Plus size retailer Torrid Holdings (NYSE:CURV) stock has dropped by 22.5% since the last time I wrote about it in February. At that time itself, signs of weakness were apparent for the company, prompting a Hold rating on its stock. It wasn’t an outright Sell, because there was a potential for improvement going forward.

Source: Seeking Alpha

But it is now. And there’s not one or two reasons for it, but three. Shrinking sales, softening earnings and a weakening balance sheet. The Q2 FY23 earnings report is likely to reflect these trends as well.

Sales weaken…

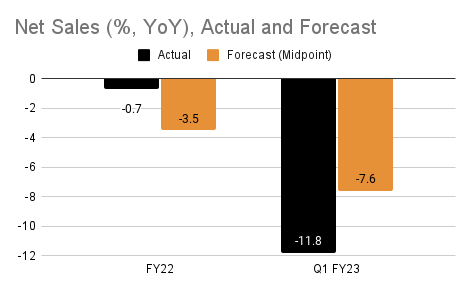

First, let’s look at its sales performance. At the time I last wrote, it had released its Q3 FY22 earnings. Since then, its full-year numbers for the last financial year ending January 28, 2023 (FY22) as well as for Q1 FY23 have been released as well.

In FY22, the company reported a 0.7% decline in net sales. The saving grace to these numbers is the fact that they came in above the decline pencilled in in the forecast range, which on average amounted to a 3.5% decline.

Source: Torrid Holdings, Author’s Estimates

However, the sales decline took a turn for the worse in Q1 FY23. Not only was the drop of 11.8% year-on-year (YoY) far sharper compared to the full year FY23, it was even worse than the company’s own expectations. Even at the lower end of its forecast range, it had expected a 9.1% sales fall.

..and the trend can get worse

For now, there isn’t a likelihood of sales buoyancy in the future either. In Q2 FY23, the company expects net sales to range between USD 280-295 million. Translated into YoY growth, this indicates that we can brace for an even sharper fall in the next earnings report.

Even if net sales come in at the highest end of the forecast range, they will show a 13.5% YoY decline. At worst, the decline can be up to 17.9% as per the forecast range. However, considering that Q1 FY23’s performance was worse than the company’s lowest expectations, we can’t rule out the possibility that they could drop lower.

Now let’s look at the full-year FY23 guidance. The first point to note here is that the guidance was revised downwards along with the release of the Q1 FY23 figures. Net sales expectations at the midpoint are notably lower at -13% since the initial guidance. It now expects a 13.1% decline in sales for the full year.

That the company provides little by way of qualitative information on why there’s a noticeable downtrend makes it even harder to anticipate improvements further into the future. This is especially so considering that its past five years’ average growth isn’t bad at 10%, so the weakening is more puzzling than it would otherwise be.

Profitable, but softening expected

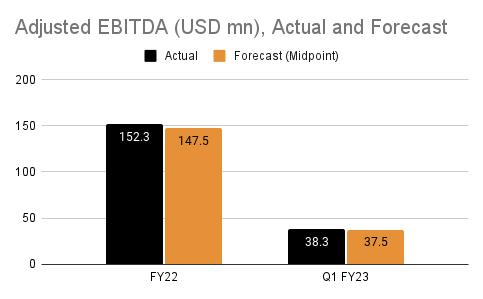

The one piece of good news in the full-year FY22 earnings report was the swing back into profits after the company reported a loss the year before. Similarly, in Q1 FY23, Torrid Holdings’ adjusted EBITDA, came in towards the higher end of the forecast range of USD 35-40 million, at USD 38.3 million. It also continued to show positive net earnings. At the same time, it’s worth noting that both the adjusted EBITDA and net profits declined YoY, and the net profit actually more than halved from Q1 FY22.

Going forward, the company expects to remain profitable, but the profits are seen shrinking. In Q2 FY23, it expects adjusted EBITDA to come in between USD 32-38 million. At the midpoint of the range, this is lower by 32.8% YoY.

Source: Seeking Alpha

For the full year FY23, the adjusted EBITDA guidance has also been reduced by 16.1% at the midpoint from the initial projections, with the company now expecting the number to range between USD 115-130 million. Even as per the initial guidance, at the midpoint, it would have been a 4.2% YoY decline. The fall is now seen being much bigger, at 19.6%.

Assuming that the company’s numbers come in the range provided, the expected weakening indicates that the EPS can decline by 24.1% for the full year FY23 to USD 0.36. To calculate this, I’ve assumed that the net income to adjusted EBITDA ratio averages at the ratios of 31% for FY22 and 32% for Q1 FY23. The adjusted EBITDA is expected to land at the midpoint of the forecast range. The number of shares is expected to remain the same as in Q1 FY23.

Weak balance sheet

Finally, consider the company’s balance sheet. Its assets-to-liabilities ratio is at 70.4% as per the latest reading, which means that the company doesn’t have enough to deal with all its liabilities if it comes to that. Its net debt alone at USD 518.6 million, is higher than its total assets at USD 515.5 million.

Now, at another time, this might not be the worst thing, if there was a possibility of improvement in Torrid Holdings’ financial conditions going forward. But right now, I’d be more cautious when the company expects to continue seeing shrinking revenues and earnings.

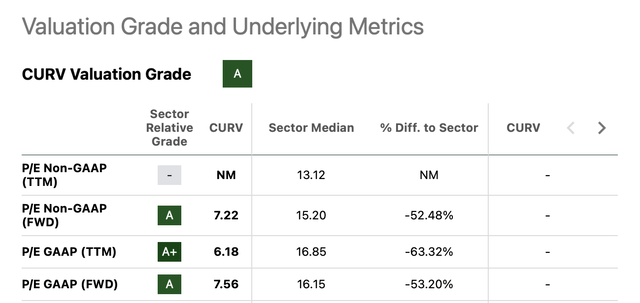

The market multiples

The only real silver lining is the forward GAAP price-to-earnings (P/E) ratio, which comes in at 6.1x based on the earnings estimates for FY23 above. This is better than the ratio available based on analysts’ estimates (see table below). But in any case, all of CURV’s P/E ratios as way lower than those for the consumer discretionary sector.

Source: Seeking Alpha

However, this is no indication that the stock is now a buy. In fact, I think it’s a reflection that investors are staying away from it. And as discussed above, there are very good reasons.

What next?

It’s clear that as far as sales go, this is going to be a washout year for Torrid Holdings. The first quarter numbers already show weakness in performance, but the upcoming results are unlikely to see any improvement. Going by the company’s own forecasts, it’s likely to be another poor quarter, as will the full year.

While it’s some comfort that it’s still likely to be profitable, declining earnings isn’t a good sign either. At this time, its balance sheet also doesn’t look appealing, which might have gotten an easier pass if the company’s income statement looked better.

While CURV’s P/E ratios are rather low compared to the consumer discretionary sector, I believe that at this time that’s more a reflection of investor diffidence in the stock than its undervaluation. Seeing no redemption for it in the near future, I’m downgrading Torrid Holdings to Sell.

Read the full article here