Reason for the update: Q2 update and Acquisition of Acer Therapeutics

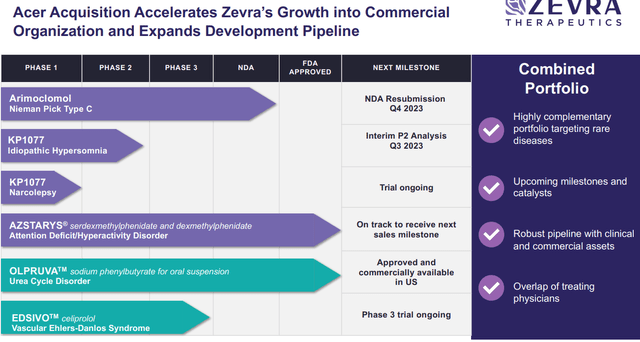

Zevra Therapeutics’ (NASDAQ:ZVRA) recent announcement of acquiring Acer Therapeutics for $91 million in stock adds significant weight to their value proposition. The deal structure – involving contingent value rights, Acer’s debt buyout at a discount, and a bridge loan extension – cements ZVRA’s commitment to the rare disease-focused strategy. Acer’s introduction of the newly launched product Olpruva, for urea cycle disorders (UCDs) aligns with ZVRA’s potential commercial efforts with arimoclomol, both targeting lucrative rare diseases. Furthermore, although a secondary asset, Acer’s Edsivo, undergoing a Phase 3 trial for vascular Ehlers-Danlos syndrome (vEDS) fills an unmet need given the absence of approved products for this rare disease.

Zevra (Company presentation)

Central to Acer’s value proposition is OLPRUVA™, an FDA-approved medicine designed for the chronic management of Urea Cycle Disorders, rare genetic conditions affecting ammonia removal from the bloodstream. OLPRUVA™ offers a novel formulation of phenylbutyrate that’s more palatable and convenient than existing treatments, with the potential to significantly improve patient compliance. We like the fact that its patent extends until 2036, assuring a long-term competitive advantage. Additionally, Acer’s pipeline includes EDSIVO™, a Phase 3 program (that recently started) targeting vascular Ehlers-Danlos syndrome, a severe genetic disorder impacting blood vessels.

Of note, Acer Therapeutics initiated patient screenings for its Phase III DiSCOVER clinical study examining EDSIVO™ (celiprolol) in treating individuals with COL3A1-positive vascular Ehlers-Danlos Syndrome last year.

Upon reaching full enrollment, the DiSCOVER study is projected to last around 3.5 years before completion, taking into account statistical evaluations and the number of main events. An interim review is scheduled about two years after full enrollment. It’s crucial to note that EDSIVO remains an experimental drug, with no approval from the U.S. FDA. There’s no assurance it will get regulatory nod or reach the commercial market in the U.S. for any use.

The Design of the Phase III DiSCOVER Study:

The DiSCOVER trial is a prospective, Phase III, randomized, double-blind, placebo-controlled efficacy trial designed to evaluate EDSIVO (celiprolol) in patients with genetically confirmed COL3A1-positive vEDS using a decentralized clinical trial design and an independent adjudication committee. The primary objective of the trial is to determine whether EDSIVO (celiprolol) reduces the occurrence of vEDS-related clinical events requiring medical attention, including fatal and non-fatal cardiac or arterial events, uterine rupture, intestinal rupture, and/or unexplained sudden death, relative to placebo as measured by time to event. Acer plans to enroll approximately 150 COL3A1-positive vEDS patients, all in the U.S., randomized 2:1 to receive either EDSIVO (celiprolol) or placebo, respectively.

From an investment perspective, we believe Zevra’s Acer acquisition presents several compelling points:

- Complementary Portfolio: The addition of Acer’s products aligns with and enhances Zevra’s rare disease focus.

- Revenue Potential: OLPRUVA™’s superior formulation addresses significant unmet needs in UCD treatments, offering an expansive market potential.

- Cost Synergies: The combined entities can realize significant savings across commercial operations.

- Operational Benefits: The merger boosts Zevra’s commercial and functional capabilities, positioning it better for future product launches.

Anticipation Surrounding Arimoclomol NDA

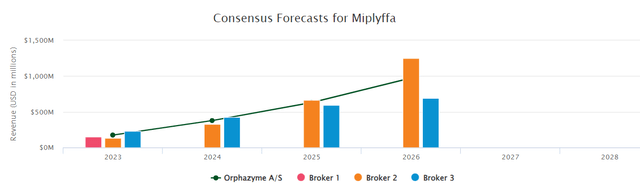

ZVRA’s arimoclomol for Niemann-Pick Type C (NPC) disease is poised for a potential re-filing in the 4th quarter of 2023. Encouragingly, after a constructive meeting with the FDA, no additional clinical work was requested, signaling a smoother path to approval. This upcoming NDA resubmission catalyzes investor interest, given the high unmet need in NPC and the potential market awaiting the drug post-approval. According to the pharma intelligence’s forecast, the peak sales seem to be revolving around $500m-1Bn. Although, clinical and regulatory risks remain, the optionality for a potential approval considering that the company is trading at an equity value of $87m. For a more detailed analysis of the compound, please read our previous article.

BMT Consensus database (Arimoclomal sales projection)

Outperforming Expectations with Azstarys Royalties

The surge in Azstarys sales for ADHD treatment, surpassing $25 million, and Zevra earned $5M milestone payments and a royalty of $0.8M during Q2, which we believe indicates the drug’s market traction. We highlight that with the FDA declaring ADHD drug shortage, we believe the ramp of Azstarys to continue, yet, it appears the market is yet to recognize the full potential of these escalating royalties in ZVRA’s valuation. Achieving further milestones, as projected by the end of 2023, will only amplify this revenue stream and underscore the company’s strong position.

Risks

However, it is essential to weigh the risks in ZVRA’s journey. Arimoclomol’s refiling may encounter unforeseen hurdles or even fail to get the nod from regulators. Challenges in the competitive landscape for NPC and other diseases can emerge. Potential management shifts or board changes might disrupt the company’s focus. And while the acquisition of Acer holds promise, any hiccups in its completion would pose a setback. Lastly, unpredictable safety issues, trial delays or failures, and potential FDA disapprovals of pipeline products could undermine the investment.

Conclusion: Maintaining a “Buy” Stance on ZVRA

Wrapping up, ZVRA’s acquisition of Acer amplifies its strategic alignment towards rare disease treatments, further diversifying and de-risking its portfolio. The anticipation surrounding the arimoclomol NDA and the encouraging trajectory of Azstary’s royalties, combined with the substantial cash runway into 2026, make ZVRA a compelling investment. Holding $87.4 million in cash at the end of the second quarter of 2023, with expectations to extend its cash runway into 2026 (considering annual cash burn of ~$35m expected based on previous several quarter’s burn), the company is well-capitalized, and we are not worried about near-term dilution. Moreover, the potential addition of revenue from arimoclomol post-approval and proceeds from possible monetization of the pediatric disease priority review voucher boosts this outlook. Given these strengths and the mitigation of short-term dilution risks, we are inclined to maintain our buy rating on ZVRA, emphasizing its undervaluation in the current market.

Read the full article here