Townsquare Media (NYSE:TSQ) is a US-based broadcast radio operator that prioritizes smaller market stations. The company has been going through a multi-year transformation from a business mainly focused on broadcast radio brands to more of an all-encompassing media enterprise. Through three distinct business segments, Townsquare derives revenue from programmatic advertising, a subscription-based marketing services business, and traditional broadcast radio advertising.

Revenue Story

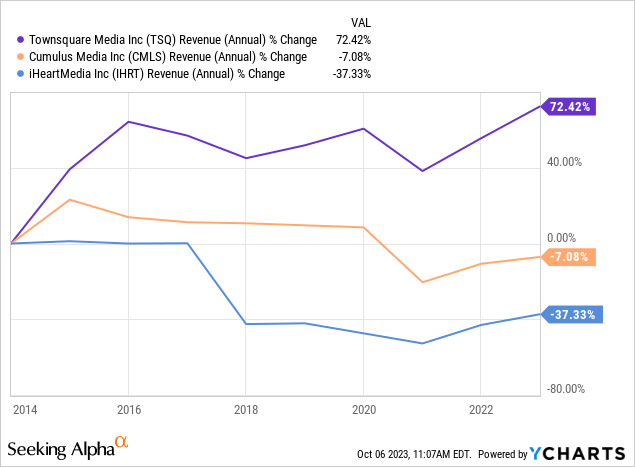

As mentioned in the introduction, Townsquare is a broadcast radio turned digital media business. At a market cap of just over $141 million, the company is significantly smaller than top broadcast radio peer iHeartMedia (IHRT) and has generally been similar in size to Cumulus Media (CMLS) through the years. Over the last ten years, Townsquare has grown annual revenue by over 70% while iHeart and Cumulus have seen declines:

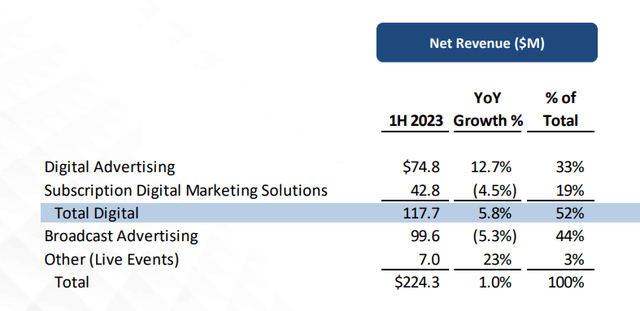

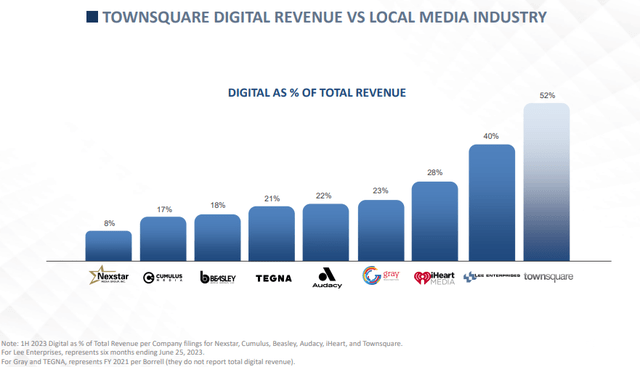

While just about every company in traditional broadcast media is building out digital revenue solutions, Townsquare’s success in doing so is commendable:

August Investor Deck (Townsquare)

Not only has Townsquare grown digital ad revenue 12.7% year over year, but the company’s total revenue mix now pulls from digital sources to a larger degree than the more analog sources.

August Investor Deck (Townsquare)

I’m actually pretty impressed with the company’s long-term growth trajectory here as Townsquare is a clear standout among traditional broadcast peers in this area. Since 2016, Townsquare’s digital revenue is growing at a 16% CAGR. However, it should be noted that the company is guiding for 9% growth in digital for 2024, indicating that digital revenue is starting to slow down a bit and we’ve already seen that in the most recent quarter.

The digital revenue bucket includes both Townsquare’s programmatic advertising brand IGNITE and the company’s subscription service brand Townsquare Interactive where clients get access to web-building, social, and SEO solutions. Townsquare has very intriguing metrics pertaining to revenue sourcing. Just 7% of the company’s total revenue comes from the national broadcast bucket. 90% of the company’s advertising revenue is from local and Townsquare generates the majority of its ad revenue directly from clients rather than from agencies.

These are all huge pluses in my view because it allows the company to have better control over how its clients are managing campaigns. Citing Miller Kaplan data, Townsquare is navigating a soft ad market significantly better than industry peers. The company’s spot broadcast revenue was down 4% versus a total industry decline of 8.6% in Q2. Digitally, one notable area of softness year over year was in subscription service revenue. That was down 4.5% year over year and is due to client churn, in part, because small businesses are struggling in the current macro environment.

Subscription Churn

However, in addition to some of the struggles small businesses are having in this macro environment, some of the subscription client churn from Townsquare Interactive this year is a result of Townsquare’s deliberate pivot from a one-to-one to a pooled customer service model. Meaning, when a client has a customer service request, there is no longer a single point of contact and requests can be serviced by anyone within the customer service department. On the call, CEO Bill Wilson indicated that while the overwhelming majority of Townsquare’s clients like the pooled model, the decision did lead to a small amount of churn.

What I also found interesting is management’s decision to create more of a tenure-based work flexibility program. My interpretation of management’s comments on the call is that new hires within customer service ops earn the benefit of a hybrid schedule after they’ve reached a certain tenure on staff and provided they’ve hit performance milestones. This appears to be in response to some employees choosing to leave the company rather than returning to the office:

we also faced issues related to employee turnover in our customer service operations at Townsquare Interactive, due to our return to work mandate. This has largely been addressed, but did contribute to an increase in client attrition year-to-date.

That decision appears to have directly led to the reduction in Townsquare Interactive clients and a decline in revenue. This is a bit of an eye-opening admission in my view because it could be argued that at least some of Townsquare’s client churn has been self-inflicted. The good thing is that company leadership seems to have realized talent in the labor market wants flexibility when off-site work is possible and customer service roles supporting out-of-market clients is clearly one of those areas.

In my view, the tenure-based hybrid approach is a much better alternative to full-time office work and Townsquare should be able to minimize employee turnover as a result of those changes. Especially considering other companies in traditional media have shown an unsurprising reluctance to adapt to changing market dynamics.

Balance Sheet & Valuation

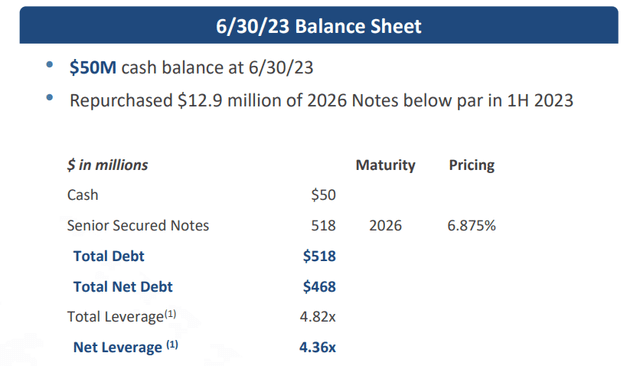

With $50 million in cash and some savvy repurchases of the company’s 2026 notes, Townsquare’s net leverage of 4.36x is well below where it has historically been.

August Investor Deck (Townsquare)

While there is still quite a bit of debt, the company has been managing its balance sheet well in my view. Even after putting $13 million into buying back their own bonds and $16 million in share repurchases, Townsquare has been able to grow cash since the end of 2022 from $43.4 million up to $49.6 million.

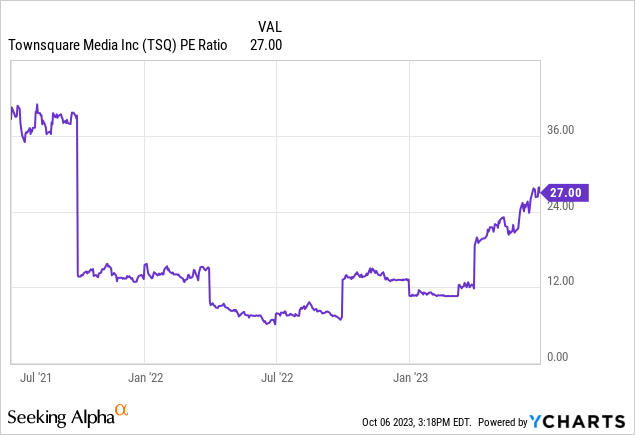

From a valuation standpoint, TSQ is pretty attractive at a 70% discount to forward sales. However, at a 27 P/E and 3 times book value, TSQ might be a little overvalued compared to the communications services sector medians of 15 and 1.5 respectively.

That said, Townsquare Media offers a highly attractive dividend at 6.5% against a sector median of 3.8%. The question one has to ask is if the market has priced in weakness through the end of the year yet or not. I personally take the view that we haven’t yet seen the real impact of higher interest rates through the broader economy yet. While higher rates may not impact Townsquare’s balance sheet directly yet, it’s possible Townsquare’s clients are in a less advantageous situation.

Risks

The most obvious risk in going long TSQ from where I sit is a possible recession. In that environment, small businesses are at risk of going bust and the ones that survive typically slash advertising budgets. That would certainly have a negative impact on Townsquare Media’s top and bottom lines. Furthermore, the digital advertising market is competitive and even though Townsquare isn’t targeting large businesses or large DMAs, the kinds of clients Townsquare is doing business with have plenty of marketing options through social media and other platforms. This is less of a problem if clientele is locally based, but 64% of Townsquare Interactive subscribers are out of market.

Summary

Debt and macro risks aside, I think there’s quite a bit to like about TSQ. I like the dividend and the successful transformation from broadcast radio to a more balanced media company. However, I do take the view that we’re likely to see macro pressures continue to impact the kind of small businesses that Townsquare Media generates revenue from. I don’t currently have any exposure to the company. However, should we see share prices head back below $8 in sympathy with any broad market weakness, I could definitely see myself getting long in small size.

Read the full article here