Co-authored by Treading Softly

Sometimes it is said that “the best defense is a good offense”, and I can understand that having the offensive ability to keep others on the defense means that you don’t have to defend yourself, but it doesn’t take long playing hockey, and pulling your goalie for the extra player to realize that even the best offense sometimes needs some good defense capabilities of its own.

When it comes to the market, investors of every type will try to have different means to play defense. Some investors will use stop-loss orders that will try to stop losses as they occur by forcing them to sell out of a position simply because the price has changed. Others will use complicated hedging methods – a mixture of options or futures contracts – as a means to try and protect them from the downside. But every means of investing in the market and every attempt to hedge has pluses and minuses. Just like pulling your goalie in hockey allows you to get an extra player to try and crowd the ice, it comes with the drawback of not having someone in the net to protect it.

As an income investor, my defense is my offense as well. You see, every dividend that I receive from a holding is a return that cannot be taken away from me. It is an irrevocable return. It is cash in my hand. The company can’t come back later and pull that cash back out of my hand. This is why I prefer dividends over growth investing or even share buybacks because I would rather have the cash now than hope that the shares will be trading at a premium later.

Another method that I use to boost the defensive capabilities of my portfolio is to buy shares of companies that have negative market sentiment against them because their prices are already depressed.

Today, I want to look at a company that’s operating in a sector that is depressed because of negative sentiment and high interest rates, and we’ll look at how this company is a diamond in the rough worth having in your income portfolio.

Let’s dive in!

Play Defense, Get Paid

Ares Commercial Real Estate Corporation (NYSE:ACRE), yielding 13.8%, is a mortgage REIT that is a direct lender of commercial mortgages. The mortgages that ACRE makes are primarily floating-rate mortgages that are secured by a first-lien interest in commercial properties.

Since ACRE invests in floating-rate loans, rising interest rates have generally been a positive for cash flow. However, as rates have risen, so have defaults in commercial properties. I’m sure you’ve seen the splashy headlines about this or that billion-dollar mortgage defaulting and the borrower handing the keys back to the lender.

In most of these news stories, the mortgages are CMBS mortgages, which have a very inflexible structure which leads to higher default rates. These are not the types of mortgage loans that ACRE makes. ACRE makes direct mortgages and maintains ownership of the mortgage, meaning that ACRE has the flexibility to work with borrowers to restructure the loan in a way that benefits both parties. Also, as a REIT, if a favorable resolution can’t be reached, ACRE has the ability to take ownership of the property and operate it. Whereas CMBS loans are usually owned by many investors who have no interest in operating property, so the property is put up for auction with everyone at the auction knowing that the seller is willing to sell for any price.

This is why, historically, CMBS mortgages tend to have higher default rates and lower recovery rates than CRE mortgages. Both are mortgages on commercial real estate, but the structural differences have a meaningful impact on what happens when times get tough.

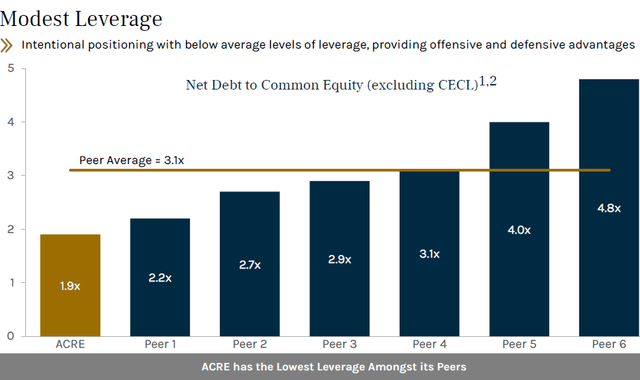

That said, ACRE knows that the environment is getting tough for a lot of borrowers. Interest rates are high, and the market isn’t very good for those looking to sell real estate. This is why we’ve seen ACRE become more conservative with its balance sheet. ACRE is operating with a high level of cash and lower-than-average leverage. Source

ACRE Sept Presentation

Lower leverage has the impact of cash flow being lower than it could be, but even at lower leverage, ACRE is covering its dividend and has some extra cash left over for share buybacks.

This defensive positioning puts ACRE in a great position to be flexible in the event that any borrowers run into trouble. ACRE won’t have to worry about its own balance sheet. The largest threat to any mortgage REIT investment is not defaults; when you do the math, even high default rates tend to have a much smaller impact than you might expect. The big risk is that the REIT might have to sell assets at poor prices or issue equity at poor prices to protect its own balance sheet, both of which can be devastating to common shareholders.

It also carries the benefit that if commercial real estate continues to struggle, as many believe it will, ACRE has the dry powder to consider making new investments. If many other lenders can’t lend, these mortgages will occur at higher spreads and lower loan-to-values, which will be a big benefit to ACRE in the future. When you are the only lender available, you get to set better terms… for yourself.

ACRE is currently trading at a 20% discount to book value. Note that book value already includes $2.07 of CECL (Current Expected Credit Loss), which are losses that are predicted by models but have not yet occurred. Excluding CECL, ACRE’s book value would be $14.84 and trading at a 30% discount. CECL is designed to predict how severe credit losses are likely to be based on current economic conditions and historical data. At current market prices, the market is pricing in a lot more trouble than the models, with more than double the realized losses.

ACRE isn’t running headlong into a distressed market. It isn’t trying to squeeze out every penny of earnings it can when trouble is on the horizon. Instead, it has battened down the hatches and prepared for the storm. When the storm comes, and banks are no longer able to lend, ACRE will be there to have its pick of the best mortgages.

Mortgage REITs got a real black eye during the GFC, as many went into the recession with leverage levels of 5x or even 6x equity with a lot of mezzanine loans and other junior debt. They were greedy for every penny, and it didn’t end well for the companies or their shareholders. Today, we see ACRE, and other mortgage REITs, operating at low levels of leverage – building up cash and being well-prepared for a recession. It is night and day from what we saw leading up to the GFC, perhaps because the managers today remember those dark times. Shareholders remember them too, and that is probably why so many are selling. They fail to recognize that the strength of balance sheets matters. As income investors, their willingness to sell at these discounts is our gain!

Conclusion

With ACRE, we gain exposure to an oversold sector with the skillful ability of a highly capable management team. ACRE is playing a defensive game with a low amount of leverage on its balance sheet and the ability to operate successfully even when others may struggle. They’re doing this all while paying a strong double-digit yield dividend to their shareholders and are able to have excess money to buy shares back as needed.

When it comes to retirement, you want to be able to trust your income stream and the management teams that are going to give it to you by investing in a company like ACRE. We’re able to enjoy strong income and special supplemental dividends, knowing that management isn’t leveraging the company to the hilt. What this means for you is that you’re going to get a strong, steady dividend. You will have that cash to rely on to pay your bills or to enjoy a hobby. Defense is your offense as a professional income investor.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here