The Apollo Tactical Income Fund (NYSE:AIF) is a closed-end fund that has recently been attracting a great deal of attention from income-focused investors. There are some very good reasons for this as the fund’s attractive 11.33% current yield is much higher than most other income-focused funds in the market and it is one of the few debt funds that has actually increased its distribution in response to the rising interest rate environment. The fact that the fund’s distribution has been increasing though is not particularly surprising considering that it invests in floating-rate debt securities, which tend to perform much better than traditional fixed-rate bonds during periods of rising rates. I explained this in my previous article on this fund.

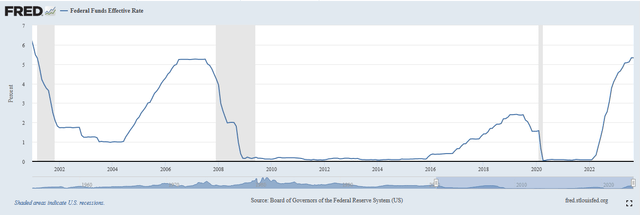

The fund has, interestingly, actually beaten the S&P 500 Index (SP500) since the time that my previous article was published on April 20, 2023. The shares of the Apollo Tactical Income Fund are up 5.04% since that time compared to a 2.41% gain in the S&P 500 Index. However, the common stock index is not an especially good benchmark for a bond fund so we will speak no more of it. A much better point of comparison would be against the broader U.S. bond market. An investor who purchased shares of the Apollo Tactical Income Fund at the time that my previous article was published would be up 10.18% today after we take the fund’s distributions into account. An investor who purchased the Bloomberg U.S. Aggregate Bond Index (AGG) at the same time would have lost 5.50% of their money, once again taking distributions paid by the index into account:

Seeking Alpha

This is a very stark performance difference, and it is likely that this will endear the Apollo Tactical Income Fund to any income-focused investor. Indeed, any investor could probably find something to like here considering that very few assets have managed to deliver a positive double-digit return over the past six months.

Now that we have established the recent appeal of this fund, it would be a good idea to take a deeper look at it. After all, past performance is no guarantee of future results, and anyone who buys the fund today will not really benefit from the strong positive performance that this fund has exhibited over the past several months.

About The Fund

According to the fund’s webpage, the Apollo Tactical Income Fund has the primary objective of providing its investors with a very high level of current income. This makes sense considering that this is a debt fund. As is usually the case, the webpage provides an in-depth description of the fund’s strategy:

Apollo Tactical Income Fund, Inc. (the “Fund”) is a diversified, closed-end management investment company. The Fund’s primary investment objective is to seek current income with a secondary objective of preservation of capital by investing in a portfolio of senior loans, corporate bonds and other credit instruments of varying maturities. The Fund seeks to generate current income and preservation of capital primarily by allocating assets among different types of credit instruments based on absolute and relative value considerations. Under normal market conditions, the Fund invests at least 80% of its managed assets (which includes leverage) in credit instruments and investments with similar economic characteristics.

As I have pointed out in numerous previous articles, debt securities by their very nature have no net capital gains over their lifetimes. This is because these securities are both issued and redeemed at face value. Thus, the only net investment profit from these securities is the coupon payments that they make to their investors. An investor who buys a debt security when it is first issued and holds it until maturity will experience no capital gains or losses, nor will that investor lose any money unless the issuer defaults.

With that said, bond prices do vary with interest rates, which results in the potential for gains and losses if the bond is not held until maturity. It is an inverse relationship, which is why bond funds have been delivering losses to their investors over the past two years. After all, the Federal Reserve has been very aggressively raising interest rates in an attempt to combat the incredibly high inflation rate that is plaguing the economy. As of the time of writing, the effective federal funds rate is 5.33%, which is the highest rate that the United States has seen since February 2001:

Federal Reserve Bank of St. Louis

This is a much higher rate than what existed in the market at the time of my previous article’s publication. At that time, the effective federal funds rate was only at 4.65%. As such, we can see that the rate is 68 basis points higher today. This is one of the big reasons why the Bloomberg U.S. Aggregate Bond Index has been down since that date.

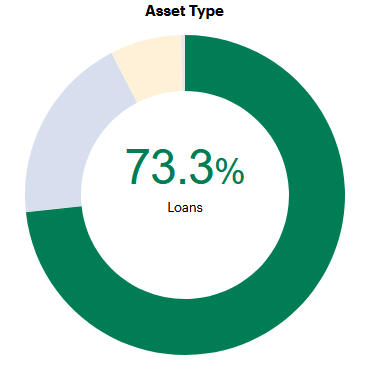

However, we can see that this fund delivered a very different performance. It actually went up despite rising rates. The reason why this is the case can be found in the above quote regarding the fund’s basic strategy. Note how the fund states that it invests in a portfolio of senior loans or corporate bonds, not only corporate bonds as the index does. As of right now, 73.3% of the Apollo Tactical Income Fund is invested in senior loans:

Apollo Funds

The remainder of the fund’s assets are deployed as follows:

|

Asset Type |

Percentage |

|

Senior Loans |

73.3% |

|

High-Yield Bonds (“Junk Bonds”) |

19.1% |

|

Structured Products |

7.2% |

One of the defining characteristics of senior loans is that they have floating rates. The coupon payment on the security actually goes up when some benchmark interest rate (usually federal funds, LIBOR, or something similar) goes up. This allows them to avoid the problem faced by other funds in a rising interest rate environment. As I explained in the previous article on the fund:

The reason why bond prices decline when interest rates increase is that newly issued bonds will have a coupon that results in the bond having a yield that corresponds to the market interest rate at the time of issuance. Thus, a bond that was issued a year ago would have a lower yield based on its face value than a bond that is issued today. As such, there is little reason for someone to pay face value for the older bond when a brand-new one can be purchased that has a higher yield. As a result, the price of the older bond needs to decline to the point where it delivers a competitive yield on cost to that of the otherwise identical brand-new bond.

As senior loans have floating coupon rates, they will always deliver a competitive yield to that of brand-new identical securities. Thus, their prices tend to hold up much better during periods of rising rates. Over the past ten years, the Bloomberg US Floating Rate Note < 5 Yrs Index (FLOT) has been almost perfectly flat:

Seeking Alpha

As 73.3% of the fund is invested in securities that are similar to the ones that comprise this index, we can clearly see why it would not be negatively affected by the “higher for longer” fears that have been pushing down the prices of just about everything else in the market over the past two months or so. In fact, this fund should actually benefit from rising rates, because the securities that comprise the majority of its portfolio will end up making larger coupon payments in such an environment. This boosts the fund’s income, which ultimately allows it to increase its distribution. This is the biggest reason why this fund’s managers were able to boost the distribution at a time when nearly every other debt-focused closed-end fund was forced to cut their payouts.

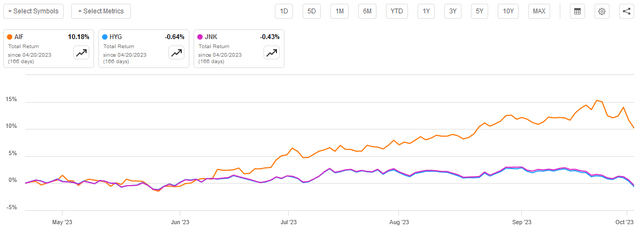

With that said though, the shares of the Apollo Tactical Income Fund have appreciated by 5.04% since the time of my last article. However, we just saw that senior loan securities tend to be remarkably stable in price. Thus, these securities probably did not deliver a gain commensurate with the fund’s shares. Therefore, we can conclude that something else was responsible for the fund’s share price increase. However, as we can see here, both the iShares iBoxx $ Corporate Bond ETF (HYG) and the SPDR Bloomberg High Yield Bond ETF (JNK), which track junk bond indices, delivered negative total returns over the period:

Seeking Alpha

So, it does not appear that junk bonds were responsible for the gains that the fund managed to deliver over the period. Senior loans and junk bonds account for 92.4% of this fund’s portfolio and yet obviously they have not delivered sufficient returns to explain the strong market performance that the fund has seen. It is possible that the structured products that account for 7.2% of the portfolio delivered sufficient gains to drive the fund’s strong performance, but that seems very unlikely considering that pretty much everything else is down. It is even more unlikely that an asset that accounts for such a small percentage of the fund’s assets could drive sufficient gains to allow it to outperform most broad-market indices.

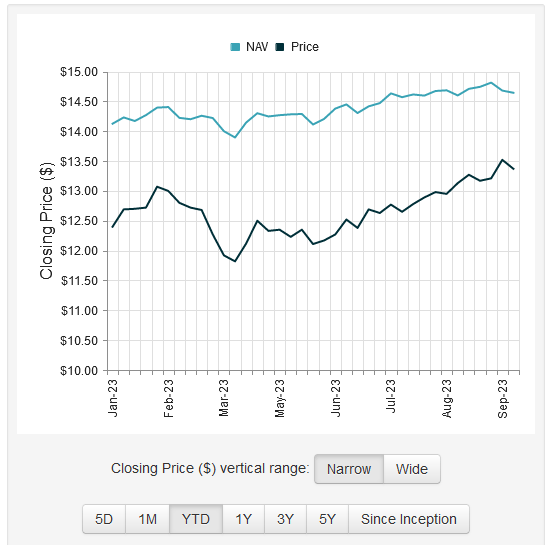

We can see a potential explanation for this situation by looking at the way that the fund’s shares have performed relative to its portfolio. As I have pointed out in a few previous articles, one of the defining characteristics of closed-end funds is that their market price performance does not always match that of the underlying portfolio. We can see that with this fund. This chart shows the market price of the fund’s shares compared to the net asset value of the portfolio on a per-share basis since January:

CEF Connect

As we can see, the fund’s net asset value has increased year-to-date, but not as much as the fund’s shares have increased in price. Thus, the difference between the net asset value and the market price has narrowed. Thus, what has basically happened is that the fund’s shares in the market have outperformed the actual assets of the portfolio. This is not necessarily a problem, as the fund’s shares are still trading for less than the net asset value. We will discuss this more later in this article.

Leverage

As I pointed out in my previous article on this fund, the Apollo Tactical Income Fund employs leverage as a method of boosting the effective yield of its portfolio. I explained how this works in the previous article:

In short, the fund is borrowing money and using that borrowed money to purchase floating-rate loans and other fixed-income assets. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, that will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage, as that would expose us to too much risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the Apollo Tactical Income Fund has levered assets comprising 36.43% of its portfolio. This is slightly less than the 36.81% that the fund had the last time that we discussed it, which actually makes a lot of sense. As we can see above, the fund’s net asset value has not really changed very much since April despite the price performance. Thus, if the fund kept its leverage static, which appears to be the case, then its ratio would only decrease slightly. As I pointed out before, this fund’s leverage is slightly above the level that I really would like to see, but in this case, it is probably okay. The overwhelming majority of the assets in this portfolio are remarkably stable in terms of price regardless of the market environment so the fund can probably carry a lot more leverage than a fund whose assets consist primarily of highly volatile assets. Overall, we probably do not need to worry too much about the fund’s debt load.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Apollo Tactical Income Fund is to provide its investors with a very high level of current income. In order to achieve this objective, the fund invests in a variety of debt instruments that deliver the bulk of their investment returns through direct payments to the shareholders. As many of these securities are leveraged loans and junk bonds, they tend to have yields that are quite a bit above the risk-free rate. This fund then applies a layer of leverage on top of its debt portfolio, which has the effect of boosting the effective yield of the portfolio beyond that of any of the individual securities in it. The fund then collects all of the payments made by these securities and pays them out to the shareholders, net of the fund’s own expenses. As such, we might expect that this would all give the fund a very high yield.

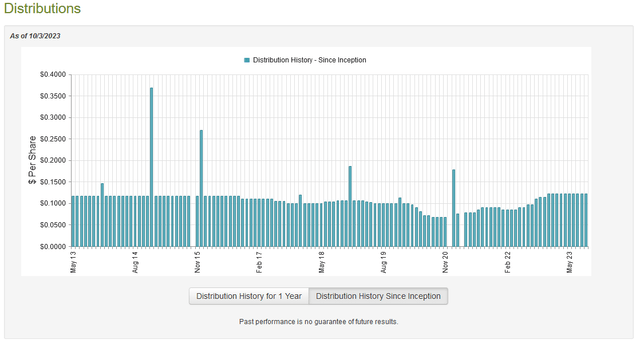

This is certainly the case as this fund pays a monthly distribution of $0.1220 per share ($1.464 per share annually), which gives it an 11.33% yield at the current price. Unfortunately, the fund has not been especially consistent with respect to its distribution over the years, as it has both raised and lowered the distribution multiple times:

CEF Connect

This highly variable distribution seems likely to reduce the fund’s appeal to those investors who are seeking a safe and sustainable source of income to use to pay their bills or finance their expenses. However, it is not unsurprising the fund would have to vary the distribution due to the impact that interest rate changes have on bond yields and prices. This is one of the few fixed-income closed-end funds that managed to increase its distribution over the past year, which is almost certainly because the rising rate environment resulted in the floating rate securities delivering a higher level of income over time. In some ways then, this fund should be able to act as a bet on rising rates, since it actually benefits from such an event.

As is always the case though, it is important that we analyze the fund’s finances in order to see just how well it is financing its distributions. After all, we do not want to be the victims of a distribution cut that reduces our incomes and probably causes the fund’s share price to decline.

Fortunately, we have a very recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the full-year period that ended on June 30, 2023. Therefore, this is a much newer report than the one that we had the last time that we discussed this fund. This is nice because it should allow us to see how sustainable the fund’s distribution is right now considering that this was the first full quarter in which the fund ran with its $0.1220 per share monthly distribution. Prior to this, the distribution was lower, so it required less income to completely cover.

During the six-month period, the Apollo Tactical Income Fund received $17,522,742 in interest from the assets in its portfolio. This was the fund’s only source of income during the period, so its total investment income is the same value. The fund paid its expenses out of this amount, which left it with $11,372,229 available for shareholders. That was more than enough to cover the $10,587,666 that the fund actually paid out in distributions during the period. Thus, as was the case the last time that we discussed this fund, it appears that it is simply paying out its net investment income to the shareholders. This should mean that the distribution is sustainable as long as interest rates remain at today’s levels. As I have mentioned in a few recent articles, there exists a great deal of uncertainty surrounding the near-term trajectory of interest rates, but this fund can actually adjust its allocation to fixed-rate bonds to generate profits from falling interest rates too. For the most part, this fund’s finances look solid, but it probably will not prove to be the most attractive play for someone who wants their income to remain relatively stable.

Valuation

As of October 3, 2023 (the most recent date for which data is available as of the time of writing), the Apollo Tactical Income Fund has a net asset value of $14.58 per share but the shares currently trade for $12.95 each. This gives the fund’s shares an attractive 11.18% discount on net asset value. I will admit that this is a far bigger discount than would normally be expected for a well-managed fund like this one, and it is much larger than the 9.92% discount that the shares have had on average over the past month. Thus, the current price looks like a very good entry point for anyone who wants this fund in their portfolios.

Conclusion

In conclusion, the Apollo Tactical Income Fund continues to prove its quality as an excellent fixed-income fund for the current environment. Its attractive 11.33% current yield is fully financed out of net asset value, which is quite nice as this fund is not relying on unreliable capital gains to sustain its payout. It has also substantially outperformed most of the broad market indices in the rising rate environment that has prevailed in recent months. When we combine this with the fact that the fund is trading at an attractive discount on net asset value right now, we have a fund that very much looks like a winner.

Read the full article here