The time to invest in a commodity like natural gas is when the market is leaving the whole sector for “dead”. At that point, prices are usually so good that the downside risk is minimal while the upside potential is considerable. Antero Resources (NYSE:AR) appears to be at a cyclical bottom. Management believes this enough that they paid to monetize the hedges so they could participate in the coming natural gas price rally. This is a management that has liquidated hedges before and usually guessed right. As an insider to the industry, their opinion is worth noting.

Swing Basin Activity

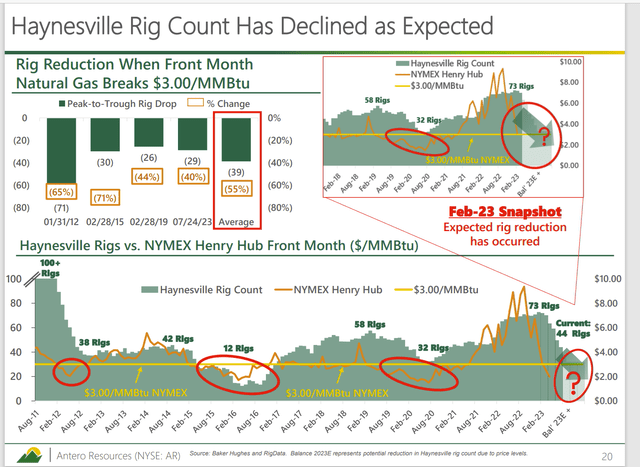

One of the key visible measures to investors was pointed out by management. These are the activity levels of the widely regarded swing basin of Haynesville.

Antero Resources Presentation Of Haynesville Swing Basin Activity Levels (Antero Resources Corporate Presentation August 2023)

The Haynesville basin is a largely dry gas basin where drilling activities were largely correlated to the prices of natural gas. Notice also that Haynesville has a sharper first-year decline in activity levels than is the case where Antero Resources operates. A higher first-year decline rate means a fairly quick adjustment for perceived over-production.

This lends some credence to the management actions at Antero Resources of selling the hedges. There are things like the weather that can delay (but will not prevent) a pricing recovery.

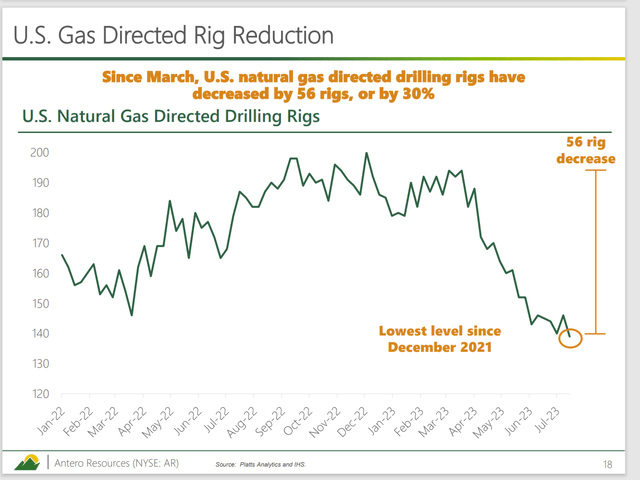

Antero Resources Natural Gas Rig Activity (Antero Resources August 2023, Corporate Presentation)

In addition to the swing basin status of Haynesville, other dry gas producers in other basins will be affected. Even “good basins” do not have uniform geology. Therefore, acreage that is just not profitable to drill no matter where it is located will be idled unless there are some mandatory holding commitments that the operator decides to meet.

So, the overall activity will decline even though the emphasis will be on Haynesville. This means, even if the weather is unfavorable for high natural gas prices, that production will decrease until natural gas prices increase no matter what that takes. Things like recessions and mild weather can only delay recovery because that rig count will continue to decline as long as pricing weakness prevails.

Investment Strategies

Sometimes, the market would have you believe that prices cannot ever recover. This is what makes the cyclical pricing action. The market imputes the past into the future even though actions are being taken to change that future outlook considerably. The market almost never reacts until the money flows. Rather than anticipate a recovery from declining rigs, the market waits until a solid basis for natural gas prices is already evident. Investors can take advantage of that time lag to pocket some of the early recovery gains which tend to be large percentages.

It needs to be noted that financially strong companies can wait for a recovery. Leveraged companies often do not make it to the recovery. Debt leverage has long been viewed as a competitive handicap as a result. The more leveraged the company is, the less uncertainty the company can withstand. This industry is very low visibility and that means a lot of uncertainty and a lot of volatility.

One of the reasons a lot of investors like John Templeton and Peter Lynch purchased bargains is because if they became greater bargains, there was still a good chance to make the originally envisioned large profits. Many investors focus on a stock price decline percentage as opposed to where the stock price is in the business cycle.

In the case of Antero, the stock price is already down from a cyclical high price in the $40s. Therefore, a further price decline from the current price could be 20% from an investor’s basis, but really only roughly 10% from the high price. Since decent managements often see their stock prices recover to old high prices plus inflation, it points out to how little the overall stock price decline matters in the later part of the business cycle before the recovery begins. This also demonstrates the risk of buying high with the far more significant damage that can be done to a portfolio.

The Growth Story

Similarly, Antero Resources is now far larger than when it went public. But management has by no means given up on per share growth.

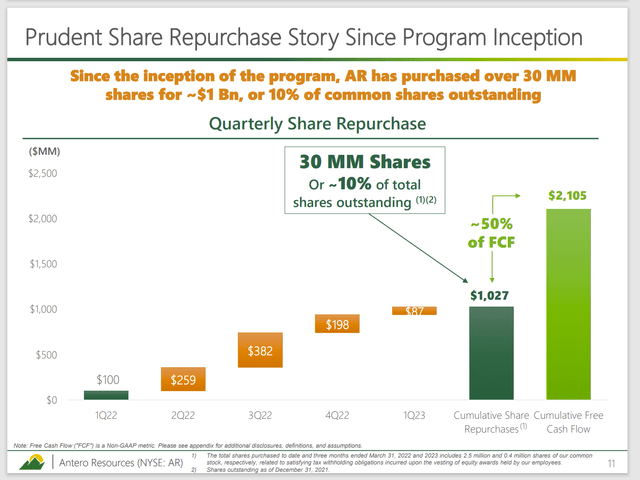

Antero Resources Recent History Of Share Buybacks (Antero Resources May 2023, Corporate Presentation)

(Note: This presentation was removed from the website.)

This management has been maintaining production while repurchasing shares. That caters to the market demand to return money to shareholders by making their shares more valuable. The share repurchases also provide some downside protection by providing demand for the common shares at a time when such demand is low.

When the recovery begins, earnings that before were record earnings will now result in a higher amount of per share earnings which would allow for that positive quarterly comparison the market loves.

Sales Strategy

Instead of production growth, the argument can be made that management will grow profits through margin expansion. Some will argue that such a strategy only works for a while. But then again management is there to come up with continuing growth strategies as the current ones wane in effectiveness.

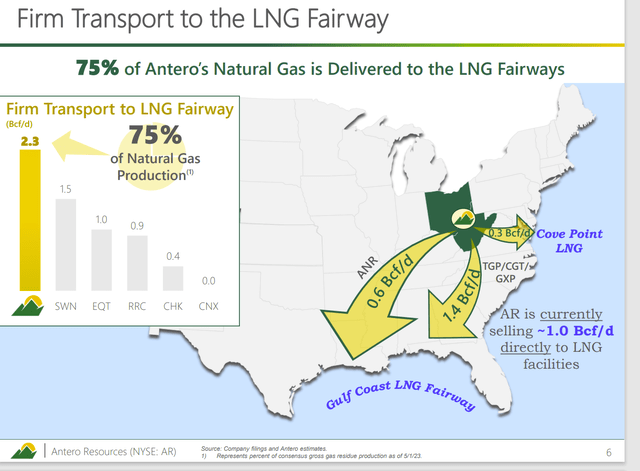

Antero Resources Marketing Strategy For Products Produced (Antero Resources Corporate Presentation August 2023)

Most predictions are for world natural gas use to grow. Antero Resources management long ago made plans to sell natural gas to the far stronger world market rather than the relatively oversupplied local market. This plan is likely to result in long-term increasing sales prices from that stronger market.

Free Cash Flow

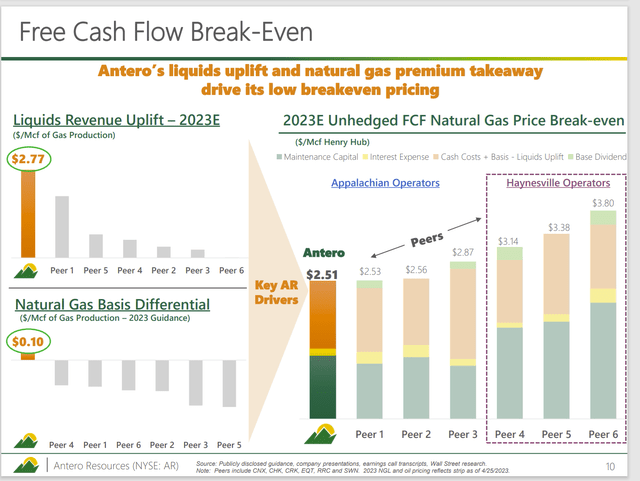

The result of the marketing strategy is an already huge cash flow advantage.

Antero Resources Free Cash Flow Breakeven Calculation (Antero Resources May 2023, Corporate Presentation)

The company gives a snapshot of a very agile moving target. That natural gas differential, for example, is usually positive but it has varied to far larger amounts in the past. The May 2023 Corporate presentation is no longer available. So, it is very possible that the natural gas price to break even has changed. This is especially true given that liquids prices generally strengthen in the second half and oil prices have risen since this slide was produced.

The liquids are exported to stronger markets for a better average price received than a lot of competition. That and better market conditions will lower the natural gas breakeven price for liquids-rich producers like Antero.

Most managements basically sell the product nearby without going the extra mile to get shareholders more money for their products. This company effectively lowers the breakeven target of the benchmark pricing by getting a relative premium for its products when compared to the competition.

But the sales strategy does make it hard for investors and analysts to predict the results without knowing where the sales occurred and at what price. Therefore, results visibility is probably considered low even compared to much of the industry even though results are often darn good.

The last consideration that the slide makes clear is that Antero is dependent upon a matrix of prices whereas dry gas producers solely rely upon the price of natural gas to make “drill or not drill” decisions. The result is that Antero needs a good result from a combination of products rather than just one. Therefore, any of the liquids can make up for natural gas pricing weakness for Antero to have decent results. Management has noted several times that they expect liquids pricing to be stronger in the second half of the fiscal year.

Summary

The growth story has switched from a production growth story to one of increasing margins and share repurchases as the company has matured. This company is in a far better position to benefit from the stronger world markets for its products than is the case for a lot of competition.

As such the common stock is probably a strong buy consideration for those investors patient enough to wait for a natural gas pricing recovery. Management has indicated it expects a future price recovery by monetizing the hedges. The decline of dry gas rig activity likewise points to a declining supply that should likewise lead to stronger prices in the future.

The timing of the recovery is of course uncertain because the industry has low visibility. But the stock price has declined to the point where the recovery potential is not priced into the stock at all while more downside is priced into the stock price even though it is unlikely to decline much if at all in the long term. That is an asymmetric return that is well worth the risk to many investors.

Read the full article here