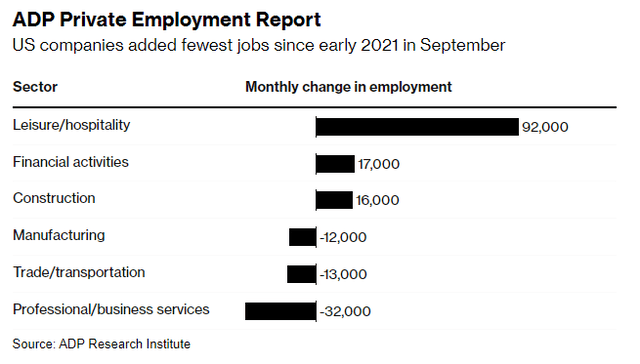

I raised suspicions about the accuracy of Tuesday’s JOLTS report for August, because it indicated a huge increase in new job openings to a total of 9.61 million, led by more than 500,000 new positions in professional and business services. Yesterday’s ADP payroll report confirmed my suspicions, as it added a mere 89,000 jobs in September, which was well below expectations for 150,000. In fact, professional and business services shed 32,000 jobs! What happened to all those openings? As a result, stocks rose and yields fell, reversing some of the previous day’s damage.

Finviz

Fed officials and market pundits who continue to espouse “higher for longer” interest rates need to focus on leading indicators, actual data, and the fact that the rate of inflation keeps falling. They should also be cognizant of the fact that the Fed’s rate increases work with a 6 to 12-month lag, which means that the most recent ones have yet to press on the brakes of the economy. This is why investors should be cheering economic strength today in the face of monetary policy headwinds because the battle with inflation is largely over. Excluding rent, the August CPI and core CPI were 1.9% and 2.2%, respectively. Rent increases are coming down dramatically. The Fed is done, and rate cuts are likely to come next year sooner than the consensus expects.

Bloomberg

The payroll report from ADP is far more important than the JOLTS report we received the day before. Not only is the labor market cooling, contrary to what JOLTS suggests, but wage growth continues to abate, as ADP indicated that annualized growth slowed to 5.9%, which was the 12th consecutive monthly decline. The JOLTS report is only important to the extent that it serves as a leading indicator of labor market strength. Obviously, the elevated number of job openings is not translating into strength, as one might expect. Therefore, Fed officials and market pundits need to stop using it as a reason to keep rates “higher for longer.”

As the argument that rates must be increased or remain high is undermined, the bears will shift focus to softer rates of economic growth, which they warn leads to recession. It is already starting to happen. The problem is that it isn’t in the numbers today any more than it was when they were forecasting a recession one year ago.

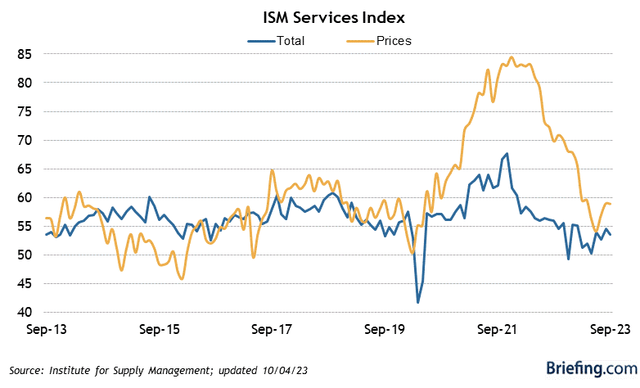

The Institute for Supply Management reported that business conditions for the service sector weakened very modestly in September, with its index falling from 54.5% to 53.6%. It has ranged between 50-55% through all of 2023, and any number above 50% indicates growth. According to the survey, “the majority of respondents remain positive about business conditions.”

Briefing.com

This is not indicative of an impending recession. The labor market may be weakening with fewer job additions and slower rates of wage growth, but the unemployment rate is near a record low. Workers started realizing inflation-adjusted wage growth over the past three months for the first time in nearly two years. The economy is still on track for a soft landing. Granted, long-term interest rates have risen dramatically in a short period of time and that will further slow growth, but corporations and the consumer are much less sensitive to changes in interest rates today than they were in prior business cycles. I will explain why in tomorrow’s brief.

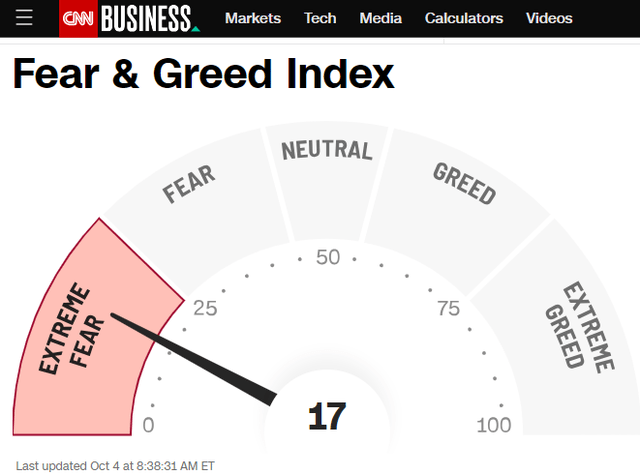

These facts have not dissuaded the bear camp from fearmongering, which is far more effective during market corrections when volatility spikes and the prices of risk assets fall. The proof can be seen in CNN’s widely followed Fear & Greed Index, which is at an extreme.

CNN

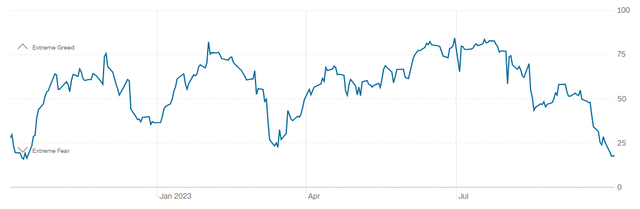

There have only been two occasions over the past year when the Fear & Greed Index fell to a level as low as it is today, which was in March of this year and October of last year. Both marked significant bottoms for the stock market. I think we are forming another significant bottom today.

CNN

Read the full article here