Universal Logistics Holdings (NASDAQ:ULH) has recently experienced a pullback in share price due to weak earnings. Even with poor earnings, I believe that Universal Logistics is currently a buy because the firm holds a fair balance sheet with room to leverage, has integrated technology into its operations to improve margins, and is undervalued assuming my DCF figures.

Business Overview

The United States, Mexico, Canada, and Colombia are all served by Universal Logistics Holdings, Inc.’s logistics and transportation services. They offer a variety of truckload alternatives, including heavy-haul, dry van, flatbed, and refrigerated transport. They also provide international and domestic freight forwarding and customs brokerage services. Automobile components, industrial equipment, construction supplies, food, paper, consumer products, steel, furniture, and a variety of metals are among the commodities they convey.

Additionally, the business offers specialized services, such as consolidation, material handling, repacking, warehousing, kitting, sequencing, sub-assembly, and effective management of returnable containers, to fulfill particular customer demands. By simplifying the short- to medium-distance transportation of steamship and rail truck containers between the railhead or port and the customer, they also provide support for intermodal services. Automobile, energy, retail, steel, consumer products, manufacturing, and other sectors of the economy as well as other transportation firms that combine loads from other shippers make up their clientele.

Universal Logistics

Financials

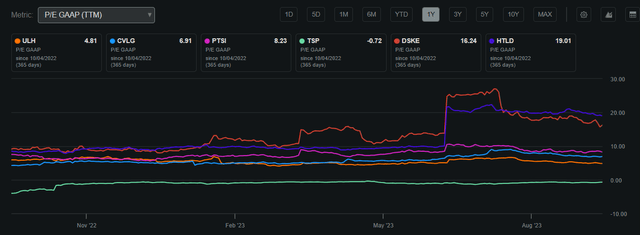

Universal Logistics Holdings is currently assessed at an approximate market capitalization of $637.48 million, showcasing a robust Return on Invested Capital of 14%. The existing stock price stands at $23.87 per share, slightly above its 52-week low of $23.74. Notably, the company’s P/E GAAP ratio is at 4.81, positioning it below all comparable peers, signaling a relative undervaluation in the market.

Universal Logistics P/E GAAP Compared to Peers (Seeking Alpha)

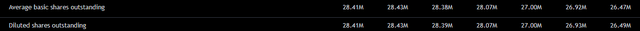

The firm also pays a dividend of 1.76% representing a payout ratio of 8.47%. This safe payout ratio demonstrates that although Universal Logistics rewards its shareholders with consistent income, most of its FCF is used to capitalize on growth. With a ROIC of 14%, Universal’s strategy to improve its core business remains prudent until this growth decelerates. The firm has also repurchased shares over the years, demonstrating its commitment to buybacks at a cheap share price.

Shares Outstanding Annual (Trading View) Share Performance (Seeking Alpha)

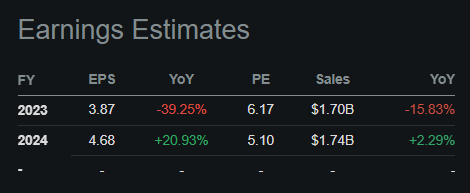

Earnings

With Q2 2023 earnings missing on the top and bottom with EPS missing by $0.11 at $0.90, and revenues missing by $35.5 million at $412.6 million showing a -21.7 YoY decline, Universal is having difficulty in enduring macro headwinds in order to foster growth. With EPS expected to recover moving into 2024, I believe that keeping a close eye on interest rates and inflation will be a key factor in the speed of Universal’s recovery and subsequently the level of cash flow it could have moving into the future.

Earnings Estimates (Seeking Alpha)

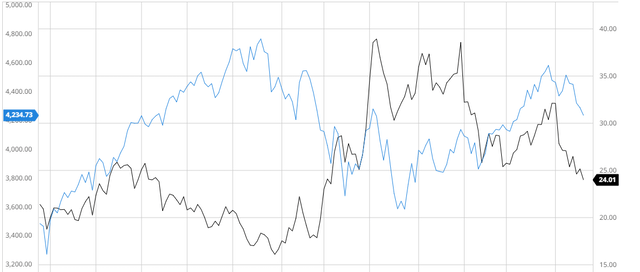

Performance Compared to the Broader Market

In the last 3 years, Universal Logistics has underperformed the S&P 500 when adjusting for dividends. I believe that this underperformance is due to recent earnings misses along with the current volatility of fuel prices resulting in reduced cash flows.

Universal Logistics Compared to the S&P 500 3Y (Created by author using Bar Charts)

Balance Sheet

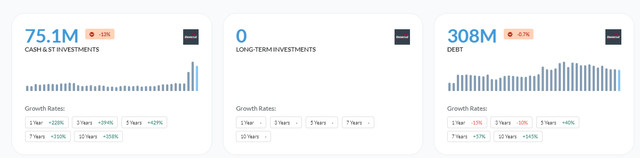

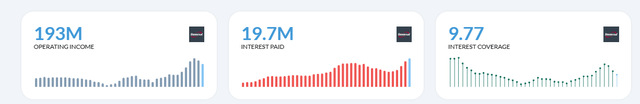

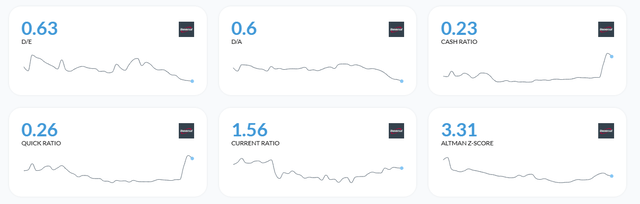

Universal Logistics’ balance sheet is relatively sound and will endure macro headwinds due to its ability to leverage. With debt declining 15% in the last year and interest coverage at 9.77, Universal can take on more debt if needed even at a higher rate. This stable balance sheet will also give the firm stable interest rates resulting in greater FCF. Lastly, with a current ratio of 1.56 and an Altman-Z-Score of 3.31, Universal Logistics will remain solvent in the medium term.

Financial Position (Alpha Spread) Interest Coverage (Alpha Spread) Solvency Ratios (Alpha Spread)

Valuation

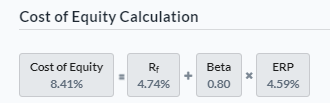

In order to calculate an accurate discount rate for Universal Logistics, I must calculate the Cost of Equity in holding Universal shares. Assuming a risk-free rate of 4.74% based on the 10-year treasury yield, I calculated a Cost of Equity of 8.41%.

Cost of Equity Calculation (Alpha Spread)

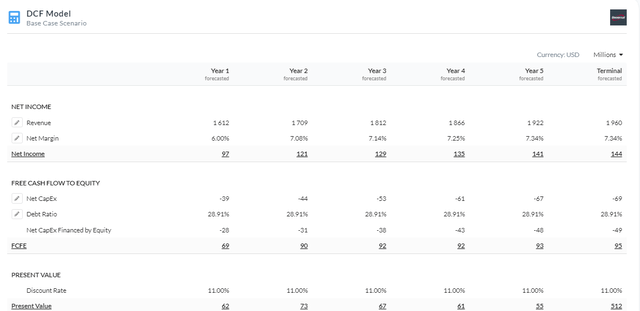

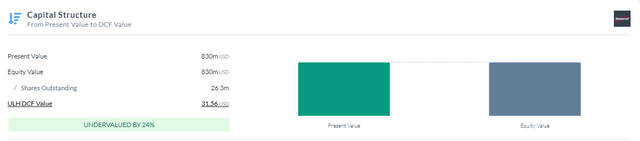

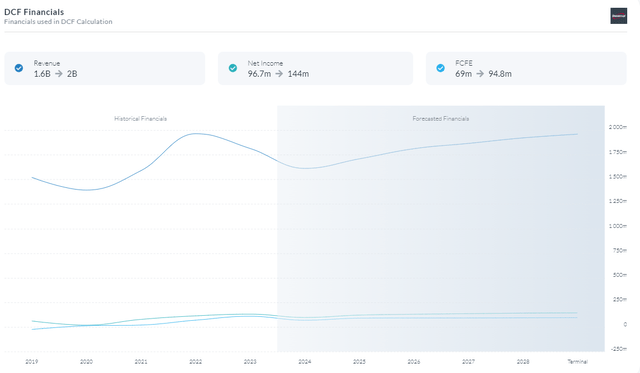

Using the previous calculation, I created a 5-year Equity Model DCF using FCFE. I utilized an 11% discount rate meaning I added a 2.59% risk premium to my assumptions. This resulted in a fair value of $31.56 presenting a 24% upside. This is to factor in macro headwinds, declining performance, and due to factoring in revenue and margins based on expectations which could be speculative moving into 2024 with a high risk of recession.

5Y Equity Model DCF Using FCFE (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Technological Optimization Resulting in Margin Expansion

In order to streamline operations and provide better logistics services, Universal Logistics Holdings is dedicated to utilizing technology in order to expand margins. Putting in place a strong Transportation Management System is a key component of their technology investment plan. Incorporating cutting-edge TMS software enables Universal Logistics to effectively plan and manage freight operations, simplify route planning, and reduce transportation costs. They now have real-time visibility into their supply chain thanks to this investment, which enables them to make quicker decisions and be more responsive to client needs.

Additionally, the business has made significant investments in telematics and fleet management programs. They may track vital information like vehicle location, driver behavior, fuel consumption, and maintenance needs by using telematics devices that have been installed in their cars. Their ability to optimize routes, improve fuel efficiency, and proactively manage their fleet, resulting in on-time and effective deliveries, is made possible by this data-driven approach. As a result, the margin will increase, generating better FCF to invest in growing the company’s core operations network.

Risks

Fuel Price Volatility: Fuel price fluctuations have a big impact on operating costs and profit margins for Universal. Any volatility would impact margins and cash flows in the long term.

Supply Chain Disruptions: Any supply chain disruptions, whether brought on by natural catastrophes, geopolitical unrest, or other unforeseeable occurrences, can have an influence on the prompt delivery of goods and services, which can have an impact on customer relations and financial success.

Conclusion

To summarize, I believe that Universal Logistics is currently a buy because the firm holds a fair balance sheet with room to leverage, has integrated technology into its operations to improve margins, and is undervalued assuming my DCF figures.

Read the full article here