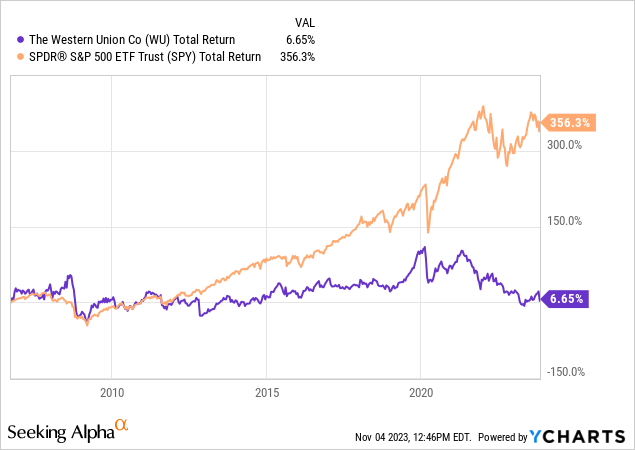

Western Union (NYSE:WU) became a public company in 2006 after it was spun off from First Data. Since then, WU shares have proved a disappointing investment. Since going public, WU has delivered a total return of just 6.6% compared to a total return of 356% delivered by the S&P 500.

While WU’s core business of cross-border money movement has been under attack for a number of years, the company has continued to deliver solid profits. However, investors are not confident that this will continue to be the case.

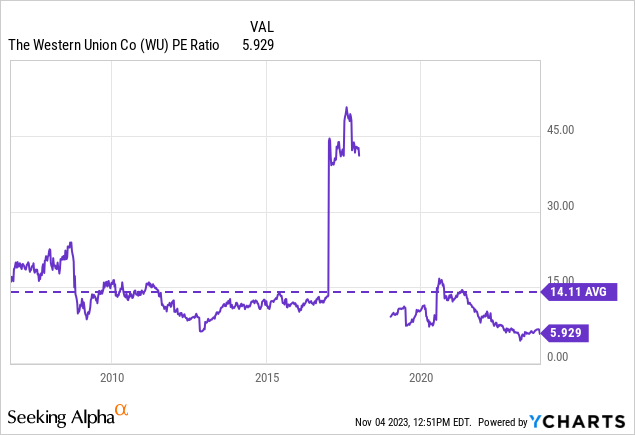

By nearly any metric WU is a cheap stock. WU trades at just 5.9x trading earnings, 4.9x EV / EBITDA, and has an 8% dividend yield. However, the stock is cheap for a reason and further analysis is required to determine if WU is a value play or value trap.

Cigar Butt Investing

Warren Buffett, arguably one of the greatest investors who has ever lived, is now associated with buying high-quality companies at reasonable prices. However, this was not always his investment strategy.

During the very early part of his career, Buffett often employed a deep value investing approach known as Cigar Butt investing. Buffett described the strategy in his 1989 shareholder letter:

My first mistake, of course, was in buying control of Berkshire. Though I knew its business – textile manufacturing – to be unpromising, I was enticed to buy because the price looked cheap. Stock purchases of that kind had proved reasonably rewarding in my early years, though by the time Berkshire came along in 1965 I was becoming aware that the strategy was not ideal.

If you buy a stock at a sufficiently low price, there will usually be some hiccup in the fortunes of the business that gives you a chance to unload at a decent profit, even though the long-term performance of the business may be terrible. I call this the “cigar butt” approach to investing. A Cigar butt found on the street that has only one puff left in it may not offer much of a smoke, but the “bargain purchase” will make that puff all profit.

Given the expected erosion of WU’s business, the stock represents a classic Cigar Butt investing type situation.

Company Overview

WU is a leader in the global money movement business. The company provides people and businesses with fast and reliable ways to send money around the world. WU was split into two business segments: Consumer-to-Consumer (“C2C”) and Business Solutions. However, the company completed a divestiture of its Business Solutions business in July 2023 and is now focused only on the C2C business.

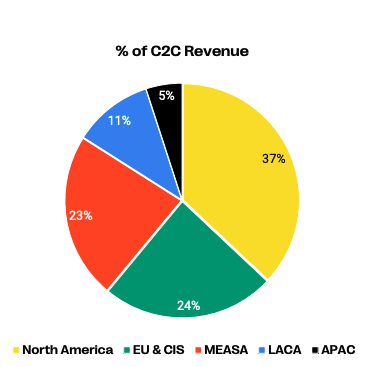

As shown by the chart below, North America represents the company’s largest market but the company is well diversified across geographic regions.

A substantial portion of C2C transfers are cross-border transactions conducted through physical retail agent locations. However, the company has been focusing on growing its digital offerings which now represent ~21% of total C2C revenues.

WU Q3 2023 C2C Revenue Breakdown (WU Investor Presentation)

Highly Competitive Business & Disruption

WU faces a significant amount of competition in what is a highly fragmented C2C money transfer industry. WU’s closest global peer is MoneyGram which is currently privately owned. WU also competes with smaller regional money transfer providers, banks, postbanks, post offices, and informal networks.

In addition to these competitors, WU also competes with digital money transfer services such as Zelle, Remitly (RELY), PayPal (PYPL) owned Venmo, Wise, OFX, and WorldRemit.

The emergence of digital payment platforms has served as a major threat to WU’s traditional business of processing payments via its agent network and physical footprint. Digital remittances typically incur fees of ~3% while cash-to-cash transfers incur fees of ~5%.

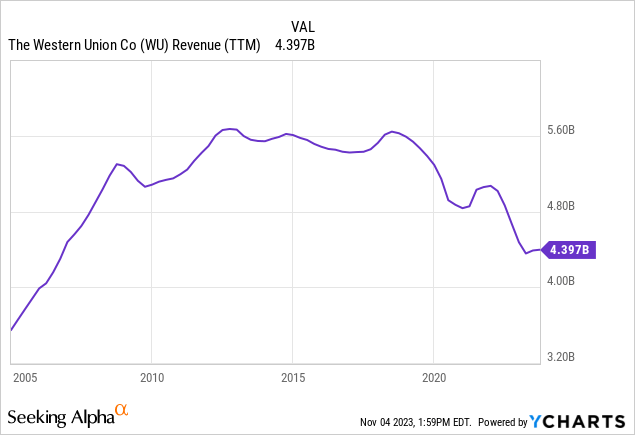

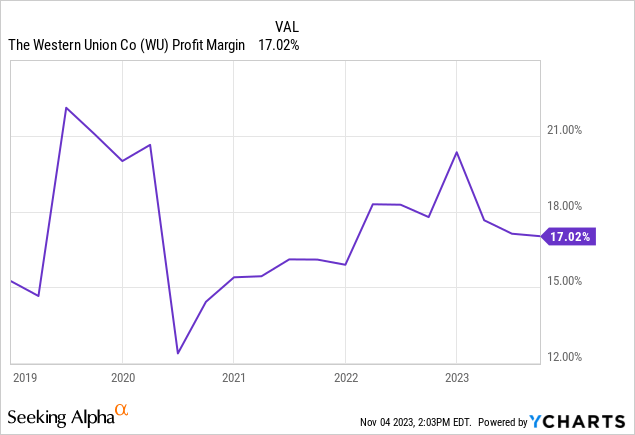

As shown by the chart below, WU revenues have sharply decreased over the past few years as a result of increased digital competition. However, despite this significant revenue pressure WU has been able to maintain its margins due to cost discipline.

WU Response To Disruption

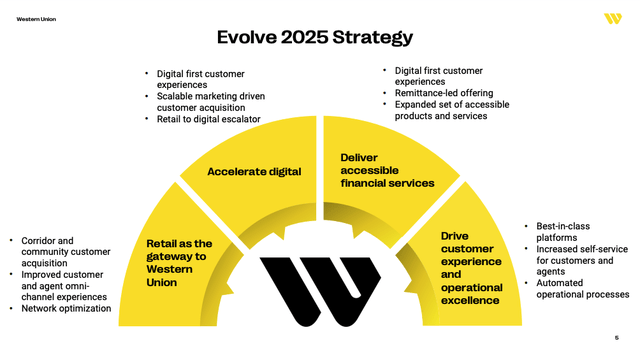

In response to the changing industry landscape due to digital payment offers, WU has launched its own digital offerings and initiated its Evolve 2025 Strategy.

Under the plan, WU has been using its retail presence as a gateway to WU. Under this plan, WU is focused on acquiring and onboarding customers via its agents and then over time moving these customers to a fully digital experience. WU is evolving to provide a digital-first customer experience and expanding its suite of product offerings.

WU has been successful in its digital rollout and the digital offerings now account for ~21% of C2C revenues.

WU also exited its business solutions business in order to fully focus on maximizing the strength of the global cross-border payments platform and financial network.

In October 2022, WU launched a five-year $150 million operating expense redeployment program. Thus far, WU has already taken actions that have resulted in $40 million in savings.

WU Investor Presentation

Performance Appears To Have Stabilized

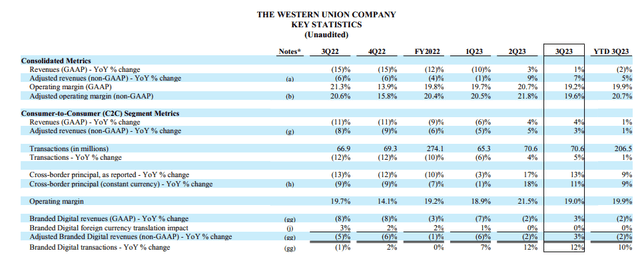

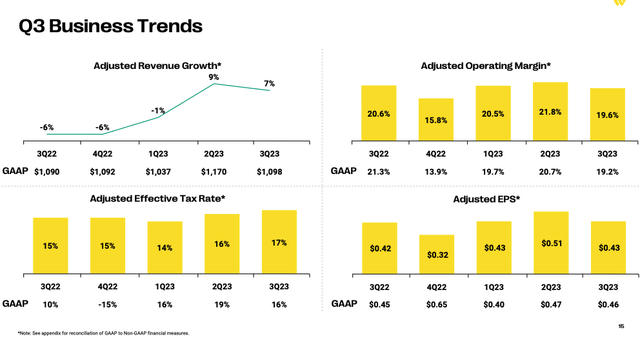

As shown by the charts below, WU has been able to deliver resilient results despite the changing business landscape. Adj. Operating margin and EPS have been stable over the past year and the company has reported strong Adjusted Revenue Growth over the past two quarters.

Additionally, the company’s digital business returned to growth in the most recent quarter posting a 3% increase compared to the same period a year ago.

CEO Devin McGranahan offered additional color regarding the stabilization on the Q3 earnings call:

We articulated a strategy that focused on driving the business through customer level economics, including improved LTV to CAC and emphasis on improving retention and an expansion of our TAM by launching new transaction based financial services products. We painted a financial picture that would fund the required investments for this strategy within our strong operating margin range of 19% to 21% and with the goal of returning Western Union to sustainable and profitable revenue growth by 2025.

Shortly thereafter, we reported Q3 2022 C2C transaction growth of negative 12% and adjusted revenue growth of negative 6%. And just one year later today, we reported Q3 2023 transaction growth of 5% and adjusted revenue growth of 7%.

Switching to digital, when we launched our new go-to-market program, I highlighted that we would first grow new customers, then we would grow transactions and finally we would start to grow revenue. In the quarter, we achieved positive revenue growth of 3% for our global branded digital business, a full quarter ahead of our previous target.

We have also begun to narrow the delta between transaction growth, which has been sustained at 12% and revenue growth.

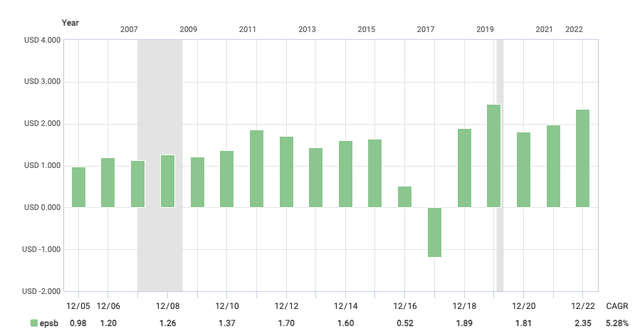

WU Q3 2023 Earnings Release WU Investor Presentation WU EPS (FAST Graphs)

Valuation

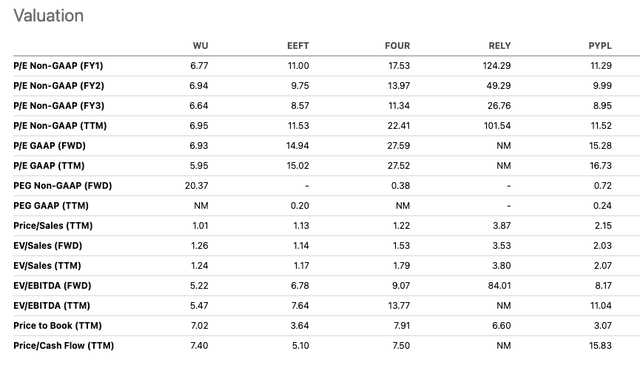

WU trades at ~5.9x trailing earnings and ~6.9x consensus 2024 earnings. Comparably, the S&P 500 is trading at ~17.4x 2024 consensus earnings. Thus, on a relative basis, WU appears to be cheap.

However, given the disruption that WU is currently experiencing in its traditional business the earnings outlook over the next few years is highly uncertain.

While the company’s Evolve 2025 Strategy is aimed at returning the company to sustainable growth in 2025, the outcome remains highly uncertain.

In regards to trading levels vs comps, WU is trading at a modest discount. PayPal which is focused exclusively on electronic payments trades at 10x forward earnings compared to 7x for WU. Remitly, which represents a direct disruptive competitor to WU, has been rapidly growing due to strong digital offerings and currently trades at ~49x forward earnings.

If WU is able to truly transform into a digital-first company then I believe it can trade at valuations more similar to PYPL. However, as it stands today WU is still an agent-focused transfer business with a massive physical presence. For this reason, I believe WU’s discount to peers is reasonable.

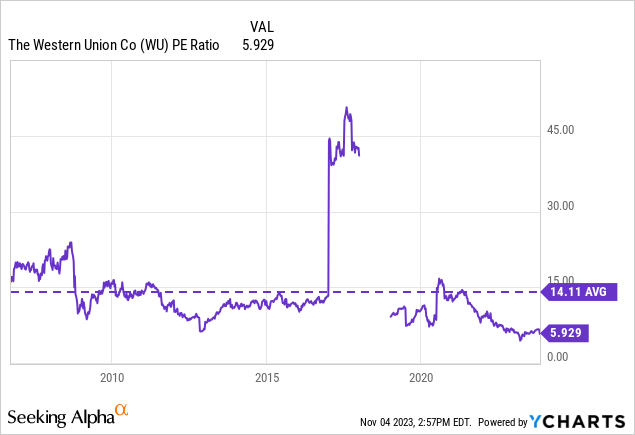

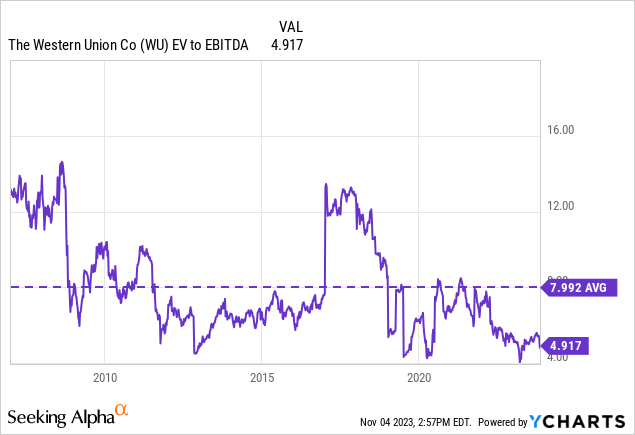

WU is trading at the low end of its historical valuation range on both a P/E ratio basis and EV/ EBITDA basis. However, I believe this is warranted given the significant challenges currently facing the company.

Seeking Alpha

Strong Dividend & Share Buyback History

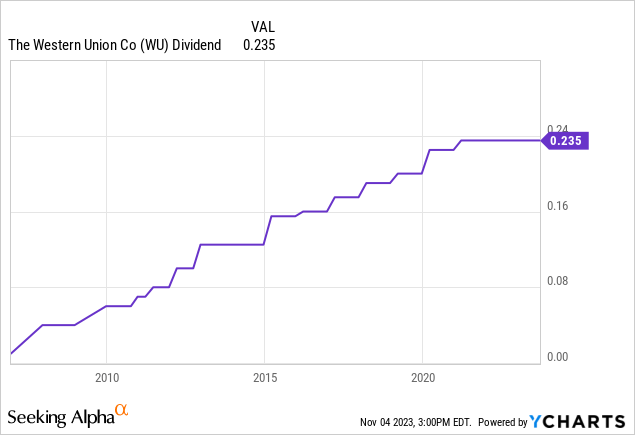

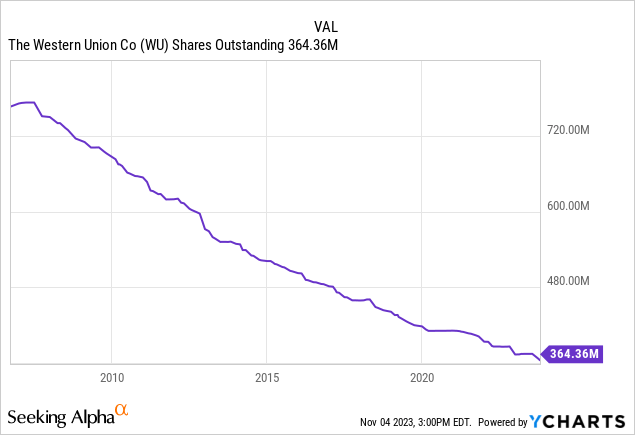

As shown by the charts below, WU has a strong history of aggressively returning capital to shareholders in the form of rising dividends and share repurchases.

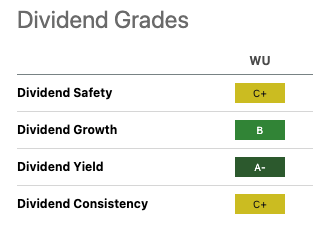

Currently WU is yielding ~8%. While this gives WU a very attractive current yield, it is unclear if the company will be able to sustain the dividend going forward. Seeking Alpha currently gives WU a dividend safety grade of C+ and I tend to agree.

While a dividend cut does not appear imminent, things can change quickly if WU is not successful in executing its transition to digital.

Seeking Alpha

Conclusion

Cigar butt investing is a tough game. While Warren Buffett relied on this strategy during the early part of his career, he has shifted away from that approach and now focuses on high-quality companies.

WU has experienced significant disruption to its traditional agent-assisted money transfer business due to the arrival of digital payment solutions. While digital payment platforms were slow to roll out for cross-border transactions, that has now changed. WU has experienced a significant revenue drop over the past 5 years as digital competition has accelerated.

WU has recognized the need to evolve into a digital-based business and has built a digital business that accounts for ~21% of C2C revenue. The company is currently implementing its Evolve 2025 strategy which aims to return the company to sustainable growth via focusing on digital payments.

While WU has shown some signs of being able to deliver on its Evolve 2025 strategy, the company has a long way to go in terms of converting customers to its digital offerings.

WU trades at a low valuation of just 5.9x trailing earnings and carries a ~8% dividend yield but I view this valuation as reasonable given the disruption that WU is currently experiencing. Moreover, WU does not appear to be highly attractive vs other payments companies such as PYPL which face less disruption.

I am initiating WU with a hold rating but would consider upgrading the stock if the company continues to successfully execute its digital transformation.

Read the full article here