Ubiquiti Inc. (NYSE:UI), the network technology company focused on enterprise customers, has turned into moderate revenue growth again after weaker quarters, although macroeconomic uncertainty still exists pressuring the industry. While the macroeconomy and high inventories still pressure earnings, a near-term recovery into even faster growth is anticipated by Wall Street.

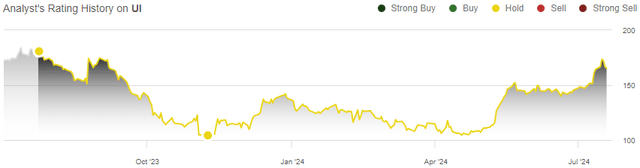

I previously wrote an update on the stock, published on the 8th of November with the title “Ubiquiti: Weak Quarters Shouldn’t Undermine Long-term Story”. In the article, I kept my rating on the stock at Hold with an anticipation of a return to growth, as the return to growth came with what I estimated as too moderate upside for a Buy rating. Since, the stock has returned 56% compared to S&P 500’s return of 25%, outpacing the index by a clear margin.

My Rating History on UI (Seeking Alpha)

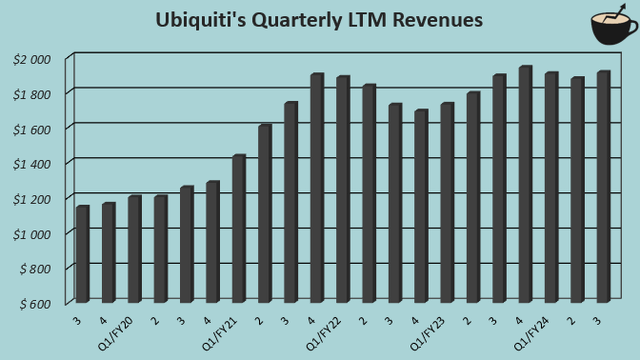

Ubiquiti Is Finally Returning to Growth

After the previous article, Ubiquiti has returned to better growth with the latest reported Q3 results, where revenues grew by 7.7% year-over-year and by 6.0% sequentially. While the less relevant Service Provider Technology revenues still declined by -$5.5 million year-over-year, Enterprise Technology revenues grew very well, ending the total revenues at $493.0 million.

The return to growth in Q3 is impressive considering the macroeconomic pressures that have ravaged industry revenues – Juniper Networks (JNPR) reported a -16.2% revenue decline in the latest quarter, Cisco Systems (CSCO) a decline of -12.8%, and Extreme Networks (EXTR) a deep decline of -36.5%, with all of the peer companies’ revenues declines only sharpening in the latest months.

The Q3 growth seems to be aided by Ubiquiti’s large number of new releases in late calendar 2023 to early 2024 – the company released UXG-Lite and UniFi Express 8 months ago, and UniFi 7 six months ago, likely already aiding Q3 revenues in early calendar 2024 very well.

Author’s Calculation Using TIKR Data

The return to growth is anticipated to only accelerate by Wall Street in upcoming quarters – for Q4, the revenue estimate is at $538.2 million (although only by one analyst), up 9.6% year-over-year, and a rapid revenue growth of 18.5% is already expected in FY2025.

I believe that the new product launches, combined with a potentially greater macroeconomic sentiment in FY2025, should aid growth very well, making the growth expectations reasonable. Investors should still watch out for a deeper macroeconomic situation in the very short term as the competitors continued to report such sharp declines in the past quarter, but the weaker macroeconomy shouldn’t be a long-term concern.

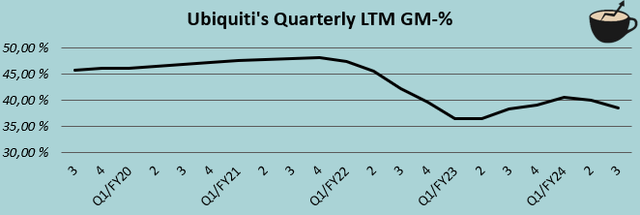

Inventories Still Burden Gross Margin

Elevated inventory levels have burdened Ubiquiti’s margins in the past couple of years. While a recovery in the gross margin started to happen after early FY2023, weaker overall sales and remaining high inventories at a current $533.5 million have caused high warehouse costs – as a result, the trailing gross margin only stands at 38.6% compared to a 48.1% peak before the macroeconomic issues began. The operating margin still stands at an incredibly strong 26.4% due to the lean organization.

Author’s Calculation Using TIKR Data

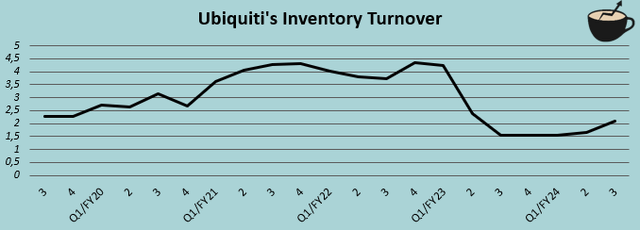

With the Q3 growth, Ubiquiti’s inventory turnover has started to recover in the latest quarter from the drought of near a 1.5 annualized rate, but was still very well below the 3.5 average level from Q3/FY2019 to Q1/FY2023. With the return to growth, the inventory turnover should continue elevating back to the historical level, aiding cash flows over the short term.

*Calculated Using Annualized Quarterly COGS Data With Quarterly Inventory Midpoint Level (Author’s Calculation Using TIKR Data)

The new releases could still create a hiccup in inventory management as the growth is achieved through new products, potentially leaving older inventories hanging for a while – I believe that the margin recovery is likely going to be very gradual.

I Estimate a Fair Stock Valuation Once Again

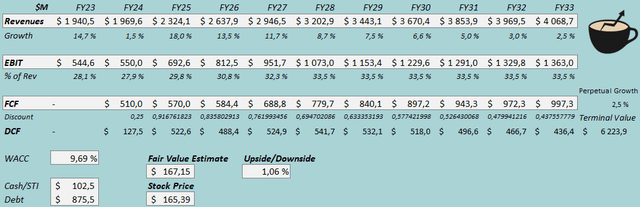

I updated my discounted cash flow [DCF] model to update the fair value estimate from November. I now estimate a revenue CAGR of 7.7% from FY2023 to FY2033, driven by the new product launches creating an accelerating growth, especially in FY2025. For FY2033, the revenue estimate is up 3% from my November model’s estimate.

I estimate the EBIT margin to expand back to 33.5% gradually from an improving inventory position and increased sales bringing operating leverage, slightly more conservative than my previous 34.0% eventual margin estimate. Ubiquiti should have a good cash flow conversion going forward.

DCF Model (Author’s Calculation)

The estimates put Ubiquiti’s fair value estimate at $167.15, very near the stock price at the time of writing – I again estimate the stock to be roughly fairly valued. I previously estimated a 17% upside with a fair value estimate of $128.78, with the fair value estimate now being driven up mainly by a lower cost of capital.

CAPM

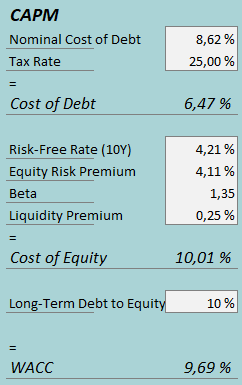

A weighted average cost of capital of 9.69% is used in the DCF model, down from 11.90% previously. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q3, Ubiquiti had $18.9 million in interest expenses, making the company’s interest rate 8.62% with the current amount of interest-bearing debt. To estimate the cost of equity, I use the 10-year bond yield of 4.21% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I again use a beta estimate of 1.35. With a liquidity premium of 0.25%, the cost of equity stands at 10.01% and the WACC at 9.69%.

Takeaway

With new product releases, Ubiquiti is finally returning to growth despite a continued pressured macroeconomic situation as competitors struggle with the top line. The margin level is pressured by excess inventories, and although the inventory turnover should slowly improve with the growth, the new product releases will likely make margin expansion gradual. I again estimate the stock to be roughly fairly valued ahead of the growth, and as such, I remain with a Hold rating for Ubiquiti.

Read the full article here