Investment thesis

Zebra Technologies (NASDAQ:ZBRA) is a high-quality business that experiences challenging times due to the current complicated macro environment. The company’s quarterly revenue is declining on a YoY basis amid the end markets’ weakness. Despite being temporary, these headwinds are likely to weigh on the company’s financial performance over multiple quarters until central banks of the developed countries loosen their monetary policies. My valuation analysis suggests that the stock is attractively valued, but I think the market overreaction risk to declining revenue is substantial and assigns the stock a “Hold” rating.

Company information

Zebra Technologies provides innovative solutions for businesses, specializing in advanced technology solutions for tracking, tracing, and managing critical resources of customers.

The company’s fiscal year ends on December 31. Zebra’s operations consist of two reportable segments: Asset Intelligence & Tracking [AIT] and Enterprise Visibility & Mobility [EVM]. According to the latest 10-K report, EVM generated about 70% of the total revenue in FY 2022.

ZBRA’s latest 10-K report

Financials

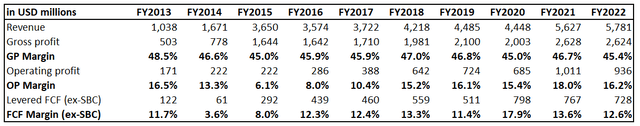

The company’s financial performance has been strong over the past decade. Revenue compounded annually at 21%, which is a stellar growth rate, especially given the length of the horizon analyzed. Profitability metrics were consistently at double digits except for a couple of years. The free cash flow [FCF] margin ex-stock-based compensation [ex-SBC] has also been consistently at double digits. While I like that profitability metrics have been solid over the long term, high-quality businesses are usually strong at absorbing the economies of scale effect with the profitability ratios expansion as the business expands. ZBRA’s profitability metrics did not improve much despite revenue growing by almost six times over the decade.

Author’s calculations

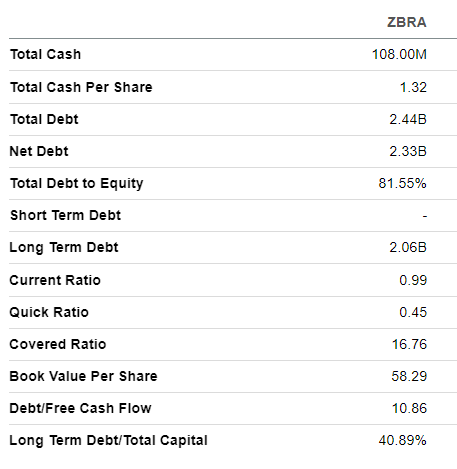

Despite having a relatively wide FCF margin, ZBRA does not pay dividends, and stock buybacks were inconsistent over the past decade. The business is asset-lite, and the major part of the FCF is allocated to cash acquisitions to scale the business up. While acquisition strategy boosted revenue growth, it seems that business combinations did not bring much synergy for profitability improvement. The balance sheet looks sound, with moderate leverage and liquidity ratios in good shape.

Seeking Alpha

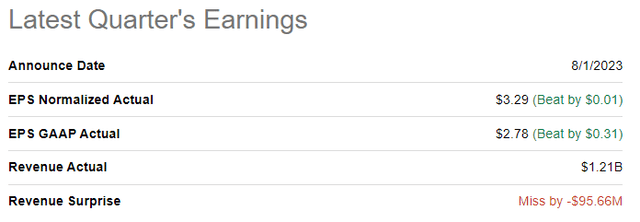

The latest quarterly earnings were released on August 1, when the company missed revenue consensus estimates, but the EPS aligned with expectations. Revenue demonstrated a notable 17% YoY drop. The topline weakness was due to weakening demand and cautious customer spending behavior across ZBRA’s end markets. Customers are tightening their CAPEX budgets, and IT device spending is softening. Despite revenue weakness, the management’s cost-efficiency measures allowed profitability metrics to demonstrate YoY expansion.

Seeking Alpha

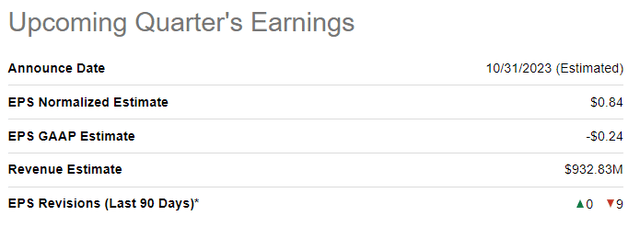

The upcoming quarter’s earnings release is scheduled for October 31. Quarterly revenue is expected by consensus at $933 million, which indicates a 32% YoY decline. That said, revenue decline is poised to accelerate, which is a red flag for investors. The adjusted EPS is forecasted by consensus from $4.12 to $0.84.

Seeking Alpha

I like the management’s response to substantially decreasing revenue by implementing cost-cutting initiatives, which allowed profitability metrics to sustain notable resilience. However, the current environment seems too tough to sustain wide profitability ratios amid this macro turmoil. Interest rates across the developed world are at their highest since the beginning of the century. This significantly weighs on the global demand from ZBRA’s end markets, meaning that the rebound is unlikely to unfold in the nearest quarters. While I think these headwinds are temporary and not secular, it might take multiple quarters before revenue growth returns to its solid long-term trajectory.

Valuation

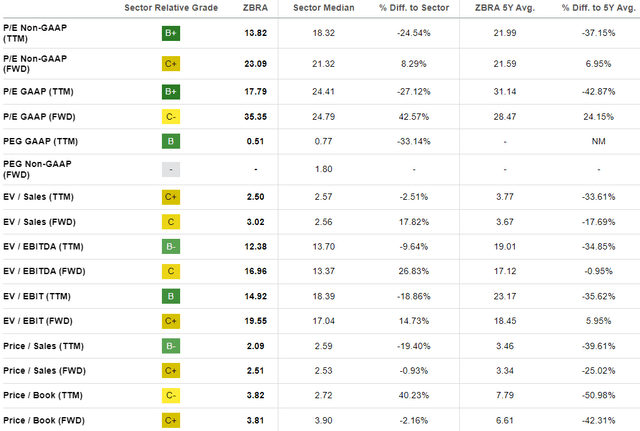

The stock price declined about 15% year-to-date, significantly underperforming the broader U.S. market. Seeking Alpha Quant assigns the stock an average “C” valuation grade. Comparisons of the current multiples to the sector median and historical averages are mixed, so I cannot conclude the attractiveness of the stock’s valuation based on the ratios analysis.

Seeking Alpha

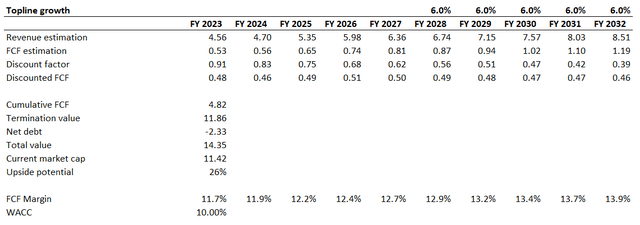

To get more conviction, I will simulate a discounted cash flow [DCF] model. I use a 10% WACC for discounting. I have revenue consensus estimates available up to 2027 and project a 6% revenue CAGR for the years beyond. I use the average 11.7% FCF margin over the past decade for my base year and expect a 25 basis points yearly expansion.

Author’s calculations

According to my calculations, the business’s fair value is about $14.3 billion. It means the stock has a 26% upside potential, and my target price for ZBRA is $280.

Risks to consider

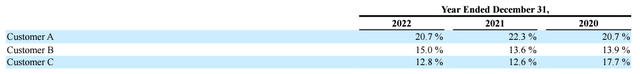

Apart from the obvious cyclicality of the business, which we have seen in the “Financials” section, I want to emphasize that ZBRA faces massive customer concentration risk. Its largest customer represents about 21% of the total sales; the top three comprise almost half of all revenues. Heavy reliance on a limited number of key customers means that Zebra’s financial performance can be substantially influenced by the financial health of its customers. Any adverse developments, such as a notable reduction in orders or a change in business priorities by these critical customers, could substantially disrupt ZBRA’s revenue and profitability.

ZBRA’s latest 10-K report

The company generates about half of its sales outside North America, meaning ZBRA faces numerous risks. Having a large portion of revenue generated in international markets poses the company with substantial foreign exchange risk. Unfavorable fluctuations in foreign exchange rates are highly likely to adversely affect the company’s earnings. Operating in multiple countries is also required to comply with a complicated web of laws and regulations, both international and domestic, for each country.

Bottom line

To conclude, ZBRA is a “Hold”. While I believe that the stock is very attractively valued with a 26% upside potential, it is highly likely that better buying opportunities are ahead. The market tends to overreact to the revenue decline, even if challenges are temporary. ZBRA experiences severe headwinds due to the end market’s softness caused by high interest rates, which weighs on the revenue dynamics. That said, there is a high probability that the stock price could decline further as the company’s revenue is declining YoY.

Read the full article here