Twilio Inc. (NYSE:TWLO) has manifested substantial stability and growth as a foremost customer interaction platform, witnessing an encouraging upswing in revenue compared to the previous year. This stability is particularly emphasized after the company underwent strategic restructuring, meticulously dividing its focus between Communications and Data and applications segments, which have showcased considerable progress in optimizing customer interactions. This piece continues the previous article on Twilio, emphasizing technical analysis to pinpoint investment prospects. Observations indicate that the stock price has persisted in the consolidation phase for the past few months. However, it seems to be establishing some form of a base pattern. Observing for a breakthrough of crucial levels will be vital for executing long positions.

Twilio Earnings Showcase Stability and Growth

In Q2 2023, Twilio showcased substantial resilience as a leading platform for customer engagement, recording promising financial results marked by noteworthy surges in revenue. The company announced total earnings of $1.04 billion, reflecting a 10% increase from the prior year, and experienced a 55% impressive rise in GAAP Loss from operations.

In February 2023, Twilio underwent a strategic reorganization, divided into Communications and Data & Applications. This restructuring, in sync with the organizational framework, enables enhanced managerial oversight and a focused approach to its varied services in messaging, voice, email, and customer engagement solutions. The evaluation of each division is mainly driven by revenue and non-GAAP gross profit, aiming for optimal organizational effectiveness and productivity. These primary segments of Twilio experienced significant growth in the second quarter of 2023.

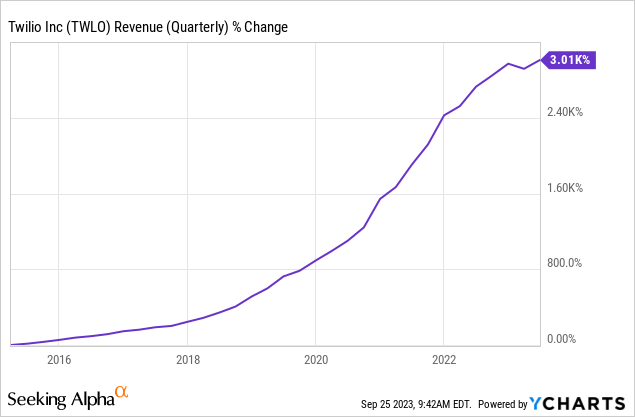

The Communication segment, which includes multiple APIs and software designed to optimize interaction between Twilio’s clients and their users, generated revenue totaling $913.1 million, marking a 10% increase from the prior year. On the other hand, the Data & Application segment yielded revenue of $124.6 million, representing a 12% year-over-year growth. The chart below presents the overall revenue growth for Twilio, which is strongly positive.

CEO Jeff Lawson expressed satisfaction over the solid second quarter, showcasing it as a period marked by record quarterly revenue, non-GAAP operational profit, and positive cash flow. He affirmed his robust confidence in Twilio’s ability to generate significant non-GAAP operational profit in the year’s second half, along with a commitment to drive sustained growth across the organization.

Furthermore, Twilio has accomplished $500 million of the planned repurchases outlined in February 2023, demonstrating the financial robustness of Twilio and its strategic dedication to augmenting shareholder value. This initiative is expected to conclude on December 31, 2024. Additionally, Twilio has refined its strategic focus by divesting its IoT and ValueFirst units in June and July 2023, respectively. This deliberate divestiture aims to refine its core business focus, omitting these units from Twilio’s future operational outcomes.

Exploring Long-Term Trends

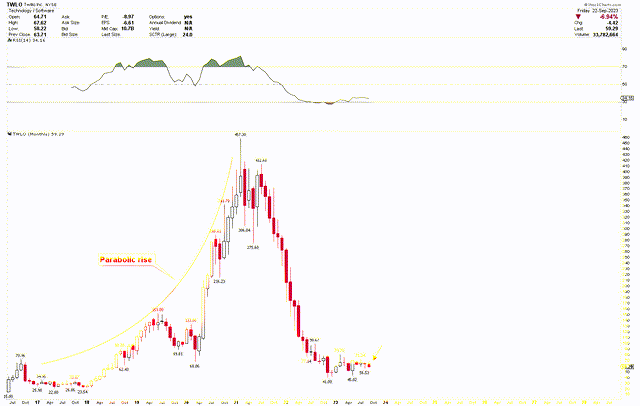

The monthly chart below depicts the long-term price trends, as discussed in the previous article of May 2023. The following monthly chart portrays the dramatic rise between 2018 and 2020. This marked rise was attributed to consistent revenue increase, strategic acquisitions, and an expanding customer base. The company, specializing in cloud communications, saw a spike in demand as organizations transitioned to remote and online approaches amidst the global pandemic, underscoring the need for reliable cloud communication platforms. Twilio’s innovative solutions, catering to diverse communication needs, attracted numerous enterprises, strengthening its market position and financial results. Moreover, the incorporation of SendGrid played a pivotal role in enhancing Twilio’s capabilities in email communications, further accelerating its growth trajectory. The sound financial health of the company and optimistic projections by analysts boosted investor confidence, raising the stock value during this period.

Twilio Monthly Chart (stockcharts.com)

However, this steep rise was not maintained and experienced a reversal in 2021. This downturn is mainly attributable to prevailing market conditions and sector shifts, with investment preference shifting from growth-focused tech stocks to value stocks and sectors poised to benefit from economic recovery. Concerns over inflation and potential interest rate increases led to a reevaluation of high multiple stocks, impacting companies like Twilio that had experienced significant stock value increases. Despite strong fundamentals and growth prospects, Twilio’s stock was not immune to the prevailing market variations and investor sentiment changes at that time.

Presently, the market is undergoing a significant consolidation phase. This substantial consolidation at lower levels suggests a possible sharp rebound, awaiting price confirmation to determine if it has reached its low. Analysis indicates that the monthly candle for May 2023 served as a strong reversal signal, but subsequent months have shown weaker patterns. A discernible uptick in stock price is crucial to confirm that a bottom has been reached.

Identifying Crucial Levels and Strategies for Investors

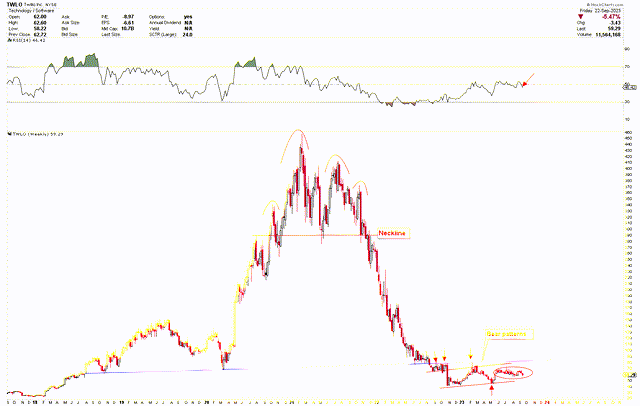

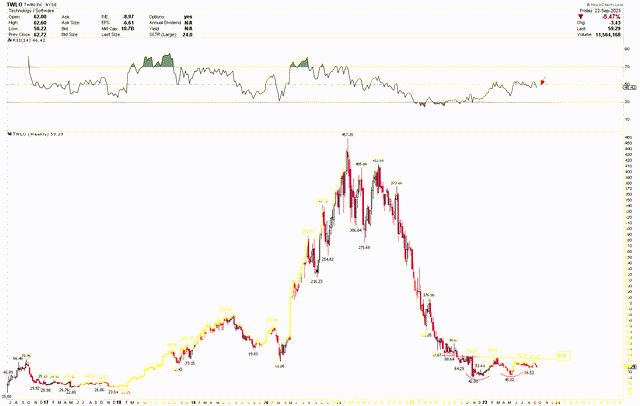

The appearance of a bear flag has been noted on the weekly chart to gain deeper insight into this pronounced consolidation pattern. The swift reversal in May 2023 remained below the blue trend line, a crucial area for sparking a substantial rally in Twilio. Any consolidation below this blue trend line suggests a high probability of additional consolidations below this level. Additionally, the RSI is below the mid-level of 50, signaling the persistence of downward momentum.

Twilio Weekly Chart (stockcharts.com)

For a clearer understanding of the critical levels in Twilio’s price, the weekly chart below illustrates the patterns formed after a robust consolidation in Twilio stocks. These patterns are characterized by a double bottom at $42 and $45.02 and have a neckline at $79. A surge above this neckline would validate the bottom and trigger a significant rally. Notably, this neckline is also aligned with an RSI level at 50, implying that a break above the neckline will likely position the RSI above mid-level 50, pointing to the probability of higher prices.

Twilio Weekly Chart (stockcharts.com)

Market Risk

Despite showcasing robust financial health and operational stability, Twilio is susceptible to market risks, primarily due to the constant fluctuations in its stock price and the failure to meet anticipated enhancements, reflecting a potential discrepancy between actual and expected stock values. This has consequential implications on investor sentiment and market perception, undermining the company’s intrinsic strengths. The downturn in 2021 further amplified systemic risks, with a paradigm shift in investment focus from tech-centric growth stocks to value stocks. The ensuing market realignments and volatile market conditions necessitate that Twilio persistently innovates and adapts to uphold its market value and counteract adverse sectorial developments. The formidable consolidation phase of the stock adds another layer of uncertainty, potentially fostering investor apprehension and compromising Twilio’s market stance if a strong reversal is not substantiated.

Moreover, Twilio’s operational sphere is entrenched in a highly competitive and rapidly evolving technological environment, where customer concentration and prevailing competition pose substantial risks to market share and revenue trajectories. The technical analysis, marked by bear flags and persistent downward momentum, signals looming market risks, requiring meticulous monitoring to avert adverse impacts on investor confidence and market valuation.

Bottom Line

In conclusion, Twilio has demonstrated impressive fiscal resilience and substantial growth in the recent quarter, enhancing revenue within the Communication and Data & Applications segments. CEO Jeff Lawson remains optimistic about the company’s future, emphasizing Twilio’s commitment to balanced growth across all its sectors. While the company’s strategic restructuring and divestments have streamlined its focus and optimized operational efficiency, Twilio remains entangled in a volatile market, requiring astute strategic navigation to maintain its market stance and growth trajectory. The market is consolidating, and while there are indicators of a strong reversal, the firm’s stock needs to validate this by breaking above the price level of $79. Investors might see a strong buying opportunity if the stock price closes the month above $79. Until this price point is surpassed, the stock price will likely continue to consolidate and potentially experience additional decline.

Read the full article here