X-FAB (OTCPK:XFABF) is a leading semiconductor foundry based in Europe, specializing in the production of high-voltage chips tailored to meet the unique requirements of its clients. The company has strategically pivoted away from the consumer sector and refocused its efforts toward serving the automotive, industrial, and medical markets.

The company has six fabs around the world, including Lubbock in Texas, acquired from Texas Instruments in the 1990s and in Sarawak, Malaysia from a merger with 1st Silicon, and is looking for more.

Silicon Carbide (“SiC”)

The Lubbock facility in Texas, operated by X-FAB, stands as one of the company’s oldest foundries. In a strategic move, X-FAB actively retooled this 150mm fab acquired, from Texas Instruments (TXN) in 1999, to specialize in Silicon Carbide (“SiC”) technology, a crucial component with applications in both industrial and automotive sectors. This SiC investment initiative was initiated back in 2014 and reached completion by 2019. X-FAB is moving to 200mm at Lubbock.

At the end of 2022, X- FAB was processing 3,000 SiC wafers a month, but plans to double this output by the end of 2023 and double again by the end of 2024, which is over 6,000 wafers for 2023 and 2024 should be 12,000 a month. With a $200 million capex for 2023-2025, capacity will increase 340%.

SiC Revenues

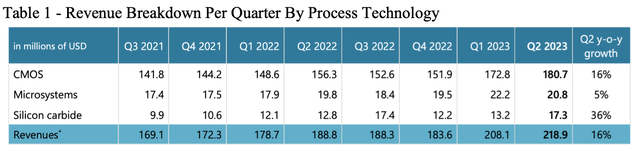

As shown in Table 1, in the second quarter of 2023, X-FAB recorded total revenues of USD 218.9 million, up 16% YoY and up 5% QoQ. Guidance for Q3 2023 revenue is expected to come in within a range of USD 225-240 million with an EBITDA margin in the range of 24-28%.

Importantly as it is the focus of this article, in the second quarter, SiC revenues reached $17.3 million, marking a notable 36% year-on-year increase. In Q3 2021, SiC represented 5.9% of total company revenues. In Q2 2023, SiC revenues increased to 7.9% of total revenues.

X-Fab

SiC Growth Compare with Competitors

X-FAB’s SiC revenues were just $17.3 million in Q2 2023, which represents just a 2% share of the global SiC device market. That share will increase for reasons I discuss below in this article.

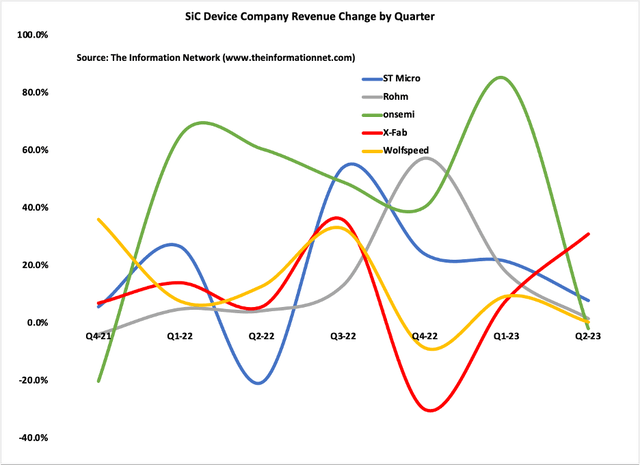

But on a QoQ SiC revenue change, X- FAB has shown comparable performance against market leaders ON Semi (ON), Rohm (OTCPK:ROHCF), STMicroelectronics (STM), Wolfspeed (WOLF), and Infineon (OTCQX:IFNNY), as shown in Chart 1, according to The Information Network’s report entitled Power Semiconductors: Markets, Materials and Technologies. In fact, X-Fab gained market share in each of the past two quarters.

The Information Network

Chart 1

X-Fab SiC Business Strategy

SiC is going from niche to mainstream application, gaining market share in high-power applications. SiC will be in around 20% of all power electronics in 2026.

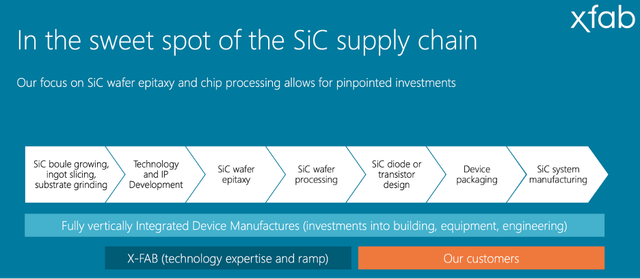

X-FAB enables fabless companies to compete in this market, with highly competitive products entering the SiC market. The company is in the sweet spot of the SiC supply chain, focusing on the entire spectrum of SiC wafer growing, epitaxy, and chip processing as shown in Chart 2.

X-Fab

Chart 2

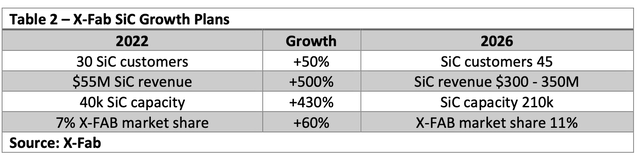

X-FAB has ambitious plans for SiC growth as shown in Table 2.

X-Fab

Investor Takeaway

The Silicon Carbide market is currently under the dominance of major Integrated Device Manufacturers (IDMs) such as Infineon and ON Semi. However, there is a rising demand from fabless companies and design houses to develop their own customized SiC devices tailored to meet the precise needs of their customers’ applications.

Competitors in the SiC foundry business are:

- Clas-SiC (U.K.)

- Episil Technologies (Taiwan)

- Sanan (China)

- Yes Power Technix YPT (South Korea)

Among these companies, X-FAB stands out as the world’s largest SiC-foundry, offering comprehensive access to SiC device processing. X-FAB operates with a business model designed to expedite time-to-market while delivering high-performance devices.

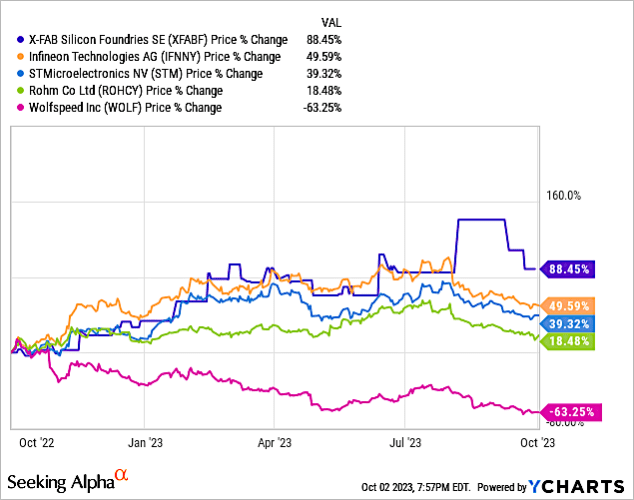

Share price of X-FAB has also been strong. In Chart 3, I show X-FABs share price has increased 88.45% in the past 1-year period. This compares to low to mid double-digit growth for Infineon, STM, and Rohm, a mid-double digit drop for Wolfspeed.

YCharts

Chart 3

In addition to its SiC business, X-FAB has further extended its market in wide bandgap semiconductor, which I detailed in my Semiconductor Deep Dive Marketplace newsletter. X-FAB is prototyping and developing GaN-on Si on 200mm wafers and has several customer engagements. GaN and SiC are progressively being integrated into electric vehicles (EVs), rapid-charging solutions, and premium mobile devices.

I rate the company a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here