Amid heightened supply concerns at the long end, the inverted Treasury yield curve has begun to ‘dis-invert’ in recent weeks, moving ten and thirty-year yields closer toward the >5% offered by shorter duration Treasury bills (T-bills). Yet, the front end still has good demand support from foreign inflows (net purchasers of U.S. debt over equities) and money market funds, hence the government’s preference for shorter-duration issuances to fund persistent post-COVID budget deficits. Plus, the Fed is reaching the end of its rate hike cycle, and supply is set to tone down (albeit from very elevated levels) now that the Treasury General Account has been replenished post-resolution of the debt ceiling. All this bodes well for relative stability at the front end over the coming months.

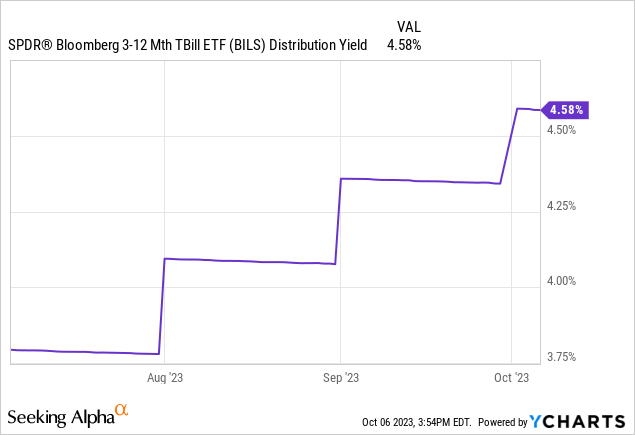

Given T-bills are also yielding well above the long-end and S&P 500 (SPY) earnings yield, investors are getting better compensation here without risking their principal or taking on duration risk. Net, investors comfortable with some reinvestment risk will find a lot to like in low-cost T-bill ETFs like the SPDR® Bloomberg 3-12 Month T-Bill ETF (NYSEARCA:BILS).

Low-Cost Exposure to the Front-End of the Treasury Curve

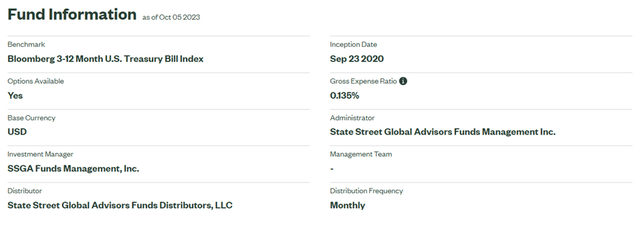

The SPDR® Bloomberg 3-12 Month T-Bill ETF seeks to track, before fees and expenses, the performance of the Bloomberg 3-12 Month U.S. Treasury Bill Index, a basket of USD-denominated Treasury securities subject to maturity (3 to 12 months) and rating (investment grade) constraints. The ETF had ~$2.7bn of assets under management at the time of writing and charged a 0.14% gross expense ratio, in line with comparable low-cost US T-Bill ETF options such as the Goldman Sachs Access Treasury 0-1 Year ETF (GBIL).

State Street

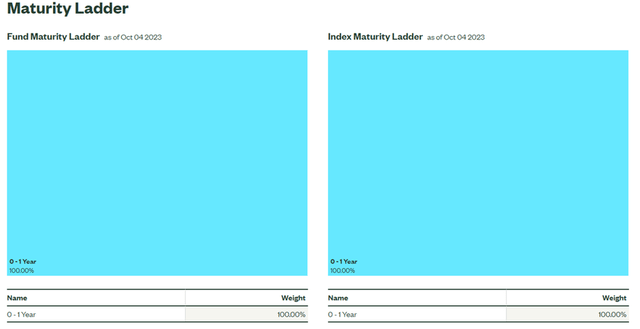

The fund is spread across 26 Treasury holdings, with an average portfolio maturity of 0.4 years and an average yield to maturity of 5.5%. Its relatively short maturity means the fund is far less sensitive to interest rate fluctuations (i.e., duration risk) compared to fund portfolios with exposure to the back end of the Treasury curve.

State Street

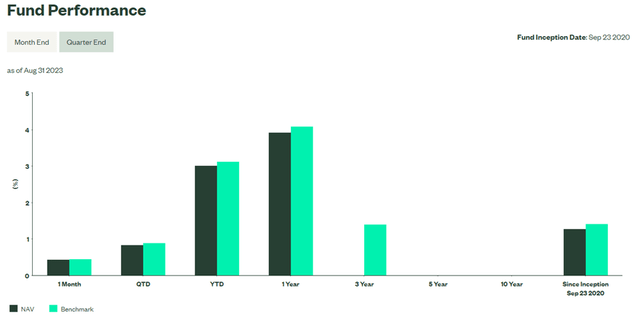

On a YTD basis, the ETF has appreciated by +3.0% in NAV and market price terms, also annualizing at a +1.3% pace since its inception in Sept 2020. The fund’s low duration has been key to its resilience (note most long-term Treasury ETFs have suffered steep drawdowns recently), shielding investors from the worst of rate hikes over the last year. Similarly, BILS won’t see as much upside in a rate cut cycle, so investors prioritizing a stable principal value with some extra yield will find this fund attractive. Plus, yields are highest at the 3–12-month maturities right now (~5%), skewing the BILS risk/reward very favorably.

State Street

A More Favorable Supply/Demand Balance for T-Bills

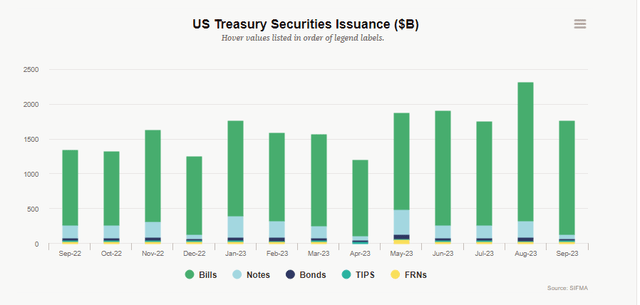

T-bills have been the go-to source of supply for the Treasury in recent months, with issuance again coming in strongly in September. As a result, year-to-date bill supply has now crossed a massive $1.6tn, mostly from the TGA rebuild following June’s debt limit resolution. While the pace of issuance has slowed down from the elevated Q2 run rate, auctions are set to ramp up again through the seasonally more demanding October/November periods. Thus, bill issuances should still run well above pre-COVID levels into year-end, which may pressure yields somewhat.

SIFMA

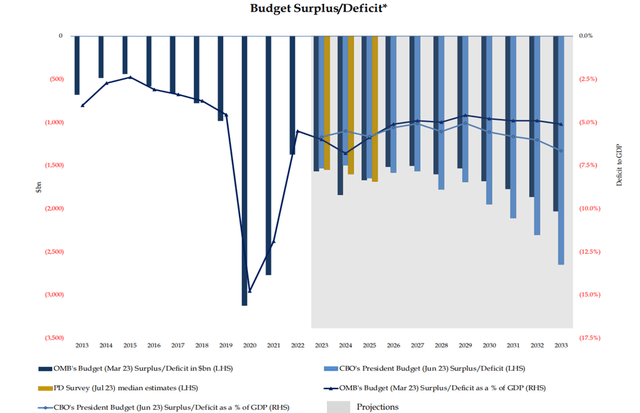

The recent yield spike at the long end might catalyze more longer-duration supply coming to market (pre-empting curve steepening), though relatively low dealer T-bill holdings mean there’s still ample capacity at the front end. That said, the key supply risk is to the upside rather than the downside, in my view, given the Biden administration’s comfort with running high-single-digit % deficits of GDP and the resolutely hawkish Fed; thus, shorter-duration debt exposure seems more prudent at current levels.

US Treasury

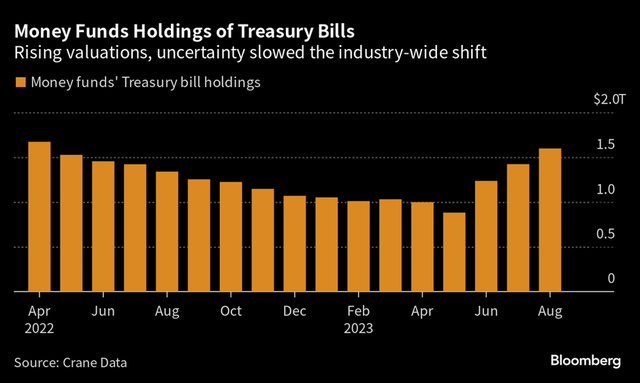

The key to the relative stability of T-bills, however, is on the demand side. Against an increasingly fractured geopolitical backdrop, foreign demand has held firm, even increasing per the latest TIC data (‘Treasury International Capital’ or a measure of portfolio flows in/out of the U.S.). The rise in July holdings, for instance, was particularly positive, given the sharp rise in T-bill net issuance post-resolution of the debt ceiling. Even longer-duration debt caught a bid, as foreign investors net purchased Treasury bonds despite net selling from China. Money market funds have also been a key source of demand, helped by a positive T-bill yield spread over reverse repos (a measure of overnight bank lending rates). With T-bill yields showing little sign of retreating from their highest levels in recent decades, resilient investor demand offers good support, even as supply picks up toward year-end.

Bloomberg

Finding Shelter in Shorter Duration Treasuries

The case for owning T-bills, at least for the near term, is as compelling as it’s ever been. While the long end of the Treasury curve is in turmoil amid concerns about persistently wide deficits and a resulting supply/demand mismatch, the front end has weathered the supply wave very well thus far. More T-bill supply will come online in Q4 for year-end funding needs, but the resilient demand for short-duration debt from foreign investors (despite Chinese selling) and money market funds should keep yields supported. In the meantime, investors get the best of all worlds – better principal protection and a superior yield on T-bills minus the downside risks associated with a typical stock/bond portfolio. Heading into a potentially turbulent year-end, investors comfortable with some reinvestment risk would do well to consider a low-cost T-Bill ETF like BILS.

Read the full article here