By Joseph Nelesen

In the history of SPIVA (S&P Indices Versus Active) Scorecards, most active managers have tended to underperform benchmarks most of the time, especially over longer periods. The SPIVA Latin America Mid-Year 2023 Scorecard revealed that active managers produced mixed performance during the first half of 2023.

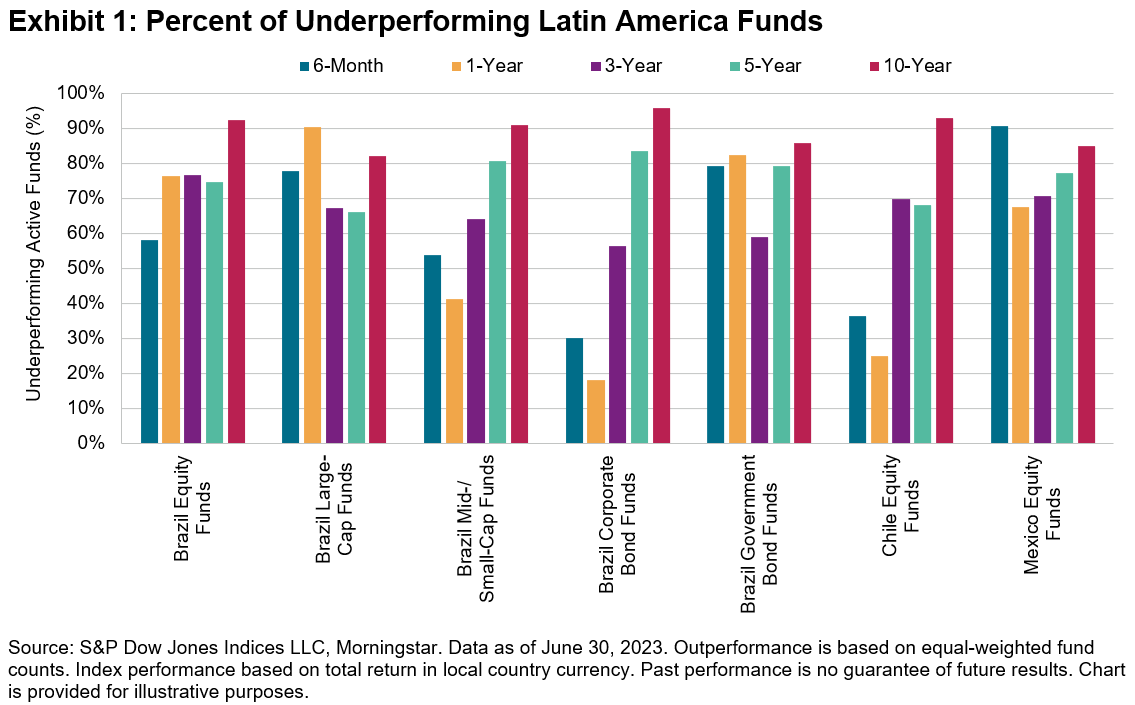

During H1 2023, more than one-half of active managers underperformed in five out of seven categories observed, ranging from 54% for Brazil Mid-/Small-Cap funds to 91% for Mexico Equity funds. The only categories in which fewer than one-half of managers underperformed were Brazil’s Corporate Bond and Chile’s Equity funds, at 30% and 36%, respectively. Over longer time horizons, outperformance was fleeting across all seven categories, with 10-year underperformance rates ranging from 82% for Brazil’s Large-Cap funds to 96% for Brazil’s Corporate Bond funds (see Exhibit 1).

S&P Dow Jones Indices LLC, Morningstar

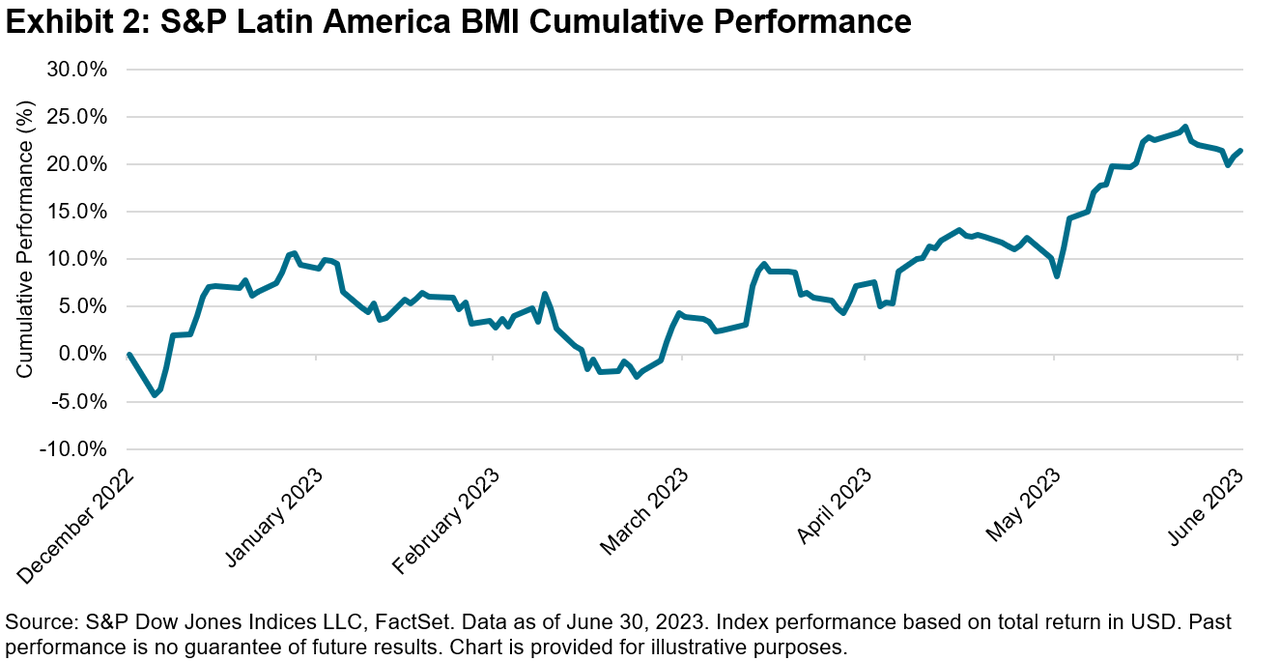

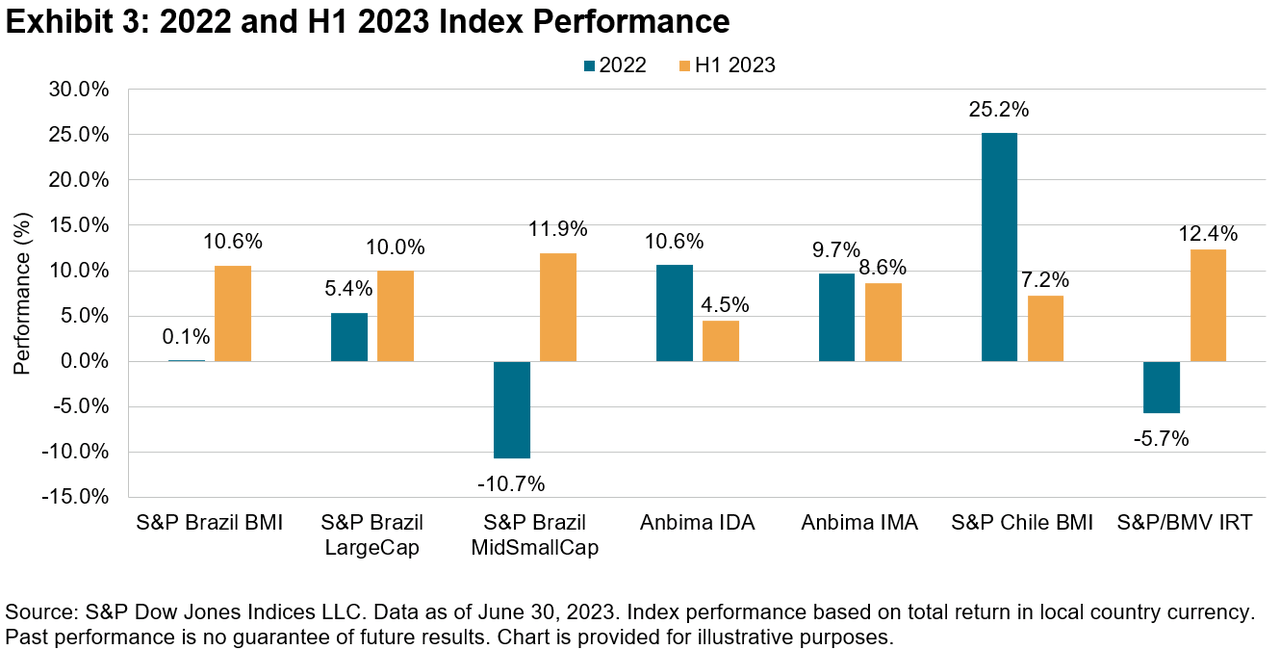

Active managers sought out performance in a generally strong market environment, with the S&P Latin America BMI rising 21.4% over the first half of the year and each regional benchmark studied generating positive performance for H1 (see Exhibits 2 and 3). The start of the year was in marked contrast to 2022, which ended with two benchmarks, S&P Brazil MidSmallCap, and Mexico’s S&P/BMV IRT, in negative territory.

S&P Dow Jones Indices LLC, FactSet

S&P Dow Jones Indices LLC

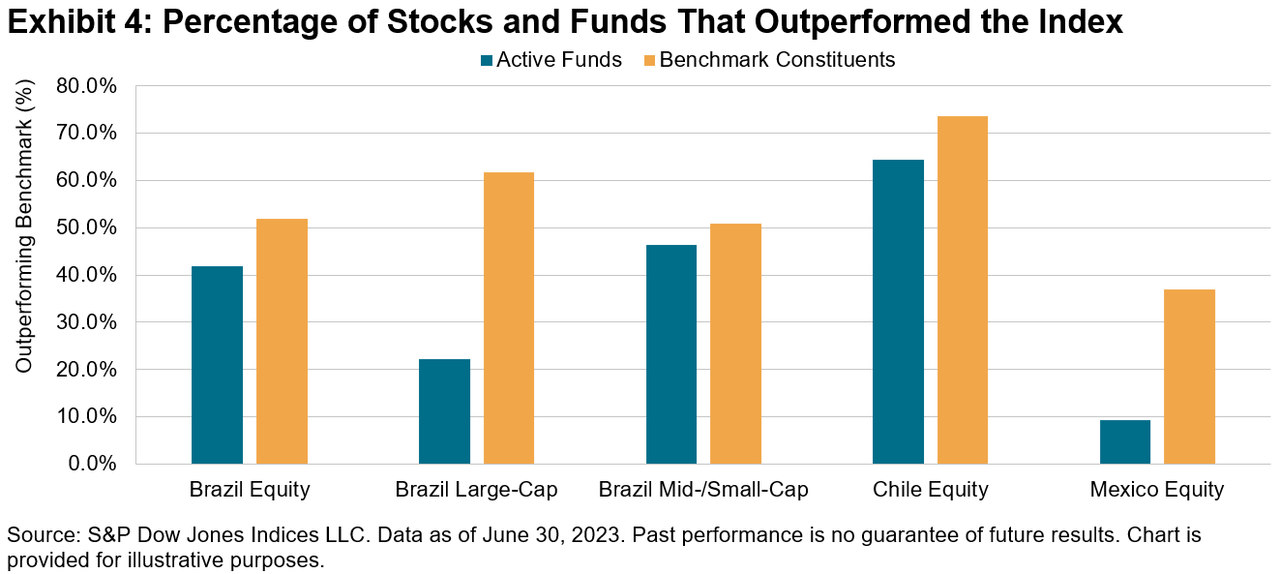

One historically common headwind for active managers has been the presence of a positively skewed distribution of constituent returns. Put more simply, a small number of stocks typically outperforms the benchmark return while the majority lags. This scenario was certainly present in Mexico, where only 37% of constituents outperformed the S&P/BMV IRT in H1 2023, perhaps a contributing factor to the extremely high underperformance rate of Mexico Equity funds. However, more than one-half of benchmark constituents outperformed across all four other equity categories (see Exhibit 4). This relatively unusual scenario meant that a randomly selected stock in each of the four benchmarks had over a 50% chance of being an outperformer. Despite this lack of positive skew, few managers capitalized on the opportunity, as the Chile Equity fund category was the sole category in which fewer than one-half of managers underperformed.

S&P Dow Jones Indices LLC

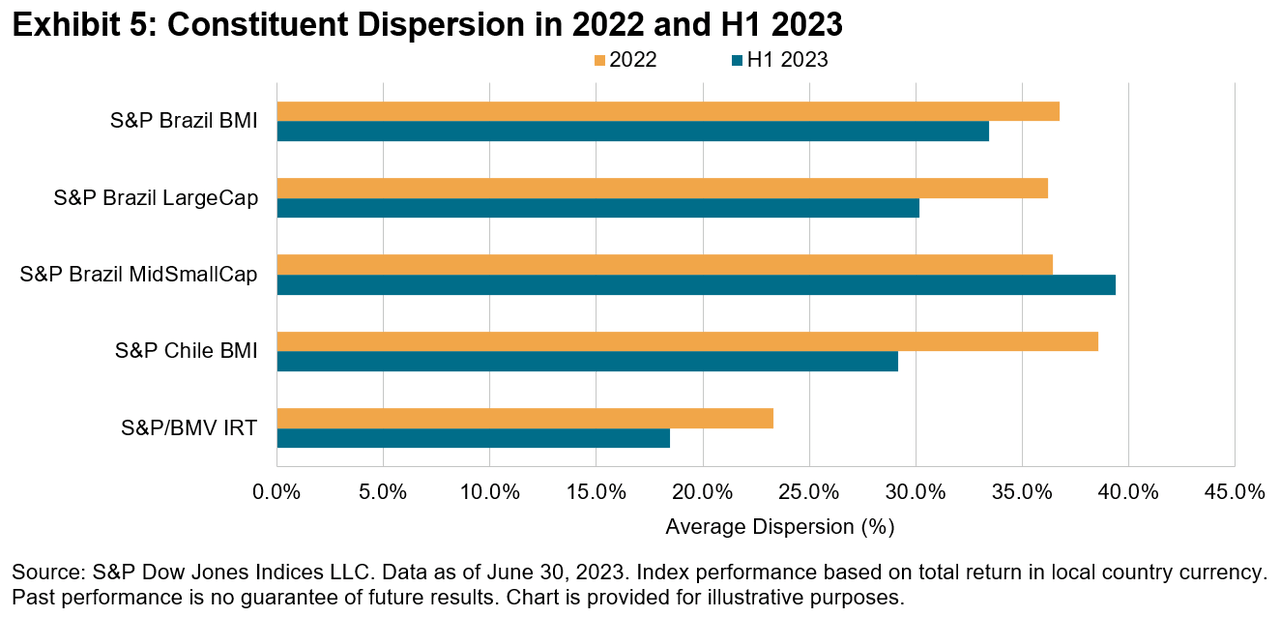

Across most Latin American equity markets, dispersion levels in H1 2023 fell slightly from 2022’s elevated levels (see Exhibit 5). Higher dispersion, a measure of cross-sectional volatility expressing differences between stock returns within each index, has typically been associated not only with greater rewards from picking outperforming stocks but also with greater penalties from selecting underperformers.

S&P Dow Jones Indices LLC

For fund selectors, risks of underperformance are twofold. First, results show that most funds underperform their benchmark over time, making the process of finding a future winner statistically unlikely. Second, the penalty of selecting an underperforming fund has historically been more punishing in terms of average negative performance than the average upside generated from outperforming funds. More precisely, bottom-quartile funds underperformed their respective benchmarks to a greater degree than top-quartile funds outperformed in four out of seven categories in H1 2023 (see Exhibit 6).

S&P Dow Jones Indices LLC

While the results for the full year are yet to be seen, for many active fund managers in Latin America, performance challenges during the first half may have made the climb ahead look much steeper.

Disclosure: Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit S&P Dow Jones Indices. For full terms of use and disclosures, please visit Terms of Use.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here