Mega cap tech was hit hard on Fed Day, and the group has given back some of its Q3 gains. Tesla, Inc. (TSLA) has likewise pared recent gains following a sharp mid-August to early September advance.

I am downgrading the YieldMax TSLA Option Income Strategy ETF (NYSEARCA:TSLY) from a buy to a hold based on neutral trading risks seen in implied volatility levels, seasonal risks, and a lukewarm Tesla chart.

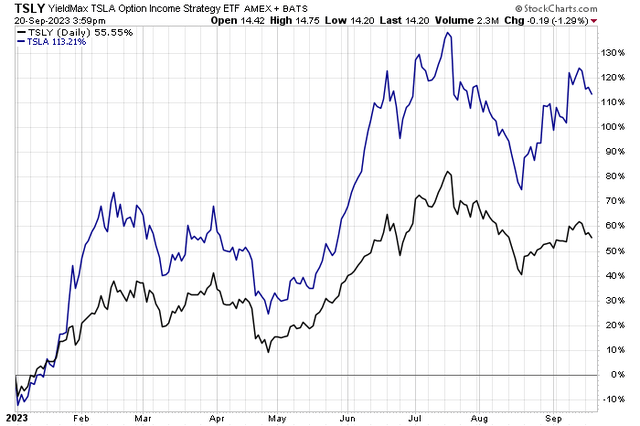

TSLA Beating TSLY YTD

StockCharts.com

According to the issuer, TSLY is an actively managed exchange-traded fund, or ETF, that seeks to generate monthly income by writing call options on TSLA. TSLY pursues a strategy that aims to harvest compelling yields while retaining capped participation in the price gains of TSLA. The current distribution rate is 48.8% as of September 19, 2023, and the portfolio pays distributions monthly. You can view the distribution schedule here.

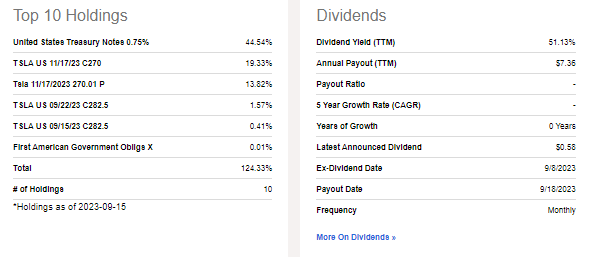

With $666 million in assets under management, TSLY has a high 0.99% annual expense ratio with a trailing 12-month dividend yield of 51.1%. The portfolio currently has short positions in near-dated TSLA call options expiring in September and November 2023 with the bulk of short exposure in the outer month. TSLY is highly liquid with a daily trading volume of 1.86 million shares, so its 30-day median bid/ask spread is just 7 basis points.

TSLY: Portfolio Holdings & Dividend Data

Seeking Alpha

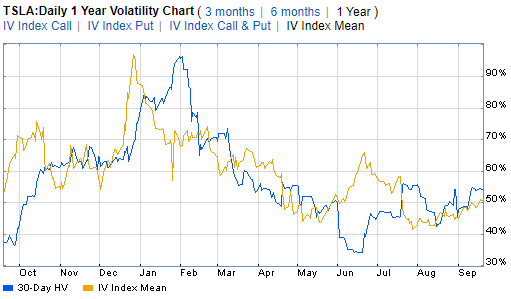

Digging into Tesla for a gauge of how TSLY might perform, I assert that analyzing volatility trends in the underlying is the right approach. Often, it comes down to whether to own TSLA shares or the covered call ETF product. When implied volatility appears high, then opting for the fund may be wise.

Today, implied volatility is just 51% – contrast that to back in December of last year when it surged to nearly 100%. TSLA has also routinely been above 60% in the last 12 months in its implied volatility. Of course, if realized volatility verifies higher than the initial implied reading, then selling options can lose out, so that’s a key risk. Right now, both realized (or historical) volatility and implied volatility are near similar levels, which are not particularly high compared to history.

TSLA: Implied Volatility Much More Muted Versus Late Last Year

Fidelity Investments

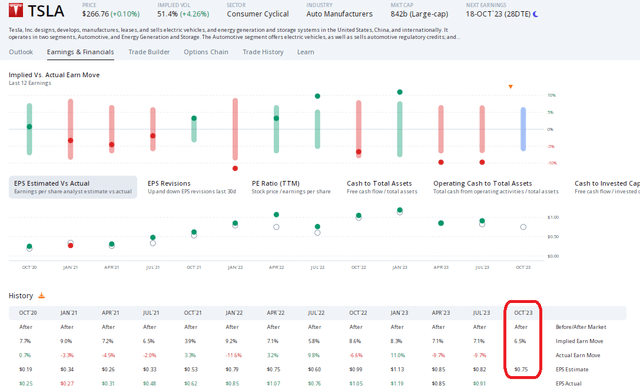

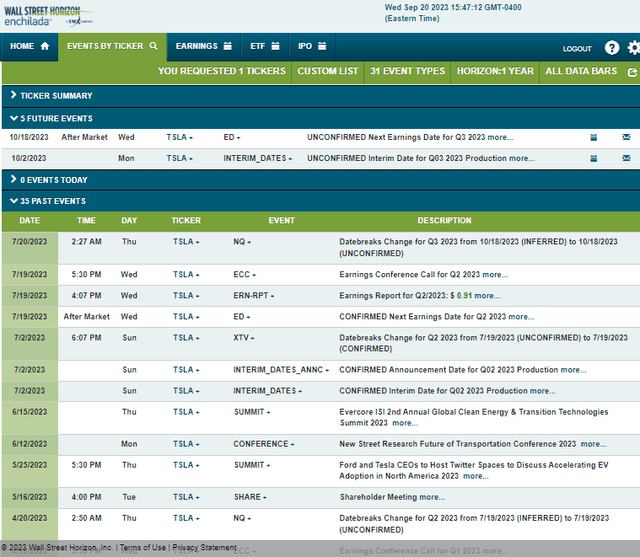

Looking ahead, Tesla reports Q3 production data on Monday, October 2 ahead of its full Q2 2023 earnings date on Wednesday, October 18. Both events could stir up some volatility, but we are not yet seeing that in options pricing much, in my view.

ORATS data shows that the 6.5% implied move when analyzing the nearest-expiring at-the-money straddle post its October earnings is the smallest since July 2022. This is a key metric for TSLY owners to consider since a lower-than-average implied volatility means less potential income return.

TSLA: Modest IV Heading Into Q3 Earnings

ORATS

Tesla Corporate Event Risk Calendar: Earnings Date Volatility Ahead

Wall Street Horizon

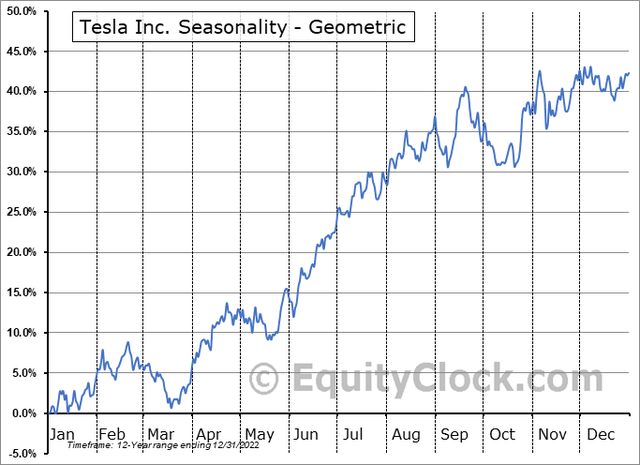

Another factor leading me to downgrade TSLY is the reality that Tesla shares tend to perform less strongly now through early next year, according to data from Equity Clock. Historically, TSLA sees big rallies from mid-March through mid-September, so it’s entering more of a choppy period based on the past 12 years of price action.

TSLA: Less Bullish Seasonality Now Through Early Next Year

Equity Clock

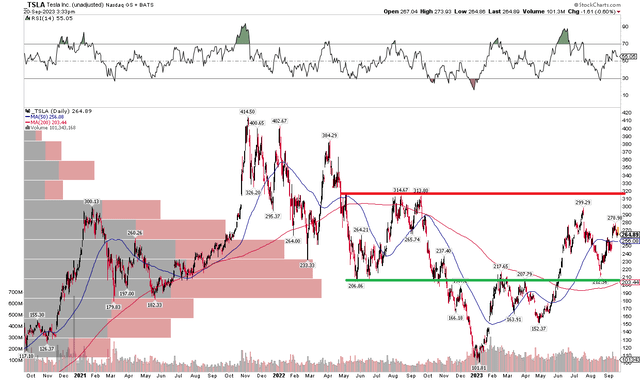

The Technical Take

With options pricing not all that high and a rougher part of the calendar now the reality, the chart of Tesla has calmed down, too. Notice in the chart below that the stock appears to have support in the $198 to $217 zone while sellers seem to come about near $300 – that has marked a peak both in Q3 of last year and this past July.

With a long-term 200-day moving average that has turned higher and is also near noted support, that could be a spot to go long the underlying, and if a retest of that price range comes with too high of implied volatility, then TSLY could be the way to play it given the higher premium collected from a beefier IV. Overall, we have defined price levels off of which to trade TSLA, but the way to play the covered call ETF is by being patient for both lower prices on TSLA or higher implied volatility levels – perhaps that comes about 20% lower from the current stock price. Another tactical play could be to sell TSLA and buy TSLY once the stock rallies closer to $300, with the idea being that shares would fall from resistance.

TSLA: Wait for A Pullback and IV Uptick Before Going Long TSLY

StockCharts.com

The Bottom Line

I am downgrading TSLY from a buy to a hold after initiating coverage on the fund back in April. While the stock has outperformed TSLY’s call-selling structure, the better than 20% total return with a lower standard deviation has been strong. Momentum has come out of TSLA shares, and writing calls generates less income today given lower implied volatility.

Read the full article here