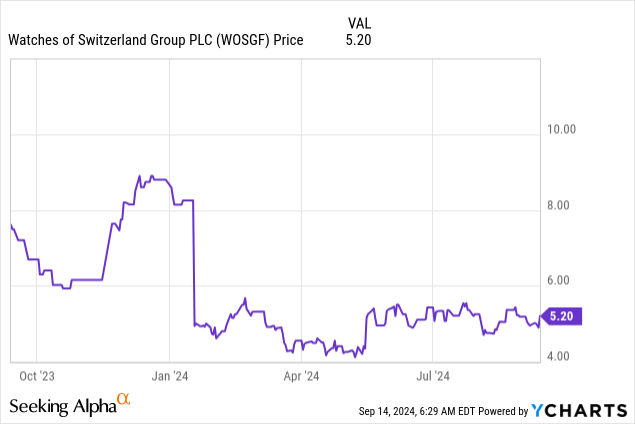

Watches of Switzerland Group or ‘WOSG’ (OTCPK:WOSGF) is among the largest luxury watch dealers in the world (mainly Rolex but also Audemars, Patek Philippe, Cartier, etc.) with clear leadership in the UK market, as well as a fast-growing US presence. The underlying WOSG economics has long been very attractive, combining best-in-class >20% ROEs with steady earnings growth through the cycles. This perception has drastically changed over the last year, however, mainly on concerns about Rolex going downstream post-acquisition of its Swiss distributor Bucherer. Not helping matters either were a series of weak trading updates and a big profit warning earlier this year.

If more recent data points are any indication, though, the worst may finally be over for WOSG. Yet, the market has kept WOSG stock firmly in the penalty box, and at the current ~10x forward P/E, the Rolex disintermediation risk is likely over-handicapped in the price. Also, not properly priced, in my view, is WOSG’s ‘floor’ value as a Bucherer-type M&A target down the line (arguably the most logical vertical integration path for Rolex).

All this simultaneously leaves WOSG investors with a healthy dose of safety margin against future execution mishaps and plenty of upside if the company gets anywhere near its ambitious “long-range growth plan” (or ‘LRP’). In sum, a favorable risk/reward here.

Another In-Line Trading Update

WOSG has had its fair share of earnings disappointments; the most recent being a massive profit warning at the start of this year citing “challenging macroeconomic conditions” that sent the stock plunging >30% lower. Since the big reset, however, trading updates have been mostly in line with management expectations.

The post-AGM commentary earlier this month was more of the same. To recap, the company reiterated the (pre-IFRS 16) FY25 outlook it initially set out in its FY24 results. For the P&L, key targets remain a GBP1.67-1.73bn top-line (implied constant currency growth of 9% – 12%) and +0.2 to +0.6 percentage points of EBIT margin expansion. Elsewhere, the GBP60-70m capex and ~70% free cash flow conversion targets are intact. Also, positive was that the integration of Roberto Coin Inc., for which the company now owns distribution rights in the US/Canada/Central America, is “progressing to plan.”

|

FY25 Guidance |

|

|

Revenue |

GBP1.67 to GBP1.73bn (+9% – 12% constant currency growth) |

|

Adjusted EBIT margin % |

+0.2 to +0.6% points YoY expansion |

|

Total finance costs |

GBP13m (including Roberto Coin Inc. financing) |

|

Underlying tax rate |

28% to 30% |

|

Capex |

GBP60 to GBP70 million |

|

Free cash flow conversion |

~70% |

Source: Watches of Switzerland

Promising Signs from Swiss Export Data

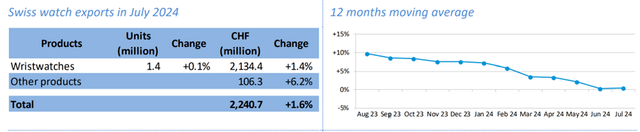

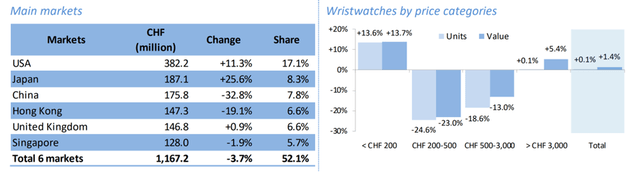

The other big plus coming out of this month’s AGM was management’s upbeat view on “demand for our key luxury brands…remains strong in both the UK and US markets, outstripping supply.” In support of this view, monthly data from the Swiss watchmaking industry points to a promising upturn.

On a headline basis, overall watch exports rose +1.4% in July – reversing consecutive monthly declines through June.

Federation of the Swiss Watch Industry

By geography, WOSG’s key UK market has been relatively resilient (+0.9%), tracking an incrementally improving macro backdrop. Meanwhile, the company’s other key geography, the US, continues to outperform at +11.3% for the month.

The even more positive read-through, though, is that watches at the very premium end, the ‘bread and butter’ for WOSG, have been outperforming. Of note, wristwatches over CHF 3k (up +5.4%) and made from precious metal (up +12.6%) led the way in July.

Federation of the Swiss Watch Industry

To be clear, making guidance won’t be straightforward this fiscal year, particularly in the US, where upcoming elections could introduce some sales volatility. Further complicating things is a back half-weighted element to the FY25 guide. Given the renewed Swiss export momentum, though, particularly for WOSG’s key categories, there’s still a good chance the company surprises to the upside from here.

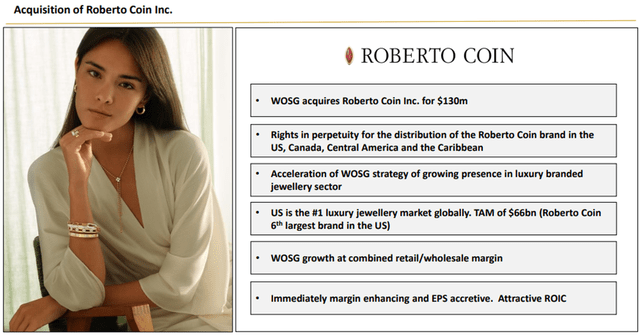

Leaning on M&A with Roberto Coin

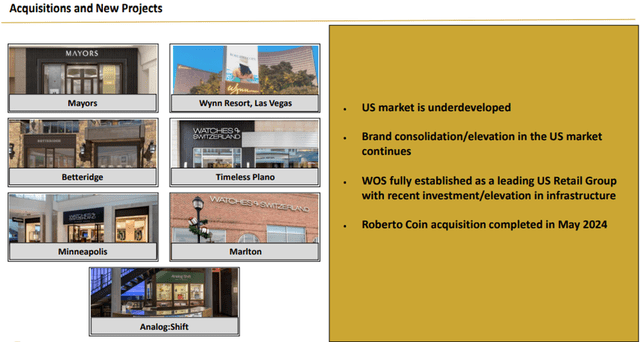

Beyond this fiscal year’s guide, there’s also the ambitious ‘LRP’ targets to “more than double sales and Adjusted EBIT by the end of FY28” to think about. Getting there entails M&A – a lever management has already begun to tap into by acquiring the exclusive rights to import and distribute Roberto Coin Inc. (a Roberto Coin S.p.A associate) into the North, Central America, and Caribbean markets.

Watches of Switzerland

Strategically, the deal is a straightforward fit, given WOSG has been retailing Roberto Coin for years now. The only big change post-deal is that WOSG also gets the wholesale margin in return for a debt-financed $130m consideration (including ~$10m tied to post-deal milestones). At ~0.8x net debt/adjusted EBITDA, though, the company will retain ample pro-forma balance sheet capacity for more M&A. Current guidance also calls for the acquisition to be immediately “margin enhancing and EPS accretive,” which seems about right in the context of an inexpensive ~4.3x trailing EBIT multiple.

Watches of Switzerland

More Inorganic Growth Key to LRP

Management’s move to diversify into branded jewelry, almost immediately after Rolex acquired a distributor, doesn’t exactly send the right message. Still, more accretive deals along the lines of Roberto Coin Inc. certainly won’t hurt.

Yes, the expansion adds complexity and doesn’t help WOSG’s value as a potential M&A target if Rolex decides to expand downstream. That said, if management can scale its acquisitions quickly and effectively enough (as it has done in the past), that won’t matter, as the seemingly ambitious ‘LRP’ targets could suddenly be within reach. And with the market still very skeptical, getting anywhere close would re-rate the stock quite significantly.

In this regard, progress on the Roberto Coin Inc. integration, as well as the broader M&A pipeline, will be key monitorables in the next few trading updates.

Watches of Switzerland

Final Note on Risks & Summing Up

It hasn’t been an easy ride for existing WOSG investors, but for new money, the stock is worth a look now, in my view, after a >70% peak-to-trough drawdown. Of course, there are still risks here, the most notable being that key brands like Rolex depart or go direct-to-consumer. And with management now pivoting to acquisitions to drive growth, there’s always the risk of bad capital allocation (somewhat mitigated by management’s track record).

All things considered, though, at ~10x earnings for a company poised to grow earnings in the high-teens % while also sustaining best-in-class ROEs, the risk/reward seems favorable enough to warrant a contrarian bet.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here