One of the things Tesla, Inc. (NASDAQ:TSLA) investors put their hopes on, is the arrival of the Tesla Model 2, codenamed “Redwood.”

The Tesla Model 2 Redwood is supposed to be priced at $25,000 and arrive in 2025. So far, it’s been described as a compact crossover, so below the Model 3/Y in size. For Tesla to be able to sell this car at $25,000, a manufacturing revolution is promised.

Tesla investors put their faith on this car, as being the model which will push Tesla’s volume and (they hope) share price up again, from the current malaise.

I am thus pleased to report that the $25,000 high-quality electric vehicle (EV) has arrived. Unfortunately, it’s not from Tesla.

The $25,000 EV

First, I need to say that there are many EVs priced significantly below $25,000. Mostly these cheap EVs are sold in China. This $25,000 EV, also sold in China, though, is different.

It’s different, because although it’s priced at $25,000, its specs and configuration are substantially equivalent to a Tesla Model 3. So, without delay, let’s see what the first $25,000 EV looks like and what it brings to the table.

Behold the Geely Automobile Holdings Limited (OTCPK:GELYF, OTCPK:GELYY) Galaxy E8:

Geely

Geely

Geely

Geely

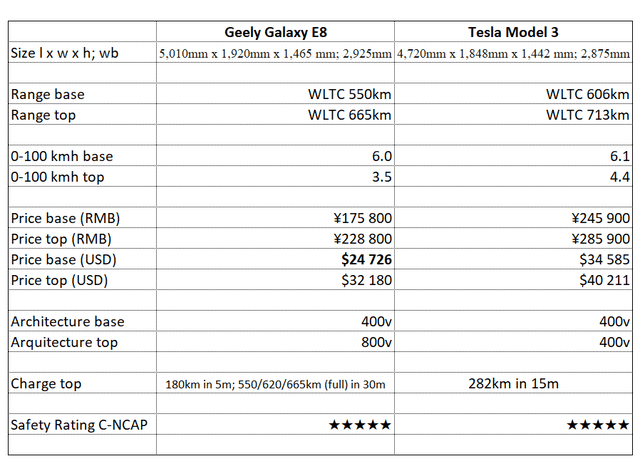

Here’s how the Galaxy E8 compares to the Tesla Model 3 on specs:

Geely, Tesla

As can be seen, the Geely Galaxy E8 is broadly comparable to the Tesla Model 3. It loses slightly on range (it’s a larger car), but it meets or beats the Model 3 everywhere else (not just on price).

This reinforces the thesis that the Geely Galaxy E8 isn’t merely a $25,000 EV, but a proper, high-quality, Tesla-level, $25,000 EV. Indeed, if Tesla fields a $25,000 EV, it will likely make it smaller than the Model 3, and the Galaxy E8 is presently larger than the Model 3.

I could even list reasonable $15,000 EVs being sold in China, with ranges starting at around 400km. However, these would already be a clear segment below in range, acceleration, design, size and performance.

It’s to be noted that the Galaxy E8 was the first “full fat” EV which arrived at the $25,000 price point. I say “full fat” in the sense that it broadly matches what’s expected of a Tesla, namely the Tesla Model 3 or Model Y, and thus also a future Model 2. However, even though the Galaxy E8 is the first $25,000 such EV, it’s a certainty that many more will quickly (as in “months”) follow it in the Chinese market — such is the nature of competition in China.

The Extreme Chinese EV Competitiveness

The Galaxy E8 is thus just an example of the extreme competitiveness of Chinese EV brands. One of many. It shows Chinese EV brands have reached and surpassed Tesla on most or all relevant metrics. Design, cost, range (other models), charging speed, and even driver assistance.

For now, this means Tesla will be pressured to lower its prices further in China. And it’s quite scary for Tesla that the Galaxy E8 is basically sold at or below Tesla’s overall COGS (Cost Of Goods Sold) — meaning, Tesla’s overall automotive margin is lower than the price differential which presently exists between the Galaxy E8 and the Model 3. Said another way, Tesla would have to sell at a zero gross margin to match the Galaxy E8 pricing.

It’s not a coincidence CEO Elon Musk said the following:

The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established,

Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.

Moreover, Chinese companies are iterating models very quickly, are improving models a lot between iterations, and even more competitive models from new entrants seem to be arriving (like from Xiaomi).

Xiaomi

As a result, and by and large, no $25,000 Model 2 arriving in 2 years will be able to push Tesla forward. At least not in China.

Tesla Is Lucky

At the same time, not everything is ugly for Tesla. While the Chinese market is turning massively more competitive by the day, Tesla will still enjoy an incredibly protectionist market in the U.S., where the Chinese will take a long time to arrive.

Even Europe looks set to discriminate against Chinese EVs. This is not just to protect domestic brands, but also Tesla. Though, in truth, Tesla might suffer from the Model 3 cars which are exported from China to Europe, but it will then be favored for having Model Y production set up locally in Berlin.

My own opinion is that the following (which is already in motion), will happen:

- Chinese brands will set up factories in Mexico (to serve the U.S. and other markets). Chinese brands will also set up factories in the EU (already happening).

- In the U.S., protectionist measures might be taken even against Mexican production. And that’s if Chinese cars (even produced in Mexico) aren’t entirely banned. These barriers are already evident in that the most recent tax credits are already not available to cars having even a small % of incorporated Chinese battery tech.

- In the EU, although tariff barriers are likely to be set against imported Chinese EVs, no such barriers are likely against local (within EU) production. Hence, the Chinese pressure will happen in the EU as well, but this competition will take 2 years or so to start arriving in earnest, given the time it takes to set up factories.

As a result, while Tesla will feel the full brunt of Chinese competition in China and some other markets, the large U.S. and EU markets will remain relatively immune for at least 2 years, and possibly more (or forever) for the closed, protectionist, U.S. market.

Still, Tesla is priced for growth, not for survival. Hence, this protection is hardly comforting.

On Chinese EV Stocks

Maybe some Chinese companies will emerge as clear EV winners. Maybe BYD Company Limited (OTCPK:BYDDY) (this looks likely, though its design is still lagging), which is now the actual worldwide EV leader by volume. Maybe Li Auto (LI). Maybe others like XPeng (XPEV) or NIO Inc. (NIO).

However, the environment remains extremely competitive, and Chinese brands are the most exposed to the Chinese market dynamics. These stocks being better known doesn’t assure a huge economic return for investors. Outside of BYD, others are merely speculative given the current environment, and aren’t really priced for the possibly disastrous outcomes they might face.

If one is willing to take on Chinese “geopolitical risk,” then it’s perhaps best to choose investments from sectors and market capitalizations which are less popular than the EV revolution. Then true bargains can be gotten (in Hong Kong, mostly).

Conclusion

The competition in China will continue to intensify daily. Chinese brands iterate much faster than Tesla and, in my opinion, Tesla will be beaten on every dimension – design, quality, features, price, cost, charging speed, range, you name it. Yet, Tesla still trades at a premium, as if such wasn’t reality.

While Tesla doesn’t seem endangered by this increased competitiveness due to the protected U.S. market and semi-protected EU market, and its survival thus looks assured, Tesla isn’t priced in a way that takes into account the likelihood of its growth coming to an end.

Yet, between local sales and exports, Tesla sold more than half its entire deliveries in 2023 from China. Local sales will be under pressure from Q1, Q2 2024 onwards due to the extreme local competitiveness. And exports will be under pressure by increased EU and U.S. protectionism against Chinese imports.

In other words, the $25,000 EV isn’t a reason to buy Tesla. It’s a reason to sell it. Because it exists already, 2 years before Tesla even starts selling its own.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here