It’s Hard To Make Predictions

“It’s tough to make predictions, especially about the future” is a saying often attributed to Yankees great Yogi Berra, but variations have been said by many individuals in different fields throughout history. If there is any place it’s understated, it’s in the area of investing, particularly one variable that affects the value of nearly all investments: interest rates.

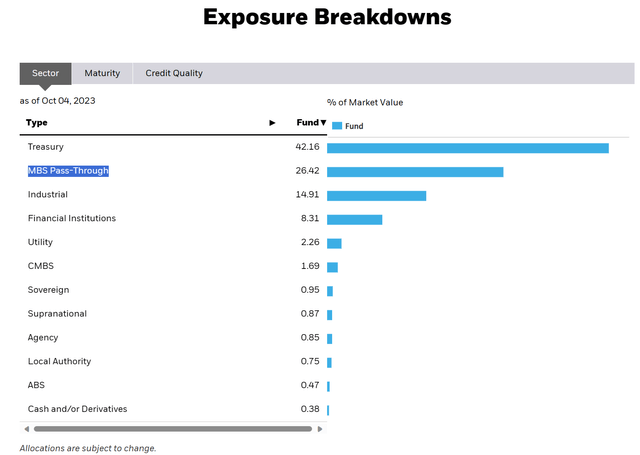

Years of low interest rates have caused investors to reach for yield in high income securities like REITS and preferred equities. Since the start of 2022, the rising interest rates have caused these investments to perform horribly, but even the higher-quality iShares Core U.S. Aggregate Bond ETF (NYSEARCA:AGG) has underperformed the stock market.

Seeking Alpha

With the Fed Funds rate hiking cycle nearing an end, according to the Federal Reserve’s own projections, it’s reasonable to believe that interest rates across the curve are headed lower, resulting in great performance for fixed income, especially in leveraged funds that have been particularly beat up in recent years. I was not immune to this belief myself, thinking in June that the pain may be over soon for funds like the Nuveen Quality Municipal Income Fund (NAD). The bond market had other ideas, taking rates higher even though inflation appears to be cooling off.

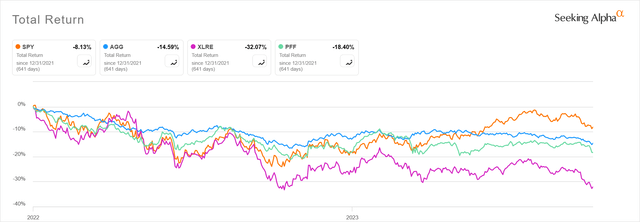

The problem with the “lower sooner” interest rate thesis as opposed to the “higher for longer” one is that history shows us plenty of times where we thought inflation was beaten and interest rates were coming down only for it to come back, resulting in a reversal to even higher rates. Most of this history happened before the investing careers (or even birth) of many of today’s market participants. As we see on the chart of inflation and interest rates below, year-on-year CPI had noticeable peaks in 1966, 1970, and 1974. Interest rates quickly followed the CPI lower only for inflation to come back and spike even higher, taking rates back up. It was only after the huge 1980 spike in inflation where rates stayed high and even increased after the peak in CPI when inflation was finally beaten, starting the long bond bull market of the next 40 years.

Author Spreadsheet

Coming back to the current environment, we see that year-on-year CPI peaked back in July 2022, but interest rates have continued to rise since then, similar to the successful inflation battle of the early 1980’s. Many smart analysts, including Ray Dalio and Seeking Alpha’s own Lyn Alden Schwartzer have made the point that interest rates should go lower, because the US government cannot afford to service its debt at high rates. The one persuasive argument for this comes from the 1940’s when rates were suppressed. Despite occasional flare-ups, persistent high inflation did not take hold during this time. My view is that the amazing labor force and productivity growth of the post-WW2 period kept inflation down and also enabled the US to pay off its high debt from the war. Had the US continued its high spending or lacked the advantage of being the only major economy not in ruins from the war, it would have had a harder time controlling inflation without rate increases.

After 1980, the US saw a push to lower government spending but also benefitted from labor force and productivity growth thanks to factors like women and baby boomers entering the work force and advances in information technology. Eventually, the US achieved a balanced budget by 2000 with tame inflation and low interest rates.

The point of this history lesson is to show that many variables impact interest rates, making them hard to predict. As we have seen, what the Fed says and does can be less influential than demographics, fiscal policy, and technological developments on inflation and interest rates. If deficits continue to widen and labor activism impacts productivity, the market could take rates higher regardless of what the Fed tries to do. On the other hand, a more balanced budget and productivity enhancing technology such as AI could take us back to the strong growth, low inflation, falling rate environment of the 1990’s.

While I have no problem with investors using a portion of their fixed income portfolio to speculate on the direction of interest rates, the inherent unpredictability of rates suggests investing most of the fixed income allocation in securities that have both low default risk and resilience in any rate environment. I have been recommending individual investment grade bonds for a while now that rates are more attractive. Still, for diversification or time savings, a core bond fund like AGG can be a big part of a balanced portfolio. Below, I will look at AGG and how I expect it to perform in different rate environments. The good news is that I expect growing distributions ahead in a stable or rising rate environment, and stable distributions but strong capital gains if rates start falling.

All About AGG

As stated on the fund’s website, “The iShares Core US Aggregate Bond ETF seeks to track the investment results of an index composed of the total U.S. investment-grade bond market.” AGG just celebrated its 20th birthday in September and is one of the largest and best-known ETF’s with $89.2 billion in net asset value. The fund holds over 11,000 individual bonds with an average maturity around 8.5 years and a duration of 6 years.

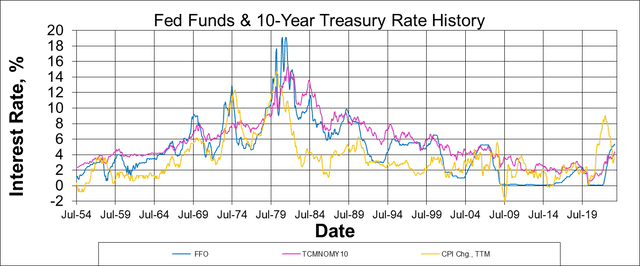

Thanks to the heavy debt issuance of the US government, Treasuries make up over 42% of AGG’s portfolio. Another 30% is in mortgage and other asset backed securities (largely US government agencies) with the remainder in investment grade corporates. With S&P rating the US government debt at AA+, AGG has about 72% of its portfolio at that rating. 3% is AAA, 12% is A, and 13% is BBB.

iShares

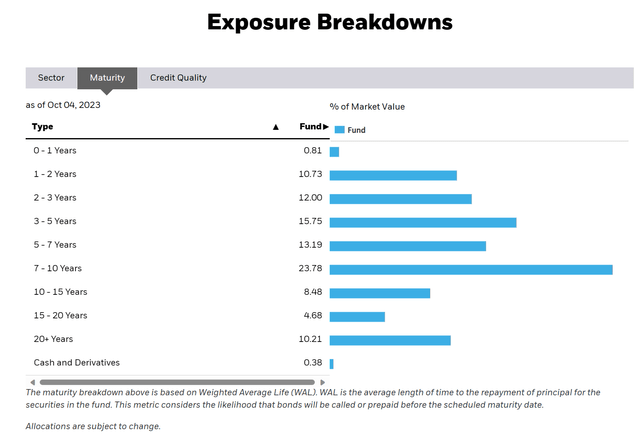

Over 52% of the fund’s holdings mature in less than 7 years. 24% each mature in 7-10 years, and over 10 years.

iShares

AGG has a rock bottom cheap expense ratio of 0.03%. While the average yield to maturity is 5.5%, the average coupon is around 3% thanks to years of low-coupon debt still in the portfolio. The resulting yield of 3.16% does not look particularly exciting to an income-focused investor, but as I will show below, I expect monthly dividends to keep increasing in the near term regardless of what rates do, thanks to older, low-coupon debt maturing and leaving the portfolio. Investors who like total return will be pleased with AGG in the case of a flat or declining rate environment. Income lovers will see their distributions grow in an increasing rate environment. In that case, there will also be capital losses, but not as severe as would be expected from leveraged funds or low-grade debt.

Resilience To Changing Rates

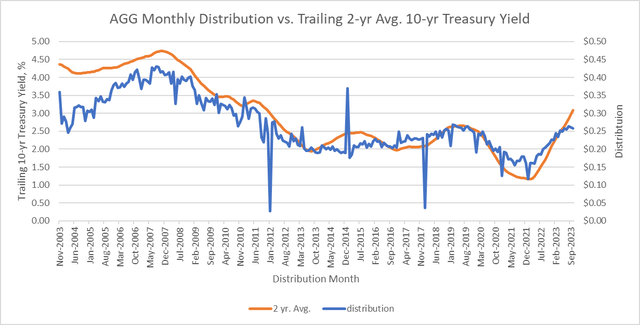

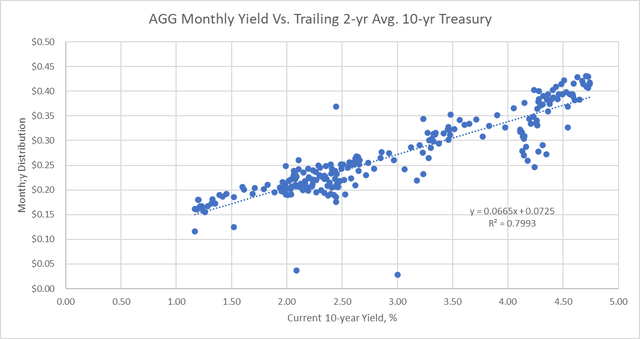

With 20 years of history, we can observe AGG’s dividend history in interest rate conditions from below 1% to over 5% on the 10-year US Treasury note. I have found that AGG’s regular monthly dividends correlate best with a trailing 2-year average of the current yield on the 10-year Treasury. I don’t have a good mathematical explanation of why a 2-year trailing average is the best fit, but it does match it closely, especially since the 2008 financial crisis.

Author Spreadsheet

The above graph shows only the monthly payments reported as income on the iShares website. The fund occasionally pays out a small capital gain distribution in December, more common when rates are falling. As you can see on the chart, there were also 3 Decembers when the amount classified as income was unusually high or low. I did not remove these data points in my regression, but if I had, AGG dividends and the trailing 24-month average 10-year Treasury yield would have matched with a correlation of over 0.85 R squared. Even with these points included, we see a strong correlation with an R^2 of 0.8.

Author Spreadsheet

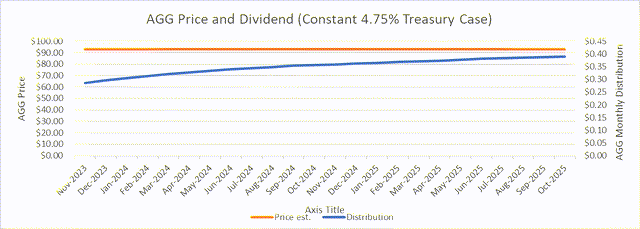

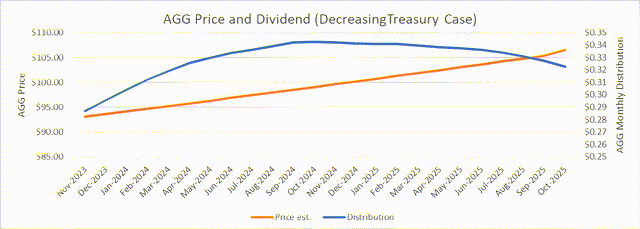

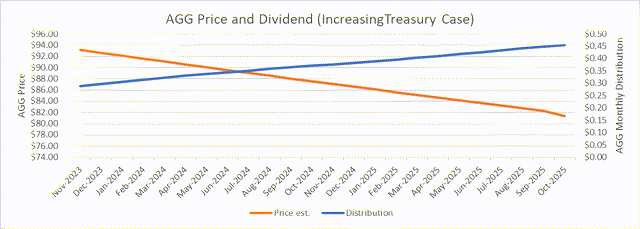

Based on this relationship, I made predictions of what will happen to AGG distributions in the case of a flat interest rate environment (10-year Treasury at 4.75%), a declining one (10-year declining to 2.5% over the next 2 years), and a rising one (10-year increasing to 7% over the next 2 years). It is also possible to forecast AGG share price using the 6 year duration, which implies a 1 percentage point increase in rates produces about a 6% drop in net asset value.

In a flat interest rate environment, AGG should still have increasing distributions as lower coupon debt matures and is replaced by higher rates consistent with a 4.75% 10-year Treasury. Specifically, I estimate the monthly dividend will rise to $0.39 from the current $0.26, a 50% increase, or 22.5% annualized growth. Share price would stay flat while the fund pays $8.42 in dividends over the next 2 years for a total return of 9%, or 4.4% annualized.

Author Spreadsheet

In a falling rate environment where the 10-year gradually drops to 2.5%, I still expect the dividend to continue rising for the next year as even lower coupon bonds mature. After that, the dividend will start to come back down. Share price, however, would rise from $93.13 to $106.55. Total dividend payout over 2 years would be $7.90 for a total return of 22.9%, or 10.9% annualized.

Author Spreadsheet

In a rising rate environment where the 10-year gradually increases to 7%, distributions will grow faster. I estimate them increasing to $0.45 by the end of 2025, a 73% improvement from current levels. The downside is that share price would drop in the higher rate environment. I estimate it dropping to $81.34. With total distributions of $8.95, total return would be about -3% over 2 years, or about -1.5% annualized. While the negative total return is not ideal, income investors would be pleased with AGG yield approaching 6.7% and capital losses not nearly as bad as they would be in a high yield or leveraged fund.

Author Spreadsheet

Conclusion

Interest rates are hard to predict. As much as we’d like to believe they will be headed lower soon, a look at history suggests the possibility they will not. Jumping into leveraged or high yield securities could be a great call if rates are headed lower but would result in large capital losses if wrong. Based on previous performance, AGG looks like it will provide income growth in a flat rate environment, capital gains in a falling rate environment, and strong dividend growth almost offsetting capital losses in a falling rate environment. I believe this makes AGG a safer pick for the core of a fixed income portfolio.

Read the full article here