chips are needed to collect and process data. Similarly, there is a growing need for chips tailored for IoT sensors in smart factories, as well as for deploying AI in large-scale cloud services, among other applications.

Financial Outlook and Valuation

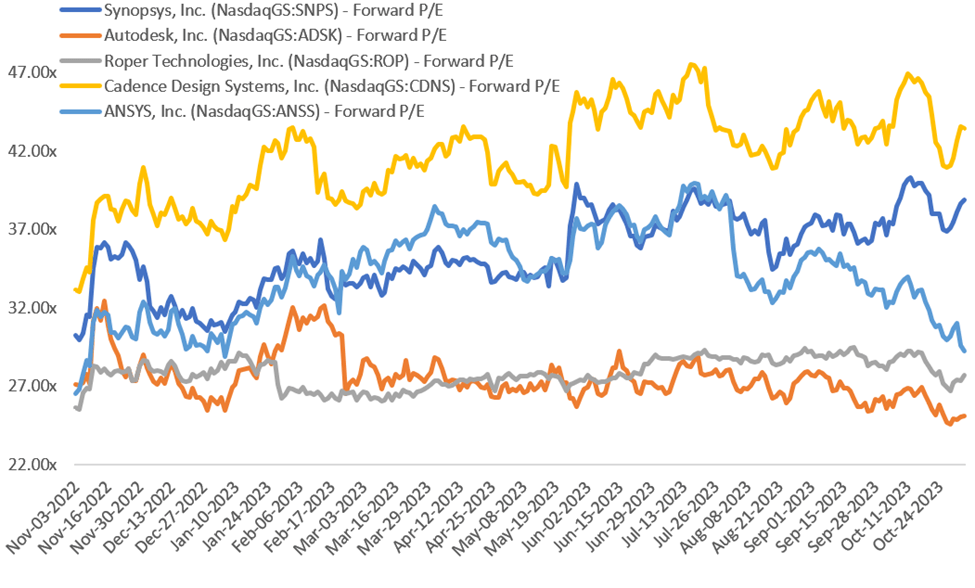

I believe Synopsys is poised for sales growth that could outpace the semiconductor market’s projected 5% annualized rate. This growth is expected to be driven by significant industry trends, including the adoption of artificial intelligence and the rollout of 5G technology, as well as the diminishing impact of Moore’s law. These factors are likely to lead to increased demand for more intricate and specialized chips optimized for specific functions, such as AI deployment in large-scale cloud services. Moreover, Synopsys can enhance its non-GAAP operating margin from 33% to 37% in the medium term. This margin improvement may be supported by a slower growth rate in operating expenses relative to sales, especially following the launch of key products like Fusion Compiler, 3DIC Compiler, Polaris Software Integrity platform, DSO.ai, and Silicon Lifecycle Management platform in recent years. Synopsys enjoys a strong competitive position and benefits from recurring revenue, which accounted for 83% of its sales in fiscal year 2022. The company’s ability to efficiently manage sales and pricing is aided by its customer contracts, which are typically renewed every 2.5 to 3 years. As per Capital IQ estimates, SNPS is currently trading at a forward EPS of 38x. Synopsys trades at higher multiples than the median of its engineering software peers and roughly in-line with its 5-year average forward PE multiple. Hence, I remain a bit cautious about buying into the stock at this moment, given the current macro environment and would wait to take an entry into the stock. I assign a hold rating to SNPS for now.

Capital IQ

Conclusion

Synopsys stands to benefit from the demand being generated by a new wave of semiconductor startups. The company has made substantial multi-year investments in digital implementation, verification, and software integrity, positioning itself for sustained growth and improved profitability. While the valuation of the company’s stock currently falls on the higher side of its historical range, I believe it is justified by several factors, including the secular growth in the semiconductor industry, Synopsys’ recurring business model with minimal exposure to economic cycles, and its industry-leading profitability. However, for long-term investors who are looking for an entry point I would suggest to wait on the sidelines and look for a better entry point. I currently assign a hold rating to the stock.

Read the full article here